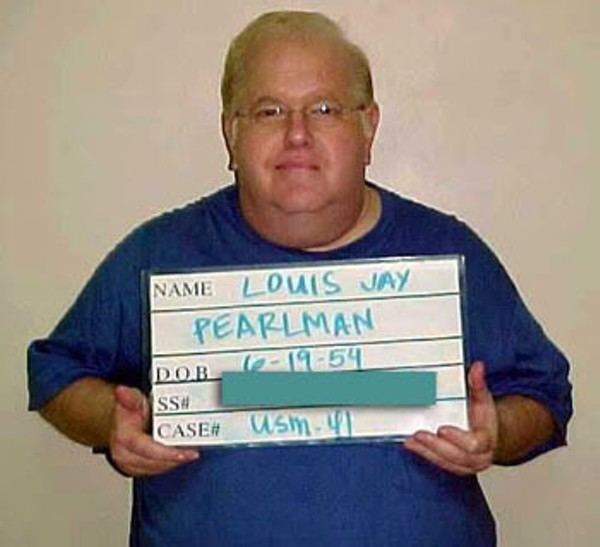

Birth name Louis Jay Pearlman Role Impresario Name Lou Pearlman | Years active 1993–2006 Occupation(s) ProducerManager | |

| ||

Also known as Big Poppa, Incognito Johnson Born June 19, 1954New York, New York ( 1954-06-19 ) Labels Trans Continental Records Books Bands, Brands and Billions: My Top 10 Rules for Making Any Business Go Platinum Parents Hy Pearlman, Reenie Pearlman Movies and TV shows Making the Band, Popstar, Inside Monkey Zetterland, Red Riding Hood, Making the Band 4 Similar People Brian Littrell, Ashley Parker Angel, Nick Carter, Mary‑Ellis Bunim, Jonathan Murray | ||

Backstreet boys discuss former ceo lou pearlman backstreet boys interview

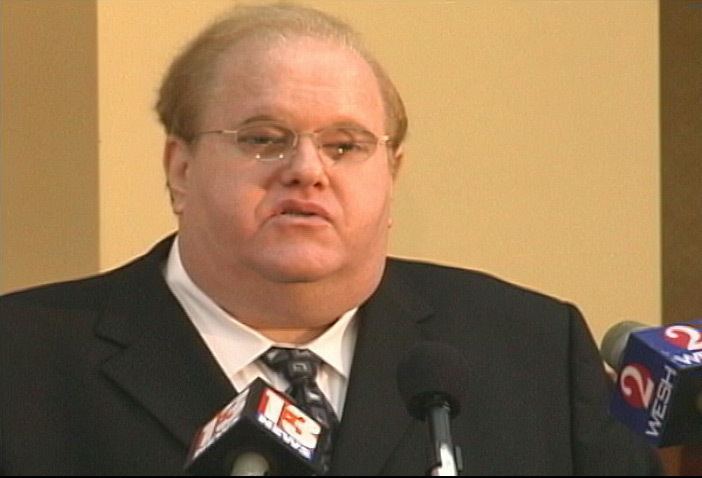

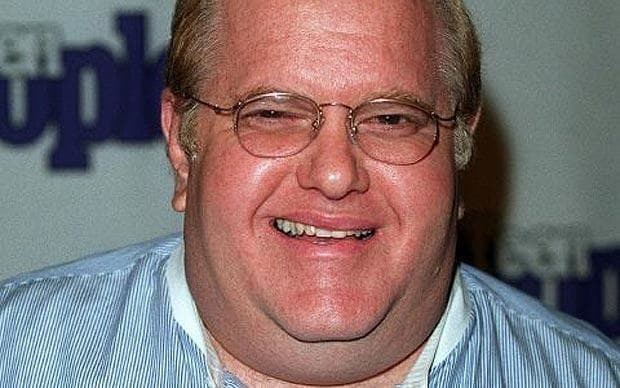

Louis Jay "Lou" Pearlman (June 19, 1954 – August 19, 2016) was an American record producer and fraudster. He was the manager of successful 1990s boy bands such as Backstreet Boys and NSYNC. In 2006, he was accused of running one of the largest and longest-running Ponzi schemes in history, leaving more than $300 million in debts. After being apprehended, he pleaded guilty to conspiracy, money laundering, and making false statements during a bankruptcy proceeding. In 2008, Pearlman was convicted and sentenced to up to 25 years in prison. He died in federal custody in 2016.

Contents

- Backstreet boys discuss former ceo lou pearlman backstreet boys interview

- Backstreet boys interview nick carter talks former manager lou pearlman

- Early life

- Suspicions of insurance fraud and pump dump

- Entertainment industry career

- Band lawsuits

- Talent scouting scandal

- Ponzi scheme

- Investigation

- Conviction and sentencing

- Bankruptcy

- Death

- References

Backstreet boys interview nick carter talks former manager lou pearlman

Early life

Pearlman was born and raised in Flushing, New York, the only child of Jewish parents, Hy Pearlman, who ran a dry cleaning business, and Reenie Pearlman, a school lunchroom aide. He was a first cousin of Art Garfunkel. His home at Mitchell Gardens Apartments was located across from Flushing Airport, where he and childhood friend Alan Gross would watch blimps take off and land. According to his autobiography, which he titled Bands, Brands, & Billions, it was during this period that he used his position on his school newspaper to earn credentials and get his first ride in a blimp. This is disputed by Gross, who claims he was the school reporter, and allowed Pearlman to tag along.

