| ||

Negative gearing is a form of financial leverage whereby an investor borrows money to acquire an income-producing investment property and expects the gross income generated by the investment, at least in the short term, to be less than the cost of owning and managing the investment, including depreciation and interest charged on the loan (but excluding capital repayments). The investor may enter into such an arrangement and expect the tax benefits (if any) and the capital gain on the investment, when the investment is ultimately disposed of, to exceed the accumulated losses of holding the investment. The investor would take into account the tax treatment of negative gearing, which may generate additional benefits to the investor in the form of tax benefits if the loss on a negatively geared investment is tax-deductible against the investor's other taxable income and if the capital gain on the sale is given a favourable tax treatment. Some countries, including Australia, Japan, and New Zealand, allow unrestricted use of negative gearing losses to offset income from other sources. Several other OECD countries, including the US, Germany, Sweden, and France, allow loss offsetting with some restrictions. In Canada, losses cannot be offset against wages or salaries. Applying tax deductions from negatively geared investment housing to other income is not permitted in the UK or the Netherlands. With respect to investment decisions and market prices, other taxes such as stamp duties and capital gains tax may be more or less onerous in those countries, increasing or decreasing the attractiveness of residential property as an investment.

Contents

- Australia

- History

- Taxation

- Arguments for and against

- Effect on rent prices

- Effect on housing affordability

- United Kingdom

- New Zealand

- Canada

- United States

- Japan

- Germany

- Netherlands

- References

Negative gearing may also apply to borrowing to purchase shares whose dividends fall short of interest costs. A common type of loan to finance such a transaction is called a margin loan. The tax treatment may or may not be the same.

When the income generated covers the interest, it is simply a geared investment, which creates passive income. A negative gearing strategy makes a profit under any of the following circumstances:

The investor must be able to fund any shortfall until the asset is sold or until the investment becomes positively geared (income > interest). The different tax treatment of planned ongoing losses and possible future capital gains affects the investor's final return. In countries that tax capital gains at a lower rate than income, it is possible for an investor to make a loss overall before taxation but a small gain after taxpayer subsidies.

Deduction of negative gearing losses on property against income from other sources is permitted in several countries, including Canada, Australia, and New Zealand. A negatively-geared investment property will generally remain negatively geared for several years, when the rental income will have increased with inflation to the point that the investment is positively geared (the rental income is greater than the interest cost).

Positive gearing occurs when one borrows to invest in an income-producing asset and the returns (income) from that asset exceed the cost of borrowing. From then on, the investor must pay tax on the rental income profit until the asset is sold, when point the investor must pay capital gains tax on any profit.

The tax treatment of negative gearing (also termed "rental loss offset against other income") varies. For example:

Australia

Australia allows the application of property losses arising from negative gearing against other types of income, such as wage or business income, with only a few limits or restrictions. Negative gearing by property investors reduced personal income tax revenue in Australia by $600 million in the 2001/02 tax year, $3.9 billion in 2004/05, and $13.2 billion in 2010/11.

Negative gearing is a controversial political issue in Australia, and was a major issue during the 2016 federal election, during which the Labor Party proposed restricting (but not eliminating) negative gearing and to halve the capital gains tax discount to 25%. Analysis had found that negative gearing in Australia provides a greater benefit to wealthier Australians than the less wealthy. Federal Treasurer Scott Morrison, in defence of negative gearing, cited tax data that shows that numerous middle income groups (he mentioned teachers, nurses, and electricians) benefit in larger numbers from negative gearing than finance managers. (The raw numbers do not show the extent to which different professional groups benefit.)

History

Traditionally, Australian taxpayers have been allowed to negatively gear their investment properties, in the strict sense of investing in property at an initial loss. Negative gearing was restricted by a prohibition on the transfer of contingent property income and the property losses could not offset income from labour. It is assumed this applied to losses as well as income, but this is unclear in the Income Tax Assessment Act 1936. Prior to 1985, Governments had allowed Courts to dictate many aspect of tax law.

