| ||

Renminbi currency value is an issue that affects the Chinese currency unit, the renminbi (Chinese: 人民币; Code:CNY) and which as of 2013 is at the forefront of world economic discussion. Since the 1980s, China has emerged as a growing economic power due to its vast population, resources, economic reforms and industrialization. The renminbi is classified as a fixed exchange rate currency "with reference to a basket of currencies", which is drawing attention or scrutiny from other western industrialized nations which have freely floated currency and has become a source of trade friction.

Contents

Some commentators have argued that with current economic conditions, the value of the renminbi should be allowed to appreciate in value by between 20 and 40 percent against the US dollar. According to the International Monetary Fund (IMF), the renminbi is undervalued somewhere between five and 27 percent.

Background

The renminbi was introduced in October 1949 after the Communists took power on the Chinese mainland and established the People's Republic of China. Since the Chinese economic reforms of 1978, China has become the world's biggest exporter, second largest economy and biggest manufacturer in the world.

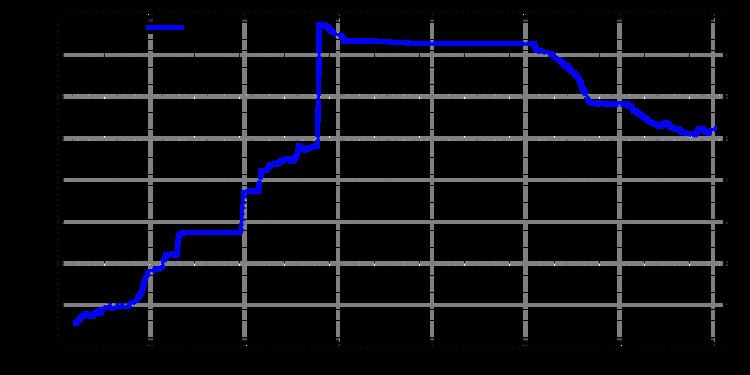

For most of its early history, the renminbi was pegged to the U.S. dollar at ¥2.46 per USD (note: during the 1970s it was revalued until it reached ¥1.50 per USD in 1980).

Its value gradually declined as China embarked on a new economic course during Deng Xiaoping's leadership and transformed into a more market-based capitalistic economy.

Since 2005, the Chinese government has overturned its previous policy of pegging the Renminbi to the US dollar. The renminbi now floats within a small margin compared to a basket of currencies selected by the Chinese government. This is seen as a move to a more fully free-market floating of the Renminbi. The Renminbi has appreciated 22 percent since the mechanism reform in 2005 of the Yuan exchange rate. However, during the onset of the 2007-2008 global financial crisis, the renminbi was unofficially repegged to the US dollar. It was again depegged from the dollar in June 2010.

Historical Undervaluation

A broad consensus exists among western economists who agree that the renminbi was undervalued before and up to 2010. The 2010 IMF report on China's economic policies also contends that the country's currency remains "undervalued." Prominent economists including World Trade Organization (WTO) Director-General Pascal Lamy, U.S. Federal Reserve Chairman Ben Bernanke, Nobel Laureate Paul Krugman, Director of the Peterson Institute for International Economics Fred Bergsten, and Cornell University Professor Eswar Prasad have repeatedly stated that China's currency is undervalued. According to the IMF, the yuan is undervalued somewhere between five and 27 percent. Peterson Institute of International Economics study says the yuan is 20 percent undervalued versus the dollar.

The undervalued currency causes serious problems and international criticism, China's current economic circumstances and its longer-term policy objectives:

- As a member of the WTO and IMF, China's undervalued renminbi violates Article XV(4) of the General Agreement on Tariffs and Trade Article 1, and 3 of the WTO Agreement on Subsidies and Countervailing Measures, and Article IV Section 1 of the IMF that prohibiting countries from currency manipulation.

- The trade dispute with the U.S., caused by the undervalued renminbi, damages China’s most important bilateral relationship. New tariffs aimed at retaliating the undervalued currency are possible in the new United States Congress, as the U.S. House of Representatives passed legislation that would impose economic sanctions on China. “Chinese officials do not understand the intensity of anger in Washington and could face a backlash if they fail to mollify their critics,” according to analyst Jason Kindopp at the Eurasia Group.

- The undervalued renminbi is a major cause of inflation. In an effort to hold the value of the yuan comparatively low, the government has to buy foreign currencies through trade surpluses and investment. China’s foreign reserves, already the world's biggest, soared to $2.8 trillion at the end of 2010. In order to buy foreign currencies, the government has to print the RMB “at a furious pace” and therefore incur inflation. China’s inflation is running five percent at the consumer level (the official number might understate true inflation.)

- The undervalued renminbi has contributed to very large portfolio foreign capital inflows. Motivated by expectations of further appreciation, international investors have pumped a large amount of money into the economy. This further inflates already overvalued asset prices and adds to pressure for the currency to rise.

- The undervalued renminbi undermines domestic consumers’ purchasing power when it comes to goods from outside the country. An undervalued currency makes foreign goods more expensive in terms of yuan.

- The undervalued renminbi exacerbates Chinese banks’ long existing capital misallocation problems and hence hampers the banking system reform, which has been one of the goals of the Chinese government. The link of capital allocation to the exchange rate comes about via the impact of an undervalued exchange rate on accumulation of international reserves and in turn, the effect of reserve accumulation on the expansion of bank reserves and on bank-lending behavior. As mentioned above, the undervalued yuan attracts a large amount of foreign capital inflow . When reserves increases, banks sell them to the central bank and receive in exchange for yuan, as required by law. Then, the bank can use the yuan to increase bank lending. Chinese commercial banks’ lending behavior, aka capital allocation, is severely inefficient. The weaknesses in the capital allocation can have enormous fiscal costs. China transferred $200 billion to fund the recapitalization of its four major state-owned banks from 2003 to 2006. The $600 billion stimulus package in 2008, which contains extensive bank lending, could cause long-term consequences for excess capacity in a number of sectors and for non-performing loans in banks that lent heavily to support such projects. The report by Bank of America Merrill Lynch in July 2010 estimates that 23 percent of the $1.1 trillion that Chinese banks lent to finance local government infrastructure projects are “clearly rotten” and the vast majority of such loans were not “financially viable”.

Chinese domestic discourse

Chinese economic reforms in the late 1970s propelled the Chinese economy from a closed centrally planned economy to one opened to foreign investments and capital, oriented to manufacturing of electrical goods, textile, toys and exports. This has allowed China to become a creditor country in relations to current accounts and the largest in terms of foreign reserves.

China maintains that the value of the renminbi is good for economic growth for China and the rest of the world. The renminbi has appreciated against the US Dollar by 2 percent since June 2010. Chinese Premier Wen stated that drastic appreciation of the Chinese yuan from 20 to 40 percent would cause disastrous bankruptcies and loss of jobs for millions of people. China says that its population receives high savings from the structure of the economy, and that gradual increase in domestic consumption is important for its own growth. While the Chinese have argued that their exchange rate is purely a domestic policy matter, economists have begun to suggest that Chinese policy will soon shift to accelerate appreciation of the Yuan in order to reduce domestic inflation and to increase the wealth of Chinese citizens.

Others in China view this dispute as an attempt to ring in China's economic development as part of a strategy for economic imperialism of the industrialized world led by the United States. They likened it to the unequal treaties signed after the Boxer rebellion and the First and Second Opium Wars.