| ||

The higher education bubble in the United States is a claim that excessive investment in higher education could have negative repercussions in the broader economy. According to the claim – generally associated with fiscal conservatives – while college tuition payments are rising, the supply of college graduates in many fields of study is exceeding the demand for their skills, which aggravates graduate unemployment and underemployment, which in turn increases the burden of student loan defaults on financial institutions and taxpayers. Also, employers have responded to the oversupply of graduates by raising the academic requirements of many occupations higher than is really necessary to perform the work. The claim has generally been used to justify cuts to public higher education spending, tax cuts, or a shift of government spending towards the criminal justice system and the Department of Defense.

Contents

Even the nonpartisan New York Fed, in the liberal-leaning state of New York, which used "a Bartik-like approach to identify the effect of increased loan supply on tuition following large policy changes in federal aid program maximums available to undergraduate students that occurred between 2008 and 2010" found "that institutions that were most exposed to these loan limit maximums ahead of the policy changes experienced disproportionate tuition increases around these changes, with effects of changes in institution-specific program maximums of Pell Grant, subsidized."

However, economic data shows that the benefits of education – in the form of higher earnings and increased likelihood of employment caused by additional education – have been growing over time, even as the supply of educated workers has grown. The benefits of higher education continue to exceed the costs by a wide margin for most students, and education contributes to economic growth. Even among those who are employed in jobs that do not ostensibly require their level of education, education increases earnings and productivity. Labor economists, statisticians and other social scientists generally struggle to explain apparent under-investment in higher education, given the large financial returns. Moreover, student loans are profitable for the government.

Discussion

Benjamin Ginsberg explains the connection between the increased ability to pay tuition and the increase in services provided in his book The Fall of the Faculty. According to Ginsberg, "there have been new sorts of demands for administrative services that require more managers per student or faculty member than was true in the past." The Goldwater Institute echoes this sentiment with its findings that, "Between 1993 and 2007, the number of full-time administrators per 100 students at America’s leading universities grew by 39 percent, while the number of employees engaged in teaching, research or service only grew by 18 percent."

As discussed below, the "higher education bubble" is controversial and has been rejected by some economists. Indeed, many Americans still believe in the value of a college education, although they are unsure about its quality and affordability. Data shows that the wage premium – the difference between what those with a four-year college degree earn and what those with only a high school education earn – has increased dramatically since the 1970s, but so has the 'debt load' incurred by students due to the tuition inflation. The data also suggests that, notwithstanding a slight increase in 2008–09, student loan default rates have declined since the mid-1980s and 1990s. Those with college degrees are much less likely than those without to be unemployed, even though they are more expensive to employ (they earn higher wages). The global management consulting firm McKinsey and Company projects a shortage of college-trained workers, and a surplus of workers without college degrees, which would cause the wage premium to increase, and cause differences in unemployment rates to become even more dramatic. What is also interesting is that the cost of tuition over last 4 years from 2009–12 has been increasing steadily over the years while wages have remained stagnant. The inflation has been at really low levels in US in past 4 years and there are no explainable reasons why Cost of Masters / Graduation is rising higher than inflation

In 1971, Time ran an article "Education: Graduates and Jobs: A Grave New World," which stated that the supply of post-graduate students was around twice larger than the expected future demand in upcoming decades. In 1987, U.S. Secretary of Education William Bennett first suggested that the availability of loans may in fact be fueling an increase in tuition prices and an education bubble. This "Bennett hypothesis" claims that readily available loans allow schools to increase tuition prices without regard to demand elasticity. College rankings are partially driven by spending levels, and higher tuition prices are correlated with increased public perceptions of prestige. Over the past thirty years, demand has increased as institutions improved facilities and provided more resources to students. Additionally, schools tend to enroll fewer students as they improve student offerings and increase prices. This suggests that it is in schools' best interest to increase tuition prices as much as possible, so long as financial aid ensures an ability to pay on the part of students and parents.

