| ||

Fossil fuel divestment or fossil fuel divestment and investment in climate solutions is the removal of investment assets including stocks, bonds, and investment funds from companies involved in extracting fossil fuels, in an attempt to reduce climate change by tackling its ultimate causes.

Contents

- Reducing carbon emissions

- Acting on the Paris Agreement The Toronto Principle

- Stranded assets the carbon bubble

- Risk of regulation and carbon pricing

- Competition from renewable energy sources

- Unstable fossil fuel prices

- Stigmatization of fossil fuel companies

- Economic risks of divestment from fossil fuels

- Legal cases

- Reaction from the fossil fuel industry

- Exponential growth into a global divestment movement

- Fossil Free ANU

- 350org

- Divest Invest Philanthropy

- The Guardian

- Divest Harvard

- Fossil Free MIT

- Support for the divestment movement by politicians and individuals

- Support for the divestment movement by investors

- Harvard University

- Glasgow University

- Companies that investors divest from

- Governments and pension funds in the United States

- Colleges and universities

- Foundations and charitable endowments

- Religious organizations

- References

Numerous groups advocate fossil fuel divestment, which in 2015 was reportedly the fastest growing divestment movement in history. Beginning on campuses in The United States in 2011 with students urging their administrations to turn investments in the fossil fuel industry into investments in clean energy and communities most impacted by climate change, the movement soon spread across the globe. By December 2016, a total of 688 institutions and over 58,000 individuals representing $5.5 trillion in assets worldwide had been divested from fossil fuels.

Reducing carbon emissions

Fossil fuel divestment aims to reduce carbon emissions by accelerating the adoption of renewable energy through the stigmatisation of fossil fuel companies. This includes putting public pressure on companies that are currently involved in fossil fuel extraction to invest in renewable energy.

The Intergovernmental Panel on Climate Change found that all future carbon dioxide emissions must be less than 1,000 gigatonnes to provide a 66% chance of avoiding dangerous climate change; this figure includes all sources of carbon emissions. To avoid dangerous climate change, only 33% of known extractable fossil fuel of known reserves can be used; this carbon budget can also be depleted by an increase in other carbon emission sources such as deforestation and cement production. It is claimed that, if other carbon emissions increase significantly, then only 10% of the fossil fuel reserves can be used to stay within projected safe limits.

Furthermore, according to the US Environmental Protection Agency, Earth's average temperature has risen by 1.4°F over the past century, and is predicted to rise another 2° to 11.5° over the next hundred years with continued carbon emission rates. This rise in temperature would far pass the level of warming that scientists have deemed safe to support life on earth.

I think this is part of a process of delegitimising this sector and saying these are odious profits, this is not a legitimate business model ... This is the beginning of the kind of model that we need, and the first step is saying these profits are not acceptable and once we collectively say that and believe that and express that in our universities, in our faith institutions, at city council level, then we’re one step away from where we need to be, which is polluter pays.

Acting on the Paris Agreement: The Toronto Principle

The Toronto Principle is a fossil fuel divestment strategy, which puts into action the aims set forth at the Paris Agreement in 2015. It was first coined by Benjamin A. Franta, in an article in the Harvard Crimson, as a reference to the University of Toronto’s fossil fuel divestment process.

After 350.org submitted a petition for divestment on 6 March 2014, President Gertler established an ad hoc Advisory Committee on Divestment from Fossil Fuels. In December of 2015, the Committee released a report with several recommendations. Foremost, they argued that “targeted and principled divestment from companies in the fossil fuels industry that meet certain criteria…should be an important part of the University of Toronto’s response to the challenges of climate change." However, the report went further, and allied itself with the Paris Agreement. It recommended that the university divest from companies that “blatantly disregard the international effort to limit the rise in average global temperatures to not more than one and a half degrees Celsius above pre-industrial averages by 2050…These are fossil fuels companies whose actions are irreconcilable with achieving internationally agreed goals.”

Franta identified this response as the Toronto Principle, which, as he argues, “aligns rhetoric and action. It suggests that it is all institutions’ responsibility to give life to the Paris agreement. Harvard could adopt this Toronto principle, too, and the world would be better for it.” Franta also identified how the Toronto Principle would be put into practice, which includes "moving investments away from coal companies and coal-fired power plants, companies seeking non-conventional or aggressive fossil fuel development (such as oil from the Arctic or tar sands), and possibly also companies that distort public policies or deceive the public on climate. At present, these activities are incompatible with the agreement in Paris.” In adhering to the Toronto Principle, Franta argues that leading institutions can use their status and power to meaningfully respond to the challenge of climate change, and act based on the goals at the Paris Agreement.

