Nationality American | Name Steve Hanke Role Economist | |

| ||

Institution Colorado School of MinesUniversity of California, BerkeleyJohns Hopkins University Influences Friedrich HayekMilton FriedmanRobert MundellKenneth BouldingPeter Thomas BauerRonald Coase Contributions Currency board ResearchDollarization ResearchHyperinflation ResearchHanke-Henry Permanent CalendarPrivatization ResearchWater resources Research Books Russian currency and finance Influenced by Friedrich Hayek, Milton Friedman, Robert Mundell, Kenneth E. Boulding, Peter Thomas Bauer, Ronald Coase | ||

School or tradition Free-market economics | ||

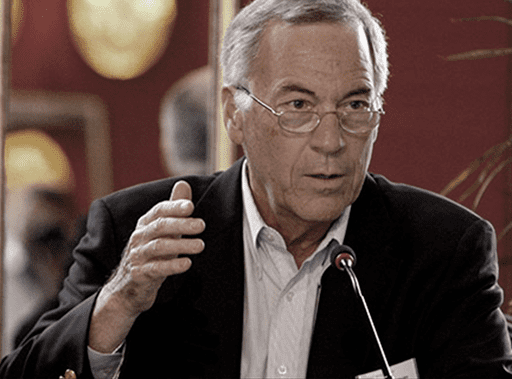

Professor Steve Hanke Explains Hyperinflation

Steve H. Hanke is an American applied economist at the Johns Hopkins University in Baltimore, Maryland. He is also a Senior Fellow and Director of the Troubled Currencies Project at the Cato Institute in Washington, DC, and Co-Director of the Johns Hopkins Institute for Applied Economics, Global Health, and the Study of Business Enterprise in Baltimore, MD.

Contents

- Professor Steve Hanke Explains Hyperinflation

- America s roundtable dr steve hanke the us economy money and monetary policy

- Early life and education

- Academic career

- Water Resource Economics

- Privatization

- Currency Boards and Dollarization

- Hyperinflation

- Monetary Analysis

- Hanke Henry Permanent Calendar

- Economic Advising and Currency Reform

- Argentina

- Yugsoslavia and Albania

- Bulgaria

- Estonia

- Lithuania

- Bosnia and Herzegovina

- Indonesia

- Montenegro

- Ecuador

- Currency and Commodity Trading

- Awards

- Criticism

- References

Hanke is known for his work as a currency reformer in emerging-market countries such as Argentina, Estonia, Lithuania, Bulgaria, Bosnia and Herzegovina, Montenegro, and Ecuador. He was a Senior Economist with President Ronald Reagan’s Council of Economic Advisers from 1981 to 1982, and has served as an adviser to heads of state in countries throughout Asia, South America, Europe, and the Middle East. He is also known for his pioneering work on currency boards, dollarization, hyperinflation, water pricing and demand, benefit-cost analysis, privatization, and other topics in applied economics.

Hanke has written extensively as a columnist for Forbes magazine and many other major publications. He is also a currency and commodity trader.

America s roundtable dr steve hanke the us economy money and monetary policy

Early life and education

Steve Hanke was born in Macon, Georgia in 1942 and grew up in Atlantic, Iowa, where he attended Atlantic High School. He then attended the University of Colorado Boulder, where he was a member of the Phi Delta Theta Fraternity. Hanke earned a B.S. in Business Administration (1964) and a Ph.D. in Economics (1969) from the University of Colorado.

Academic career

Hanke's first academic appointment was at the Colorado School of Mines in 1966, when he was 24. During this time, Hanke developed and taught courses in mineral and petroleum economics, while completing his Ph.D. dissertation on the effects of meter installation on municipal water demand.

Hanke then joined the faculty of the Johns Hopkins University, where he initially specialized in water resource economics. After six years at Johns Hopkins, including a one-year visiting professorship at the University of California, Berkeley, Hanke attained the rank of Full Professor, one of the fastest promotions to that rank in the school’s history. At present, Hanke teaches courses in applied economics and finance that are widely recognized as a gateway for Hopkins students to gain employment on Wall Street.

