A tax exile is a person who leaves a country to avoid the payment of income or other taxes. It is a person who already owes money to the tax authorities or wishes to avoid being liable in the future to taxation at what he or she considers high tax rates, instead choosing to reside in a foreign country or jurisdiction which has no taxes or lower tax rates. In general, there is no extradition agreement between countries which covers extradition for outstanding tax liabilities. Going into tax exile is a form of tax mitigation or avoidance. A tax exile normally cannot return to their home country without being subject to outstanding tax liabilities, which may prevent them from leaving the country until they have been paid.

Most countries tax individuals who are resident in their jurisdiction. Though residency rules vary, most commonly individuals are resident in a country for taxation purposes if they spend at least six months (or some other period) in any one tax year in the country, and/or having an abiding attachment to the country, such as owning a fixed property.

A very simplified 'rule of thumb' is that under UK law a person is "tax resident" if that person meets any of the residency tests set out under the Statutory Residency Test introduced on 6 April 2014. The reality of the matter is far more complex and unclear.

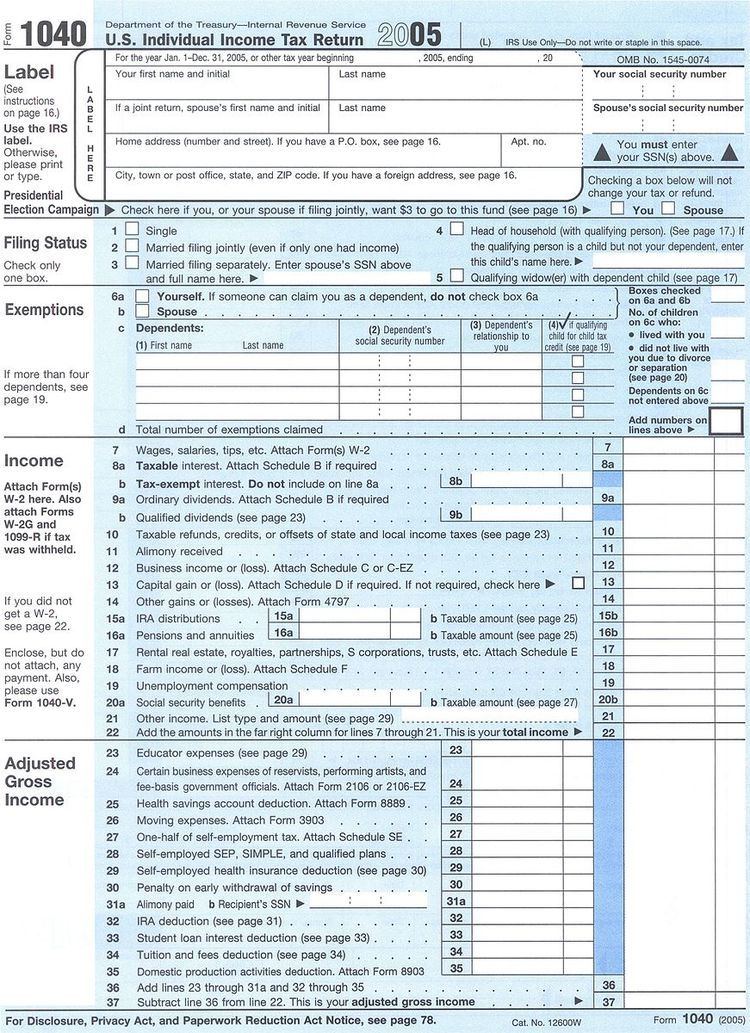

Under the Internal Revenue Code, a United States citizen is taxed on his or her worldwide income, regardless to their place of residence. United States citizens can avoid tax liability only by both moving abroad and renouncing citizenship, but if they continue to earn money inside the United States, they will still be liable for taxes as if they were guest workers. However, United States citizens living abroad are entitled to substantial tax savings through the foreign earned income exclusion.

