Name Kenneth Griffin Religion Presbyterian Christian | Salary $1.3 billion (2014) Net worth 7 billion USD (2015) | |

| ||

Similar People Anne Dias‑Griffin, James Harris Simons, Bruce Rauner, Bill Ackman, Sam Zell | ||

Occupation Founder & CEO, Citadel Marriage location Versailles, France | ||

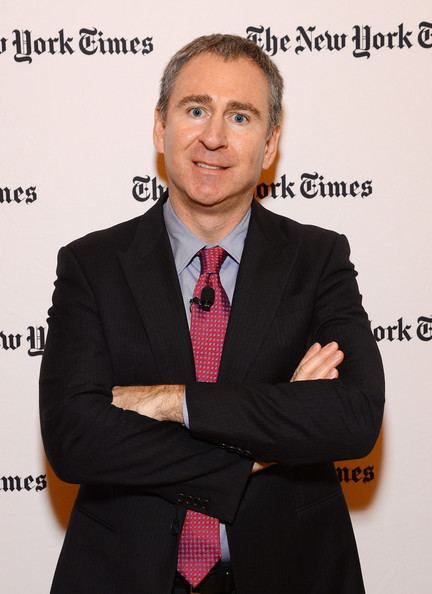

Kenneth c griffin

Kenneth C. Griffin (born October 15, 1968) is an American investor, hedge fund manager, and philanthropist. He is the founder and chief executive of the global investment firm Citadel, founded in 1990. As of March 2015, Citadel is one of the world's largest alternative investment management firms with an estimated $25 billion in investment capital. Citadel's group of hedge funds rank among the largest and most successful hedge funds in the world. Forbes identified Griffin as one of 2012's highest earning hedge fund managers as well as one of the Forbes 400.

Contents

- Kenneth c griffin

- Early life and education

- Investment career

- Citadel

- Political and economic views

- Views on market structure

- Personal life

- Wealth and philanthropy

- Art collection

- Legacy and awards

- References

As of May 2015 Griffin had an estimated net worth of US$6.6 billion. At the beginning of 2014, Griffin made a $150 million donation to the financial aid program at Harvard University, his alma mater, the largest single donation ever made to the institution at the time, and his donations to various organizations and causes have totaled about $500 million.

Early life and education

Kenneth C. Griffin was born in 1968 in Daytona Beach, Florida. In high school, he excelled academically while also being the president of his math club. In 1986, Griffin started to invest during his freshman year at Harvard University after reading a Forbes magazine article. During his second year at Harvard, he started a hedge fund focused on convertible bond arbitrage. The fund was capitalized with $265,000 from friends and family, including money from his grandmother. He installed a satellite link to his dorm to acquire real-time market data. The investment strategy helped preserve capital during the stock market crash of 1987. Griffin's early success enabled him to launch a second fund, and between the two funds he was managing just over $1 million. Griffin graduated from Harvard in 1989 with a degree in economics.

Investment career

After graduating from Harvard, Frank C. Meyer, an investor and founder of Glenwood Capital LLC, provided Griffin with $1 million to invest. Griffin exceeded Meyer's expectations and, according to The New York Times, Meyer made 70 percent return on the investment.

Citadel

In 1990, Griffin founded Citadel with $4.6 million. By 1998, Citadel had grown to a team of more than 100 employees and $1 billion in investment capital.

In June 2002, Griffin was included in CFO Magazine's Global 100, a list of the most influential people in the world of finance.

Griffin has appeared numerous times in Forbes' Forbes 400, first in 2003, with an estimated net worth of $650 million. At 34, he was the youngest self-made individual on the list. In September 2004, Fortune magazine ranked Griffin, who was 35 that year, as the eighth richest American under forty in the category of self-made, United States-based wealth. In 2006, Griffin was the fifth youngest of the seven members under the age of 40 listed on the Forbes 400. In 2007, Griffin had an estimated net worth of $3 billion. By 2014, Griffin’s net worth was estimated at $5.5 billion.

In March 2015, Citadel received a Top 10 Great Workplaces in Financial Services ranking by the Great Places to Work Institute, based on a survey by Citadel employees. Griffin was credited for implementing a collaborative work culture and providing perks to employees including free lunch, museum tours, fitness programs and personal gifts.

Griffin was a featured panelist at the 2015 Milken Institute Global Conference where he spoke about Citadel, building complex organizations by investing in employees, and corporate activism in which he said: "I’m all in favor of liberating access to the boardroom by activists and giving shareholders a greater role in how [the company is] managed. That benefit accrues to everyone in society."

Political and economic views

Griffin serves on the Committee on Capital Markets Regulation. Griffin is also a member of the G100, a network of 100 CEOs that meets periodically to discuss the global economy. In 2012, Griffin said in an interview with the Chicago Tribune that he was a Reagan Republican. He said, "This belief that a larger government is what creates prosperity, that a larger government is what creates good: is wrong." After the 2007–08 financial crisis, Griffin made political contributions and donations to political candidates, parties, and organizations that supported his views of limited government such as American Crossroads, the Republican Governors Association, and Restore Our Future, a Super PAC that supported Mitt Romney's presidential bid. Griffin backed Mitt Romney's 2012 run for the presidency and has donated to former U.S. Representative Eric Cantor, Republican of Virginia, and former Senator Mark Kirk, Republican of Illinois. He donated $2.5 million to Bruce Rauner, a Republican candidate for Illinois governor.