Over the course of his career, Hanke has held editorial positions with a number of academic journals, including the Journal of Economic Policy Reform; Water Resources Research; Land Economics; and Water Engineering and Management. He currently holds editorial positions with The International Economy, The Independent Review, Cato Journal, Review of Austrian Economics, Economic Journal Watch, and Central Banking.

In 1995, Hanke and Johns Hopkins University History Professor Louis Galambos founded the Johns Hopkins Institute for Applied Economics, Global Health and Study of Business Enterprise. Hanke is also a Senior Fellow and Director of the Troubled Currencies Project at the Cato Institute, a Special Counselor to the Center for Financial Stability, and a member of the Charter Council of the Society of Economic Measurement.

Hanke is a Senior Advisor at Renmin University’s International Monetary Research Institute, along with Nobel laureate Robert Mundell of Columbia.

Water Resource Economics

In 1969, Steve Hanke began his academic career as a water resource economist in the Johns Hopkins Department of Geography and Environmental Engineering, a department founded by famed sanitary engineer Abel Wolman. At the time, the department was known as the premier water resource engineering department in the country, and was home to world-renowned sanitary engineer John C. Geyer, with whom Hanke would frequently collaborate.

Hanke was hired to continue the water-related research program at Johns Hopkins that began during the Geyer era. During his initial years in the department, Hanke focused on issues including water pricing and demand, benefit-cost analysis, system design, and leak detection and control. He produced a number of important pieces of scholarship, including the first event study of the effects of water meter installation on water use, as well as sewer interceptor design criteria which are still commonly used today in Europe.

During this time, Hanke served as the Associate Editor of the Water Resources Bulletin and Water Resources Research, as the economics editor for Water Engineering and Management, and as a member of the editorial board of Land Economics. He was also an adviser to the French water companies Compagnie Générale des Eaux (now Veolia Environment) and Compagnie Lyonnaise des Eaux, as well as to the engineering firms Snowy Mountains Engineering Corporation in Australia, and Binnie & Partners in London.

In 1981, Hanke was appointed a senior economist with the President’s Council of Economic Advisers, where his responsibilities included the Reagan White House’s water portfolio. While at the CEA, Hanke led a team that re-wrote the federal government’s Principles and Guidelines for Water and Land Related Resources Implementation Studies, to include more rigorous benefit-cost analysis requirements.

Hanke continues to be active in the water resources field, focusing primarily on municipal water system privatization. He was a founding member of the Notre Dame Global Adaptation Index’s Advisory Board and is currently a member of the Johns Hopkins University Global Water Program.

Privatization

Hanke has produced eight books and numerous articles and proposals dealing with the privatization of public-sector resources and development. In 1972, he was a Research Associate at the National Museum of Kenya, where he worked with anthropologist and conservationist Richard Leakey on the economics of big game cropping and hunting, as well as the privatization of big game reservations to combat poaching. Hanke also worked with Prof. Barney Dowdle of the University of Washington and the Confederated Tribes of Siletz Indians of Lincoln County, Oregon on a proposal to privatize portions of their reservation, as a means of improving economic opportunity on Native American reservations.

While at the White House, Hanke worked closely with his long-time associate, CEA member William A. Niskanen. He was known as a member of the supply-side economics movement within the Reagan Administration. It was during this time that Hanke was noted for developing President Ronald Reagan’s program for privatizing public assets and services – particularly municipal water systems and public grazing and timber lands. This plan was endorsed by one of President Reagan's closest allies, Nevada Senator Paul Laxalt, among others.

Hanke’s work to privatize public lands put him at odds with Secretary of the Interior James Watt and members of the Sagebrush Rebellion, who sought to transfer federal public lands to state control, rather than to private ownership. In 1982, Hanke left the CEA, joining a number of influential Reagan Administration supply-siders, including Martin Anderson, Norman B. Ture, and Paul Craig Roberts.