His cousin Garfunkel's fame and wealth helped fire Pearlman's own interest in the music business. As a teenager he managed a band, but when success in music proved elusive, he turned his attention to aviation. During his first year as a student at Queens College, Pearlman wrote a business plan for a class project based on the idea of a helicopter taxi service in New York City. By the late 1970s, he had launched the business based on his business plan, starting with one helicopter. He persuaded German businessman Theodor Wüllenkemper to train him on blimps and subsequently spent some time at Wüllenkemper's facilities in Germany learning about the airships.

Suspicions of insurance fraud and pump & dump

Returning to the United States, Pearlman formed Airship Enterprises Ltd, which leased a blimp to Jordache before actually owning one. He used the funds from Jordache to construct a blimp, which promptly crashed. The two parties sued each other, and seven years later Pearlman was awarded $2.5 million in damages. On the advice of a friend, Pearlman started a new company, Airship International, taking it public to raise the $3 million he needed to purchase a blimp, claiming (falsely) that he had a partnership with Wüllenkemper. He leased the blimp to McDonald's for advertising.

He then relocated Airship International to Orlando, Florida in July 1991, where he signed MetLife and SeaWorld as clients for his blimps. Airship International suffered when one of its clients left and three of the aircraft crashed. The company's stock, which had once been pumped up to $6 a share, dropped to a price of 3 cents a share, and the company was shut down:

After he took his air charter company, Airship International, public in 1985, Pearlman became personally and professionally close to Jerome Rosen, a partner at small-cap trading outfit Norbay Securities. Based in Bayside, Queens, and frequently in trouble with regulators, Norbay actively traded Airship stock. This sent Airship's stock price consistently higher, enabling Pearlman to sell hundreds of thousands of shares and warrants at ever-higher prices. However, Airship was reporting little revenue, cash flow or net income. In return for keeping his penny stock liquid, Pearlman allegedly paid Rosen handsome commissions, according to a mutual friend, that reached into 'the tens of thousands of dollars' per trade.

Entertainment industry career

Pearlman became fascinated with the success of the New Kids on the Block, who had made hundreds of millions of dollars in record, tour and merchandise sales. He started Trans Continental Records with the intent of mimicking their boy-band business model. The label's first band, the Backstreet Boys, consisted of five unknown performers selected by Pearlman in a $3 million talent search. Management duties were assigned to a former New Kids on the Block manager, Johnny Wright, and his wife Donna. The Backstreet Boys became the best-selling boy band of all time, with record sales of 130 million, hitting gold, platinum, and diamond in 45 different countries. Pearlman and the Wrights then repeated this formula almost exactly with the band *NSYNC, which sold over 55 million records globally.

With these two major successes under his belt, Pearlman had become a music mogul. Other boy bands managed by Pearlman were O-Town (created during the ABC–MTV reality TV series Making the Band and headed by Ashley Parker Angel), LFO, Take 5, Natural and US5, as well as the girl group Innosense (with Britney Spears in the very beginning as a short-term member), co-managed with Lynn Harless (the mother of *NSYNC band member Justin Timberlake). Other artists on the Trans Continental label included Aaron Carter, Jordan Knight, Smilez & Southstar and C-Note. Pearlman also owned a large entertainment complex in Orlando, including a recording studio he called Trans Continental Studios, and a dance studio by Disney World named "O-Town." In 2002, Pearlman and Wes Smith co-wrote Bands, Brands and Billions: My Top 10 Rules for Making Any Business Go Platinum, where he made such statements as the one disputed above.

Lou Pearlman also was an officer at TAG Entertainment. This independent film company produced some low-budget, yet profitable, movies and DVDs.

Band lawsuits

With the exception of US5, all of the musical acts who worked with Pearlman sued him in Federal Court for misrepresentation and fraud. All cases against Pearlman have either been won by those who have brought lawsuits against him, or have been settled out of court. All cases also ended with a confidentiality agreement, meaning that none of the parties are allowed to discuss Pearlman's practices in detail.

The members of Backstreet Boys were the first to file a lawsuit against Pearlman, feeling that their contract — under which Pearlman collected as both manager and producer — was unfair, since Pearlman was also paid as a sixth member of the Backstreet Boys (i.e., one-sixth of the band's own income). The band's dissatisfaction began when member Brian Littrell hired a lawyer to determine why the group had received only $300,000 for all of their work, while Pearlman and his record company had made millions. Fellow boy band *NSYNC was having similar issues with Pearlman, and its members soon followed suit.

At the age of 14, pop star Aaron Carter filed a lawsuit in 2002 that accused Pearlman and Trans Continental Records of cheating him out of hundreds of thousands of dollars and of racketeering in a deliberate pattern of criminal activity. This suit was later settled out of court.

