| ||

The stock of new energy vehicles in China is the world's largest, with cumulative sales of more than 951,000 units through December 2016. These figures include passenger cars and heavy-duty commercial vehicles such buses and sanitation trucks, and only accounts for vehicles manufactured in the country. The Chinese government uses the term new energy vehicles (NEVs) to designate plug-in electric vehicles eligible for public subsidies, and includes only battery electric vehicles and plug-in hybrid electric vehicles. Sales of new energy vehicles since 2011 passed the 500,000 unit milestone in March 2016, while sales of new energy passenger cars achieved the 500,000 unit milestone in September 2016, both, excluding imports. Domestically produced passenger cars account for 96% of new energy car sales in China.

Contents

- Government policies and incentives

- New energy vehicle sales

- 2011 2013

- 2014

- 2015

- 2016

- Passenger cars sales by model

- References

As of November 2016, the Chinese stock of plug-in electric vehicles consisted of over 640,000 all-electric vehicles (75.6%) and more than 206,000 plug-in hybrids (24.4%) sold since 2011. Most of the stock of new energy vehicles was sold during the last three years. Deliveries between January 2014 and November 2016 account for 95.4% of all new energy vehicle sales since 2011. Of these, 402,000 sold during the first eleven months of 2016 (47.5%), and 331,092 in 2015 (39.1%). As of December 2015, China listed as the world's largest electric bus market with almost 173,000 plug-in electric buses. The production of all-electric buses totaled 115,664 units in 2016, up 31% from 2015. By 2020, the country is expected to account for more than 50% of the global electric bus market.

As of December 2016, with more than 630,000 new energy passenger cars sold since 2005, China has the world's largest fleet of light-duty plug-in electric vehicles, after having overtook during 2016 both the U.S. and Europe in terms of cumulative sales. The Chinese plug-in stock represented 29.2% of the global stock of highway legal light-duty plug-in electric vehicles as of September 2016. China was the world's best-selling plug-in electric car market in 2015, with record annual sales of more than 207,000 plug-in passenger cars, representing over 34% of global sales in 2015. During 2016 through November, China has remained as the world's top selling market in terms of annual sales of plug-in electric cars, surpassing both the U.S. and Europe. A particular feature of the Chinese passenger plug-in market is the dominance of small entry level vehicles. All-electric car sales in the mini and small segments (A-segment) represented 87% of total pure electric car sales in 2015, while 96% of total plug-in hybrid car sales were in the compact segment (C-segment).

BYD Auto ended 2015 as the world's best selling manufacturer of highway legal light-duty plug-in electric vehicles, and for a second year running was the world's top selling plug-in car manufacturer with over 100,000 units delivered in 2016. During 2016 BYD surpassed Mitsubishi Motors and Tesla Motors to become the world's all-time second largest plug-in electric passenger car manufacturer after the Renault-Nissan Alliance. As of October 2016, BYD Auto has sold sold more than 171,000 new energy passenger cars in China since 2008. The BYD Qin was the top selling new energy passenger car for two years in a row, 2014 and 2015. The BYD Tang was the best selling plug-in passenger car in 2016. As of December 2016, the Qin is the all-time top selling plug-in electric car in the country with 68,655 units sold since its inception.

The government's political support for the adoption of electric vehicles has four goals, to create a world-leading industry that would produce jobs and exports; energy security to reduce its oil dependence which comes from the Middle East; to reduce urban air pollution; and to reduce its carbon emissions. In June 2012 the State Council of China published a plan to develop the domestic energy-saving and new energy vehicle industry. The plan set a sales target of 500,000 new energy vehicles by 2015 and 5 million by 2020. As sales of new energy vehicles were slower than expected, in September 2013, the central government introduced a subsidy scheme providing a maximum of US$9,800 toward the purchase of an all-electric passenger vehicle and up to US$81,600 for an electric bus. The subsidies are part of the government's efforts to address China's problematic air pollution.