A common method of bypassing the restrictions on property losses offsetting income from labour was to convert such income into another form through the use of partnerships and other legal mechanisms. As a result, this restriction may not have been significant.

In 1983, the Victorian Deputy Commissioner of Taxation briefly denied Victorian property investors the deduction for interest in excess of the rental income, so losses could not be transferred nor moved to a future tax year. That ruling was quickly over-ruled by the federal tax commissioner.

Under the Hawke government, negative gearing rules were changed so that property losses were no longer quarantined and instead could offset wage income. Six months later, following the tax summit in July 1985, the Hawke government undid this change, once more quarantining negative gearing interest expenses on new transactions so that they could be claimed only against rental income, not other income. (Any excess loss could be carried forward to offset property income in later years.) That ensured that at personal level and, more importantly, at a national level, property losses would not be subsidised by income from personal exertion. In applying the formula, all previous governments thereby isolated and consequently discouraged capital speculation being subsidised from the general income tax receipts pool.

In addition, a capital gains tax (CGT) was introduced in Australia on 20 September 1985. While a separate tax, it is often associated with negative gearing.

The Hawke government's reversion to the earlier system in which property losses could not offset income from labour was unpopular with property investors. These investors claimed this reversion had caused investment in rental accommodation to dry up and rents to rise substantially. This was unsupported by evidence other than localised increases in real rents in both Perth and Sydney, which also had the lowest vacancy rates of all capital cities at the time. However, in July 1987, after intense lobbying by the property industry, the government reversed its decision once more, allowing negative gearing losses to be applied against income from labour.

Taxation

Australian tax treatment of negative gearing is as follows:

The tax treatment of negative gearing and capital gains may benefit investors in a number of ways, including:

However, in certain situations the tax rate applied to the capital gain may be higher than the rate of tax saving because of initial deductions such as for investors who have a low marginal tax rate while they make deductions but a high marginal rate in the year the capital gain is realised.

In contrast, the tax treatment of real estate by owner-occupiers differs from investment properties. Mortgage interest and upkeep expenses on a private property are not deductible, but any capital gain (or loss) made on disposal of a primary residence is tax-free. (Special rules apply on a change from private use to renting or vice versa and for what is considered a main residence.)

Arguments for and against

The economic and social effects of negative gearing in Australia are a matter of ongoing debate. Those in favour of negative gearing argue:

Opponents of negative gearing argue:

Effect on rent prices

The view that the temporary removal of negative gearing between 1985 and 1987 caused rents to rise has been challenged by Chief Economist of the ANZ Saul Eslake, who has been quoted as saying:

It's true, according to Real Estate Institute data, that rents went up in Sydney and Perth. But the same data doesn't show any discernible increase in the other state capitals. I would say that, if negative gearing had been responsible for a surge in rents, then you should have observed it everywhere, not just two capitals. In fact, if you dig into other parts of the REI database, what you find is that vacancy rates were unusually low at that time before negative gearing was abolished.

Eslake is referring to changes in inflation-adjusted rents (i.e., when CPI inflation is subtracted from the nominal rent increases). These are also known as real rent changes. Nominal rents nationally rose by over 25% during the two years that negative gearing was quarantined. They rose strongly in every Australian capital city, according to the official ABS CPI data. However, as nominal changes include inflation, they provide a less clear picture of how rents changed in effect, and of how changes such as disallowing property losses to offset other types of income affect rent.

Additionally, it is difficult to assess the impact no longer allowing such deductions had during those two years, given that these deductions had only been allowed for six months prior to their disallowance in July 1985.

Effect on housing affordability

In 2003, the Reserve Bank of Australia (RBA) stated in its submission to the Productivity Commission First Home Ownership Inquiry:

there are no specific aspects of current tax arrangements designed to encourage investment in property relative to other investments in the Australian tax system. Nor is there any recent tax policy initiative we can point to that accounts for the rapid growth in geared property investment. But the fact is that when we observe the results, resources and finance are being disproportionately channelled into this area, and property promoters use tax effectiveness as an important selling point.