Talent scouting scandal

In September 2002, Pearlman purchased Mark Tolner's internet-based talent company, Options Talent Group f/k/a Sector Communications, which had previously named Emodel and Studio 58 and would then go through several names including Trans Continental Talent, TCT, Wilhelmina Scouting Network or WSN, Web Style Network, Fashion Rock, and Talent Rock. Regardless of the name, all incarnations were based on the business model used by Emodel founder Ayman "Alec" Difrawi (aka Alec Defrawy), himself a convicted con-man, who played a principal role in running Options / TCT / WSN and setting up Fashion Rock. The companies received unfavorable press attention, ranging from questions about their business practices to outright declarations that they were scams.

After Hotjobs and Monster.com pulled over a thousand of the company's job ads from their boards, they were further advertised on the Difrawi-founded "Industry Magazine" website. The Better Business Bureau's opinion about Options / TCT / WSN was negative, citing a "pattern of complaints concerning misrepresentation in selling practices." The New York State Consumer Protection Board issued an alert, naming it the largest example they had found of a photo mill scam (in which agencies force models to shoot portfolios with photographers on their own payrolls), and a state senator called it trying "to make a quick, dishonest dollar."

The San Francisco labor commissioner declared it in violation of California law, and several state agencies were reported to be investigating it. In Florida, around 2,000 complaints were filed with the then-Attorney General Charlie Crist and the Better Business Bureau, and an investigation was started by Assistant AG Dowd. However, no charges were filed, as the newly appointed Assistant AG MacGregor was unable to find "any substantial violations" and the company had declared bankruptcy, "leaving no deep pockets to collect damages from."

By June of 2004, Fashion Rock, LLC had filed a civil suit for defamation against some who had criticized Pearlman's talent businesses. The case was dismissed and closed in 2006. One of the accused, Canadian consumer-fraud expert Les Henderson, successfully pursued a libel lawsuit against Pearlman, Tolner, El-Difrawi and several others.

Fashion Rock, LLC lived on until February 2, 2007, when its assets were sold in Pearlman's bankruptcy proceeding. Difrawi continued filing lawsuits that all got dismissed and was most recently running Expand, Inc. dba Softrock.org aka Employer Network, from the same address as former TCT.

Ponzi scheme

In 2006, investigators discovered Pearlman had perpetrated a long-running Ponzi scheme that defrauded investors out of more than $300 million. For more than 20 years, Pearlman had enticed individuals and banks to invest in Trans Continental Airlines Travel Services Inc. and Trans Continental Airlines Inc., both of which existed only on paper. Pearlman used falsified Federal Deposit Insurance Corporation, AIG and Lloyd's of London documents to win investors's confidence in his "Employee Investment Savings Account" program, and he used fake financial statements created by the fictitious accounting firm Cohen and Siegel to secure bank loans.

Investigation

In February of 2007, Florida regulators announced that Pearlman's Trans Continental Savings Program was indeed a massive fraud, and the state took possession of the company. Most of the at least $95 million which was collected from investors was gone. Orange County Circuit Judge Renee Roche ordered Pearlman and two of his associates, Robert Fischetti and Michael Crudelle, to bring back to the United States "any assets taken abroad which were derived from illegal transactions."

Following a flight from officials, Pearlman was arrested in Indonesia on June 14, 2007 after being spotted by a German tourist couple. He was living in a tourist hotel in Nusa Dua in Bali. Pearlman had been seen in Orlando in late January of 2007, in early February in Germany, including an appearance on German television on February 1. Reportedly he was also seen in Russia, Belarus, Israel, Spain, Panama and Brazil. In early February, an attorney in Florida received a letter from Pearlman sent from Bali. Pearlman was then indicted by a federal grand jury on June 27, 2007. Specifically, Pearlman was charged with three counts of bank fraud, one count of mail fraud and one count of wire fraud.

Conviction and sentencing

Five days before his sentencing, Pearlman requested a telephone and an Internet connection two days a week to continue to promote bands. U. S. District Judge G. Kendall Sharp rejected the request. On May 21, 2008, Sharp sentenced Pearlman to 25 years in prison on charges of conspiracy, money laundering, and making false statements during a bankruptcy proceeding. Pearlman could reduce his prison time by one month for every million dollars he helped a bankruptcy trustee recover. He also ordered individual investors to be paid before institutions in distributing any eventual assets.

Bankruptcy

Pearlman and his companies were forced into involuntary bankruptcy in March of 2007. Trustees and lenders auctioned off Pearlman's assets and personal belongings through eBay and a traditional bankruptcy auction. Church Street Station, a historic train station in downtown Orlando which Pearlman had purchased in 2002, was sold at a bankruptcy auction in April of 2007 for $34 million. Several of Pearlman's belongings, including his college degrees, were purchased by The A.V. Club journalist and film critic Nathan Rabin during the eBay auction.

Death

In 2008, Pearlman began his prison sentence with a projected release date of March 24, 2029. But he suffered a stroke in 2010 while incarcerated. Pearlman died, while still in custody at the Federal Correctional Institution in Miami, Florida, on August 19, 2016 from cardiac arrest, at the age of 62 years.