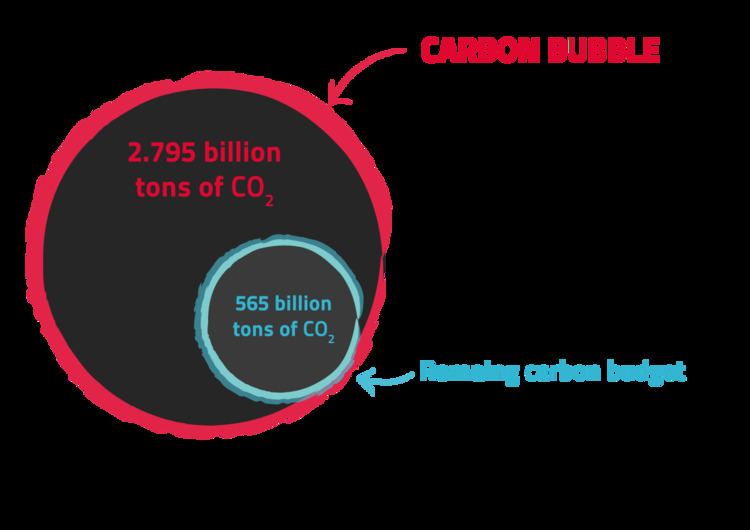

Stranded assets – the carbon bubble

Stranded assets, which are known in relation to fossil fuel companies as the carbon bubble, occur when the reserves of fossil fuel companies are deemed environmentally unsustainable and so unusable and so must be written off. Currently the price of fossil fuels companies' shares is calculated under the assumption that all of the companies' fossil fuel reserves will be consumed, and so the true costs of carbon dioxide in intensifying global warming is not taken into account in a company's stock market valuation.

In 2013 a study by HSBC found that between 40% and 60% of the market value of BP, Royal Dutch Shell and other European fossil fuel companies could be wiped out because of stranded assets caused by carbon emission regulation. Bank of England governor Mark Carney, speaking at the 2015 World Bank seminar, has stated: "The vast majority of reserves are unburnable" if global temperature rises are to be limited to below 2 °C.

In June 2014, the International Energy Agency released an independent analysis on the effect of carbon emissions controls. This estimated that $300 billion in fossil-fuel investments would be stranded by 2035 if cuts in carbon emissions are adopted so that the global mean surface temperature increases by no more than 2 °C.

A report by the Carbon Tracker Initiative found that between 2010 and 2015 the US coal sector had lost 76% of its value including the closure of 200 mines. It found that Peabody Energy, the world's largest private coal mining company, had lost 80% of its share price over this time. This was attributed to Environmental Protection Agency regulations and competition from shale gas.

In 2013, fossil fuel companies invested $670 billion in exploration of new oil and gas resources.

Risk of regulation and carbon pricing

A 2015 report studied 20 fossil fuel companies and found that, while highly profitable, the hidden economic cost to society was also large. The report spans the period 2008–2012 and notes that: "for all companies and all years, the economic cost to society of their CO2 emissions was greater than their after‐tax profit, with the single exception of ExxonMobil in 2008." Pure coal companies fare even worse: "the economic cost to society exceeds total revenue (employment, taxes, supply purchases, and indirect employment) in all years, with this cost varying between nearly $2 and nearly $9 per $1 of revenue." The paper suggests:

This hidden or externalised cost is an implicit subsidy and accordingly represents a risk to those companies. There is a reasonable chance that society will act to either reduce this societal cost by regulating against fossil fuel use or recover it by imposing carbon prices. Investors are increasingly focused on this risk and seeking to understand and manage it."

Competition from renewable energy sources

Competition from renewable energy sources may lead to the loss of value of fossil fuel companies due to their inability to compete commercially with the renewable energy sources. In some cases this has already happened. Deutsche Bank predicts that 80% of the global electricity market will have reached grid parity for solar electricity generation by the end of 2017. In 2012, 67% of the world's electricity generation was produced from fossil fuels.

Kepler Chevreux projects $28 trillion in lost value from fossil fuel companies due to the impact of the growing renewable electricity industry over the next two decades.