A variation on the higher education bubble theory suggests that there is no general bubble in higher education – that is, on average, higher education really does boost income and employment by more than enough to make it a good investment – but that degrees in some specific fields may be overvalued because they do little to boost income or improve job prospects, while degrees in other fields may in fact be undervalued because students do not appreciate the extent to which these degrees could benefit their employment prospects and future income. Proponents of this theory have noted that schools charge equal prices for tuition regardless of what students study, the interest rate on federal student loans is not adjusted according to risk, and there is evidence that undergraduate students in their first 3 years of college are not very good at predicting future wages by major.

A 2011 article in The Huffington Post, related concern that new college graduates hiring rates are up by 10 percent and that attaining a secondary level education eventually pays off. It is also suggested that high school graduates are three times more likely to live in poverty than students with higher education degrees. A recent study from the Labor Department suggests that attaining a bachelor's degree "represents a significant advantage in the job market". However, the article also claims that those who only have a high school education – unemployment is slightly higher at a rate of 9.3 percent. The proponents of the article also claim that companies are most likely to hire an applicant straight from college rather than one who has been unemployed.

A 2010 article in the The Christian Science Monitor, suggest ten main benefits of obtaining a degree via higher education. Also suggesting that a college degree pays off financially and intangibly for the graduate, and overall for society. In November 2011, The Chronicle of Higher Education ran an article claiming that the future is bright for college graduates and expected to improve. A rapid 10% increase is anticipated for new bachelor's hires. A survey conducted by The Chronicle of Higher Education suggests that 40 percent of 3,300 employers plan to hire graduates from all fields of study. The survey suggested stability in the upcoming job market.

A 2009 article in The Chronicle of Higher Education, related concern from parents wondering whether it is worth the price to send their children to college. The Economist in turn hypothesized that the bubble bursting may make it harder for colleges to fill their classes, and that some building projects will come to a halt. The Boston Herald further suggested the possibility of mergers, closures and even bankruptcies of smaller colleges that have spent too much and taken on too much debt. National Review writer Dan Lips has proposed that the bubble's bursting may bring down higher education prices.

Glenn Reynolds wrote in the Washington Examiner that those who have financed their educations with debt may be particularly hard-hit. Reynolds continued arguing his case in The Higher Education Bubble where he noted that higher education, as a "product grows more and more elaborate – and more expensive – but the expense is offset by cheap credit provided by sellers who are eager to encourage buyers to buy."

Further speculation as to the higher education bubble was the focus of a series of articles in The Economist in 2011.

Controversy

The view that higher education is a bubble is controversial. Most economists do not think the returns to college education are falling – in fact, the data suggests the rate of return is increasing. Indeed, the returns to education are much higher than the returns to other forms of investment such as the stock market, bonds, real estate, and private equity. This suggests underinvestment in higher education – the exact opposite of a bubble. However, this does not apply to the economy overall. Studies have questioned the causality of the growth-education relationship and have largely found negative correlations.

In a financial bubble, assets like houses are sometimes purchased with a view to reselling at a higher price, and this can produce rapidly escalating prices as people speculate on future prices. An end to the spiral can provoke abrupt selling of the assets, resulting in an abrupt collapse in price – the bursting of the bubble. Because the asset acquired through college attendance – a higher education – cannot be sold (only rented through wages), there is no similar mechanism that would cause an abrupt collapse in the value of existing degrees. For this reason, many people find this analogy misleading. However, one rebuttal to the claims that a bubble analogy is misleading is the observation that the 'bursting' of the bubble are the negative effects on students who incur student debt, for example, as the American Association of State Colleges and Universities reports that "Students are deeper in debt today than ever before...The trend of heavy debt burdens threatens to limit access to higher education, particularly for low-income and first-generation students, who tend to carry the heaviest debt burden. Federal student aid policy has steadily put resources into student loan programs rather than need-based grants, a trend that straps future generations with high debt burdens. Even students who receive federal grant aid are finding it more difficult to pay for college." In this analogy, the increased inability of students to pay for their debt would represent the crash or bubble bursting, thus causing the tax payers to bail out the government for giving out bad loans -as the ratio of the aggregate debt compared to the aggregate earning potential grows to the tipping point, due to the finite amount of high paying positions, the limiting factor in this analogy.

