Code ISK Plural krónur Symbol kr, Íkr | 1/100 eyrir

(obsolete 2003) eyrir aurar Nickname kall | |

| ||

The króna ([ˈkʰroːuna]; plural krónur) (sign: kr; code: ISK) is the currency of Iceland. The króna was historically subdivided into 100 aurar (singular eyrir), but this subdivision is no longer used.

Contents

- First krna 18741981

- Coins

- Banknotes

- Second krna 1981present

- Issues affecting the Icelandic krna

- 2008 financial crisis

- Iceland and the euro

- Iceland and unilateral adoption of another currency

- References

Like the Nordic currencies (such as the Danish krone, Swedish krona and Norwegian krone) that participated in the historical Scandinavian Monetary Union, the name króna (meaning crown) comes from the Latin word corona ("crown"). The name "Icelandic crown" is sometimes used, for example in the financial markets. The word eyrir derives from Latin aureus ("golden"), there being historically 100 gold pieces to a crown.

First króna, 1874–1981

The Danish krone was introduced to Iceland in 1874, replacing the earlier Danish currency, the rigsdaler. In 1885, Iceland began issuing its own banknotes.

The Icelandic króna separated from the Danish krone after the dissolution of the Scandinavian Monetary Union at the start of World War I and Icelandic autonomy from Denmark in 1918. The first coins were issued in 1922.

Iceland was forced to devalue the Icelandic króna in 1922, by 23% against the Danish krone, which saw the beginning of an independent monetary policy in Iceland, and was to be the first of many subsequent devaluations of the króna.

In 1925 the króna was pegged to the British pound for the next 14 years until the spring of 1939. Later in 1939 the currency was pegged to the US Dollar, which was maintained until 1949.

Coins

Iceland's first coins were 10- and 25-aurar pieces introduced in 1922. These were followed in 1925 by 1 króna and 2 krónur pieces and in 1926 by 1-, 2- and 5-aurar pieces. In 1946, the coins' designs were altered to remove the royal monogram (CXR), following Icelandic independence from Denmark in 1944.

Starting in 1967, new coins were introduced due to a considerable fall in the value of the króna. 10 krónur coins were introduced in that year, followed by 50 aurar and 5 krónur pieces in 1969 and 50 krónur pieces in 1970.

Banknotes

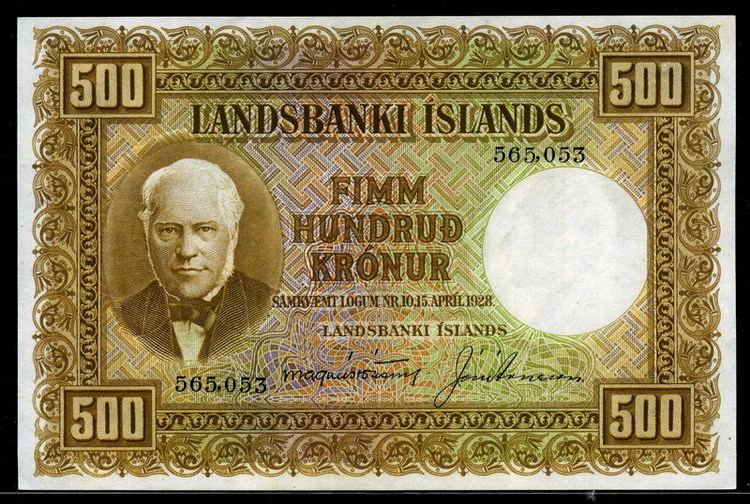

The first notes issued in 1885 by the Landssjóður Íslands were in denominations of 5, 10 and 50 krónur. In 1904, the Bank of Iceland (Íslands Banki) took over note production and introduced 100 krónur notes. In 1921, the Ríkissjóður Íslands began issuing paper money, with notes for 1, 5, 10 and 50 krónur.

In 1928, another bank, the Landsbanki Íslands, took over issuance of denominations of 5 krónur and above, with the Ríkissjóður Íslands continuing to issue 1 króna notes until 1947. The Landsbanki Íslands introduced 500 krónur notes in 1935, followed by 25- and 1000-krónur notes in 1957.

In 1961, the Seðlabanki Íslands became the central bank of Iceland and started issuing paper money, in denominations of 10, 25, 100, and 500 krónur. They were manufactured in England by De la Rue.