In 1984, Hanke was appointed a Senior Adviser to the Joint Economic Committee of the U.S. Congress, where he advised Senators Steve Symms and Paul Laxalt on privatization.

Although the English term “reprivatisation” first appeared in The Economist magazine in the 1930s, and subsequently in various academic journals, Hanke and his wife, Liliane, are often credited with popularizing the term “privatization” – derived from the French term “privatise” – in the American economic lexicon during the 1980s, as well as for bringing about its inclusion in Merriam-Webster's Collegiate Dictionary.

Hanke has authored numerous articles on the subject of privatization, including the entry for “Privatization” in the 1987 edition of The New Palgrave: A Dictionary of Economics.

Currency Boards and Dollarization

After Hong Kong reinstated its currency board in 1983, Hanke began to collaborate with his fellow Johns Hopkins Professor, and Margaret Thatcher’s personal economic adviser, Sir Alan Walters, on the subject of currency boards. A currency board is a monetary authority that issues a local currency that is fully backed by a foreign reserve currency, and which is freely convertible with the foreign reserve currency at a fixed exchange rate. Walters was a key advocate of the reestablishment of Hong Kong’s currency board.

Hanke and Walters established a currency board research program at Johns Hopkins. One of Hanke’s first post-doctoral fellows in that program was Kurt Schuler. Shortly after Schuler’s arrival at Johns Hopkins, Hanke and Schuler discovered that John Maynard Keynes was an advocate of currency boards. Hanke and Schuler presented these findings, including original documentation, in a book edited by Walters and Hanke.

During this time, Hanke also began conducting research on dollarization, whereby a country replaces its domestic currency with a stable foreign currency – creating a de facto fixed-exchange-rate monetary system between two countries.

Over the course of his career, Hanke has written over 20 books and monographs and over 300 articles on currency boards and dollarization. Many of these were written in collaboration with Kurt Schuler. Hanke also authored the entry for “Currency Boards” in the 1992 edition of The New Palgrave Dictionary of Money and Finance.

In addition, he played a central role in drafting and bringing about the inclusion of the so-called “Hanke Amendment” in the 1993 Foreign Operations Appropriations Bill. This measure, sponsored by Senators Phil Graham, Bob Dole, Connie Mack, Jesse Helms, and Steve Symms allowed U.S. contributions to the International Monetary Fund to be used for the purpose of establishing currency boards.

Hyperinflation

Hanke has also written extensively on the subject of hyperinflation, which occurs when a country’s inflation rate exceeds 50% per month. In 2008, Hanke and Alex Kwok published a paper, which estimated that Zimbabwe’s hyperinflation peaked in November 2008 at 7.96×1010%. This makes Zimbabwe’s hyperinflation the second-highest in history – peaking 3.5 months after the Mugabe government stopped reporting inflation statistics, with a peak inflation rate 30 million times higher than the last official rate.

Hanke frequently employs a unique methodology, based on the principle of purchasing power parity, which allows him to accurately estimate inflation rates in countries with very high inflation rates. Using this methodology, Hanke and his collaborators discovered several cases of hyperinflation that had previously gone unreported in the academic literature and popular press. These include the 1923 hyperinflation episode in the Free City of Danzig, and more recently, suspected cases in North Korea (2011), and Iran (2012). In 2012, Hanke and Nicholas Krus documented all 56 cases of hyperinflation that have occurred in history, in “World Hyperinflations,” a chapter in the Routledge Handbook of Major Events in Economic History.

In 2013, Hanke founded the Troubled Currencies Project, a collaboration between the Johns Hopkins University and the Cato Institute, in order to track exchange-rate and inflation data in countries including Argentina, Egypt, Nigeria, North Korea, Syria, and Venezuela.

Monetary Analysis

Hanke’s views on monetary policy are influenced by his experience as a currency and commodities trader, as well as by the economics of Milton Friedman, Robert Mundell, and Friedrich Hayek. Hanke is a proponent of Divisia monetary aggregates, developed by Francois Divisia, and later, William A. Barnett of the University of Kansas and the Center for Financial Stability. Hanke also favors broad monetary aggregates, as articulated by economists including Tim Congdon.