However, the data actually show that, notwithstanding a slight increase in 2008–2009, student loan default rates have declined since the mid-1980s and 1990s. And even during the recession, those with college degrees are much less likely than those without to be unemployed, even though they earn higher wages.

Ohio University economist Richard Vedder has written in the Wall Street Journal that:

"A key measure of the benefits of a degree is the college graduate's earning potential – and on this score, their advantage over high-school graduates is deteriorating. Since 2006, the gap between what the median college graduate earned compared with the median high-school graduate has narrowed by $1,387 for men over 25 working full time, a 5% fall. Women in the same category have fared worse, losing 7% of their income advantage ($1,496). A college degree's declining value is even more pronounced for younger Americans. According to data collected by the College Board, for those in the 25-34 age range the differential between college graduate and high school graduate earnings fell 11% for men, to $18,303 from $20,623. The decline for women was an extraordinary 19.7%, to $14,868 from $18,525. Meanwhile, the cost of college has increased 16.5% in 2012 dollars since 2006, according to the Bureau of Labor Statistics' higher education tuition-fee index."

Nader Habibi, who runs the website overeducation.org, writing in The New Republic, cited this evidence:

In a 2014 study, two economists affiliated with the Federal Reserve Bank of New York found that since 1990 at least 30 percent of all workers (aged 22 to 65) with college degrees have been consistently employed in jobs that do not require a college degree for the required tasks, even ten years after graduation. Not surprisingly, the percent of recent college graduates (aged 22 to 27) with such jobs has been much higher than the figure above and has ranged from 38 percent to 49 percent since 1990.... The Obama administration recently created a valuable online database called College Scorecard to offer a more realistic picture of income prospects with a college degree. One of the indicators in this database shows that more than half of graduates at hundreds of colleges are earning less than the average income of someone holding a high school degree ($25,000 a year) ten years after enrollment. Ideally, this ratio should be zero. A large number of unemployed and underemployed graduates are also burdened with high student loan debts—more than $100 billion in 2013 alone—they have trouble paying back. We should not forget the billions that federal, state and local governments spend on higher education through subsidies and financial aid—$157.5 billion in 2014. The portion of this spending that supports the education of underemployed graduates could be used more effectively for job creation or training of students in vocational skills which are more in demand.

Some like Michael Wenisch, of Georgetown University, calls the education bubble a "student loan bubble" and have suggested that "without the continuing growth of the student loan bubble, it is foreseeable that many colleges and universities will be forced to declare bankruptcy and cease operations over the next ten years."