Second króna, 1981–present

In 1981, the Icelandic króna was revalued, due to high inflation, with 100 old krónur (ISJ) being worth 1 new króna (ISK) and a new 500 krónur banknote was first put into circulation in 1981. The 1000 krónur was put into circulation in 1984 and the 5000 krónur in 1986. The 2000 krónur banknote was put into circulation in 1995 but never became very popular. The 10000 krónur banknote was put into circulation in 2013.

Coins of less than one króna have not circulated for many years. In September 2002, Davíð Oddsson, the Icelandic Prime Minister at the time, signed two regulations decreeing that all monetary amounts on invoices and financial claims should be stated and paid in whole krónur only and that coins with a value of less than one króna should be withdrawn from circulation. Certain shares on the Iceland Stock Exchange are priced in aurar (just as share prices on the London Stock Exchange can be quoted in decimals of a penny).

Coins

In 1981, coins were introduced in denominations of 5, 10 and 50 aurar, 1 króna and 5 krónur. These were followed by 10 krónur pieces in 1984, 50 krónur in 1987 and 100 krónur in 1995. Since 2003, Icelandic banks no longer accept any coins denominated in aurar.

Banknotes

Icelandic banknotes are printed with the dates from which the legal basis of the currency derives. In 1981, notes were issued in denominations of 10, 50, 100 and 500 krónur based on the law of 29 March 1961. 1000 krónur notes were introduced in 1984, followed by 5000 krónur notes in 1986 with the same law.

100, 500, and 1000 krónur notes were reissued in 1994 under the law of 5 May 1986. In the following year, a new denomination of 2000 krónur was issued for the first time. The 2000 krónur note is subtly different from the other notes. For example, the underprint pattern extends all the way upward and downward, while the other denominations had white margins on every side. The number 2000 is printed in multi color for 3 of the 4 occurrences. And the numeral 2000 on the lower left corner of reverse is vertical. The "shadow" of the numeral is printed with SÍ in microprint.

The 22 May 2001 series, saw substantial changes. The underprint and microprint features of the 2000 krónur note were extended to other denominations. The 1000- and 5000-krónur notes also received metallic foils next to the portrait.

In 2013, a new 10,000 krónur banknote was introduced. The face of natural scientist and poet Jónas Hallgrímsson appears on the bill, as well as the Eurasian golden plover.

Notes of 100 krónur or less are no longer in circulation, as they have been withdrawn by the central bank. As of 2006, the vast majority of banknotes in circulation are of the 500, 1000, 2000 and 5000 denominations (these generally being the only notes dispensed by ATMs, for example).

Issues affecting the Icelandic króna

Iceland is not a member of the European Union and does not use the euro. The Icelandic currency is a low-volume world currency, strongly managed by its central bank. Its value in terms of toward other currencies has historically been swift to change, for example against the US and Canadian dollars, and the other Nordic currencies (Swedish krona, Norwegian krone, Danish krone), and the euro. For example, during the first half of 2006, the Icelandic króna ranged between 50 and 80 per US dollar. Prior to the currency's collapse in October 2008, the króna was considered overvalued.

In most shops electronic payment is accepted. Other currencies are very rarely accepted in Iceland. A notable exception is Keflavík International Airport (which has many transfer passengers), where the US dollar, euro and some other currencies are accepted by all merchants. Certain stores in downtown Reykjavík accept some foreign currencies.

Iceland's overall level of technological sophistication is noteworthy. Iceland's per capita computer usage, for example, is among the highest in the world: far higher than the UK or US. The saturation of technology in Iceland has had ramifications in the monetary system: a very high proportion of payments in Iceland are made electronically, e.g. by debit or credit cards or online bank transfers. The largest denomination banknote, the 10,000 krónur note (around €65 in October 2014) has a relatively low value, therefore most of Iceland's high value trades are usually done in electronic transfers and other currencies.

2008 financial crisis

In October 2008, the financial crisis of 2007–2008 brought about a collapse of the Icelandic banking sector. The value of the Icelandic króna dropped, and on 7 October 2008 the Icelandic Central Bank attempted to peg it at 131 against the euro. This peg was abandoned the next day. The króna later dropped again and to 340 against the euro before trade in the currency was suspended (by comparison, the rate at the start of 2008 was about 90 krónur to the euro). After a period of tentative, very low-volume international trading in the króna, activity had been expected to pick up again throughout November 2008, albeit still with low liquidity, as Iceland secured an International Monetary Fund loan. However, as of January 2009 the króna was still not being traded regularly, with the ECB reference rate being set only intermittently, the last time on 3 December 2008 at 290 króna per euro.

