Journal reference L225, 30.07.2014, p.1 | Date made 15 July 2014 | |

| ||

Title Establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Resolution Fund Applicability All EU members. SRM provisions however only apply to Member States participating in the SSM. Made under Article 114 of the TFEU. | ||

The Single Resolution Mechanism (SRM) is one of the pillars of the European Union's banking union. The Single Resolution Mechanism entered into force on 19 August 2014 and is directly responsible for the resolution of the entities and groups directly supervised by the European Central Bank as well as other cross-border groups. The centralised decision making is built around a strong Single Resolution Board consisting of a Chair, a Vice Chair, four permanent members, and the relevant national resolution authorities (those where the bank has its headquarters as well as branches and/or subsidiaries).

Contents

Upon notification from the ECB that a bank is failing or likely to fail, the Board will adopt a resolution scheme including relevant resolution tools and any use of the Single Resolution Fund, established by the SRM Regulation (EU) No 806/2014. The Single Resolution Fund helps to ensure a uniform administrative practice in the financing of resolution within the SRM. By 1 January 2024, the available financial means of the SRF will reach the target level of at least 1% of the amount of covered deposits of all credit institutions authorised in all of the participating Member States.

A Single Resolution Fund (SRF) to finance the restructuring of failing credit institutions was established as an essential part of the SRM by a complementary intergovernmental agreement, after its ratification. If it is decided to resolve a bank facing serious difficulties, its resolution will be managed efficiently, at minimum costs to taxpayers and the real economy. In extraordinary circumstances, the Single Resolution Fund (SRF), financed by the banking sector itself, can be accessed. The SRF is established under the control of the SRB. The total target size of the Fund will equal at least 1% of the covered deposits of all banks in Member States participating in the Banking Union. The SRF is to be built up over eight years, beginning in 2016.

History

The SRM was enacted through a Regulation and an Intergovernmental Agreement (IGA) which are titled:

The proposed Regulation was put forward by the European Commission in July 2013 to compliment the other pillars of the EU banking union, the Single Supervisory Mechanism (SSM). The details of some aspects of the functioning of the SRF, including the transfer and mutualisation of funds from national authorities to the centralized fund, was split off from the Regulation into the IGA due to concerns, especially by Germany, that they were incompatible with current EU treaties.

The Parliament and the Council of the European Union reached an agreement on the Regulation on 20 March 2014. The European Parliament approved the Regulation on 15 April 2014, and the Council followed suit on 14 July, leading to its entry into force on 19 August 2014. The SRM automatically applies to all SSM members, and states which do not participate in the SSM cannot participate in the SRM.