They went on to say that "the most sensible area to look for moderation of demand is among investors", and that:

the taxation treatment in Australia is more favourable to investors than is the case in other countries. In particular, the following areas appear worthy of further study by the Productivity Commission:

i. ability to negatively gear an investment property when there is little prospect of the property being cash-flow positive for many years;

ii. the benefit that investors receive by virtue of the fact that when property depreciation allowances are "clawed back" through the capital gains tax, the rate of tax is lower than the rate that applied when depreciation was allowed in the first place.

iii. the general treatment of property depreciation, including the ability to claim depreciation on loss-making investments.

In 2008, the report of the Senate Select Committee on Housing Affordability in Australia echoed the findings of the 2004 Productivity Commission report. One recommendation to the enquiry suggested that negative gearing should be capped: "There should not be unlimited access. Millionaires and billionaires should not be able to access it, and you should not be able to access it on your 20th investment property. There should be limits to it."

A 2015 report from the Senate Economics References Committee argues that, while negative gearing has an influence on housing affordability, the primary issue is a mismatch between supply and demand. A submission to this committee from the Department of Social Services stated that:

[while] demand for housing has increased significantly over the last 30 years, the supply of new dwellings has not responded, with average annual completions of new dwellings remaining around 150,000 since the mid-1980s.

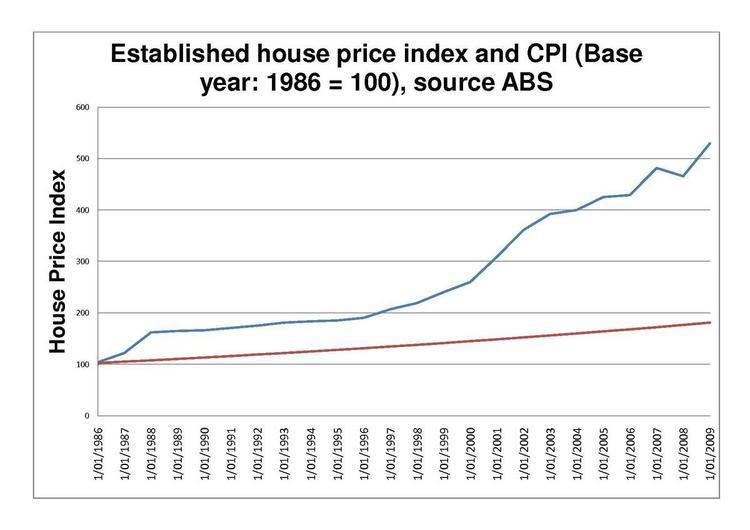

The effect of negative gearing on the supply side of dwelling construction is difficult to pin down. Commentary from Eslake and others has highlighted the preponderance of negatively-geared purchases in established suburbs where the probability of a lightly-taxed capital gain exists, challenging the idea that negative gearing leads to substantial amounts of new construction. Many economists have commented extensively on the tax subsidy being made available to speculative buyers in competition against homebuyers, who have no such tax subsidy, leading to significant social dislocation.

Additionally, the tax subsidy feeding into higher home prices adds to the wealth of those taking advantage of negative gearing. The process that crowds out domestic home owners by pushing up the price of housing also makes the successful user of negative gearing more asset rich due to the increase in land value. This allows these people to borrow further funds against equity in the previously acquired properties, resulting in further acquisitions under tax subsidy. This process can raise prices and thereby make it harder for people who wish to buy a house as an owner-occupier.

United Kingdom

While allowing for negative gearing in its basic form, the United Kingdom does not allow the transfer of one type of income (or loss) to another type of income. This is due to its schedular system of taxation. In this type of taxation system, the tax paid is dependent on income source. Therefore, an individual who received an income from labour and from land would pay two separate tax rates for the two relevant income sources.

Between 1997 and 2007, the Tax Law Rewrite Project changed this system by simplifying the schedules. As with the previous system, people would not be allowed to transfer incomes (or losses).

A UK government online resource on renting out property in England and Wales outlines how to offset losses. It states that losses can be offset against "future profits by carrying it forward to a later year" or against "profits from other properties (if you have them)".

