Nationality British Occupation Investment management | Name Amanda Staveley | |

| ||

Spouse(s) Mehrdad Ghodoussi (m. 2011) Parent(s) Robert Staveley, Lynne Staveley | ||

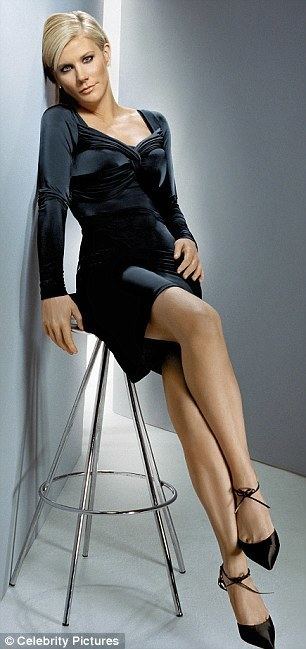

PCP Capital’s Staveley Likes Mining, Hotels in Middle East

Amanda Louise Staveley (born 11 April 1973 near Ripon, North Yorkshire, England) is a British businesswoman notable chiefly for her connections with Middle Eastern investors. In 2008 Staveley played a prominent role in the investment of £7.3 billion in Barclays by the ruling families of Abu Dhabi and Qatar, and by the Qatari sovereign wealth fund. Staveley’s firm, PCP Capital Partners, acted for Sheikh Mansour Bin Zayed Al Nahyan of the Abu Dhabi royal family, who invested £3.5 billion to control 16 per cent of the bank. The deal was reported to have earned PCP Capital Partners a commission of £110 million, which, after paying advisers, represented a profit of £40 million. Staveley was also involved in Sheik Mansour's high-profile purchase of Manchester City Football Club in September 2008.

Contents

- PCP Capitals Staveley Likes Mining Hotels in Middle East

- A plea to Amanda Staveley Take a look at the North West clubs

- Early life and education

- Early career and creation of Qton

- Qton and EuroTelecom

- Background

- Barclays

- Manchester City and Liverpool

- Other deals

- Personal life

- References

Staveley, who once described herself as "a dealmaker at heart", told The Guardian newspaper in 2008: "I'm just grateful to have been given the opportunities I've had so far. It's not about money — it wouldn't matter if I was making £8 million or £200 million. I just want to go to bed at night and say I've done a good job."

A plea to Amanda Staveley | Take a look at the North West clubs

Early life and education

Staveley was born in Yorkshire and in adulthood retained her Yorkshire accent. She is the daughter of Robert Staveley, a North Yorkshire landowner who founded the Lightwater Valley theme park, where Staveley waitressed as a child; her mother, Lynne, was an occasional model and champion showjumper. Staveley spent much of her childhood with her maternal grandparents. Her grandfather, Ralph Raper, made a fortune running a chain of betting shops, including "the biggest illegal betting shop in the North" in a Doncaster cellar where takings sometimes reached £10,000 a day. They later owned Doncaster dog track and profited further from investment in land and stocks. "He taught me everything", Staveley said. "I am always asking myself what he would do in a certain situation."

Staveley was educated at Queen Margaret's School, York. She admitted to having lots of drive as a child and competed in showjumping and athletics. She ran 12.6 seconds for the hundred metres at the age of 14, before a snapped Achilles tendon ended her involvement in the sport. At the age of 16, Staveley left school and enrolled at a crammer, taking her A-levels in a single year and winning a place to read modern languages at St Catharine's College, Cambridge. As a student she worked as a model to supplement her income. Staveley abandoned her degree after ending up in hospital suffering from stress after the death of her grandfather.

Early career and creation of Q.ton

In 1996, at the age of 22 and without any training, Staveley borrowed £180,000 and bought the restaurant, Stocks, in Bottisham between Cambridge and Newmarket. She would get up at about 4 am to begin preparing food and then waitressed in the evening having spent the afternoon writing business plans and studying for her city exams. "I lived and breathed business and banking," she later said. "I thought one day they would come in useful." Through the restaurant Staveley came to know members of Newmarket's racing community, in particular those associated with the Godolphin Racing stables owned by the Al Maktoum family of Dubai, as well as people from Cambridge's high-tech businesses. Through the late 1990s she started dealing in shares and became an active angel investor, especially in dot.com enterprises and biotech firms such as Futura Medical. "If I'm shown a good idea," she said, "I can't help but look."

Staveley closed Stocks and in 2000 opened Q.ton, a £10 million conference centre and facility developed in a joint venture with Trinity College, Cambridge on Cambridge Science Park. The investors in Q.ton were believed to include King Abdullah of Jordan, who visited the development in November 2001. That visit that was followed by a trip to Jordan by Staveley as King Abdullah's guest. In 2000 she was named Businesswoman of the Year.

