Nationality American Role Economist Influences David Hendry | Contributions ARCHCointegration Name Robert Engle Books Anticipating correlations | |

| ||

Institution New York University, since 2000University of California, San Diego, (1975–2003)Massachusetts Institute of Technology, (1969–1975) Influenced | ||

Influenced by David Forbes Hendry | ||

Dr robert f engle on financial market volatility

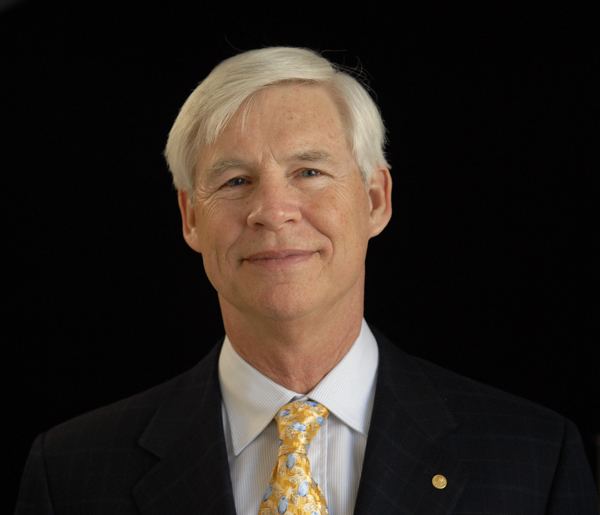

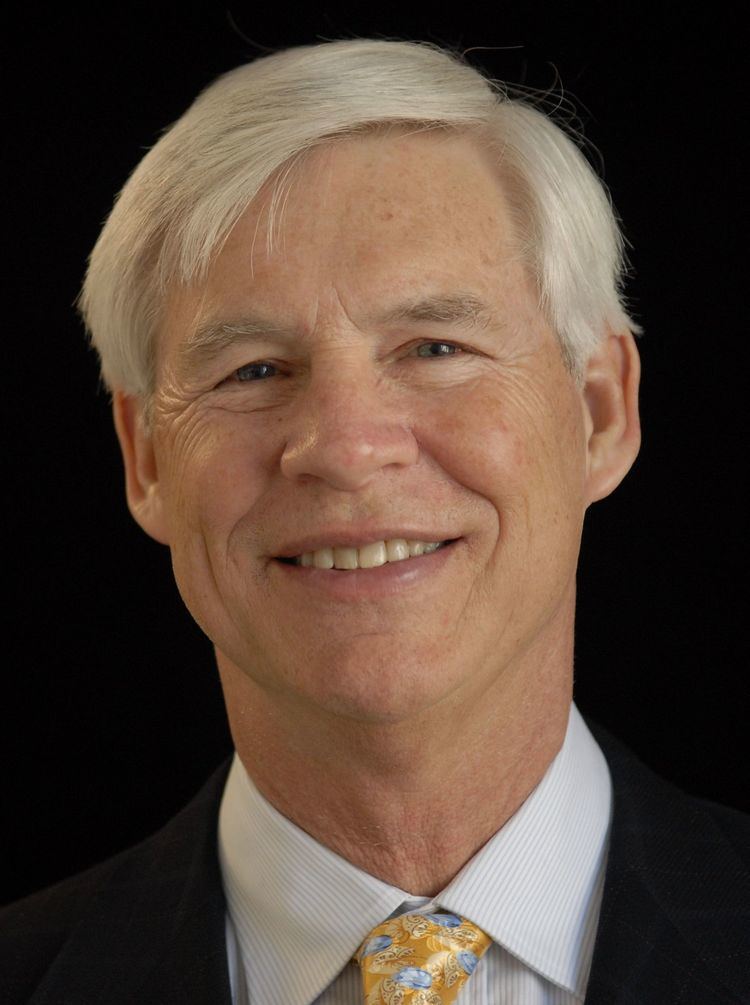

Robert Fry Engle III (born November 10, 1942) is an American economist and the winner of the 2003 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, sharing the award with Clive Granger, "for methods of analyzing economic time series with time-varying volatility (ARCH)".

Contents

- Dr robert f engle on financial market volatility

- Ideas nobel laureate robert f engle

- Biography

- Personal life

- Selected works

- References

Ideas nobel laureate robert f engle

Biography

Engle was born in Syracuse, New York into Quaker family and went on to graduate from Williams College with a B.S. in physics. He earned an M.S. in physics and a Ph.D. in economics, both from Cornell University in 1966 and 1969 respectively. After completing his Ph.D., Engle became Professor of Economics at the Massachusetts Institute of Technology from 1969 to 1977. He joined the faculty of the University of California, San Diego (UCSD) in 1975, wherefrom he retired in 2003. He now holds positions of Professor Emeritus and Research Professor at UCSD. He currently teaches at New York University, Stern School of Business where he is the Michael Armellino professor in Management of Financial Services. At New York University, Engle teaches for the Master of Science in Risk Management Program for Executives, which is offered in partnership with the Amsterdam Institute of Finance.

Engle’s most important contribution was his path-breaking discovery of a method for analyzing unpredictable movements in financial market prices and interest rates. Accurate characterization and prediction of these volatile movements are essential for quantifying and effectively managing risk. For example, risk measurement plays a key role in pricing options and financial derivatives. Previous researchers had either assumed constant volatility or had used simple devices to approximate it. Engle developed new statistical models of volatility that captured the tendency of stock prices and other financial variables to move between high volatility and low volatility periods (“Autoregressive Conditional Heteroskedasticity: ARCH”). These statistical models have become essential tools of modern arbitrage pricing theory and practice.

Engle was the central founder and director of NYU-Stern's Volatility Institute which publishes weekly date on systemic risk across countries on its V-LAB site.

More recently, Engle (and Eric Ghysels) co-founded the Society for Financial Econometrics (SoFiE).