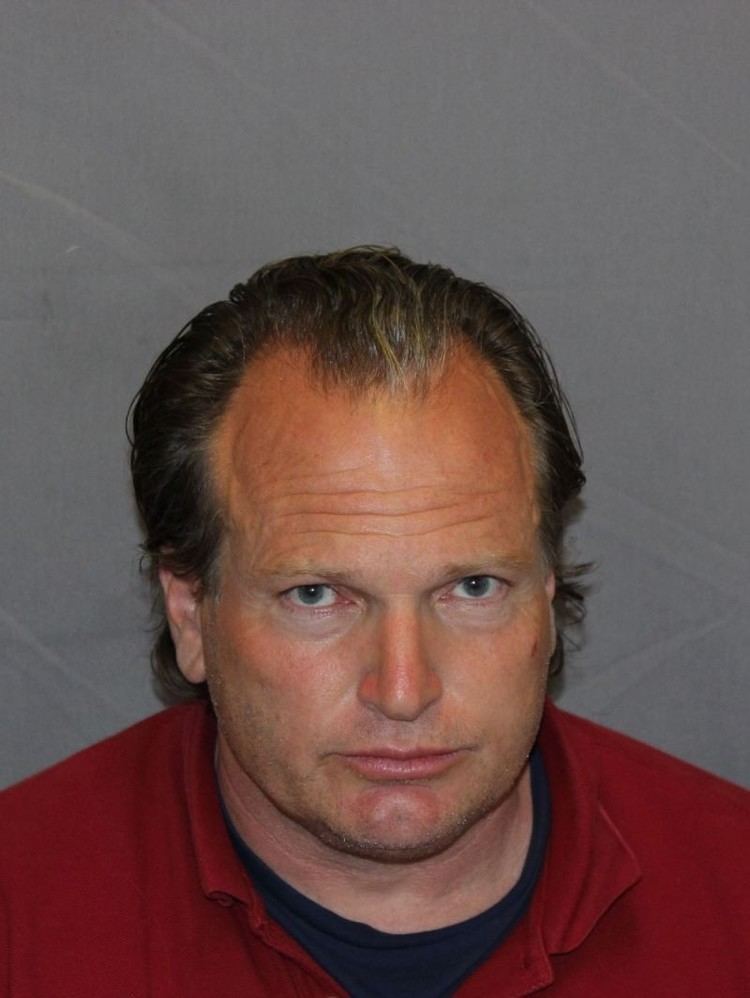

Name Luke Brugnara | ||

| ||

15 10509 usa v luke brugnara

Luke Dominic Brugnara ,(born October 18, 1963), also known as "Lucky Luke", is an American fraudster and former commercial real estate investor and developer. He was president of Brugnara Corporation, which declared bankruptcy in 2009.

Contents

- 15 10509 usa v luke brugnara

- Childhood

- Career

- Las Vegas

- Legal

- Personal life

- Philanthropy

- Water

- Art

- References

Childhood

Brugnara was born in the Sunset District of San Francisco, the son of a "juvenile hall manager". He went to school at St. Ignatius College Preparatory, a private preparatory Jesuit school. During his schooling years, he was interested in sports such as track, eventually becoming good enough "in the 400 meters to run for San Diego State." Brugnara was a competitive flycaster during his teenage years and set several national accuracy flycasting records in the American Casting Association which still stand today.

Career

Brugnara earned a bachelor's degree in Communications and a master's degree in Finance in 1988, graduating from San Diego State University. Thereafter he attended San Francisco Law School. Soon after, he began working in the real estate business at a "private mortgage banking firm". Working at the firm helped him to figure out a method to succeed in real estate, which he enacted in 1992 by purchasing "a $12.5 million first TD on a property in downtown San Francisco through bankruptcy court from American Savings for only $1.5 million". Brugnara also "was able to purchase four more high-rise office buildings in 1993 after taking out a $3 million mortgage on the property". By 1999, those four extra properties had been sold for over $130 million, which Brugnara used to make larger purchases. Brugnara's high-rise office building purchases in San Francisco included: the Kress Building, 939 Market Street, 814 Mission Street, the Bulletin Building, the Westinghouse Electric Building, 171 Second Street, 450 Pacific, Fritz Plaza, 735 Market Street, 140 Sansome Street, the Royal Insurance Building, 201 Sansome Street, the Pacific Bank Building, 351 California Street, the Medico-Dental Building, 490 Post Street. Brugnara also contracted to purchase the Chevron Building at a steep discount during this buying binge. Because he had purchased more than "one million square feet" of high-rise office buildings during that time without partners, he "became the largest 100% fee owner of real estate in downtown San Francisco" and accumulated "a net worth of over a quarter of a billion dollars" ($250 million).

