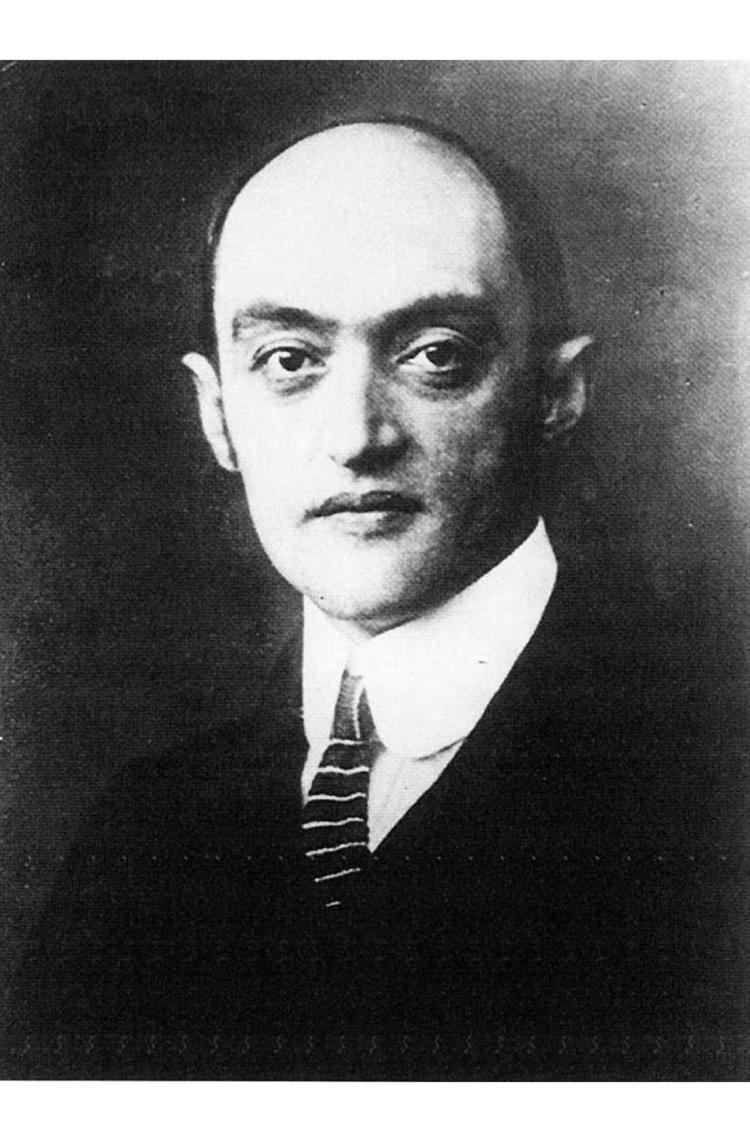

Role Economist | School or tradition Historical school Name Joseph Schumpeter | |

Institution Harvard University 1932–50University of Bonn 1925–32Biedermann Bank 1921–24University of Graz 1912–14University of Czernowitz 1909–11 Field Economics, Econometrics Influences Eugen von Bohm-Bawerk, Leon Walras, Gustav von Schmoller, Werner Sombart, Nikolai Kondratiev, Anne-Robert-Jacques Turgot Died January 8, 1950, Taconic, Connecticut, United States Parents Joseph Schumpeter Sr., Johanna Schumpeter Books Capitalism - Socialism and Dem, The theory of economic, History of Economic Analysis, Imperialism and Social Classes, Can Capitalism survive? Similar People John Maynard Keynes, Friedrich Hayek, Adam Smith, Karl Marx, Peter Drucker | ||

Methodological individualism by joseph schumpeter

Joseph Alois Schumpeter ( [ˈʃʊmpeːta]; 8 February 1883 – 8 January 1950) was an Austrian-born American economist and political scientist. He briefly served as Finance Minister of Austria in 1919. In 1932 he became a professor at Harvard University where he remained until the end of his career. One of the most influential economists of the 20th century, Schumpeter popularized the term "creative destruction" in economics.