Government policies and incentives

The Chinese government adopted in 2009 a plan to leapfrog current automotive technology, and seize the growing new energy vehicle (NEV) market to become of the world leaders in manufacturing of all-electric and hybrid vehicles. The government's political support for the adoption of electric vehicles has four goals, to create a world-leading industry that would produce jobs and exports; energy security to reduce its oil dependence which comes from the Middle East; to reduce urban air pollution; and to reduce its carbon emissions. However, a study by Mckinsey found that even though local air pollution would be reduced by replacing a gasoline car with a similar-size electric car, it would reduce greenhouse gas emissions by only 19%, as China uses coal for 75% of its electricity production. The Chinese government uses the term new energy vehicles (NEVs) to designate plug-in electric vehicles, and only pure electric vehicles and plug-in hybrid electric vehicles are subject to purchase incentives. Initially, conventional hybrids were also included.

On June 1, 2010, the Chinese government announced a trial program to provide incentives for new energy vehicles of up to 60,000 yuan (~US$9,281 in June 2011) for private purchase of new battery electric vehicles and 50,000 yuan (~US$7,634 in June 2011) for plug-in hybrids in five cities. The cities participating in the pilot program are Shanghai, Shenzhen, Hangzhou, Hefei and Changchun. The subsidies are paid directly to automakers rather than consumers, but the government expects that vehicle prices will be reduced accordingly. The amount of the subsidy will be reduced once 50,000 units are sold. Electricity utilities have been ordered to set up electric car charging stations in Beijing, Shanghai and Tianjin. The government set the goal to raise the country's annual production capacity to 500,000 plug-in hybrid or all-electric cars and buses by the end of 2011, up from 2,100 in 2008.

In June 2012 the State Council of China published a plan to develop the domestic energy-saving and new energy vehicle industry. The plan set a sales target of 500,000 new energy vehicles by 2015 and 5 million by 2020. According to a report by Mckinsey, electric vehicle sales between January 2009 and June 2012 represented less than 0.01% of new car sales in China. A mid-September 2013 joint announcement by the National Development and Reform Commission and finance, science, and industry ministries confirmed that the central government would provide a maximum of US$9,800 toward the purchase of an all-electric passenger vehicle and up to US$81,600 for an electric bus. The subsidies are part of the government's efforts to address China's problematic air pollution.

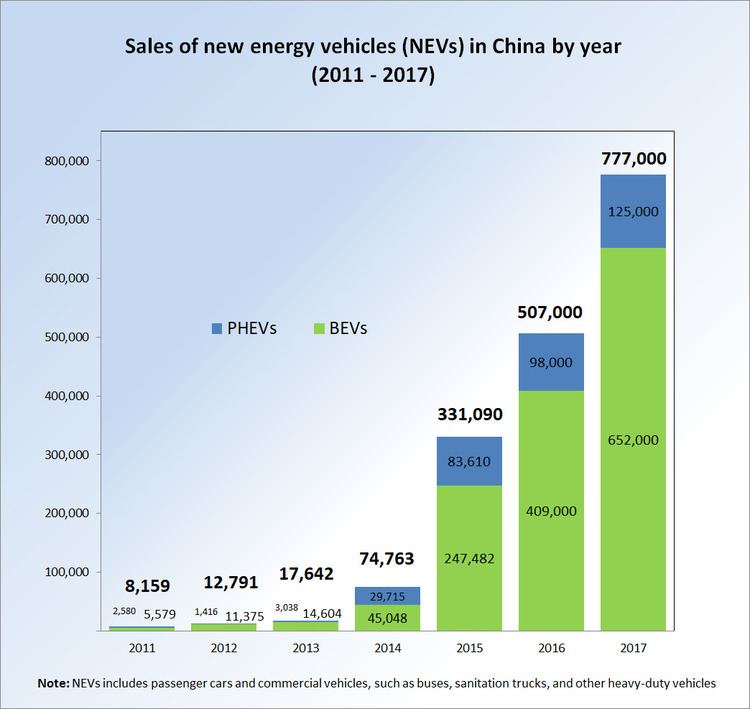

The China Association of Automobile Manufacturers (CAAM) expected that sales of electric and hybrid electric vehicles in China would reach 60,000 to 80,000 units in 2014. As sales have been much lower than initially expected, and most of the deployed NEV stock has been purchased by the government for public fleets, new monetary incentives were issued in 2014, and the national government set a sales target of 160,000 units for 2014. Although the goal was not achieved, new energy vehicles sales in 2014 totaled 74,763 units, up 324% from 2013. The China Industrial Association of Power Sources expected new energy vehicle sales to reach between 200,000 and 220,000 NEVs in 2015, and 400,000 units in 2016. The surge in demand continued in 2015, with a total of 331,092 NEVs sold in 2015, rising 343% year-on-year.

