| ||

A world taxation system or global tax is a proposed system for the collection of taxes by a central international revenue service. The idea has garnered currency as a means of compelling institutions to pay, rather than avoid, taxes; it has also aroused the ire of nationalists as an infringement upon national sovereignty.

Contents

Financial transaction tax

The financial transaction tax has been supported by a number of economists as both a rectification of jurisdictional discrepancies in taxation. Discussion of a global FTT has increased in the 2000s, especially after the Late-2000s recession.

UN Global Transaction Tax

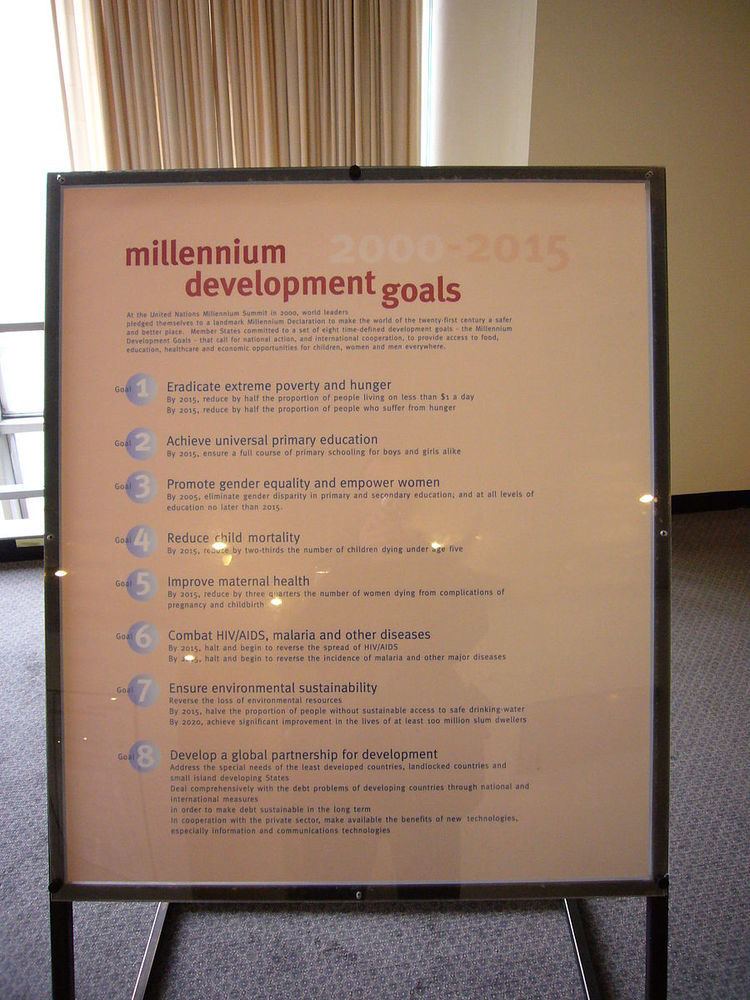

According to Dr. Stephen Spratt, "the revenues raised could be used for....international development objectives...such as meeting the [ Millennium Development Goals ]." These are eight international development goals that 192 United Nations member states and at least 23 international organizations have agreed (in 2000) to achieve by the year 2015. They include reducing extreme poverty, reducing child mortality rates, fighting disease epidemics such as AIDS, and developing a global partnership for development.

In 2000, a representative of a “pro Tobin tax” NGO proposed the following: "In the face of increasing income disparity and social inequity, the Tobin Tax represents a rare opportunity to capture the enormous wealth of an untaxed sector and redirect it towards the public good. Conservative estimates show the tax could yield from $150-300 billion annually. The UN estimates that the cost of wiping out the worst forms of poverty and environmental destruction globally would be around $225 billion per year."

At the UN September 2001 World Conference against Racism, when the issue of compensation for colonialism and slavery arose in the agenda, Fidel Castro, the President of Cuba, advocated the Tobin Tax to address that issue. (According to Cliff Kincaid, Castro advocated it "specifically in order to generate U.S. financial reparations to the rest of the world," however a closer reading of Castro's speech shows that he never did mention "the rest of the world" as being recipients of revenue.) Castro cited holocaust reparations as a previously established precedent for the concept of reparations.

Castro also suggested that the United Nations be the administrator of this tax, stating the following:

"May the tax suggested by Nobel Prize Laureate James Tobin be imposed in a reasonable and effective way on the current speculative operations accounting for trillions of US dollars every 24 hours, then the United Nations, which cannot go on depending on meager, inadequate, and belated donations and charities, will have one trillion US dollars annually to save and develop the world. Given the seriousness and urgency of the existing problems, which have become a real hazard for the very survival of our species on the planet, that is what would actually be needed before it is too late."

On March 6, 2006, US Congressman Dr Ron Paul stated the following: "The United Nations remains determined to rob from wealthy countries and, after taking a big cut for itself, send what’s left to the poor countries. Of course, most of this money will go to the very dictators whose reckless policies have impoverished their citizens. The UN global tax plan...resurrects the long-held dream of the 'Tobin Tax'. A dangerous precedent would be set, however: the idea that the UN possesses legitimate taxing authority to fund its operations."

Bank tax

Bank taxes have also been proposed as another means of worldwide taxation, as have been sales taxes. Proposals include the Financial stability contribution (FSC) and Financial Activities Tax (FAT).

Wealth tax

A global wealth tax of about 1% on all wealth, including individual assets exceeding about US$ 1 million (including stocks and bonds) and all publicly listed companies and all trusts would raise at least US$ 600 billion per year (that's 1% of total world market capitalization, which in 2012 is about US$ 60 trillion). About half of that amount, about 300 billion per year, corresponds to the total developmental budget goal of 0.7% GNP of industrialised countries (see Millennium Development Goals), which would enable poorer countries cross the threshold of economic competitivity in 15–20 years (cf. Jeffrey Sachs: The End of Poverty). Some 300 billion per year would also be necessary to limit global warming to +2 degrees Celsius and finance recovery from more frequent climate disasters. Expensive but probably inevitable strategies to slow global warming include renewable energy research, reducing greenhouse gas emissions, and reforestation (or preventing deforestation).

On December 7, 2009 Nancy Pelosi, Speaker of the United States House of Representatives stated her support for a "G20 global tax" that combined selected wealth and transaction taxes.

Sovereignty

In US and other countries' nationalist movements, the idea of global taxation arouses ire in its perception by such circles as a potential infringement upon national sovereignty.

Should the bank tax be global?

On August 30, 2009, British Financial Services Authority chairman Lord Adair Turner had said it was "ridiculous" to think he would propose a new tax on London and not the rest of the world. However, in May, and June 2010, the government of Canada expressed opposition to the bank tax becoming "global" in nature.