In 2012, Hanke developed a method of monetary analysis known as State-Money/Bank-Money Analysis (SMBMA). This methodology is based on John Maynard Keynes’ distinction between money produced by a central bank (”state money”) and money produced via the private banking sector, through deposit creation (“bank money”), contained in the 1930 classic A Treatise on Money.

Hanke has employed SMBMA as a method of analyzing the response of various countries to the 2008 financial crisis. In particular, Hanke has employed SMBMA for the United States, the United Kingdom, and various countries in the European Union to study the pro-cyclical effects of higher capital-asset ratios implemented during economic downturns. Hanke has been an outspoken critic of pro-cyclical capital requirements imposed under Basel III, Dodd-Frank, and other financial regulatory regimes. Also, he is on the advisory board of OMFIF where he is regularly involved in meetings regarding the financial and monetary system.

Hanke-Henry Permanent Calendar

Hanke and his colleague Richard Conn Henry, a professor in the Johns Hopkins Department of Physics and Astronomy, developed the Hanke-Henry Permanent Calendar, which aims to reform the current Gregorian calendar by making every year identical. With the Hanke-Henry Permanent Calendar, every calendar date would always fall on the same day of the week. Some of the advantages would include a permanent day of the week for all holidays; a simplification of financial calculations, and it would not draw criticism from religious groups because it retains the Sabbath.

Economic Advising and Currency Reform

Hanke began advising political leaders on economic issues in the late 1970s, when he served as a member of the Governor’s Council of Economic Advisers for the State of Maryland, along with Carl Christ and Clopper Almon. After stints at the Council of Economic Advisers, the Joint Economic Committee, and the President’s Task Force on Project Economic Justice during the Reagan administration, Hanke began advising heads of state in developing countries on a pro-bono basis.

Hanke has advised five presidents (Bulgaria, Indonesia, Kazakhstan, Venezuela, and Montenegro); five cabinet ministers (Albania, Argentina, Ecuador, Yugoslavia, and the United Arab Emirates); and has held two cabinet-level positions (Lithuania and Montenegro).

As the fall of communism and the Soviet ruble began to spark currency crises throughout the former Soviet Union, Hanke began to work as an economic adviser to a number of heads of state in newly independent countries in Eastern Europe and the Balkans.

In collaboration with his then-post-doctoral student, Kurt Schuler, Hanke developed a blueprint for a currency board reform package, which he proposed in a number of countries throughout the 1990s, including Bulgaria, Albania, Russia, Lithuania, Estonia, and Argentina.

Argentina

In 1989, Hanke met Argentine President Carlos Menem, who connected Hanke and his wife, Liliane, with the libertarian faction in the Argentine Congress led by Alvaro Alsogaray, for the purpose of developing a currency reform that would end Argentina’s inflation problems. Hanke was an early proponent of a currency board system for Argentina, which he outlined in a 1991 book. The book, ¿Banco Central O Caja de Conversión? was co-authored by Kurt Schuler and included a preface by Argentine Congressman José María Ibarbia, who was a member of the Alsogaray faction.

Later, Hanke worked closely with Menem and members of the Argentine Congress to implement a currency board, along the general lines of Hanke and Schuler’s original proposal. The result was not an orthodox currency board, but rather a “Convertibility System,” passed in the Convertibility Law of 1991, which ended Argentina’s hyperinflation episode.

Following Hanke and Sir Alan Walters’ 1994 prediction of the Mexican peso’s collapse, Argentine Finance Minister Domingo Cavallo invited Hanke to serve as his adviser. During this time, Hanke’s primary role was to leverage his scholarship and experience as one of the experts who was in the middle of the currency reform debates before the adoption of the Convertibility System – as well as his credibility established when he predicted the Tequila Crisis – to explain how the Convertibility System operated at the time, and to restore confidence in Argentina and the peso’s international credibility. At the time, Hanke was described by Argentine newspapers as “Cavallo’s spokesman” and the “generator of confidence” in the Argentine economy.