Contents

- Methodological individualism by joseph schumpeter

- Joseph schumpeter robert dahl

- Life

- Influences

- Evolutionary economics

- History of Economic Analysis

- Business cycles

- Keynesianism

- Demise of capitalism

- Democratic theory

- Entrepreneurship

- Cycles and long wave theory

- Innovation

- Legacy

- Books

- Journal articles

- Memoriams

- Reviews

- Quotes

- References

Joseph schumpeter robert dahl

Life

Schumpeter was born in Triesch, Habsburg Moravia (now Trest in the Czech Republic, then part of Austria-Hungary) in 1883 to Catholic German-speaking parents. His father owned a factory, but he died when Joseph was only four years old. In 1893, Joseph and his mother moved to Vienna.

Schumpeter began his career studying law at the University of Vienna under the Austrian capital theorist Eugen von Bohm-Bawerk, taking his PhD in 1906. In 1909, after some study trips, he became a professor of economics and government at the University of Czernowitz. In 1911, he joined the University of Graz, where he remained until World War I.

In 1918, Schumpeter was a member of the Socialization Commission established by the Council of the People's Deputies in Germany. In March 1919, he was invited to take office as Minister of Finance in the Republic of German-Austria. He proposed a capital levy as a way to tackle the war debt and opposed the socialization of the Alpine Mountain plant. In 1921, he became president of the private Biedermann Bank. He was also a board a member at the Kaufmann Bank. Problems at those banks left Schumpeter in debt. His resignation was a condition of the takeover of the Biedermann Bank in September 1924.

From 1925 to 1932, Schumpeter held a chair at the University of Bonn, Germany. He lectured at Harvard in 1927–1928 and 1930. In 1931, he was a visiting professor at The Tokyo College of Commerce. In 1932, Schumpeter moved to the United States, and soon began what would become extensive efforts to help central European economist colleagues displaced by Nazism. Schumpeter also became known for his opposition to Marxism and socialism that he thought would lead to dictatorship, and even criticized President Franklin Roosevelt's New Deal. In 1939, Schumpeter became a US citizen. In the beginning of World War II, the FBI investigated him and his wife (a prominent scholar of Japanese economics) for pro-Nazi leanings, but found no evidence of Nazi sympathies.

At Harvard, Schumpeter was considered a memorable character, erudite and even showy in the classroom. He became known for his heavy teaching load and his personal and painstaking interest in his students. He served as the faculty advisor of the Graduate Economics Club and organized private seminars and discussion groups. Some colleagues thought his views outdated by Keynesianism which was fashionable; others resented his criticisms, particularly of their failure to offer an assistant professorship to Paul Samuelson, but recanted when they thought him likely to accept a position at Yale University. This period of his life was characterized by hard work and comparatively little recognition of his massive 2-volume book Business Cycles. However, the Schumpeters persevered, and in 1942 published what became the most popular of all his works, Capitalism, Socialism and Democracy, reprinted many times and in many languages in the following decades, as well as cited thousands of times.

Schumpeter claimed that he had set himself three goals in life: to be the greatest economist in the world, to be the best horseman in all of Austria and the greatest lover in all of Vienna. He said he had reached two of his goals, but he never said which two, although he is reported to have said that there were too many fine horsemen in Austria for him to succeed in all his aspirations.

Schumpeter died in his home in Taconic, Connecticut, at the age of 66, on the night of 7 January 1950.

He was married three times. His first wife was Gladys Ricarde Seaver, an Englishwoman nearly 12 years his senior (married 1907, separated 1913, divorced 1925). His best man at his wedding was his friend and Austrian jurist Hans Kelsen. His second was Anna Reisinger, 20 years his junior and daughter of the concierge of the apartment where he grew up. They married in 1925, but within a year, she died in childbirth. The loss of his wife and newborn son came only weeks after Schumpeter's mother had died. In 1937, Schumpeter married the American economic historian Elizabeth Boody, who helped him popularize his work and edited what became their magnum opus, the posthumously published History of Economic Analysis.

