| ||

Digital goods are software programs, music, videos or other electronic files that users download exclusively from the Internet. Some digital goods are free, others are available for a fee. The taxation of digital goods is partially governed by a federal statute and has been the area of significant state legislative and rule-making activity.

Contents

- History

- Legal status by state

- States relying on general tax laws to govern digital goods

- States that have enacted laws specifically addressing digital goods taxation

- States that expressly do not tax digital goods

- Legal status in the European Union

- Businesses located within an EU member state

- Distance selling threshold

- Selling e services within the EU

- Proposed new Australian digital services tax

- References

History

In 1997, the federal government decided to limit taxation of Internet activity for a period of time. The Internet Tax Freedom Act (ITFA) prohibits taxes on Internet access, which is defined as a service that allows users access to content, information, email or other services offered over the Internet and may include access to proprietary content, information, and other services as part of a package offered to customers. The Act has exceptions for taxes levied before the statute was written and for sales taxes on online purchases of physical goods.

The statute has been amended three times since its enactment to extend this prohibition. The first amendment solely extended the Act's duration. The second extended it again and clarified the definition of Internet access as including certain telecommunication services, as well as reorganizing sections within the Act. The third amendment again extended the prohibition but narrowed the definition of Internet access to “not include voice, audio or video programming, or other products and services . . . that utilize Internet protocol . . . and for which there is a charge” except those related to a homepage, email, instant messaging, video clips, and personal storage capacity.

In 2009, Anna Eshoo, Congresswoman from California’s 14th District (which includes most of Silicon Valley), introduced a bill to make the Act permanent in its most recent permutation. However, this bill died in committee.

States levying a tax on digital goods may be violating the ITFA. The states using their original tax code may fall within the grandfather clause of the ITFA, but there has been no litigation to clarify this or other aspects of the Act. One of the few cases brought under the ITFA involved Community Telecable of Seattle suing the city of Seattle in Washington state court, where Telecable claimed it should not have to pay a telephone utility tax because it was an Internet access provider under the ITFA. The Washington State Supreme Court held that Telecable could not be taxed as a telephone provider when it was providing Internet access under the ITFA.

Every digital-specific tax created by a state has been enacted after the ITFA became law. These laws may be preempted because the ITFA bars taxes on Internet access, and multiple or discriminatory taxes on electronic commerce. Courts have yet to clarify whether the existing laws compound taxes or are discriminatory. Although, it is likely that these laws can survive scrutiny under the ITFA because they can be interpreted to only tax services that fit within the exception to Internet access described in the statute and to be the only taxes on these digital products. On the other hand, there may be problems with these taxes because they may cover products and services dealing with homepages, email, personal storage, or video clips.

Without litigation, it may be difficult to distinguish the difference between the definitions of content given by the ITFA, such as between a video clip and video programming. iTunes, for example, could be designated as video programming for the videos it sells based on the definition found in the federal statute regulating cable companies, and as video clips for its previews. These laws may also run into trouble if they tax a download that is already taxed by another state, because multiple taxes are defined as taxing property that has been taxed once before by another state or political subdivision. VIDEO software>

Another possible federal limitation on Internet taxation is the United States Supreme Court case, Quill Corp. v. North Dakota, 504 U.S. 298 (1992), which held that under the dormant commerce clause, goods purchased through mail order cannot be subject to a state’s sales tax unless the vendor has a substantial nexus with the state levying the tax. The dormant commerce clause could also apply to any efforts to tax downloads. Since most downloads are from companies that are centralized in a small number of states, it is likely that there will not be many states with a substantial nexus to download providers. At present, no litigation has arisen to determine what will be defined as a proper nexus for a distributor of digital content within a state. It is possible that a state would argue that servers are enough of a nexus to tax the content passing through, although the Supreme Court has already ruled that communication by common carrier is not enough to form a substantial nexus.