Argentina’s Convertibility System differed in several key respects from Hanke’s original proposal, however. In October 1991, the year the system was implemented, Hanke warned in a Wall Street Journal op-ed that the convertibility system could begin to function as a central bank, and eventually collapse. This prediction came true in the late 1990s, as the Argentine Convertibility System began to function like a central bank and engage in sterilization.

As the convertibility system began to falter, Carlos Menem, on Hanke’s advice, proposed dollarization for Argentina – first in 1995 and again in January 1999. In February 1999, Menem asked Hanke to prepare a dollarization blueprint for Argentina. This proposal was never acted upon, and the Convertibility System ultimately collapsed in 2002.

Yugsoslavia and Albania

In January 1990, Hanke was appointed the personal economic adviser to Yugoslav Deputy Prime Minister Zivko Pregl. Although Pregl was at one point a leader of the Communist League of Yugoslavia, he sought Hanke’s council on ways to liberalize Yugoslavia’s socialist economy. During this time, Hanke proposed a number of free-market reforms, including the privatization of Yugoslavia’s pension system, as well as a currency board system to address the failing Yugoslav dinar.

In 1991, the Ekonomski Institute Beograd published a book, in the Serbo-Croatian language, which Hanke and Schuler co-authored. The book laid out the details about what would have been a Yugoslav currency board. However, these efforts were suspended when the Yugoslav civil war broke out and Pregl resigned in June 1991. After the war broke out, Hanke continued his involvement in the Balkans, working with Deloitte & Touche’s Eastern European division to establish new Deloitte offices and bring traditional financial accounting to the formerly Communist country.

In 1991, Hanke began advising Albanian Deputy Prime Minister and Minister of Economy Gramoz Pashko on the possibility of establishing a currency board in Albania. The proposal was contained in Hanke and Kurt Schuler’s 1991 monograph A Currency Board Solution for the Albanian Lek, published by the International Freedom Foundation. The proposal was never acted upon.

Bulgaria

In 1990, Hanke anticipated Bulgaria’s 1991 hyperinflation episode and began designing a currency board system for Bulgaria. He incorporated this proposal into a monograph co-authored with Kurt Schuler. The monograph, Teeth for the Bulgarian Lev: A Currency Board Solution was published in 1991.

Hanke continued his work on a Bulgarian currency board, periodically visiting Sofia throughout the early 1990s. In late 1996, Hanke and Schuler’s currency reform handbook Currency Boards for Developing Countries gained popularity when a pirated Bulgarian-language version of the book became a best-seller in Sofia.

In 1997, during Bulgaria’s second episode of hyperinflation, Hanke was appointed as an Adviser to Bulgarian President Petar Stoyanov, and worked to bring about the establishment of Bulgaria’s currency board. Inspired by the original Hanke-Schuler blueprint, members of the Bulgarian government drafted a law which converted the Bulgarian National Bank to a currency board system. Acting in his capacity as Stoyanov’s adviser, Hanke continued to be deeply involved in fine-tuning and steering his idea to full adoption, throughout the drafting, legislative, and implementation process.

Bulgaria adopted the proposal and installed the currency board on July 1, 1997. The currency board linked the lev to the German Deutsche mark, and later the euro. Upon adoption, the Bulgarian Currency Board immediately put an end to the country’s 1997 hyperinflation episode. Hanke continued to serve as President Stoyanov’s adviser until the end of his term in 2002.

Hanke remains active in Bulgaria, as a vocal supporter of the currency board, the country’s flat tax, and anti-corruption measures. He frequently contributes to the Bulgarian publications Capital, Trud and Novinite, among others. In 2013, the Bulgarian Academy of Sciences awarded Hanke a Doctorate Honoris Causa, and, in 2015, Varna Free University awarded Hanke the title Doctor Honoris Causa, in honor of his scholarship on currency boards and his reform efforts in Bulgaria.