Stanwell Corporation, an electricity generator owned by the Government of Queensland made a loss in 2013 from its 4,000 MW of coal and gas fired generation capacity. The company attributed this loss to the expansion of rooftop solar generation which reducing the price of electricity during the day; on some days the price (usually AUD$40–50/MWh) was almost zero. The Australian Government and Bloomberg New Energy Finance forecast the production of energy by rooftop solar to rise sixfold between 2014 and 2024.

Unstable fossil fuel prices

Unstable fossil fuel prices has made investment in fossil fuel extraction a more risky investment opportunity. West Texas Intermediate crude oil fell in value from $107 per barrel in June 2014 to $50 per barrel in January 2015. Goldman Sachs stated in January 2015 that, if oil were to stabilize at $70 per barrel, $1 trillion of planned oilfield investments would not be profitable.

Stigmatization of fossil fuel companies

A study by the Smith School of Enterprise and Environment at University of Oxford found that the stigmatisation of fossil fuel companies caused by divestment can "materially increase the uncertainty surrounding the future cash flows of fossil-fuel companies." That, in turn, "can lead to a permanent compression in the trading multiples – e.g., the share price to earnings (P/E) ratio of a target company."

The study also says that:

The outcome of the stigmatisation process poses the most far-reaching threat to fossil fuel companies. Any direct impacts pale in comparison.

Economic risks of divestment from fossil fuels

According to a 2013 study by the Aperio Group, the economic risks of disinvestment from fossil fuel companies in the Russell 3000 Index are "statistically irrelevant".

Legal cases

In November 2014, a group of seven undergraduate, graduate, and law students filed a lawsuit at the Suffolk County Superior Court against the president and fellows of Harvard College and others for "mismanagement of charitable funds" and "intentional investment in abnormally dangerous activities" in relation to Harvard's investments in fossil-fuel companies. In March 2015, the superior court granted Harvard's motion to dismiss. The superior judge wrote: "Plaintiffs have brought their advocacy, fervent and articulate and admirable as it is, to a forum that cannot grant the relief they seek."

Reaction from the fossil-fuel industry

In October 2014, Exxon Mobil stated that the fossil-fuel divestment was "out of step with reality" and that "to not use fossil fuels is tantamount to not using energy at all, and that's not feasible."

In March 2014, John Felmy, the chief economist of the American Petroleum Institute, stated that the movement to divest from fossil-fuel companies "truly disgusts me" and stated that academics and campaigners who support divestment are misinformed, uninformed or liars. Felmy particularly criticized the environmentalist and author Bill McKibben.

The World Coal Association has pointed out that divesting from the fossil fuel industry does not necessarily result in a reduction of demand for fossil fuels, rather it would result in environmentally conscious investors losing influence over the operation of those companies. In fact, coal has been the fastest growing energy source over the last decade and is an important raw material for steel and cement in developing countries.

Exponential growth into a global divestment movement

From half a dozen college campuses in 2011, calling on their administrations to divest endowments from coal and other fossil fuels and invest in clean energy and "just transition" strategies to empower those most impacted by environmental degradation and climate change, the campaign had spread to an estimated 50 campuses in spring 2012. By September 2014, 181 institutions and 656 individuals had committed to divest over $50 billion. One year later, by September 2015, the numbers had grown to 436 institutions and 2,040 individuals across 43 countries, representing $2.6 trillion in assets, of which 56% were based on the commitment of pension funds and 37% of private companies. By April 2016, already 515 institutions had joined the pledge, of which 27% faith-based groups, 24% foundations, 13% governmental organisations, 13% pension funds and 12% colleges, universities and schools, representing, together with the individual investors, a total of $3.4 trillion in assets.

Fossil Free ANU

The divestment campaign at the Australian National University is one of the longest running in the world and, while it has not yet achieved full fossil fuel divestment, it has had substantial wins, most notably in 2011 and 2014.

Fossil Free ANU formed out of the ANU Environment Collective (EC), a consensus-based and non-hierarchical group of students affiliated with the Australian Student Environment Network, when students were notified in 2011 by campaigners at the Northern Rivers, NSW that ANU was the 12th largest shareholders in the coal seam gas company Metgasco. Following student protests, including an event called 'ANU Gets Fracked' that saw students erect a mock gas rig in Union Court, the ANU Council announced in October 2013 that it would divest from Metgasco, citing student concerns and the fact that the Australian Ethical Investments did not approve of them. Tom Stayner, an activist from the EC, stated in the ANU student paper Woroni that: "He took some convincing, but the Vice Chancellor is showing leadership on this urgent issue."