Las Vegas

Brugnara first became involved in Las Vegas real estate in 1999, when he attempted to buy the Desert Inn for $270 million, but was bought out by Sun International and Steve Wynn. He then proceeded to buy the Silver City Casino and the Las Vegas Shopping Plaza on the Las Vegas Strip for $40 million, which he closed in November 1999 in order to turn them into a "3,000 room mega-resort casino", but he converted the property into a shopping center in 2004 after the Nevada Gaming Commission denied him a gambling license in 2001. Brugnara signed the highest grossing lease in the country for a retail store with a $100 million Walgreens lease in his shopping center. The Gaming Commission had cited his "license application and business acumen" as reasons for not allowing him the license, adding that his alleged verbal abuse against officials during cases involving his properties, such as an alleged overgrowth of ivy, were additional reasons why his application was denied. In response, Brugnara stated that the Nevada Gaming Commissioners were "being controlled by a cartel of insiders" and were "puppets of his casino competitors since they were all in appointed positions", along with a threat to file an anti-trust lawsuit through barrister Joseph Alioto. Brugnara chose not to file an anti-trust suit against the Nevada Gaming Commission and casinos after Gaming Chairman, and current Governor of Nevada, Brian Sandoval, stated that "Brugnara is welcome to reapply for the license, and would be suitable for licensure once the issues of concern were addressed". Sandoval also stated that he "admired" Brugnara for his accomplishments.

In 2006–2007, Brugnara leased his 20,000+ sq ft, 11-bedroom Las Vegas mansion to Michael Jackson for over $1 million for six months. Brugnara's mansion was reported to have various amenities including a 2,000 sq ft closet in the master bedroom. That same year, Brugnara contracted to purchase the Crazy Horse Too strip club for $40 million; Brugnara's net worth was estimated at a half-billion dollars ($500 million).

In January 2010, he submitted a $170 million bid with U.S. Bankruptcy Court in Miami to purchase the bankrupt $2 billion Fontainebleau project on the Las Vegas Strip, but was told that he had submitted the incorrect paperwork. Carl Icahn is "expected to take over ownership", even though he had offered less money than Brugnara.

Legal

In 1998, Brugnara was sued by the SF City Attorney for building code violations in some of his highrise office buildings. The date of the purported violations, mostly open building permits, dated to over a decade before Brugnara ever purchased the properties. Brugnara categorized the lawsuit as politically motivated due to his rapid rise and his uncle who was the Chief of Police and a political adversary of the SF Mayor and City Attorney. The case was resolved for $1 million payment.

In 2001, Brugnara was sued by US Tax Attorneys in Federal Civil Court, who claimed Brugnara owed an additional $11 million in taxes for tax years 1993 through 1997. When the case finally went to Federal Court in March 2008, Federal Judge Haines ruled that the US Tax Attorneys were wrong and Brugnara owed no additional taxes ($0) to the US government for tax years 1993–1997.