New Zealand

New Zealand allows negative gearing and the transfer of losses to other income streams, with some restrictions.

The Rental Income Guide states a loss can only be deducted against other incomes if the rental income is at market rate.

The Opposition Labour Party attempted to raise negative gearing in the 2011 election, but after their failure to win government the issue reduced in significance.

Canada

In principle, Canada does not allow the transfer of income streams. However, the most current Canadian tax form indicates this can occur in some circumstances. According to "Line 221 - Carrying charges and interest expenses", interest payments from an investment designed to generate an income can be deducted:

Claim the following carrying charges and interest you paid to earn income from investments: [...] Most interest you pay on money you borrow for investment purposes, but generally only if you use it to try to earn investment income, including interest and dividends. However, if the only earnings your investment can produce are capital gains, you cannot claim the interest you paid.

Other sources indicate the deduction must be reasonable and that people should contact the Canada Revenue Agency for more information. The "Rental Income Includes Form T776" states people can deduce rental losses from other sources of income: "You have a rental loss if your rental expenses are more than your gross rental income. If you incur the expenses to earn income, you can deduct your rental loss against your other sources of income." However, there is a caveat: the rental loss must be reasonable. What is reasonable is not defined in the "Rental Income Includes Form T776" Guide.

Based on these sources, claiming rental losses against other incomes in a given year is allowed as long as a profit is made over the life of the investment, excluding the effects of capital gains.

It should be noted that Canada has a Federal and Provincial income tax, and the above only relates to Federal income tax.

United States

In principle, the US federal tax does not allow the transfer of income streams. In general, taxpayers can only deduct expenses of renting property from their rental income, as renting property out is usually considered a passive activity. However, if renters are considered to have actively participated in the activities, they can claim deductions from rental losses against their other "nonpassive income". A definition of "active participation" is outlined in the "Reporting Rental Income, Expenses, and Losses" guide:

You actively participated in a rental real estate activity if you (and your spouse) owned at least 10% of the rental property and you made management decisions or arranged for others to provide services (such as repairs) in a significant and bona fide sense. Management decisions that may count as active participation include approving new tenants, deciding on rental terms, approving expenditures, and other similar decisions.

It is possible deduct any loss against other incomes, depending on a range of factors.

Japan

Japan allows tax payers to offset rental losses against other income.

Individuals can claim losses against rental loss with minimal restrictions, but if the property was owned through a partnership or trust there are restrictions.

There are a number of additional rules, such as restricting claims of losses due to Bad Debt. Additional information can be found in the Japan Tax Site.

Germany

The German tax system is complex, but within the bounds of standard federal income tax, Germany does not allow the transfer of income. Rental losses can only be offset against rental income. As stated on the Global Property Guide site, "Owners can deduct any expenses from the gross receipts, which were incurred to produce, maintain and safeguard that income."

Germany recognizes seven sources of income:

- Agriculture and forestry

- Trade and business

- Independent personal services

- Employment

- Capital investment

- Rents and royalties

- "other income", as specified and strictly limited by law to certain types of income such as income from private transactions and income of a recurring nature (e.g. pensions)

The income from each of these sources is calculated separately.

Rental income is taxed as income and is subject to the progressive tax rate. Interest on loans provided to finance real estate, expenses, and property-related cost (e.g., management fees, insurance) can be deducted from the taxable rental income.

Netherlands

In principle, the Dutch tax system does not allow the transfer of income. Most citizens calculate tax, separately, in 3 income groups:

- Box 1 income includes income from employment and income from the primary residence

- Box 2 income, which includes income from a substantial holding in a company, as well as gains from substantial shareholdings

- Box 3 deals with income from savings and investments

However, there is no clear definition where rental income fits in these categories. Dutch resident and non-resident companies and partnerships owning Dutch property are in principle allowed to deduct interest expenses on loans from banks or affiliated companies, and property-related costs from their taxable income.

As with many countries, the practice of offsetting rental losses against income tax is possible, in certain situations.