Estonia

In 1992, Hanke, Kurt Schuler, and Prof. Lars Jonung – then a Professor at the Stockholm School of Economics – released a book in both English and Estonian containing a blueprint for an Estonian currency board.

After Jonung was appointed Chief Economic Advisor to Swedish Prime Minister Carl Bildt, in 1992, Jonung convinced Bildt to embrace the idea of a currency board for Estonia and arrange for its presentation to the Estonian government. In May 1992, Hanke presented the currency board blueprint to members of Estonia’s Constituent Assembly in Tallinn.

One month later, in June 1992, Estonia adopted a monetary system based on the Hanke-Jonung-Schuler proposal. Estonia thus abandoned the Soviet ruble and began issuing its own currency, linking the Estonian kroon to the German mark at a fixed exchange rate. Following the introduction of the euro, the kroon was linked to the euro, until January 1, 2011, when Estonia officially adopted the euro as its currency.

Lithuania

In the early 1990s, George Selgin, Joseph Sinkey, Jr., and Kurt Schuler began working with Elena Leontjeva of the Lithuanian Free Market Institute (LFMI) on a reform proposal for Lithuania’s central bank. Later, Hanke also began collaborating with the LFMI during regular visits to Vilnius.

Having witnessed the positive effects of neighboring Estonia’s currency board, Lithuanian Prime Minister Adolfas Šleževičius, met with Hanke and his wife Liliane over lunch in January 1994 to discuss the possibility of a currency reform package for Lithuania. During that meeting, Šleževičius appointed Hanke a State Counselor – a cabinet-level appointment – and tasked him with designing a currency board system for Lithuania.

The LFMI immediately arranged for Hanke and Schuler to publish a book in Lithuanian. Their book contained a currency board blueprint for the country. This measure was adopted in April 1994, linking the Lithuanian litas to the German mark at a fixed exchange rate. Following the introduction of the euro, the litas was linked to the euro, until January 1, 2015, when Lithuania officially adopted the euro as its currency.

Bosnia and Herzegovina

Influenced by the 1991 Hanke-Schuler book proposing a currency board for Yugoslavia, the 1995 Dayton Agreement required Bosnia and Herzegovina to employ a currency board for at least six years. In the aftermath of the Yugoslav civil war, local officials and an IMF team set about to create a central bank for Bosnia and Herzegovina based on the principles of a currency board.

Hanke began serving as a special adviser to the U.S. Government in December 1996 and was tasked with ensuring that the central bank law resulted in a currency board system that was as orthodox as possible.

Shortly after his appointment, Hanke published a critique of the IMF currency board proposal. Warren Coats, a key member of the IMF team discussed Hanke’s involvement at length in the 2007 book. In a section of the book titled “Steve Hanke” Coats recounts:

“Following [Hanke]’s visit, he published an article in the Winter 1996/97 issue of Central Banking in which he praised the adopting of a currency board by Bosnia but criticized some of the features we were trying to give it in our draft law…In the end, the seeds he planted took root and won out, though I am not sure whether it was because the Serbs required the changes he proposed or whether the U.S. Treasury did.”

Indonesia

In August 1997, upon urging from the International Monetary Fund, Indonesia adopted a floating exchange rate for its currency, the rupiah. In the ensuing months, the rupiah weakened significantly against the U.S. dollar. Inflation in Indonesia began to accelerate, sparking food riots across the country.

In February 1998, Indonesian President Suharto invited Hanke to serve as his economic adviser. On the day of Hanke’s appointment as Special Counselor and a member of Indonesia’s Economic and Monetary Resilience Council, the rupiah appreciated by 28% against the U.S. dollar. During his time as Suharto's adviser, Hanke had an unprecedented level of access to the Indonesian President and even played a role in the dismissal of Indonesia's Central Bank Governor.

Hanke recommended that Indonesia institute an orthodox currency board, linking the rupiah to the U.S. dollar at a fixed exchange rate. Hanke supported the reforms contained in the IMF’s package. But, he argued that the IMF’s program would fail unless it was coupled with a currency board arrangement.