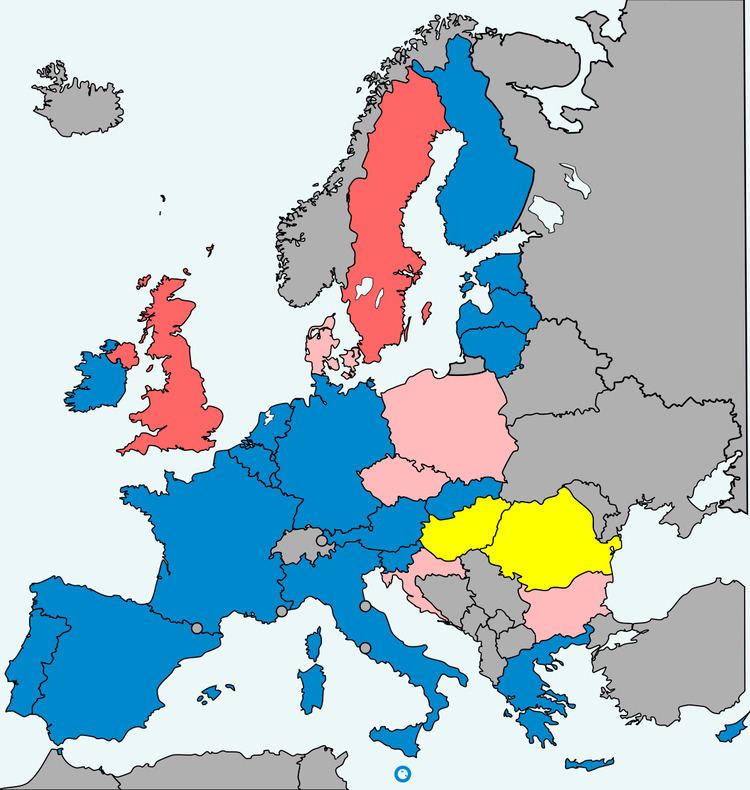

The IGA was signed by 26 EU member states (all but Sweden and the United Kingdom) on 21 May 2014 and is open to accession to any other EU member states. It was to enter into force on the first day of the second month following the deposit of instruments of ratification by states representing at least 90% of the weighted vote of SSM and SRM participating states, and was applied from 1 January 2016, since the Regulation had entered into force, but only to SSM and SRM participating states.

Some of the provisions of the Regulation were applied from 1 January 2015, but the authority to carry out bank resolutions did not apply until 1 January 2016, and were subject to the entry into force of the IGA.

Proposal and reactions

The European Commission argued that centralizing the resolution mechanism for the participating states will allow for more coordinated and timely decisions to be made on weak banks. Internal Market and Services Commissioner Michel Barnier stated that "by ensuring that supervision and resolution are aligned at a central level, whilst involving all relevant national players, and backed by an appropriate resolution funding arrangement, it will allow bank crises to be managed more effectively in the banking union and contribute to breaking the link between sovereign crises and ailing banks."

Ratings Agencies have stated their approval of the measure and believe it will cause European ratings and credit to rise as it will limit the impact of a bank failure. Critics have stated their concerns that this mechanism will result in sovereign states' taxpayers' money being used to pay off other nation's bank failures.

Functioning

The SRM allows for troubled banks operating under the SSM (as well as other cross border groups) to be restructured with a variety of tools including bailout funds from the centralized SRF, valued at at least 1% of covered deposits of all credit institutions authorised in all the participating member states (estimated to be around 55 billion euros), which would be filled with contributions by participating banks during an eight-year establishment phase. This would help to alleviate the impact of failing banks on the sovereign debt of individual states. The SRM also handles the winding down of non-viable banks. The Single Resolution Board is directly responsible for the resolution of significant banks under ECB supervision, as well as other cross border groups, while national authorities will take the lead in smaller banks.

Like the SSM, the SRM Regulation will cover all banks in the eurozone, with other states eligible to join. The text of the Regulation approved by the European Parliament stipulates that all states participating in the SSM, including those non-eurozone states with a "close cooperation" agreement, will automatically be participants in the SRM.

The IGA states that the intention of the signatories is to incorporate the IGA's provisions into EU structures within 10 years.

Single Resolution Board

The Single Resolution Board (SRB) opened on 1 January 2015 (fully responsible for resolution on 1 January 2016), is the resolution authority for around 143 significant banking groups as well as any cross border banking group established within participating Member States.

Resolution is the restructuring of a bank by a resolution authority through the use of resolution tools in order to safeguard public interests, including the continuity of the bank’s critical functions and financial stability, at minimal costs to taxpayers.

The Single Resolution Board's main tasks are:

The Board has its seat in Brussels and consists of the following members:

IGA ratification

As of 2 March 2017, 21 states have ratified the intergovernmental agreement (IGA). A sufficient number of participating Member States ratified the IGA, surpassing the 90% voting share of participating member states required for entry into force, before 30 November, allowing the Single Resolution Board (SRB) to take over full responsibility for bank resolution as planned on 1 January 2016. The only eurozone states which had not completed their ratification at the time were Greece and Luxembourg. Greece subsequently did so in December, while Luxembourg followed suit in February 2016.

No requests to enter into "close cooperation" were made by non-eurozone states in 2014. Therefore, only the eurozone states are considered when calculating the total weighted voting of participating member states for evaluating the 90% entry into force criteria.

The Danish government announced in April 2015 its intention to join the banking union. Although the justice ministry found that the move did not entail any transfer of sovereignty and thus would not automatically require a referendum, the Danish People's Party, Red Green Alliance and Liberal Alliance oppose joining the banking union and collectively the three won enough seats in the subsequent June 2015 election to prevent parliament from joining without the approval through a referendum.