Initially, CAAM expected new energy vehicle sales to more than double 2015 sales and reach 700,000 NEVs in 2016. After the government imposed penalties to several carmakers for defrauding the subsidy program out of almost 10 billion yuan, CAAM revised downward in September 2016 its 2016 sales target to 400,000 new energy vehicle orders. Only 289,000 new energy vehicles had been sold during the first nine months of 2016.

As intercity driving is rare in China, electric cars provide several practical advantages because commutes are fairly short and at low speeds due to traffic congestion. These particular local conditions make the range limitation of all-electric cars less of a problem, especially as the latest Chinese models have a top speed of 100 km/h (60 mph) and a range of 200 km (120 mi) between charges. As of May 2010, Chinese automakers have developed at least 10 models of high-speed, all-electric cars with plans for volume production.

The Chinese government reaffirmed their priority to promote new energy vehicles in its 13th Five-Year Plan (2016-2020). The Central Committee of the Communist Party of China approved the document that emphasizes boosting technological innovations in the manufacturing of new energy vehicles and promoting the use of electric cars, plug-in hybrids and fuel cell vehicles, included in its latest Five-Year Plan. The consulting firm PwC estimates the sales of new-energy vehicles in China will climb to 1.4 million units by 2020, and about 3.75 million units by 2025.

As part of its commitment to promote electric vehicles, the Chinese government announced plans in September 2015 to build a nationwide charging-station network to fulfil the power demand of 5 million electric vehicles by 2020. This network will cover residential areas, business districts, public space and inter-city highways, according to a guideline released by the State Council. Also, the plan mandates that new residential complexes should build charging points or assign space for them, while public parking lots should have no less than 10% of parking spaces with charging facilities. According to the guideline, there should be at least one public charging station for every 2,000 NEVs. Also the State Council ordered local governments not to restrict the sales or use of new energy cars.

In October 2015, Tesla Motor announced the company is negotiating with the Chinese government on producing its electric cars domestically. Local production has the potential to reduce the sales prices of Tesla models by a third, and so improving the weak sales of the Model S. A Model S starts at about US$76,000 in the U.S., while in China pricing starts at CN¥673,000, about US$106,000, after duties and other taxes. Foreign automakers are generally required to establish a joint venture with a Chinese company to produce cars domestically.

In April 2016 the Traffic Management Bureau under the Ministry of Public Security announced the introduction of new green license plates to identify new energy vehicles, as opposed to the country's standard blue plates. The NEV plates include a Chinese character short for the provincial region where they are issued, and seven numbers and letters, compared to six on standard plates. The objective of the special plates is to facilite police enforcement of the preferential policies that some local authorities apply to cleaner cars to help cut emissions and ease traffic. For example, central Beijing has in place a road space rationing scheme, a driving restriction regulation that bans conventional vehicles from entering the city for one day a week, but new energy vehicles are exempted from the restriction. Beijing also introduced a vehicle quota system in 2011, awarding new car licenses through a lottery, with a ceiling of 6 million units for 2017. New energy vehicles were placed in a special category where the odds of winning a license plate are much higher than conventional autos.

New energy vehicle sales

New energy vehicle sales in China totaled 951,447 units between January 2011 and December 2016. These figures include heavy-duty commercial vehicles such buses and sanitation trucks, and only accounts for vehicles manufactured in the country because imports are not subject to government subsidies. As of November 2016, the Chinese stock of plug-in electric vehicles consisted of 640,088 all-electric vehicles (75.6%) and 206,359 plug-in hybrids (24.4%) sold since 2011. Most of the stock of new energy vehicles was sold during the last three years. Deliveries between January 2014 and November 2016 account for 95.4% of all new energy vehicle sales since 2011. Of these, 402,000 sold during the first eleven months of 2016 (47.5%), and 331,092 in 2015 (39.1%).