Two days after Judge Haines ruled in favor of Brugnara, in April 2008, the US Attorneys filed a case against Brugnara for "failing to report capital gains from the sale of property in San Francisco and Las Vegas for tax years 2000 and 2001" and for "blocking the migration of steelhead trout in a creek that runs through his farm". Although the US Attorneys indicted Brugnara for not reporting $45 million in capital gains, after the forensic accounting was completed in January 2010 by the US Attorneys and Brugnara's accountants, "it was discovered and agreed by the US Attorneys that the tax loss was not $45 million, but was only $300,000 tax loss for the year in question; a 99% error by the US Attorneys from their original $45 million claim, and a mere 1/3rd of 1% of the $103 million income that Brugnara earned from the tax year 2001 under indictment." The information was discovered because of a background investigation conducted by the Nevada Gaming Control Board in regards to Brugnara's gaming license application. Brugnara was convicted by plea in May 2010 of the $300,000 tax loss and fish charge. Brugnara filed an appeal with the Ninth Circuit Court of Appeals to overturn his plea conviction and to go to trial claiming "his plea was coerced after the US Attorneys, suddenly without notice or cause, placed Brugnara in a dangerous jail cell in East Oakland with violent gang members the evening before the trial was set to commence, and then delayed the trial for four weeks to extract the plea." Additionally, Brugnara asserted that the entire case by the US Attorney was "malicious prosecution from losing the prior US Tax Case in Judge Haines Federal Court just days prior to the indictment." Brugnara's attorneys stated that there was no "tax crime" as there must be "criminal intent" for a tax crime, and "1/3 of 1% of tax loss from ten years prior with no subsequent indiscrepencies does not equate to criminal intent." Judge William Alsup did not allow Brugnara to withdraw his plea despite Brugnara maintaining his innocence and requesting a trial. An order for restitution in the amount of $1,904,625 was affirmed and Brugnara's counsel agreed "the numbers mathematically are correct.".

In May 2014 Brugnara was accused of fraud involving art delivered to his Sea Cliff estate. After allegedly receiving $11 million of contemporary and modern art from Rose Long, a woman from Tennessee Brugnara alleges has a history of art fraud, Brugnara determined that the art was not authentic and were reproductions that had little value. Moreover, Long gave Brugnara 365 days to authenticate the art, but Brugnara had his attorney negotiate a mutual release with her attorney within 48 hours after the crates were delivered to have them returned to Long. Long refused to pick up the unopened crates, according to SFGate. He was subsequently charged with mail fraud, with the suggestion that he had failed to pay for works from de Kooning and Degas. It was later revealed during court proceedings that Long was a front for Walter Maibaum who actually owned the pieces. Maibaum is a New York dealer who was sued by publisher S.I. Newhouse and Christies auction house in 2009 in New York Supreme Court for fraud for selling Newhouse a fake bronze Picasso for $6M, which Maibaum purchased just weeks earlier for a few thousand dollars. Brugnara maintains his innocence and claimed he was an intended victim of Long and Maibaum.

In 2015, Brugnara made the FBI Most Wanted List after escaping from custody while at the San Francisco federal building during a meeting with his attorney. He was recaptured a week later in Los Gatos, California.

Brugnara represented himself in the trial, which was tried before Judge Alsup of the Northern District of California. By the end of the trial Judge Alsup had sentenced Brugnara to 471 days in prison for contempt due to Brugnara's conduct during the trial, including routinely ignoring Judge Alsup's evidentiary and procedural rulings, yelling at witnesses, throwing tantrums, and insulting the government's attorneys, including calling U.S. District Attorney Robin Harris a "Nazi" in front of the jury.

On October 20, 2015, Brugnara was sentenced to seven years in prison for art fraud. On May 11, 2017 the Appeals Court affirmed all the convictions, rejected Brugnara's argument his pro se self-representation violated his right to a fair trial, and denied his request for a new trial.

Personal life

After becoming acquainted with his future wife in college, they married in the 1990s and have four children. Brugnara splits residence between Las Vegas and an "expansive San Francisco Sea Cliff villa purchased for over $16M in 2000 from comedian Cheech Marin." Brugnara is the nephew of former San Francisco Police Chief Anthony "Tony" Ribera.

Philanthropy

Brugnara is a long-time supporter of charitable causes, including Catholic Charities, and $3 million to save St. Brigid Church in San Francisco in 2005.

Water

Brugnara owns and controls over 25,000 acre feet (31,000,000 m3) of appropriated water rights in California and a dam and reservoir which holds over 2,000 acre feet of water. In 2008 Brugnara was in negotiations to supply the city of Gilroy their domestic water supply.

Art

Brugnara has an art collection he values at over $100 million, including what he believes is a painting by Leonardo da Vinci.