In December 2015, Griffin endorsed Sen. Marco Rubio for the 2016 Republican presidential nomination and stated that he planned to donate millions to a pro-Rubio super PAC. Before this endorsement, Griffin had donated $100,000 each to three super PACs supporting Rubio, Jeb Bush, and Scott Walker for the GOP nomination.

In 2015, Griffin donated $5.855 million to Conservative Solutions PAC, Freedom Partners Action Fund, Right To Rise USA and Future45.

Views on market structure

In 2014 Griffin voiced his stance on issues on financial regulations and market structure and has testified at various government hearings. In 2014 he gave testimony at a U.S. Senate Committee hearing on "The Role of Regulation in Shaping Equity Market Structure and Electronic Trading", in which he reiterated the need to have industry regulations catch up with the changes in market structure to increase the fairness and resilience of American equity markets. Griffin, along with NASDAQ Executive Vice President Thomas A. Whittman and Jeff Sprecher, founder and CEO of Intercontinental Exchange and the NYSE, has voiced concerns about regulation failing to keep pace with changes in market structure as in the practice of dark pools discriminating against certain customer segments.

In May 2008, Griffin criticized the risk management practices of Wall Street saying: "As an industry, we have a responsibility to manage risk in a way that is prudent ... The capital markets are controlled by a bunch of right-out-of business school young guys who haven't really seen that much. You have a real lack of wisdom." Griffin has also stated: "We, as an industry, dropped the ball. The industry needs to overhaul its thinking, accept greater regulation." He explained his views on regulation and risk in a 2008 New York Times article where he was quoted as saying "The unwillingness of the Federal Reserve and the S.E.C. to require working capital limits only exacerbates the risk-taking environment because the banks are playing the equivalent of no-limit poker." Later in 2008, he testified to the United States House Committee on Oversight and Government Reform, stating that "The rapid growth in the use of derivatives has created an opaque market whose outstanding notional value is measured in the hundreds of trillions of dollars. As a result, there is great concern about the systemic effects of the failure of any one financial institution."

Personal life

Griffin married his first wife Katherine Weingartt, who he had met in high school. Griffin later married Anne Dias-Griffin, the founder of Aragon Global Management, another Chicago-based hedge fund firm, in July 2004. with whom he had three children. Griffin and his wife later divorced in October 2015, citing "irreconcilable differences". He is a member of the Fourth Presbyterian Church of Chicago. In 2011, Griffin donated $11 million of the $38.2 million needed to build a new chapel at the church. The modern building is called "The Gratz Center" in honor of Griffin's grandparents.

In 2013, he acquired four real estate properties in Palm Beach, Florida that cost a cumulated sum of $130 million. In 2014, Griffin was elected to a five-year term on the University of Chicago's Board of Trustees. He is a member of the Board of Trustees for the Art Institute of Chicago, the Museum of Contemporary Art and the Whitney Museum of American Art. He is also a member of a number of organizations including the Economic Club of Chicago, and the Civic Committee of the Commercial Club of Chicago. Griffin serves as the vice chairman of the Chicago Public Education Fund.

Wealth and philanthropy

In 2003 Griffin made contributions to the Robin Hood Foundation.

In October 2006, the Griffins and the Bill and Melinda Gates Foundation funded and supported the opening of a new charter school in Chicago called Woodlawn High School.

In 2007 Griffin donated a $19 million addition to the Art Institute of Chicago that was designed by Renzo Piano. The Paul Cézanne paintings have also been loaned to the Institute. In October 2009, Griffin and his wife founded the Kenneth and Anne Griffin Foundation. The foundation's contributions include $10 million for the Chicago Heights Early Childhood Center, $16 million to Children's Memorial Hospital, funding the University of Chicago’s Early Childhood Center, and others.

The Chicago Heights Early Childhood Center, located in Chicago Heights, Illinois, is an experimental educational effort run by economics professor John A. List, from University of Chicago, to test whether investing in teachers or in parents produces better student performance in school.

As of 2010 Griffin had contributed to the Art Institute of Chicago, public education, the Children's Memorial Hospital in Chicago, the Chicago Public Library and the Chicago Symphony Orchestra.

Griffin also contributed to the Museum of Contemporary Art, the "Evolving Planet" at the Field Museum of Natural History and endowed professorships at the University of Chicago.

In February 2014, Griffin gave $150 million to Harvard University his alma mater, largely for need-based undergraduate financial aid. At the time, it was the largest single gift in Harvard's history. As of November 2014 Griffin had donated about $500 million to support various causes, including tens of millions to institutions in Chicago.

Art collection

Griffin is one of the most active art buyers in the world. In 1999, he paid a record price of $60 million for Paul Cézanne's painting Curtain, Jug and Fruit Bowl. In October 2006, Griffin purchased False Start by artist Jasper Johns for $80 million from Dreamworks co-founder David Geffen.

As of February 2016, Griffin had purchased Willem de Kooning's 1955 oil painting, Interchange for $300 million, and Jackson Pollock’s 1948 painting, Number 17A, for $200 million, both from David Geffen.

In 2015, Griffin donated $10 million to the Museum of Contemporary Art in Chicago. In December 2015 he donated an unrestricted gift of $40 million to the Museum of Modern Art in New York, one of the single largest in the history of the museum.

Legacy and awards

In 2008, he was inducted into Institutional Investors Alpha's Hedge Fund Manager Hall of Fame along with David Swensen, Louis Bacon, Steven Cohen, Seth Klarman, Paul Tudor Jones, George Soros, Michael Steinhardt, Jack Nash, James Simons, Alfred Jones, Leon Levy, Julian Robertson, and Bruce Kovner.