According to the Minister of Science and Technology, by mid-2013 more than 80% of the country's plug-in stock was on duty in public fleet vehicles, used mainly in public transport, for both bus and taxi services, and also in solid waste recollection services (sanitation trucks). As of December 2014, a total of 83,198 plug-in electric passenger cars and 36,500 pure electric buses had been registered in the country since 2008. A particular feature of the Chinese passenger plug-in market is the dominance of small entry level vehicles. In 2015, all-electric car sales in the mini and small segments (A-segment) represented 87% of total pure electric car sales, while 96% of total plug-in hybrid car sales were in the compact segment (C-segment). Among the electric drive segments, mid-size car (D-segment) sales were significant only in the conventional hybrid segment, representing about 50% of hybrid sales.

The country achieved record sales of 207,380 new energy passenger cars in 2015, making China the world's top selling plug-in passenger car country market in calendar year 2015, surpassing the European market and also the United States, the leading market in 2014. During the first three quarters of 2016 a total of 209,359 domestically produced new energy passenger cars were sold in China, surpassing 2015 annual sales, and allowing the country to remain as the world's top selling plug-in car market in 2016, followed by the U.S. with almost 110,000 units sold in the same period. As of September 2016, cumulative sales of domestically produced new energy passenger cars totaled 521,649 units since 2005, excluding imports, such as the Tesla Model S and Model X, BMW i3 and Smart ED. Domestically produced cars account for 96% of new energy car sales in China.

China, together with the U.S., had the world's largest country stock of plug-in electric passenger cars until September 2016, with the Chinese plug-in stock representing 29.2% of the global stock of highway legal plug-in electric passenger cars. In October 2016, with about 31,000 plug-in passenger cars sold in China, while U.S. sales totaled over 11,000 units, China became the country with the world's largest stock of plug-in passenger cars, totaling about 553,000 units versus almost 533,000 in the American market. The gap between the two countries widened in November 2016, as 41,795 new energy passenger cars were sold in China, while only 14,124 were sold in the U.S. By November 2016, China’s cumulative total plug-in passenger vehicles sales also overtook Europe, making the country the global leader in the light-duty plug-in vehicle segment. As of December 2016, sales of domestically produced new energy passenger cars since 2010 totaled 632,371 units. IHS Automotive predicted Chinese annual plug-in car sales will reach 1 million in 2019, four years before the United States.

As of December 2015, China listed as the world's leader in the plug-in heavy-duty segment, including electric buses and plug-in trucks, the latter, particularly sanitation/garbage trucks. Over 160,000 heavy-duty new energy vehicles have been sold between 2011 and 2015, of which, 123,710 (77.2%) were sold in 2015. Sales of commercial new energy vehicles in 2015 consisted of 100,763 all-electric vehicles (81.5%) and 22,947 plug-in hybrid vehicles (18.5%).

The share of all-electric bus sales in the Chinese bus market climbed from 2% in 2010 to 9.9% in 2012, and was expected to be closed to 20% for 2013. As of December 2015, the global stock of plug-in electric buses is estimated to be about 173,000 units, almost entirely deployed in China, the world's largest electric bus market. Of these, almost 150,000 are all-electric buses. The Chinese electric bus stock grew nearly six fold between 2014 and 2015. The production of all-electric buses totaled 115,664 units in 2016, up 31% from 88,248 electric buses produced in 2015. By 2020, the Chinese government plans to have a stock of over 200,000 electric buses, accompanied by a network of about 4,000 charging stations dedicated to buses. Also by 2020, the country is expected to account for more than 50% of the global electric bus market.

2011-2013

A total of 8,159 new energy vehicles were sold in China during 2011, including passenger cars (61%) and buses (28%). Of these, 5,579 units were all-electric vehicles and 2,580 plug-in hybrids. Electric vehicle sales represented 0.04% of total new car sales in 2011. Sales of new energy vehicles in 2012 reached 12,791 units, which includes 11,375 all-electric vehicles and 1,416 plug-in hybrids. New energy vehicle sales in 2012 represented 0.07% of the country's total new car sales. During 2013 new energy vehicle sales totaled 17,642 units, up 37.9% from 2012 and representing 0.08% of the nearly 22 million new car sold in the country in 2013. Deliveries included 14,604 pure electric vehicles and 3,038 plug-in hybrids. In addition, a total of 200,000 low-speed small electric cars were sold in 2013, most of which are powered by lead-acid batteries and not accounted by the government as new energy vehicles due to safety and environmental concerns.