However, student concerns were again raised in 2012 when it was revealed that the ANU had only reduced its holding in Metgasco from over 4 million shares in 2011 to 2.5 million in 2012. In 2013, Tom Swann filed a FOI request to the ANU requesting all "documents created during 2012, which refer to the University's purchase, sale or ownership of shares in any company which generates revenue from oil, coal, gas, or uranium." These documents revealed that ANU had substantial holdings in major fossil fuel companies and had been buying shares in Santos while selling shares in Metgasco. Students lobbying and public pressure led the ANU Council to implement a Socially Responsible Investment Policy (SRI) in late 2013 modelled on Stanford University, which aims to "avoid investment opportunities considered to be likely to cause substantial social injury."

In 2014, students from Fossil Free ANU organised the first student-initatied referendum at the ANU and in elections in September more than 82 per cent of students voted in favour of the ANU divesting from fossil fuels in what was the highest turnout in a student election at the university in more than a decade. In October 2014, the ANU Council announced that it would divest from seven companies, two of which, Santos and Oil Search, performed poorly in an independent review undertaken by the Centre for Australian Ethical Research. This decision provoked a month-long controversy with the Australian Financial Review publishing over 53 stories criticising the decision including 12 front pages attacking the ANU, with its editor-in-chief, Michael Stutchbury, prouncing the decision to be as "disingenuous" as banning the burqa. These attacks, which The Canberra Times editorial described as "verging on hysterical" was joined by members of the cabinet of the Abbott Government, with the Treasurer Joe Hockey stating that the ANU Council is "removed from the reality of what is helping to drive the Australian economy and create more employment," Education Minister Christopher Pyne calling it "bizarre" and Prime Minister Tony Abbott calling it "stupid." In response, Louis Klee, an activist from Fossil Free ANU, wrote in The Age that the reaction demonstrated not just "the complicity of state power with the mining industry," but also

that the citizens of this country are powerful voices in the debate over climate justice. It demonstrates that they are, ultimately, voices speaking with growing eloquence, urgency and authority for one thing: action to address global climate change.

Vice-Chancellor of ANU Ian Young stood by the decision, stating:

On divestment, it is clear we were in the right and played a truly national and international leadership role. ... [W]e seem to have played a major role in a movement which now seems unstoppable.

Meeting with students in the wake of the furore of the decision, Ian Young told activists from Fossil Free ANU that while he initially thought divestment was "a sideshow," the reaction of the mining companies revealed that students "were right all along."

ANU still has holdings in fossil fuel companies and Fossil Free ANU continues to campaign for ANU to 'Divest the Rest'.

350.org

350.org is an international environmental organization encouraging citizens to action with the belief that publicizing the increasing levels of carbon dioxide will pressure world leaders to address climate change and to reduce levels from 400 parts per million to 350 parts per million. As part of its global policy, 350.org launched their Go Fossil Free: Divest from Fossil Fuels! campaign in 2012, which campaign calls for colleges and universities, as well as cities, religious institutions, and pension funds to withdraw their investments from fossil fuel companies.

Divest-Invest Philanthropy

Divest-Invest Philanthropy is an international platform for institutions committed to fossil fuel divestment.

The Guardian

In March 2015, The Guardian launched the 'Keep it in the ground' campaign encouraging the Wellcome Trust and the Bill & Melinda Gates Foundation to divest from fossil fuel companies in which the foundation has a minimum of $1.4 billion invested. The Wellcome Trust has £450m of investments in Shell, BHP Billiton, Rio Tinto and BP. The petition had received over 140,000 signatures by the end of March 2015.

Divest Harvard

Divest Harvard is an organization at Harvard University that seeks to compel the university to divest from fossil fuel companies. The group was founded in 2012 by students at Harvard College. In November 2012, a referendum on divestment passed at Harvard College with 72% support, followed by a similar referendum at the Harvard Law School in May 2013, which passed with 67% support. During this time, representatives from Divest Harvard began meeting with members of Harvard University's governing body, the Harvard Corporation, but the meetings were described as unproductive.

In October 2013, the Harvard Corporation formally announced that the university would not consider a policy of divestment. Following this, Divest Harvard began organizing rallies, teach-ins, and debates on divestment. In March 2014, students from Divest Harvard recorded an impromptu exchange on divestment with Harvard President Drew Gilpin Faust, during which Faust appeared to claim that fossil fuel companies do not block efforts to counteract climate change. The video has since become a source of controversy.