Hanke referred to his alternative reform package for Indonesia as “IMF Plus.” It garnered the support of notable economists, including Gary Becker, Rudiger Dornbusch, Milton Friedman, Merton Miller, Robert Mundell, and Sir Alan Walters. Hanke was also named one of the twenty-five most influential people in the world by World Trade Magazine during this time.

In 1998, during his State of the Nation address, Suharto announced his intention to adopt Hanke’s currency board proposal. This plan was met with opposition by the governments of Germany, Japan, and Singapore, among others. Economists including Nouriel Roubini and Paul Krugman also entered the fray with criticism of Hanke’s proposal. The fiercest resistance, however, came from the IMF and from U.S. President Bill Clinton – who threatened to withdraw $43 billion in aid if Indonesia adopted Hanke’s proposal.

Later, officials including former U.S. Secretary of State Lawrence Eagleburger and former Australian Prime Minister Paul Keating conceded that criticism of Hanke’s proposal did not stem from opposition to the economics of Hanke’s proposal, but rather out of concern that a stable rupiah would thwart U.S.-led efforts to oust Suharto. As Nobel Laureate Merton Miller recalled in 1999, the objection to Hanke’s proposal was “…not that it wouldn’t work but that it would, and if it worked, they would be stuck with Suharto.”

Under intense international pressure, Suharto ultimately reversed course and abandoned Hanke’s “IMF Plus” proposal. On May 21, 1998, amid continued currency problems, as well as protests and reports of a brewing military coup, Suharto resigned as President of Indonesia.

Montenegro

In 1999, Hanke and Montenegrin economist Željko Bogetić, who was an economist at the IMF at the time, wrote Crnogorska marka, a book published in Montenegro, proposing an orthodox currency board for the federal unit within the Federal Republic of Yugoslavia, which would issue a Montenegrin “marka” to replace the Yugoslav dinar. Later that year in July 1999, Hanke was appointed State Counselor – a cabinet-level position – and began advising Montenegrin President Milo Đukanović on issues including currency reform. After assessing the political and economic realities on the ground, Hanke advised Đukanović that Montenegro should abandon the faltering Yugoslav dinar and adopt a foreign currency, the German mark, as its own. This process is known as dollarization.

In 1999, Montenegro was part of the Federal Republic of Yugoslavia, along with Serbia. Đukanović began pursuing Hanke’s dollarization proposal for both economic and political reasons. In addition to providing relief from high inflation, dollarization also promised Montenegro the ability to pursue economic – and ultimately political – independence from Serbia.

In late 1999, Montenegro introduced the German mark as an official currency. In late 2000, the Yugoslav dinar was officially dropped, making the Deutsche mark the sole legal tender in Montenegro.

Ecuador

Hanke was also an early proponent of currency boards, and later, dollarization in Ecuador. In 1995, Hanke and Kurt Schuler published a currency board blueprint in Spanish that was widely circulated in Ecuador. In May 1996, Hanke traveled to Ecuador to encourage then-presidential candidate Abdalá Bucaram to pursue a currency board for Ecuador. Shortly thereafter, Bucaram raised the idea of a currency board while on the campaign trail.

Following Bucaram’s election, Hanke presented a dollarization proposal to members of the Ecuadorian government. But, by February 1997, Bucaram had been removed from office on insanity charges, and the dollarization idea lay dormant.

However, in 1999, Ecuador’s currency, the sucre, collapsed, losing 75% of its value against the U.S. dollar from the start of 1999 until the first week of January 2000. Shortly thereafter, Ecuadorian President Jamil Mahuad resurrected the dollarization idea. On January 9, 2000, he announced that Ecuador would abandon the sucre and officially adopt the U.S. dollar, putting an end to Ecuador’s high inflation.

In 2001, Hanke was appointed Adviser to Ecuador’s Minister of Finance and Economy, to assist with the implementation of dollarization. In 2003, he was awarded the honorary degree Doctor of Arts, Honoris Causa by the Universidad San Francisco de Quito, and in 2004, he was named Professor Asociado by the Universidad del Azuay in Cuenca, Ecuador, in honor of his reform efforts in Ecuador and scholarship on dollarization.

