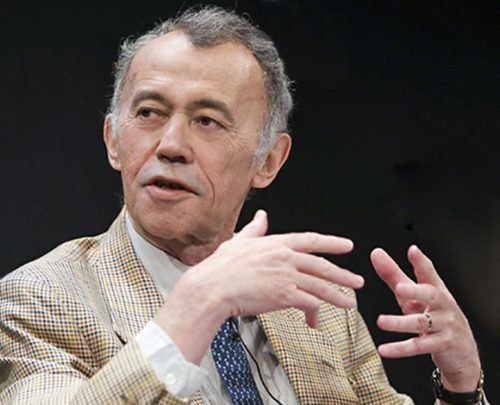

Name Jean-Marie Eveillard | Education HEC Paris | |

| ||

Interview with jean marie eveillard senior adviser first eagle funds

Jean-Marie Eveillard is a French international investor who currently serves as the senior investment adviser to First Eagle Funds. Eveillard, who served more than a quarter century as a portfolio manager, was co-honored in 2001 by Morningstar, Inc. as "Stock Manager of the Year" and was a finalist for their 2009 "fund manager of the decade award for non-U.S. stocks". In 2003, the group gave him a "Fund Manager Lifetime Achievement" award.

Contents

- Interview with jean marie eveillard senior adviser first eagle funds

- Jean marie eveillard discusses his preferred valuation metric views on margin of safety

- Biography

- Quotes

- References

Jean marie eveillard discusses his preferred valuation metric views on margin of safety

Biography

Eveillard was born in Poitiers in 1940 and attended the École des Hautes Études Commerciales before entering the world of finance in 1962 with a position at the Société Générale. In 1970, two years after he relocated to the United States, Eveillard took a position with SoGen International Fund as an analyst, becoming portfolio manager of the SoGen International Fund (as of 2000, First Eagle Global) in 1978. He remained in the position, managing the First Eagle Global, Oversease, Gold, and U.S. Value Funds, until December 31, 2004, during which time he had become — according to Fortune magazine — "one of Wall Street's best value investors". In 2001, Eveillard was honored as Morningstar's International's "Stock Manager of the Year. In 2003, Morningstar bestowed on Eveillard a "Fund Manager Lifetime Achievement Award", created to recognize "mutual fund managers who throughout their careers have delivered outstanding long-term performance, aligned their interests with shareholders, demonstrated the courage to differ from consensus, and shown the ability to adapt to changes in the industry."

Eveillard transitioned to the role of Senior Adviser to First Eagle Funds in March 2009, a position he also held from January 2005 to March 2007. In 2009, Eveillard was a finalist for the Morningstar "fund manager of the decade award for non-U.S. stocks."

In addition to his role as senior adviser, Eveillard continues to be a member of First Eagle Funds' Board of Trustees and a Senior Vice President of First Eagle Investment Management, LLC. Eveillard is the William von Mueffling Professor of Professional Practice in the Finance and Economics division of Columbia Business School.

Quotes

"We don't look at gold as a commodity, but as a form of insurance against what Peter Bernstein calls extreme outcomes. In most circumstances in which worldwide equity markets would go down - and not just for a week or two - the price of gold would go up, providing a partial offset to the hits we'd take in our equity portfolio".

"In general, there aren't many countries in which we wouldn't invest. But if a country is too economically or politically prevail, we pass. The main country in which we won't invest today is Russia. There's still too much risk for foreign (or even local) investors that you'll think you own an asset and then Mr. Putin decides you don't".

"The knock on diversified funds is that they're index-huggers, which given the geographic breadth of where we invest, is not at all the case for us. I know the argument that you should only own your best 30 or 40 ideas, but I've never proven over time that I actually know in advance what those are".

"Our cash balance is purely a residual of whether or not we're finding enough to invest in".

"If one is wrong in judging a company to have a sustainable competitive advantage, the investment results can be disastrous".

"Top executives from a Japanese property company and casualty insurer we've owned for years just in our office last month explaining the extent of the CDO exposure in their investment portfolio, which was upsetting to us. We said,"Didn't the fact that you were buying a triple-A rated product with a yield much in excess of what you could get from Procter & Gamble sound too good to be true?". But that kind of thing happened around the world.