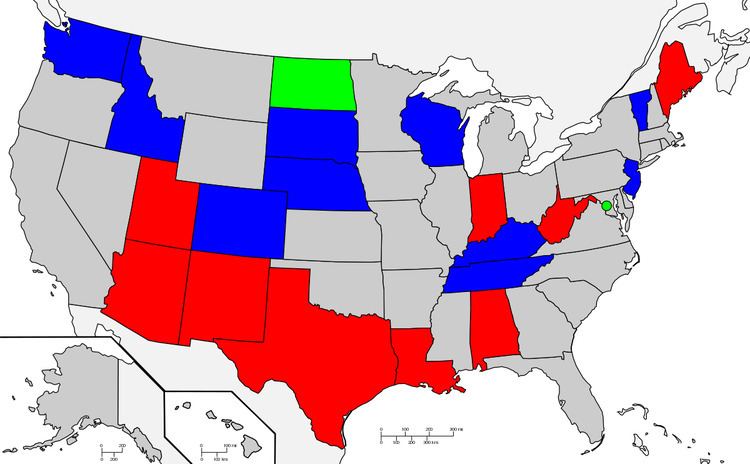

Legal status by state

States initially were slow to enact taxes on downloads, but with recent downturns in tax revenue caused by consumers purchasing more digital downloads, many states have sought ways to impose taxes on purely digital transactions. There are multiple ways that downloads are taxed. Some states use their existing franchise, sales, and use taxes to tax purchases/uses/transactions of consumers of Internet goods and services. Other states enacted laws specifically aimed at digital downloads.

States relying on general tax laws to govern digital goods

Some states presume that downloads are automatically covered by their existing tax statutes based on the common law definition of tangible personal property, which is anything that holds value on its own that is not real property.

In other states, state tax boards have released bulletins to explain what products are subject to sales and use taxes, tax administrative boards have handed down revenue rulings, and statutes have been amended to define “tangible personal property” to include digital goods and therefore subject them to sales tax.

States that have enacted laws specifically addressing digital goods taxation

The remaining states that tax downloads have specific statutes that define exactly what is to be taxed and what is not. The similarity in these taxes is that they are based on a sales-type scheme, where each download (or group of downloads) is taxed like a purchase in physical space.

States that expressly do not tax digital goods

Some of these laws specifically address the taxation of software, which may or may not be interpreted by those states’ courts to include downloadable content, i.e. music and video files.

Legal status in the European Union

The EU operates Value Added Tax (VAT) and electronic goods and services are subject to VAT at the applicable rate. Each member state may set its own rate of VAT if they want

VAT regulations are very complicated and the intent of this article is not to provide definitive guidance but rather to list some of the relevant factors.

Businesses located within an EU member state

If a business is located within an EU member state and its turnover through internet sales or otherwise exceeds that member state's VAT threshold then the business must register for VAT. It is then obliged to collect VAT on its sales (outputs) and remit it to the tax authorities having deducted the VAT it pays on its purchases (inputs).

Distance selling threshold

If a business makes sales of physical goods to a member state that exceeds that member states distance selling threshold (typically either EUR 30,000 or EUR 100,000) then it must register to pay VAT in that member state and collect VAT at that member state's VAT rate.

If sales are below the distance selling threshold VAT must be collected at the VAT rate in the business' own member state.

Selling e-services within the EU

If a business is located within an EU member state and supplies e-services to an individual who is not VAT registered in another EU member state then VAT rules of the state where the business is located apply. If the business supplies e-services to a VAT-registered individual in another state then the business is not obliged to pay VAT in its state and thus the individual must pay VAT in its state. If the business supplies e-services to a VAT-registered individual yet the individual receives the e-services in a state where neither the business nor the individual has their establishment then the business is obliged to register for VAT in the state where the e-services are delivered to. The 2015 EU VAT legislation requires two non-conflicting pieces of evidence to be produced so as to determine what VAT rate should be applied to these digital goods sales.

A business must always charge VAT to non-VAT registered entities (i.e. consumers) but should not charge VAT to foreign EU VAT registered businesses who provide them with a VAT number. These foreign EU businesses are required to declare their purchase and the tax due to their own tax authorities.

Proposed new Australian digital services tax

In his budget of May 12, 2015, the then Australian Federal Government Treasurer Joe Hockey revealed details of a new 10% goods and services tax (GST) to be introduced on "certain electronic supplies".

The proposed GST has already been dubbed the 'Netflix Tax' in Australia as on-demand video-streaming is one of the services that will come under the scope of the new rules. The Australian GST on digital services is due to come into effect in July 2017.

On Wednesday, February 10, 2016, the draft bill outlining Australia's new digital GST was introduced with Treasurer Scott Morrison telling the Australian Parliament that the new rules would: "ensure Australian businesses selling digital products and services are not disadvantaged relative to overseas businesses that sell equivalent products in Australia.”