Influences

The source of Joseph Schumpeter's dynamic, change-oriented, and innovation-based economics was the Historical School of economics. Although his writings could be critical of the School, Schumpeter's work on the role of innovation and entrepreneurship can be seen as a continuation of ideas originated by the Historical School, especially the work of Gustav von Schmoller and Werner Sombart.

Evolutionary economics

According to Christopher Freeman (2009), a scholar who devoted much time researching Schumpeter's work: "the central point of his whole life work [is]: that capitalism can only be understood as an evolutionary process of continuous innovation and 'creative destruction'".

History of Economic Analysis

Schumpeter's scholarship is apparent in his posthumous History of Economic Analysis, although some of his judgments seem idiosyncratic and sometimes cavalier. For instance, Schumpeter thought that the greatest 18th century economist was Turgot, not Adam Smith, as many consider, and he considered Leon Walras to be the "greatest of all economists", beside whom other economists' theories were "like inadequate attempts to catch some particular aspects of Walrasian truth". Schumpeter criticized John Maynard Keynes and David Ricardo for the "Ricardian vice." According to Schumpeter, Ricardo and Keynes reasoned in terms of abstract models, where they would freeze all but a few variables. Then they could argue that one caused the other in a simple monotonic fashion. This led to the belief that one could easily deduce policy conclusions directly from a highly abstract theoretical model.

In this book, Joseph Schumpeter recognized the implication of a gold monetary standard compared to a fiat monetary standard. In History of Economic Analysis, Schumpeter stated the following: "An 'automatic' gold currency is part and parcel of a laissez-faire and free-trade economy. It links every nation's money rates and price levels with the money-rates and price levels of all the other nations that are 'on gold.' It is extremely sensitive to government expenditure and even to attitudes or policies that do not involve expenditure directly, for example, to foreign policy, to certain policies of taxation, and, in general, to precisely all those policies that violate the principles of [classical] liberalism. This is the reason why gold is so unpopular now and also why it was so popular in a bourgeois era."

Business cycles

Schumpeter's relationships with the ideas of other economists were quite complex in his most important contributions to economic analysis – the theory of business cycles and development. Following neither Walras nor Keynes, Schumpeter starts in The Theory of Economic Development with a treatise of circular flow which, excluding any innovations and innovative activities, leads to a stationary state. The stationary state is, according to Schumpeter, described by Walrasian equilibrium. The hero of his story is the entrepreneur.

The entrepreneur disturbs this equilibrium and is the prime cause of economic development, which proceeds in cyclic fashion along several time scales. In fashioning this theory connecting innovations, cycles, and development, Schumpeter kept alive the Russian Nikolai Kondratiev's ideas on 50-year cycles, Kondratiev waves.

Schumpeter suggested a model in which the four main cycles, Kondratiev (54 years), Kuznets (18 years), Juglar (9 years) and Kitchin (about 4 years) can be added together to form a composite waveform. Actually there was considerable professional rivalry between Schumpeter and Kuznets. The wave form suggested here did not include the Kuznets Cycle simply because Schumpeter did not recognize it as a valid cycle. See "business cycle" for further information. A Kondratiev wave could consist of three lower degree Kuznets waves. Each Kuznets wave could, itself, be made up of two Juglar waves. Similarly two (or three) Kitchin waves could form a higher degree Juglar wave. If each of these were in phase, more importantly if the downward arc of each was simultaneous so that the nadir of each was coincident it would explain disastrous slumps and consequent depressions. As far as the segmentation of the Kondratiev Wave, Schumpeter never proposed such a fixed model. He saw these cycles varying in time – although in a tight time frame by coincidence – and for each to serve a specific purpose.

Keynesianism

In Schumpeter's theory, Walrasian equilibrium is not adequate to capture the key mechanisms of economic development. Schumpeter also thought that the institution enabling the entrepreneur to buy the resources needed to realize his or her vision was a well-developed capitalist financial system, including a whole range of institutions for granting credit. One could divide economists among (1) those who emphasized "real" analysis and regarded money as merely a "veil" and (2) those who thought monetary institutions are important and money could be a separate driving force. Both Schumpeter and Keynes were among the latter.