The top selling new energy car in China between 2011 and 2013 was the Chery QQ3 EV city car, with 2,167 units sold in 2011, 3,129 in 2012, and 5,727 in 2013. The JAC J3 EV ranked second in 2012 with 2,485 units sold, followed by the BYD e6 with 1,690 cars. During 2013, the BYD e6 ranked second with 1,544 units sold, followed by the BAIC E150 EV with 1,466 units. The BYD Qin plug-in hybrid was launched in the country in December 2013. The Qin replaced the BYD F3DM, the world's first mass-produced plug-in hybrid automobile, launched in China in December 2008.

2014

In April 2014 Dongfeng Nissan announced that retail sales of the Chinese manufactured version of the Nissan Leaf, the Venucia e30, were scheduled to begin in September 2014. The Venucia e30 sold 582 units in 2014.

The first Tesla Model S retail deliveries took place in Beijing on 22 April 2014. About 2,800 Model S sedans have been imported by mid September 2014, but only 432 had received the license plates. According to a Tesla spokesman, the major reasons for the discrepancy could be that registration rules were holding deliveries in Shanghai, and Tesla only recently was able to start delivering the electric cars to customers who bought them in Shanghai. Secondly, many Chinese customers have delayed taking possession of their Model S car while waiting for the government to add the Tesla to the list of electric vehicles exempt from its 8% to 10% purchase tax. As of January 2015, a total of 2,968 Model S cars have been registered in China.

New energy vehicle sales in China during 2014 totaled 74,763 units, consisting of 45,048 all-electric vehicles, and 29,715 plug-in hybrids. Of these, 71% were passenger cars, 27% buses, and 1% trucks. Pure electric vehicle sales increased 210% from 2013 while plug-in hybrid sales grew 880% from the previous year. Production of new energy vehicles in the country in 2014 reached 78,499 units, up 350% from 2013. The plug-in electric segment market share reached 0.32% of the 23.5 million new car sales sold in 2014. The BYD Qin ranked as the top selling plug-in electric car in China in 2014, with 14,747 units sold during the year, and became the country's top selling plug-in passenger car ever. The Qin was followed by the all-electrics Kandi EV with 14,398, Zotye Zhidou E20, with 7,341 units, and BAIC E150 EV with 5,234.

2015

Domestically produced new energy vehicle sales in 2015 totaled a record 331,092 units, consisting of 247,482 all-electric vehicles and 83,610 plug-in hybrid vehicles, up 449% and 191% from 2014, respectively. Sales of plug-in passenger cars, excluding imports, totaled 207,380 units in 2015, consisting of 146,720 all-electrics and 60,660 plug-in hybrids. This record level of sales allowed China to rank as the world's best-selling plug-in electric car country market in 2015, ahead of the U.S., which was the top selling country in 2014. The plug-in electric passenger car segment market share rose to 0.84% in 2015, up from 0.25% in 2014. The top selling plug-in passenger models in 2015 were the BYD Qin plug-in hybrid with 31,898 units sold, followed by the BYD Tang (18,375), and the all-electrics Kandi EV (16,736), BAIC E150/160/200 EV (16,488), and the Zotye Z100 EV (15,467).

September 2015 achieved the best monthly NEV sales volume on record, with 20,892 units sold. BYD Auto also achieved record monthly sales volume, with 5,749 of its plug-in cars delivered in September 2015, consisting of 3,044 Tangs, 2,115 Qins, 465 e6s and 125 units of the new all-electric e5. Sales of new energy vehicles in October 2015 totaled 34,316 units, a new sales record and five times higher year-on-year. Cumulative sales of NEVs reached 171,145 units during the first ten months of 2015. Sales of new energy passenger cars also reached a record sales volume, with 21,375 plug-in cars sold in October 2015, up from 18,047 the previous month, and totaling 115,058 new energy cars sold during the first ten months of 2015.

