Sahara India Pariwar investor fraud case is the case of the failure of Subrata Roy-led Sahara India Pariwar to return Rs 24,000 crore plus interests to its investors as directed by the Supreme Court of India, after a prolonged legal battle with the Securities and Exchange Board of India.

On 26 February 2014, the Supreme Court of India ordered the arrest of Subrata Roy, chairman and founder of Sahara India Pariwar, for failing to appear in court in connection with the Rs. 24,000 crore deposits his company failed to refund to its investors as per a Supreme Court order, after a legal dispute with the Indian market regulator SEBI (Securities and Exchange Board of India). He was eventually arrested on 28 February 2014 by Uttar Pradesh police on a Supreme Court warrant. In a statement after the arrest, his lawyer said Subrata's 92-year-old mother was in poor health and needed her eldest son by her side, and hence he failed to appear at the court. He was granted interim bail by the Supreme Court on 26 March 2014 on the condition that he would deposit Rs 10,000 crore with SEBI. Subrata was eventually taken into judicial custody and sent to Tihar jail, along with two other Sahara directors, on 4 March 2014 for failing to deposit Rs 10,000 crore with SEBI. In Tihar jail, Subrata unsuccessfully tried to sell some of his hotel properties to raise Rs 10,000 crore for his bail bond. He remained in Tihar jail for more than two years, and was released on parole in May 2016 to attend the last rites of his deceased mother.

The unravelling of this fraud case started in 2010 and it is still in process in the Supreme Court of India as of 2016.

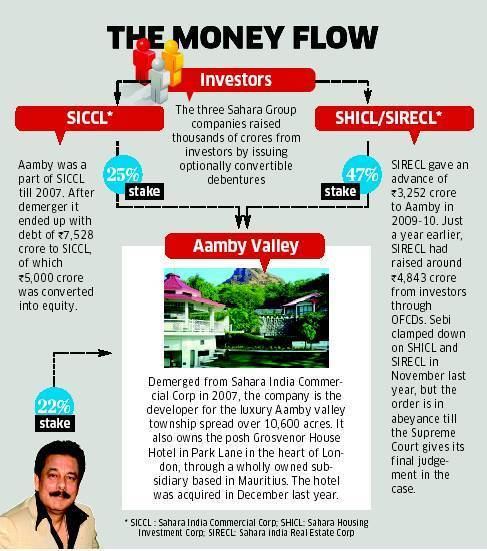

November 2010 - Securities and Exchange Board of India barred Sahara India Pariwar chief Subrata Roy and two of its companies – Sahara India Real Estate Corp (SIREC) and Sahara Housing Investment Corp (SHIC) - from raising money from the public as they had raised several thousand crores through optionally fully convertible debentures (OCFDs) that SEBI deemed illegal.December 2010 - Sahara appealed in the Allahabad High Court, which ordered SEBI not to take any action until a court order is passed.January 2011 - Delhi High Court issued a warrant against Sahara India Pariwar chairman Subrata Roy and four other officials of the group on a complaint that it deceived investors in a proposed housing project of Rs. 25,000 crore.February 2011 - Delhi High Court stays proceedings against Sahara India Pariwar chairman Subrata Roy and four other officials of the group on a complaint that it deceived investors in a proposed housing project.May 2011 - Supreme Court of India asked Sahara India Real Estate (SIREC) to furnish the format of the application for its optionally fully convertible debenture (OFCD) scheme and a list of accredited agents that raised money on the company's behalf.June 2011 - SEBI ordered Sahara firms to immediately refund the money collected through its sale of OFCDs.October 2011 - Securities Appellate Tribunal (SAT), set up by the Supreme Court, ordered two unlisted Sahara group companies to refund within six weeks about Rs. 17,656.53 crore with 15% interest, which it had raised through OFCDs.November 2011 - Sahara India Pariwar moved the Supreme Court against SAT's order and the Supreme Court stayed the SAT order, and asked the two companies to refund Rs. 17,400 crores to their investors and asked the details and liabilities of the companies.January 2012 - Supreme Court gives three weeks time to Sahara India Pariwar to choose between options to return investments made by public in its OFCD scheme. Sahara to either to give sufficient bank guarantee or attach properties worth the amount raised through OFCDs.May 2012 - Supreme Court is informed by senior counsel Fali Nariman of Sahara India Real Estate Corp that SEBI could not have taken up this issue of Sahara Group of companies raising funds through OFCD as there was no complaint from any investor.June 2012 - SEBI informed the Supreme Court that the real estate division of Sahara India Pariwar had no right to mobilize Rs. 27,000 crore from investors through OFCD without complying to the norms of the market regulator - SEBI.August 2012 - Supreme Court directed Sahara India Real Estate Corporation Ltd. (SIRECL) and the Sahara Housing Investment Corporation Ltd. (SHICL) to refund over Rs. 24,400 crore to its investors.February 2014 - Subrata Roy arrested by Uttar Pradesh police for failure to appear before the Supreme Court.March 2014 - Subrata Roy, along with two other directors of Sahara, sent to Tihar jail.March 2015 - Supreme Court stated that the total dues from Sahara have gone up to Rs 40,000 crore with the accretion of interest.July 2015 - SEBI cancelled the licence of Sahara’s mutual fund business.May 2016 - Subrata Roy released on parole from Tihar jail.