In April 2014, a group of nearly 100 Harvard faculty released an open letter to the Harvard Corporation arguing for divestment. This was followed by a 30-hour blockade of the Harvard president's office by students protesting the president's refusal to engage in a public discussion of divestment; the Harvard administration terminated the blockade by arresting one of the student protesters. Following the protest, Faust said she would not hold the open forum that students and faculty had requested and would not engage with students from Divest Harvard. In May 2014, a group of Harvard alumni interrupted an alumni reunion event with Faust present by standing and holding a pro-divestment banner; the alumni were removed from the event and banned from Harvard's campus.

In September 2014, Harvard faculty renewed their calls for an open forum on divestment and continued to argue for divestment publicly. In October, 2014, Divest Harvard organized a three-day fast and public outreach event to call attention to the harms of climate change. In November 2014, a group of students calling themselves the Harvard Climate Justice Coalition filed a lawsuit against the Harvard Corporation to compel divestment on the grounds of Harvard's status as a non-profit organization. The lawsuit was dismissed by a Massachusetts Superior Court judge, who wrote that "Plaintiffs have brought their advocacy, fervent and articulate and admirable as it is, to a forum that cannot grant the relief they seek." The plaintiffs have stated that they plan to appeal the decision.

In January 2015, it was revealed that Harvard had increased its direct investments in fossil fuel companies considerably, and the number of faculty and alumni supporting divestment grew. By April 2015, the faculty group calling for divestment grew to 250, the Harvard alumni club of Vermont officially voted to endorse divestment, and Divest Harvard announced the creation of a fossil-free alumni donation fund that Harvard would receive conditional on divestment. In February 2015, Divest Harvard occupied the president's office for 24 hours in protest of the Harvard Corporation's continued unwillingness to engage students on the topic of divestment. This was followed by an open letter from a group of prominent Harvard alumni urging the university to divest. In April 2015, Divest Harvard and Harvard alumni carried out an announced week-long protest called Harvard Heat Week, which included rallies, marches, public outreach, and a continuous civil disobedience blockade of administrative buildings on campus. The Harvard administration avoided engaging with the protest. Following Heat Week, Divest Harvard carried out an unannounced one-day civil disobedience blockade of the Harvard president's office in protest of continued lack of action by the Harvard administration.

Fossil Free MIT

Fossil Free MIT (FFMIT) is a student organization at the Massachusetts Institute of Technology made up of MIT undergrads, graduate students, post-docs, faculty, staff and alumni. The group was formed in Fall 2012 by six MIT students following a visit to Boston by Bill McKibben of 350.org on his “Do the Math” tour. The group has collected over 3,500 signatures in a petition calling for MIT to (1) immediately freeze new investments in fossil fuel companies, and (2) divest within five years from current holdings in these companies.

Following discussions with FFMIT, the university administration initiated a “campus-wide conversation” on climate change to take place from November 2014 to May 2015, which included the formation of the MIT Climate Change Conversation Committee. The committee, composed of 13 faculty, staff, and students, was charged with engaging the MIT community to determine how the university could address climate change and with offering recommendations. The conversation included solicitation of ideas and opinions of MIT community members, as well as a number of public events. The largest event was a fossil fuel divestment debate among six prominent voices on climate change that was attended by approximately 500 people.

The committee released a report in June 2015, recommending a number of initiatives to be undertaken by the university. In regards to fossil fuel divestment, the committee “rejected the idea of blanket divestment from all fossil fuel companies”; although there was “support by (three-quarter) majority of the committee for targeted divestment from companies whose operations are heavily focused on the exploration for and/or extraction of the fossil fuels that are least compatible with mitigating climate change, for example coal and tar sands.”

Following the campus-wide conversation, on October 21, 2015, President L. Rafael Reif announced the MIT Plan for Action on Climate Change. While the plan enacted many of the committee’s recommendations, the university administration chose not to divest its holdings in fossil fuel companies, stating that “divestment…is incompatible with the strategy of engagement with industry to solve problems that is at the heart of today’s plan.”