Currency and Commodity Trading

Hanke has been trading commodities and currencies for over 50 years. He has also trained a number of Johns Hopkins students who have gone on to successful careers in finance. He is Chairman Emeritus of the Friedberg Mercantile Group, Inc. in Toronto. During the 1990s, he served as President of Toronto Trust Argentina (TTA) in Buenos Aires.

Hanke also serves on the supervisory board of Advanced Metallurgical Group, NV, a Dutch metallurgy company. In the past, he has served on the Board of the Philadelphia Stock Exchange and the National Bank of Kuwait’s International Advisory Board.

In 1995, during the Mexican Tequila Crisis, many investors were shying away from Argentine investments. Relying on his deep understanding of the convertibility system, Hanke bet against the market and had TTA fully invest in Argentine peso-denominated bonds.

Hanke has taken several other notable successful trading positions during his career. For example, in late 1985, he was among the first to correctly predict that oil would fall below $10 per barrel, and in 1993, he joined a successful speculative attack on the French franc.

In 1998, under Hanke’s leadership, Friedberg Mercantile Group, Inc. was one of the few trading shops to predict the devaluation of the Russian ruble. Hanke predicted that the devaluation would occur after mid-year, and the ruble collapsed shortly thereafter, on August 17, 1998.

Hanke has also worked as an expert witness in financial litigation, specializing in derivatives cases. In the past, he was a principal at Chicago Partners (now Navigant Consulting), a financial expert witness consulting firm. In 1994, Hanke, his then-post-doctoral student Christopher Culp, and Nobel Laureate Merton Miller waded into the debate over the collapse of Metallgesellschaft AG. Although not officially involved in the case, Hanke, Culp, and Miller made headlines when they revealed that Metallgesellschaft’s oil futures hedge was sound, and that it was Deutsche Bank who was responsible for the collapse of the $1.3 billion position.

Awards

Hanke has received various honors in recognition of his scholarship on exchange rate regimes and his currency reform efforts.

Criticism

In the past, Hanke has come under fire for his advocacy of currency board systems, particularly from local government officials in countries where he has worked as an adviser, as well as from rival economists.

For example, Former Bulgarian Minister Krasimir Angarski who was tasked with the introduction of the currency board has contested the often repeated claim that Hanke is the "father of the Bulgarian currency board" and has added that Hanke had no knowledge of the Currency Board law because Angarski refused to provide him the manuscript he was working on.

Angarski's claim is contradicted by the fact that Hanke first proposed a currency board for Bulgaria in 1991, with his book "Teeth for the Bulgarian Lev: A Currency Board Solution." Hanke later helped bring about its adoption in 1997, when he served as an adviser to President Petar Stoyanov. In July 2013 Hanke's work on the Bulgarian currency board has also been praised by Bulgarian Prime Minister, Plamen Oresharski, as well as by the Bulgarian Academy of Sciences, which in 2013 awarded Hanke the title "Doctor Honoris Causa," in recognition of his currency reform efforts in Bulgaria.

In December 2013, the Bulgarian newspaper Trud published an exposé refuting Angarski's claims and revealing that the Bulgarian National Audit Office had used official resources to propagate Angarski's claims. The head of Bulgarian National Audit Office, Valeri Dimitrov, was subsequently dismissed.

In the article "Rupiah Rasputin" written in 1998 for Fortune, Paul Krugman presented Hanke as "a self-promoter whose image as a successful country doctor has been pumped up by resume inflation." and accused him of fraudulently claiming that he is an adviser to former Argentine Finance Minister Domingo Cavallo: "Cavallo himself tells a different story, though. He claims Hanke first became involved three years after the board was established, when he volunteered his services as a publicist.". Krugman additionally claimed that creating a currency board in Indonesia "was probably a bad idea right now", because it would interfere with payments for imports or debt service.