Demise of capitalism

Schumpeter's most popular book in English is probably Capitalism, Socialism and Democracy. While he agrees with Karl Marx that capitalism will collapse and be replaced by socialism, Schumpeter predicts a different way this will come about. While Marx predicted that capitalism would be overthrown by a violent proletarian revolution, which actually occurred in the least capitalist countries, Schumpeter believed that capitalism would gradually weaken by itself and eventually collapse. Specifically, the success of capitalism would lead to corporatism and to values hostile to capitalism, especially among intellectuals. "Intellectuals" are a social class in a position to critique societal matters for which they are not directly responsible and to stand up for the interests of other classes. Intellectuals tend to have a negative outlook of capitalism, even while relying on it for prestige, because their professions rely on antagonism toward it. The growing number of people with higher education is a great advantage of capitalism, according to Schumpeter. Yet, unemployment and a lack of fulfilling work will cause intellectual critique, discontent and protests. Parliaments will increasingly elect social democratic parties, and democratic majorities will vote for restrictions on entrepreneurship. Increasing workers' self-management, industrial democracy and regulatory institutions would evolve non-politically into "liberal capitalism". Thus, the intellectual and social climate needed for thriving entrepreneurship will be replaced by some form of "laborism". This will restrict "creative destruction" (a borrowed phrase to denote an endogenous replacement of which old ways of doing things by new ways) and so will burden and destroy the capitalist structure.

Schumpeter emphasizes throughout this book that he is analyzing trends, not engaging in political advocacy.

Democratic theory

In the same book, Schumpeter expounded a theory of democracy which sought to challenge what he called the "classical doctrine". He disputed the idea that democracy was a process by which the electorate identified the common good, and politicians carried this out for them. He argued this was unrealistic, and that people's ignorance and superficiality meant that in fact they were largely manipulated by politicians, who set the agenda. This made a 'rule by the people' concept both unlikely and undesirable. Instead he advocated a minimalist model, much influenced by Max Weber, whereby democracy is the mechanism for competition between leaders, much like a market structure. Although periodic votes by the general public legitimize governments and keep them accountable, the policy program is very much seen as their own and not that of the people, and the participatory role for individuals is usually severely limited.

Entrepreneurship

Schumpeter was probably the first scholar to theorize about entrepreneurship, and the field owed much to his contributions. His fundamental theories are often referred to as Mark I and Mark II. In the first, Schumpeter argued that the innovation and technological change of a nation come from the entrepreneurs, or wild spirits. He coined the word Unternehmergeist, German for "entrepreneur-spirit", and asserted that "... the doing of new things or the doing of things that are already being done in a new way" stemmed directly from the efforts of entrepreneurs.

Mark II was developed when Schumpeter was a professor at Harvard. Many social economists and popular authors of the day argued that large businesses had a negative effect on the standard of living of ordinary people. Contrary to this prevailing opinion, Schumpeter argued that the agents that drive innovation and the economy are large companies which have the capital to invest in research and development of new products and services and to deliver them to customers cheaper, thus raising their standard of living. In one of his seminal works, "Capitalism, Socialism and Democracy", Schumpeter wrote:

As soon as we go into details and inquire into the individual items in which progress was most conspicuous, the trail leads not to the doors of those firms that work under conditions of comparatively free competition but precisely to the door of the large concernswhich, as in the case of agricultural machinery, also account for much of the progress in the competitive sectorand a shocking suspicion dawns upon us that big business may have had more to do with creating that standard of life than with keeping it down.

Mark I and Mark II arguments are considered complementary today.