The following day, Fossil Free MIT began a sit-in outside the office of the President to protest the shortcomings of the plan, including the rejection of divestment. Over 100 people overall participated in the sit-in, which received coverage by multiple news outlets, including the Boston Globe, Boston Magazine, and the Daily Caller. The sit-in, which lasted 116 days, ended officially with an agreement with Vice President for Research Maria Zuber following negotiations about how to improve the Plan. The agreement did not include divestment, but succeeded in establishing a climate advisory committee and a climate ethics forum. In addition, the administration agreed to strengthen the university’s carbon mitigation commitments, striving for carbon neutrality “as soon as possible.”

Support for the divestment movement by politicians and individuals

A number of individuals and organisations have voiced support for fossil fuel divestment including:

In March 2015 Mary Robinson, Ban Ki-moon’s special envoy on climate change and former Irish President stated, "it is almost a due diligence requirement to consider ending investment in dirty energy companies".

Desmond Tutu has voiced support for fossil fuel divestment and compared it to divestment from South Africa in protest of apartheid.

We must stop climate change. And we can, if we use the tactics that worked in South Africa against the worst carbon emitters ... Throughout my life I have believed that the only just response to injustice is what Mahatma Gandhi termed "passive resistance". During the anti-apartheid struggle in South Africa, using boycotts, divestment and sanctions, and supported by our friends overseas, we were not only able to apply economic pressure on the unjust state, but also serious moral pressure.

In 2015, the London Assembly passed a motion calling on the Mayor of London to urgently divest pension funds from fossil fuel companies

Support for the divestment movement by investors

A prominent speaker at the 5th annual World Pensions & Investments Forum held in December 2015, Earth Institute Director Jeffrey Sachs voiced for institutional investors to take their fiduciary responsibility in reducing the risk of losses via fossil fuel divestment.

Harvard University

In February 2015 alumni of Harvard University including Natalie Portman, Robert F. Kennedy, Jr, Darren Aronofsky and Susan Faludi wrote an open letter to Harvard University demanding that it divest its $35.9 billion endowment from coal, gas, and oil companies.

Those students have done a remarkable job in garnering overwhelming student support for divestment, and the faculty too have delivered a strong message. But so far [Harvard] has not just refused to divest, they’ve doubled down by announcing the decision to buy stock in some of the dirtiest energy companies on the planet.

Harvard's decision not to divest was explained in an open letter from the University President, Drew Faust:

Divestment is likely to have negligible financial impact on the affected companies. And such a strategy would diminish the influence or voice we might have with this industry. Divestment pits concerned citizens and institutions against companies that have enormous capacity and responsibility to promote progress toward a more sustainable future.

Glasgow University

Glasgow University became the first university in Europe to agree to divest from fossil fuels. The NSA whistle-blower Edward Snowden commented:

I am proud to offer my support and endorsement for Climate Action Society’s fossil fuels divestment campaign. By confronting the threat of unsustainable energy use and exploration to our planetary habitat, the students of Glasgow University do a public service for all families of today and tomorrow.

Companies that investors divest from

Fossil fuel divestment targets a number of fossil fuel extractors, divestment campaigns often use the Fossil Free Indexes list of the top 100 public coal companies globally and the top 100 public oil and gas companies globally, ranked by the potential carbon emissions content of their reported reserves.

Governments and pension funds in the United States

Governments and pension funds in the United States that have partially or completely divested, or that have taken steps toward divestment, include (listed alphabetically):

Colleges and universities

Colleges and universities which have partially or completely divested, or which have taken steps toward divestment, include (listed alphabetically):

Foundations and charitable endowments

In September the Rockefeller Brothers Fund announced it would be divesting its fossil fuel investments totalling $60 million. "We are quite convinced that if he were alive today, as an astute businessman looking out to the future, he would be moving out of fossil fuels and investing in clean, renewable energy."

Religious organizations

The 2013 general synod of the United Church of Christ (UCC) passed a resolution (sponsored by the Massachusetts Conference and ten other conferences of the UCC) outlining a path to divestment of church funds from fossil-fuel holdings. Under the resolution, a plan for divestment will be developed by June 2018. The original proposal considered by the general synod called for a five-year plan to divestment; this was changed following negotiations between divestment proponents and the UCC's investment arm, United Church Funds. United Church Funds also established a denominational fossil-free fund (believed to be the first of its kind), which raised almost $16 million from UCC congregations, conferences, and other groups by late September 2014.

In June 2014, the trustees of Union Theological Seminary in New York City unanimously voted to begin divesting fossil fuels from the seminary's $108.4 million endowment.

On 30 April 2015, the Church of England agreed to divest £12 million from its tar sands oil and thermal coal holdings. The church has a £9 billion investment fund.