Q.ton and EuroTelecom

In 2000 Staveley sold a 49 per cent share in Q.ton to the telecoms company, EuroTelecom, for £2 million; Staveley joined the firm as a non-executive director. A few months later EuroTelecom went out of business in the collapse of the Dotcom boom. At the time it was claimed that Q.ton owed EuroTelecom £835,000 and that Staveley had agreed to buy back the company's 49 per cent stake, only for the money not to be forthcoming. Staveley denied having agreed any payments and in a statement said: "The work performed by EuroTelecom was vastly over-specified yet seriously defective ... there could be no question of our agreeing their claim." She hired Kroll Inc. to investigate the executive members of the EuroTelecom board.

Staveley bought EuroTelecom's stake in Q.ton from the firm's administrator PricewaterhouseCooper, a deal that led to a discontinued petition of bankruptcy against her when payment was delayed. She began raising £35 million from private investors to roll the Q.ton concept out throughout the UK and Europe. However, the company failed. Staveley agreed an Individual Voluntary Arrangement and in 2008 was paying back her creditors, including Barclays. "I was a cocky, arrogant bugger. Now I never want to go through something like that ever again," she said in 2008.

Background

After the failure of Q.ton Staveley moved to Dubai, cultivating connections centred on Abu Dhabi but extending across the Middle East. "She has absorbed their culture and respects them. That has put her in an extremely strong position," one financial adviser commented. Mark Horrocks, a hedge fund manager, suggested that the "reasonably good standing" of the Staveley family allowed her to be accepted in the region. Staveley herself spoke of the excitement of working in the Middle East, adding, "There is something about the growth of this young economy that I saw in myself."

In 2008 the Financial Times described her firm, PCP Capital Partners, as really amounting to Staveley and her legal partner, Craig Eadie, and explained that, although based in Mayfair, London, the company acts "via offshore private equity affiliates" as a vehicle for the investment of Middle Eastern money, with Staveley acting as an adviser on those deals. One associate was quoted at this time as saying, "Amanda is known and trusted by her contacts in the Persian Gulf region like almost no other non-Arab. She has spent a decade building that relationship. She tells things as they are and has a clarity of purpose that they appreciate."

Barclays

These contacts brought Staveley to a new level of prominence at the end of 2008 with the investment of Middle Eastern funds in Barclays as the bank sought to recapitalise by raising money privately rather than accept a bail-out from the British government following the financial crisis of that year. Roger Jenkins, reputedly the highest paid banker in the City, was responsible for delivering Qatari involvement in the deal, while Staveley advised Sheikh Mansour on his £3.5 billion investment, for which he gained control of 16 per cent of the bank. Staveley earned a fee of £30 million for her role in the transaction. At the time Staveley said: "We would happily have gone further. We could have taken up to 25 per cent." Staveley, who said that she had been watching Barclays for some time, had begun talking to Sheikh Mansour about investment opportunities in British banking six months previously. In 2010, The Daily Telegraph reported that Sheikh Mansour's disposals of his stake in Barclays had made him a profit of about £2.25 billion.

Manchester City and Liverpool

The Barclays deal followed Sheikh Mansour's £210 million purchase of Manchester City F.C. in September of the same year through the Abu Dhabi United Group, a transaction reportedly worth £10 million in commission to PCP Capital Partners. At the same time Staveley was involved in extended negotiations by Sheikh Mohammed bin Rashid Al Maktoum's Dubai International Capital to buy a 49 per cent stake in Liverpool Football Club, although the deal, which would have given Staveley a place on the club's board, eventually foundered.

Other deals

Also in 2008 Staveley fronted a bid by the Qatar Investment Authority to buy the Trillium facilities management business from the Land Securities property group, an offer reportedly totaling £1.1 billion. The bid in the end came to nothing in the autumn of that year and Trillium was sold to Telereal for £750 million in January 2009.

Later that year Staveley was involved in an attempt to help finance the $13.5 billion sale of Barclays Global Investors to the US firm BlackRock, offering $2.8 billion of funding in return for a shareholding of 10 per cent, an amount that reportedly included a commitment of Staveley's own money. In June 2009, with details being finalised, Blackrock pulled out of the deal. Press reports at the time suggested that BlackRock had sought further clarification of the identity of the investors behind the special purpose vehicle created by PCP Capital Partners to handle the offer, although alternative reports claimed that they had always been aware of the conditions of the deal. In the end BlackRock funded its purchase of BGI from other sources.

In 2010 Staveley was reported to have advised the Qatari property investment company Barwa in their purchase of the Park House site on Oxford Street from Land Securities for £250 million, a deal that was said to have earned PCP Capital Partners in the region of £5 million to £7.5 million in fees. In March 2012 it was announced that Waterway PCP Properties Ltd, a Middle Eastern private equity group fronted by Staveley, had paid Land Securities £234 million for their Arundel Great Court site on the north bank of the Thames in London.

Personal life

Staveley initially hit the tabloid headlines after dating The Duke of York in 2003. In 2011 she married Iranian-born Mehrdad Ghodoussi.

Staveley lives in Dubai and has a house in London's Park Lane.