Alternatives to bubble theory

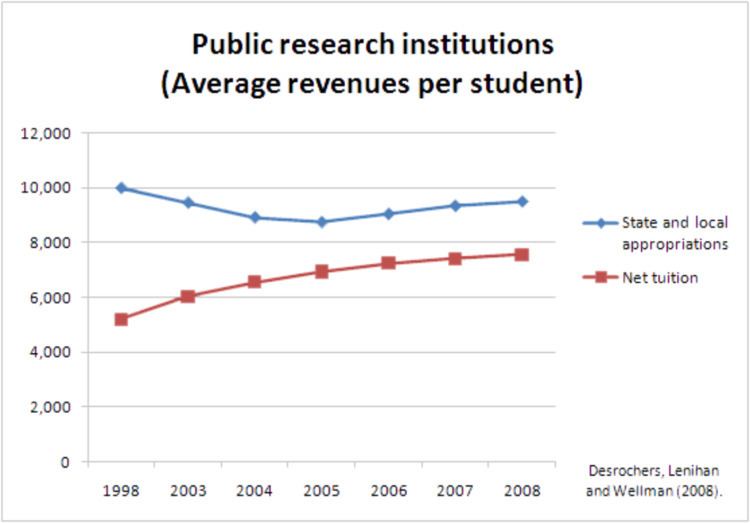

A different proposal for the cause of rising tuition is the reduction of state and federal appropriations to colleges, making them rely more on student tuition. Thus, it is not a bubble, but a form of shifting costs away from state and federal funding over to students. This has mostly applied to public universities which in 2011 for the first time have taken in more in tuition than in state funding, and had the greatest increases in tuition. Implied from this shift away from public funding to tuition is privatization, although The New York Times reported that such claims are exaggerated.

Another proposed cause of increased tuition is U.S. Congress' occasional raising of the 'loan limits' of student loans, in which the increased availability of students to take out deeper loans sends a message to colleges and universities that students can afford more, and then, in response, institutions of higher education raise tuition to match, leaving the student back where he began, but deeper in debt. Therefore, if the students are able to afford a much higher amount than the free market would otherwise support for students without the ability to take out a loan, then the tuition is 'bid up' to the new, higher, level that the student can now afford with loan subsidies. One rebuttal to that theory is the fact that even in years when loan limits have not risen, tuition has still continued to climb. However, that may not disprove this proposed cause: It may simply mean that other factors besides 'loan limit' increases played a part in the increases in tuition.

A third, novel, theory claims that the recent change in federal law removing all standard consumer protections (truth in lending, bankruptcy proceedings, statutes of limits, the right to refinance, adherence to usury laws, and Fair Debt & Collection practices, etc.) strips students of the ability to declare bankruptcy, and, in response, the lenders and colleges know that students, defenseless to declare bankruptcy, are on the hook for any amount that they borrow -including late fees and interest (which can be capitalized and increase the principal loan amount), thus removing the incentive to provide the student with a reasonable loan that he/she can pay back. As proof of this theory, it has been shown that returning bankruptcy protections (and other Standard Consumer Protections) to Student Loans would cause lenders to be more cautious, thereby causing a sharp decline in the availability of student loans, which, in turn, would decrease the influx of dollars to colleges and universities, who, in turn, would have to sharply decrease tuition to match the lower availability of funds. Under this theory, if student loans did not have the ability to file for bankruptcy, it would be more profitable for the lender if the student defaulted (due to the increases in the amount of the loan after fees and interest are capitalized), and thus there is no free market pressure-type motive for the lender or the college to help the student avoid default. This is especially true because the government, if it is the lender or guarantor of the loan, has the ability to garnish the borrower's wages, tax return, and Social Security Disability income without a court order. Some have called the Federal Government 'predatory' for making loans which will have such a high default rate, since the default rate for Student Loans is projected to reach 46.3% of all federal dollars disbursed to students at for-profit colleges in 2008 (Budget lifetime default rate, loan default rate only 18.6%, meaning that 18.6% of all loans contain 46.3% of all dollars loaned out).

Economic and social commentator Gary North has remarked at LewRockwell.com that "To speak of college as a bubble is silly. A bubble does not pop until months or years after the funding ceases. There is no indication that the funding for college education will cease."

Azar Nafisi, Johns Hopkins University professor and bestselling author of Reading Lolita in Tehran, has stated on the PBS NewsHour that a purely economic analysis of a higher education bubble is incomplete:

"Universities become sort of like canaries in the mine for a culture. They become the sort of standard of where a culture is going. The dynamism, the originality of these entrepreneurial experiences, the fact that a society allows people to be original, to take risks, all of it comes from a passionate love of knowledge. And universities represent all the different areas and fields within a society. And the students and faculty come from all these fields. This is a community that represents the best that a society has to offer. And there was a mention of our universities being the best in the world."

Recommendations

Based on the available data, recommendations to address rising tuition have been advanced by experts and consumer and students' rights advocates: