Type Public Industry Oil & Gas Headquarters Singapore | Traded as SGX: 5WH Founded 2013 | |

| ||

Key people Dan Brostrom, (Chairman)

Mans Lidgren, (CEO) Products Rex Gravity

Rex Seepage

Rex Virtual Drilling

Rexonics

Rex Gas Indicator Stock price 5WH (SGX) SGD 0.07 0.00 (0.00%)29 Mar, 9:17 AM GMT+8 - Disclaimer Subsidiaries Rex International Investments Pte Ltd. | ||

Rex International Holding is an oil and gas company headquartered in Singapore. The company's main activity is in oil exploration and has stakes in some 20 assets internationally. Its offshore assets are located in Oman and Norway, while its onshore assets are in Trinidad & Tobago and the US.

Contents

The company owns Rex Technologies, a suite of exploration technologies which are developed by its Swedish founders. Of the Rex Technologies, Rex Gravity and Rex Seepage analyze satellite data while Rex Virtual Drilling, a liquid hydrocarbon indicator, studies resonance information in seismic data to location hydrocarbons in the earth's subsurface. Rex International believes that Rex Virtual Drilling substantially increases the chance of success of finding oil in exploration drilling.

Rex International is also in a joint venture to provide well-bore cleaning services for producing oil wells using Rexonics, an ultrasound technology developed in Switzerland. The technology has been tested and found to be able to significantly increase oil production in wells that have clogging and deposit issues.

Rex International was publicly listed on 31 July 2013 and is on Singapore Exchange's secondary board, Catalist.

History

The Company was founded by Dr Karl Lidgren, Mr Hans Lidgen and Mr Svein Kjellesvik. The three then founded Rex Partners, whose subsidiary Rex Commercial and Schroders & Co Bank AG were the initial shareholders of Rex International Holding, a private company incorporated in Singapore on 11 January 2013.

31 July 2013: Rex International Holding was listed on the Singapore Exchange Securities Trading Limited’s (SGX-ST) Catalist Board. It is one of the largest company listed on the Catalist Board. At listing, the Company had an initial portfolio of interest in 10 licences in the Middle East, Norway and the US.

24 October 2013: Rex International Holding signed a shareholders’ agreement with Swiss from Ogsonic to set up Rexonic AG. The Company had a 66.7% stake in Rexonic AG.

12 December 2014: The Company acquired 100% shareholding interest in Rex Technology Management, owner of suite of Rex Technologies. The acquisition alleviates concerns the investors had and also allowed the Company to hold its key differentiator – the Rex Technologies, in the listed entity.

June 2015: Rex International Holding had grown its portfolio of interest to 25 licenses in Middle East, Norway, Trinidad & Tobago, Australia and the US.

11 December 2015: Rex International Holding pared down its stake in Rexonic AG from 66.67% to 50%. This divestment would allow the Company to focus on its core assets in Oman and Norway, due to the lower working capital contributions. The divestment reflected the good working relations between the partners and is a clear demonstration of the commitment from Mr Peter Spenger, Ogsonic founder and Rexonic CEO, to the joint venture and the technology he developed.

January 2016: At the Awards in Pre-defined Areas 2015 (APA 2015) licencing round, the Company’s subsidiary Lime Petroleum Norway AS was awarded 5 exploration and Production licences. This brings Rex International Holding portfolio of interest of about 30 licenses in the Middle East, Norway, Trinidad & Tobago, and the US.

Technologies

Dr Karl Lidgren and Mr Hans Lidgen, two of the three founders of Rex International Holding developed Rex Technologies. The proprietary exploration technologies have the ability to visualise and predict the location of liquid hydrocarbons.

- Rex Gravity, is an exploration technology that finds areas with suitable geological conditions for hydrocarbon accumulations.

- Rex Seepage, works together with Rex Gravity. Rex Seepage was developed to spot offshore oil seepages in order to better understand the potential presence of oil reservoirs.

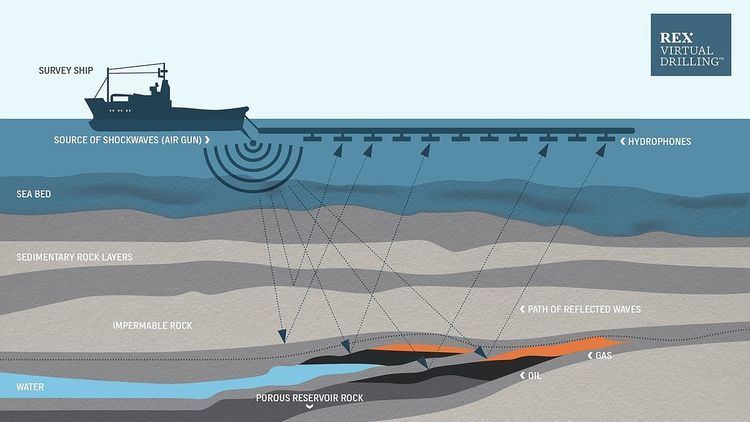

- Rex Virtual Drilling

is used to detect liquid hydrocarbon accumulations using seismic data interpretation techniques.

9 February 2015: The Company announced that it had developed an improved version of Rex Virtual Drilling. This second generation RVD has improved depth resolution in the analysis of seismic data. This allows for correlation with conventional geological studies. - Rexonics is an environmentally-friendly, high-power ultrasound technology for commercial oil well stimulation that has been proven to increase oil production by between 30% and up to 380% both onshore and offshore.

- Rex Gas Indicator, the latest addition to the suite of Technologies was announced on 13 August 2014. This technology is able to detect hydrocarbons in their gaseous phase using conventional seismic data.

Operations

The Company’s assets are located in regions that are rich in oil, have established infrastructure and attractive fiscal policies for oil exploration and production. In its press release dated 21 January 2015, the Company said that its general criteria for investment is a potential of about 50 million barrels of oil in each concession.

Norway

One of the main areas of focus for the Company is Norway as it is a matured market with high activity with reputed operators, attractive fiscal policies and good quality seismic data to be analysed with Rex Virtual Drilling. A lot of Norway’s oil production occurs in the North Sea and smaller amounts in the Norwegian Sea. In recent times, new exploration and production activity is occurring in the Barents Sea. As at March 2015, the Group has interest in 15 concessions in Norway totalling 5,728 km2 – 7 in the North Sea, 4 in the Norwegian Sea and 4 in the Barents Sea. Looking ahead, Rex International will continue to look for farm-in opportunities that have scheduled drilling activities.

After the 2015 APA round, the Group has interest in 24 concessions in Norway – 11 in the North Sea, 8 in the Norwegian Sea and 5 in the Barents Sea.

Oman

Oman is the largest oil producer in the Middle East that is not part of OPEC. According to the US Energy Information Administration (EIA) Oman had 5.5 billion barrels of estimated proved oil reserves as of January 2014. Oman’s 5.5 billion barrels of proved oil reserves rank seventh in the Middle East, and 23rd in the world. Located in the East of the Gulf of Masirah, Block 50 Oman is one of the first concessions secured by the founders of Rex International before IPO. The discovery is significant as it is the first offshore discovery in the area after 30 years of exploration activity. Block 50 spans approximately 17,000 km2, roughly 24 times the size of Singapore. This discovery won Masirah Oil, a 64% indirectly owned subsidiary of its jointly-controlled entity, Lime Petroleum Plc, the Offshore Discovery of the Year award for discovering hydrocarbons in its second offshore exploration well in Block 50 Oman.

Oman

On 4 February 2014, an oil discovery was announced in Block 50 Oman. The second exploration well that was drilled in the concession had successfully reached the well target depth of more than 3,000m into the Cambrian formation. Hydrocarbons were discovered in several formations with good oil sample extracted.

Block 50 Oman was one of the first concessions secured by the founders of Rex International Holding before the Company’s IPO. The Company’s founders were involved in Lundin Petroleum’s (then known as International Petroleum Corporation (IPC)) commercial oil discovery in the Bukha field, offshore Oman in 1986.

The oil discovery in Block 50 Oman in 2014 is significant as it is the first offshore discovery east of Oman, after 30 years of exploration activity in the area. The discovery won the ‘Offshore Discovery of the Year’ award, one of six awards presented in conjunction with the launch of the Oil & Gas Year Oman 2014 energy report, produced by publisher Wildcat International, in partnership with the Ministry of Oil and Gas and OPAL (Oman Society for Petroleum Services).

During a 48-hour test, hydrocarbons were flowed to the surface and the well achieved light oil flow rate of up to 3,000 stock tank barrels per day (stb/d) with no water production.

In March 2014, the Ministry of Oil and Gas of Oman approved Masirah’s entry into the Second Phase of the Minimum Work Obligation, with the fulfilment of the commitments specified in the Exploration and Production Sharing Agreement (EPSA) for this phase.

The concession is 17,000 square kilometres and is roughly 24 times the size of Singapore. The area explored so far (where the previous two drillings were made) is only a couple of hundred square kilometres. Hence, the Company believes there to be promising remaining potential in the block. To this end, plans have been made to drill at least two more exploration wells in the concession. The new wells, if successful, will be grouped with the first oil discovery to reap economies of scale for EWT.

Norway

On 22 December 2015, the Company announced that the drilling of exploration well in the North Sea licence PL338C, in which Lime Petroleum Norway AS participated, has been completed as an oil discovery.

A production test (DST) was performed in this close to vertical exploration well, achieving a production rate of 315 barrels of oil per day through a 36/64” choke. The moderate flow rate seems to be caused by limited communication between the reservoir and the wellbore. A frac and injection test was carried out, giving a stable injection rate of some 6,000 barrels per day. Further studies will be done to incorporate all the findings and establish future planning.

The operator Lundin gave a total gross resource estimate in the range of 12 to 46 million barrels of oil equivalents

With the use of Rex International Holding’s proprietary Rex Virtual Drilling technology, the Company identified the key risks associated with the Rolvsnes well to be the irregular porosity and permeability distributions in the unconventional weathered and fractured basement reservoir. This was also the first time that RVD was applied in this kind of rocks, where the calibration was uncertain. Building on the thorough and innovative G&G work by operator Lundin, Rex International Holding undertook its own independent prospect analysis. The good alignment of conventional G&G prognoses and those of RVD, which identified this discovery, is testament to RVD’s role as a powerful tool in reducing exploration risks.

PL338C is held by operator Lundin at 50 per cent, Lime Norway at 30 per cent and OMV (Norge) at 20 per cent. Lime Norway also has 30 per cent participation in the nearby licences PL544 and PL410, all operated by Lundin.