As of December 2015, with 31,898 units sold in 2015, the BYD Qin continued to rank as the all-time top selling plug-in passenger car in the country, with cumulative sales of 46,787 units since its introduction. The BYD Qin was the world's second best selling plug-in hybrid car in 2015 after the Mitsubishi Outlander P-HEV, and also ranked fifth among the world's top selling plug-in electric cars in 2015. BYD Auto ended 2015 as the world's best selling manufacturer of highway legal light-duty plug-in electric vehicles, with 61,772 units sold in China, followed by Tesla Motors, with global sales of 50,580 units in 2015. Accounting for heavy-duty vehicles, BYD total sales rises to 69,222 units. BYD Auto net profits jumped 552.6% in 2015 to a total of CN¥2.829 billion (~ US$450 million). Sales of new energy vehicles were the main driver for BYD’s huge profit growth, with alternative energy vehicles accounting for half of the company's profits while the same percentage in 2014 was just 27%.

In addition, sales of low-speed small electric passenger vehicles totaled more than 600,000 units in 2015. Sales of these low-speed electric cars experienced considerable growth in China between 2012 and 2015 due to their affordability and flexibility because they can be driven without a driver license. Most of these small electric cars are used in small cities, but hey are expanding to larger cities.

2016

The stock of new energy vehicles sold in China since 2011 passed the 500,000 unit milestone in March 2016, including heavy-duty commercial vehicles such buses and sanitation trucks, and making the country the world's leader in the plug-in heavy-duty segment. This figure only includes vehicles manufactured in the country as imports are not subject to government subsidies.

A total of about 402,000 new energy vehicles were sold during the first eleven months of 2016, up 60.4% year-on-year, consisting of 316,000 pure electric vehicles, up 77.8% year-on-year, and 86,000 plug-in hybrid vehicles, up 18.0% from the same period the previous year. Despite more than doubling sales year-on-year, growth through September has been lower than expected due to the government's inquiry about extensive fraud cases regarding subsidies granted to manufacturers in 2015. As a result of this inquiry, the government has withheld the release of the electric bus subsidy scheme. CAAM considers that without this subsidy, the goal of 500,000 new energy vehicle sales for 2016 will not be met. In addition, sales of low-speed small electric passenger vehicles, which are popular in small cities, totaled more than 700,000 units during the first ten months of 2016.

Sales of plug-in passenger cars achieved the 500,000 unit milestone in September 2016. Imported plug-in cars, such as Tesla Model S or BMW i3s are not included. A total of 209,359 new energy passenger cars were sold in the first three quarters of 2016, up 122% year-on-year, consisting of about 145,000 all-electric cars, up 170% year-on-year, and about 65,000 plug-in hybrids, up 60% year-on-year. The domestic plug-in segment market share totaled 1.08% of new car sales during the period. Sales of BMW plug-in hybrid and i3 electric cars in China totaled 1,796 units during the first nine months of 2016. Tesla Inc. sales totaled 10,399 vehicles in 2016, consisting of 6,334 Model S cars and 4,065 Model X SUVs. In November 2016, with cumulative sales of about 600,000 plug-in electric passenger cars, China had overtook both Europe and the U.S., and became the market with the world's largest stock of light-duty plug-in vehicles.

Three BYD Auto models topped the Chinese ranking of best-selling new energy passenger cars in 2016. The BYD Tang plug-in hybrid SUV was the top selling plug-in car with 31,405 units delivered, followed by the BYD Qin (21,868), BYD e6 (20,605), BAIC E-Series EV (18,814), and the SAIC Roewe e550 (18,805). As of December 2016, the BYD Qin, with 68,655 units sold since its inception, remained the all-time top selling plug-in electric car in the country.

In September 2016, BYD Auto surpassed Mitsubishi Motors as the third largest global plug-in car manufacturer with cumulative sales of 161,000 plug-in cars delivered in China since 2008, ranking behind Tesla Motors (164,000) and the Renault-Nissan Alliance (almost 369,000). In October 2016, BYD passed Tesla Motors to become the world's all-time second largest plug-in electric passenger car manufacturer with more than 171,000 units delivered in China. BYD Auto was the world's top selling plug-in car manufacturer for a second year in a row with more than 100,000 units delivered in China in 2016, up 64% from 2015, and ahead of Tesla Motors by about 30,000 units. However, in terms of sales revenue, Tesla ranked ahead with US$6.35 billion from its electric car sales in 2016, while BYD sales totaled US$3.88 billion from its electric car division.

Passenger cars sales by model

The following table presents annual sales of new energy passenger cars by model between January 2011 and December 2015.