| ||

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world.

Contents

- Cooperative banking

- Credit unions

- Cooperative banks

- Land development banks

- Building societies

- Others

- International associations

- Canada

- Quebec

- United Kingdom

- Continental Europe

- United States

- India

- Israel

- Italy

- Microcredit and microfinance

- References

Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses.

Cooperative banking

Credit unions

Credit unions have the purpose of promoting thrift, providing credit at reasonable rates, and providing other financial services to its members. Its members are usually required to share a common bond, such as locality, employer, religion or profession, and credit unions are usually funded entirely by member deposits, and avoid outside borrowing. They are typically (though not exclusively) the smaller form of cooperative banking institution. In some countries they are restricted to providing only unsecured personal loans, whereas in others, they can provide business loans to farmers, and mortgages.

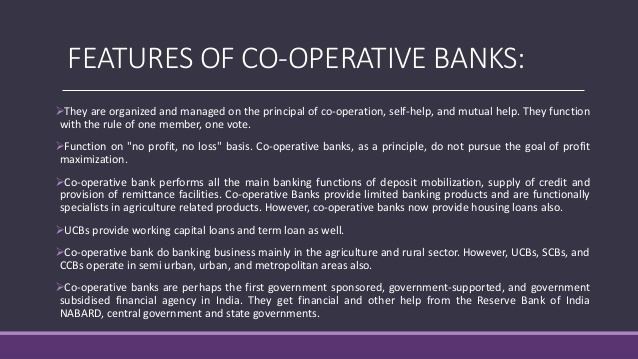

Cooperative banks

Larger institutions are often called cooperative banks. Some are tightly integrated federations of credit unions, though those member credit unions may not subscribe to all nine of the strict principles of the World Council of Credit Unions (WOCCU).

Like credit unions, cooperative banks are owned by their customers and follow the cooperative principle of one person, one vote. Unlike credit unions, however, cooperative banks are often regulated under both banking and cooperative legislation. They provide services such as savings and loans to non-members as well as to members, and some participate in the wholesale markets for bonds, money and even equities. Many cooperative banks are traded on public stock markets, with the result that they are partly owned by non-members. Member control is diluted by these outside stakes, so they may be regarded as semi-cooperative.

Cooperative banking systems are also usually more integrated than credit union systems. Local branches of cooperative banks select their own boards of directors and manage their own operations, but most strategic decisions require approval from a central office. Credit unions usually retain strategic decision-making at a local level, though they share back-office functions, such as access to the global payments system, by federating.

Some cooperative banks are criticized for diluting their cooperative principles. Principles 2-4 of the "Statement on the Co-operative Identity" can be interpreted to require that members must control both the governance systems and capital of their cooperatives. A cooperative bank that raises capital on public stock markets creates a second class of shareholders who compete with the members for control. In some circumstances, the members may lose control. This effectively means that the bank ceases to be a cooperative. Accepting deposits from non-members may also lead to a dilution of member control.

Land development banks

The special banks providing Long Term Loans are called Land Development Banks, in the short, LDB. The history of LDB is quite old. The first LDB was started at Jhang in Punjab in 1920. This bank is also based on Co-operative. The main objective of the LDBs are to promote the development of land, agriculture and increase the agricultural production. The LDBs provide long-term finance to members directly through their branches.

Building societies

Building societies exist in Britain, Ireland and several Commonwealth countries. They are similar to credit unions in organisation, though few enforce a common bond. However, rather than promoting thrift and offering unsecured and business loans, their purpose is to provide home mortgages for members. Borrowers and depositors are society members, setting policy and appointing directors on a one-member, one-vote basis. Building societies often provide other retail banking services, such as current accounts, credit cards and personal loans. In the United Kingdom, regulations permit up to half of their lending to be funded by debt to non-members, allowing societies to access wholesale bond and money markets to fund mortgages. The world's largest building society is Britain's Nationwide Building Society.

Others

Mutual savings banks and mutual savings and loan associations were very common in the 19th and 20th centuries, but declined in number and market share in the late 20th century, becoming globally less significant than cooperative banks, building societies and credit unions.

Trustee savings banks are similar to other savings banks, but they are not cooperatives, as they are controlled by trustees, rather than their depositors.

International associations

The most important international associations of cooperative banks are the Paris-based International Cooperative Banking Association (ICBA), which has member institutions from around the world, the Brussels-based European Association of Co-operative Banks and the Brussels-based Unico Banking Group.

Canada

In Canada, cooperative banking is provided by credit unions (caisses populaires in French). As of September 30, 2012, there were 357 credit unions and caisses populaires affiliated with Credit Union Central of Canada. They operated 1,761 branches across the country with 5.3 million members and $149.7 billion in assets.

Quebec

The caisse populaire movement started by Alphonse Desjardins in Quebec, Canada, pioneered credit unions. Desjardins opened the first credit union in North America in 1900, from his home in Lévis, Quebec, marking the beginning of the Mouvement Desjardins. He was interested in bringing financial protection to working people.

United Kingdom

British building societies developed into general-purpose savings and banking institutions with ‘one member, one vote’ ownership and can be seen as a form of financial cooperative (although many de-mutualised into conventionally owned banks in the 1980s and 1990s). The UK Co-operative Group includes both an insurance provider, The Co-operative Insurance, and The Co-operative Bank, both noted for promoting ethical investment.

Continental Europe

Important continental cooperative banking systems include the Crédit Agricole, Crédit Mutuel, Banque Populaire and Caisse d'épargne in France, Rabobank in the Netherlands, BVR/DZ Bank in Germany, Banco Popolare, UBI Banca and Banca Popolare di Milano in Italy, Migros and Coop Bank in Switzerland, and the Raiffeisen system in several countries in central and eastern Europe. The cooperative banks that are members of the European Association of Co-operative Banks have 130 million customers, 4 trillion euros in assets, and 17% of Europe's deposits. The International Confederation of Cooperative Banks (CIBP) is the oldest association of cooperative banks at international level.

In Scandinavia, there is a clear distinction between mutual savings banks (Sparbank) and true credit unions (Andelsbank).

United States

Credit unions in the United States had 96.3 million members in 2013 and assets of $1.06 trillion.

India

Cooperative banks serve an important role in the Indian economy, especially in rural areas. In urban areas, they mainly serve small industry and self-employed workers. They are registered under the Cooperative Societies Act, 1912. They are regulated by the Reserve Bank of India under the Banking Regulation Act, 1949 and Banking Laws (Application to Co-operative Societies) Act, 1965. Anyonya Sahakari Mandali, established in 1889 in the province of Baroda, is the earliest known cooperative credit union in India.

Israel

Ofek (Hebrew: אופק) is a cooperative initiative founded in mid-2012 that intended to establish the first cooperative bank in Israel.

Italy

See also: Category:Cooperative banks of Italy.Since the 19th century, Italy has had hundreds of "banche popolari" (people banks) and "banche di credito cooperativo" (cooperative credit banks) which are different kinds of cooperative societies (governed by an assembly where every shareholder/member has 1 vote). As of 2016, the biggest was Banca Popolare di Milano (founded in 1865).

Starting in 2016, due to a new law, several cooperative banks will be forced to merge and/or be converted to società per azioni.

Microcredit and microfinance

The more recent phenomena of microcredit and microfinance are often based on a cooperative model. These focus on small business lending. In 2006, Muhammad Yunus, founder of the Grameen Bank in Bangladesh, won the Nobel Peace Prize for his ideas regarding development and his pursuit of the microcredit concept. In this concept the institution provide micro loan to requires.