Cycles and long wave theory

Schumpeter was the most influential thinker to argue that long cycles are caused by innovation, and are an incident of it. His treatise on business cycles developed were based on Kondratiev's ideas which attributed the causes very differently. Schumpeter's treatise brought Kondratiev's ideas to the attention of English-speaking economists. Kondratiev fused important elements that Schumpeter missed. Yet, the Schumpeterian variant of long-cycles hypothesis, stressing the initiating role of innovations, commands the widest attention today. In Schumpeter's view, technological innovation is at the cause of both cyclical instability and economic growth. Fluctuations in innovation cause fluctuation in investment and those cause cycles in economic growth. Schumpeter sees innovations as clustering around certain points in time periods that he refers to as "neighborhoods of equilibrium", when entrepreneurs perceive that risk and returns warrant innovative commitments. These clusters lead to long cycles by generating periods of acceleration in aggregate growth.

The technological view of change needs to demonstrate that changes in the rate of innovation governs changes in the rate of new investments, and that the combined impact of innovation clusters takes the form of fluctuation in aggregate output or employment. The process of technological innovation involves extremely complex relations among a set of key variables: inventions, innovations, diffusion paths and investment activities. The impact of technological innovation on aggregate output is mediated through a succession of relationships that have yet to be explored systematically in the context of long wave. New inventions are typically primitive, their performance is usually poorer than existing technologies and the cost of their production is high. A production technology may not yet exist, as is often the case in major chemical inventions, pharmaceutical inventions. The speed with which inventions are transformed into innovations and diffused depends on actual and expected trajectory of performance improvement and cost reduction.

Innovation

Schumpeter identified innovation as the critical dimension of economic change. He argued that economic change revolves around innovation, entrepreneurial activities, and market power. He sought to prove that innovation-originated market power can provide better results than the invisible hand and price competition. He argues that technological innovation often creates temporary monopolies, allowing abnormal profits that would soon be competed away by rivals and imitators. These temporary monopolies were necessary to provide the incentive for firms to develop new products and processes.

Legacy

For some time after his death, Schumpeter's views were most influential among various heterodox economists, especially European, who were interested in industrial organization, evolutionary theory, and economic development, and who tended to be on the other end of the political spectrum from Schumpeter and were also often influenced by Keynes, Karl Marx, and Thorstein Veblen. Robert Heilbroner was one of Schumpeter's most renowned pupils, who wrote extensively about him in The Worldly Philosophers. In the journal Monthly Review John Bellamy Foster wrote of that journal's founder Paul Sweezy, one of the leading Marxist economists in the United States and a graduate assistant of Schumpeter's at Harvard, that Schumpeter "played a formative role in his development as a thinker". Other outstanding students of Schumpeter's include the economists Nicholas Georgescu-Roegen and Hyman Minsky and former chairman of the Federal Reserve, Alan Greenspan. Future Nobel Laureate Robert Solow was his student at Harvard, and he expanded on Schumpeter's theory.

Today, Schumpeter has a following outside standard textbook economics, in areas such as economic policy, management studies, industrial policy, and the study of innovation. Schumpeter was probably the first scholar to develop theories about entrepreneurship. For instance, the European Union's innovation program, and its main development plan, the Lisbon Strategy, are influenced by Schumpeter. The International Joseph A. Schumpeter Society awards the Schumpeter Prize.

The Schumpeter School of Business and Economics opened in October 2008 at the University of Wuppertal. According to University President Professor Lambert T. Koch, "Schumpeter will not only be the name of the Faculty of Management and Economics, but this is also a research and teaching programme related to Joseph A. Schumpeter."

On 17 September 2009, The Economist inaugurated a column on business and management named "Schumpeter." The publication has a history of naming columns after significant figures or symbols in the covered field, including naming its British affairs column after former editor Walter Bagehot and its European affairs column after Charlemagne. The initial Schumpeter column praised him as a "champion of innovation and entrepreneurship" whose writing showed an understanding of the benefits and dangers of business that proved to be far ahead of its time.

Books

Journal articles

Memoriams

Reviews

Quotes

Capitalism inevitably and by virtue of the very logic of its civilization creates - educates and subsidizes a vested interest in social unrest

Entrepreneurial profit is the expression of the value of what the entrepreneur contributes to production

Bureaucracy is not an obstacle to democracy but an inevitable complement to it