The Icelandic króna similarly lowered in value against the US dollar, from around 50 to 80 per dollar to about 110–115 per dollar; by mid-November 2008 it had continued to lower to 135 to the dollar. As of 2 April 2009, the value hovered around 119 per dollar, roughly maintaining that value over the next two years with 23 March 2011, prices around 114 per dollar. With this, the previously high costs for foreign traders and tourists thereby dropped, which Iceland's trade and tourism industry hope to exploit. In July 2008, a Big Mac cost the equivalent of nearly US$6, versus $3.57 in the US.

Iceland and the euro

Theoretically the adoption of the euro could have several advantages. Adopting what is perceived by some as a historically stronger currency might help Iceland to "avoid the turbulence surrounding speculations in international financial markets". In addition, Icelandic economists listed several arguments in favour of the Euro before the crisis. "In terms of growth potentials and welfare, the euro could be expected to bring lower long-term interest rates [...]. This would of course increase capital investment and labour productivity. The euro might lower consumer prices by facilitating a comparison with other euro countries." Because of the volatility between the euro and the króna, former Foreign Minister Valgerður Sverrisdóttir considered the idea that Iceland might dollarize itself into the Eurozone without joining the European Union.

Opinion regarding the euro is mixed among Icelanders. An opinion poll about Iceland joining the European Union released on 11 September 2007 showed that 53% of respondents were in favour of adopting the euro, 37% opposed and 10% undecided. Another poll produced for the Icelandic newspaper Fréttablaðið and released on 30 September 2007 showed 56% opposed to euro adoption and 44% in favour. In January 2008, a poll by the Icelandic Chamber of Commerce put support for Iceland to abandon the króna for another currency at 63%. A number of companies in Iceland, such as Össur, have started to pay their employees in euros or US dollars, mainly due to the high inflation and high volatility.

The financial crisis prompted further calls for Iceland to join the Eurozone. In January 2009, one senior Icelandic official stated that due to the crisis "the króna is dead. We need a new currency. The only serious option is the euro." In March 2009, a report by Iceland's Minister for Foreign Affairs, Össur Skarphédinsson, considered three options: retaining the króna, adopting the euro without joining the EU and adopting the euro through EU membership. The report recommended the third option.

An economic study of the impact of the adoption of the euro by Iceland found that the Icelandic króna acts both as a barrier and buffer to international trade, and that by joining the EU and adopting the euro, Icelandic international trade might be 60% higher.

In July 2009, the Alþingi (parliament) narrowly voted to apply for EU membership, but that application has been frozen since 2013 (see accession of Iceland to the European Union).

In March 2015, Icelandic authorities announced by letter to the Presidency of the Council of the European Union that Iceland should not be seen as candidate state, and that there were no specific plans to continue any membership process. Leaders of the ruling government parties have also stated that the króna will remain as Iceland's currency for at least the foreseeable future.

Iceland and unilateral adoption of another currency

Some small countries such as El Salvador, Ecuador and Montenegro have unilaterally adopted the use of a more stable foreign currency as a means of controlling inflation. The cost of this is generally very high, as the adopting country loses all control over monetary policy, and all the benefits of seignorage. A currency board is a second tier solution, where the exchange rate of the currency is fixed to that of another country, or a basket of currencies.

In a Gallup poll, seven out of ten Icelanders that participated in the poll stated a preference to abandon their currency to adopt another, and the most favoured choice was the Canadian dollar, outscoring the US dollar, the euro, and the Norwegian krone. Canada was favoured due to its northern geography and similar resource based economy, in addition to its relative economic stability. The Canadian ambassador to Iceland also stated that Iceland could adopt the currency if it wishes. However, it should be noted that the idea of unilateral foreign currency adoption has only recently been suggested in Iceland, it is strongly influenced by economic turmoil related to the banking crisis of 2008, and remains to be seen if it will continue to be seen as a feasible option for the greater future.

Mr. Arnór Sighvatsson, Deputy Governor of the Central Bank of Iceland, at a meeting of the Icelandic Federation of Labour on 10 January 2012, said:

As of 2016, Icelandic authorities have no plans to adopt a foreign currency.