A permanent resident in the United States is generally treated as a citizen for tax purposes unless his or her residency lapses. An immigrant not legally admitted for permanent residence (such as a guest worker) becomes liable for United States taxes if he or she spends more than 122 days in the tax year in the United States.

Bad Company moved to Malibu, California, in 1975 to avoid what Mick Ralphs described as "ridiculously high tax in England".David and Frederick Barclay live on Brecqhou, one of the Channel Islands, located just west of Sark, and give their address as Avenue de Grande-Bretagne, Monte-Carlo.John Barry, the composer of 11 James Bond films, moved to the United States in 1975 where he resided until his death in 2011.Shirley Bassey started living as a tax exile from the United Kingdom in 1968, and was unable to work in Britain for almost two years. She currently lives in Monte Carlo.Marc Bolan relocated from the United Kingdom to Los Angeles in 1973 due to the UK's income tax, staying there until relocating to London in mid-1976.David Bowie moved from the United Kingdom to Switzerland in 1976, first settling in Blonay and then Lausanne in 1982.Michael Caine moved to the United States in the late 1970s to avoid the 83% tax on top earners that existed in Britain at the time. He spent several years in the United States before returning to Britain.Ronnie Corbett and Ronnie Barker spent 1979 in Australia to avoid taxation on their previous year's income.Noël Coward left the UK for tax reasons in the 1950s, receiving harsh criticism in the press. He first settled in Bermuda but later bought houses in Jamaica and Switzerland (in the village of Les Avants, near Montreux), which remained his homes for the rest of his life.Marvin Gaye first relocated to Hawaii from Los Angeles to avoid problems with the IRS in 1980. Later that year, Gaye relocated to London following the end of a European tour, then moved to Ostend, Belgium in February 1981. He recorded his final album Midnight Love (released in March 1982) while living in Belgium.Stelios Haji-Ioannou who was quoted as saying: "I have no UK income to be taxed in the UK." Source: David Leigh, Monday, July 10, 2006, The Guardian.Guy Hamilton, the director of four James Bond films, became a tax exile in the mid-1970s when he was originally hired to direct Superman (1978). Because of the U.K. tax laws, he could remain in the United Kingdom for 30 days a year. As a result, fellow Bond director John Glen has directed five films in the franchise.The band Jethro Tull moved to France from Britain in 1973, and while there, attempted to produce a new double album, but abandoned the effort.Tom Jones also moved to Los Angeles for tax purposes following the election of Harold Wilson as British prime minister in 1974, who put income tax up to 83% for top earners.In 1978, the members of the band Pink Floyd spent exactly one year outside of the United Kingdom, also for tax reasons.In early 1970s, some members of The Rolling Stones used trusts and offshore companies to avoid payment of British taxes. According to a 2006 article in the Daily Mail, their holding company was in Holland, where there is no direct tax on royalties, and there were also offices in the Caribbean. The article also says that "they have been tax exiles ever since - meaning they cannot make Britain their main home" and that "The Rolling Stones have paid just 1.6% tax on their earnings of £242 million over the past 20 years." The article also suggests that other performing artists have adopted the same financial arrangements.Cat Stevens became a tax exile from the United Kingdom in 1973 for one year, living in Rio de Janeiro, Brazil, South America.Rod Stewart left the United Kingdom and made his home in Los Angeles in 1975 to avoid the 83% tax on top earners that existed in Britain at the time.Gérard Depardieu, formerly a French national, became a tax exile, taking up an official resident of Néchin, Belgium, on 7 December 2012. Then on 15 December 2012, Depardieu handed back his French passport, and on 3 January 2013, was granted Russian citizenship.The Tax Exile was the title of a 1989 novel by Guy Bellamy.In various versions of The Hitchhiker's Guide to the Galaxy by Douglas Adams, the rock star Hotblack Desiato is reported as "spending a year dead for tax reasons". Also, the character of Veet Voojagig "was finally sent into tax exile, which is the usual fate reserved for those who are determined to make a fool of themselves in public."Characters in the play Noises Off have to sneak into their home in England because they are tax exiles and will lose their status if it becomes known they are in the country.