Products Web application Founded 2009 Type Privately held company | Headquarters New York City Number of employees 7 | |

Industry Financial advice, Personal finance, Software Key people Raj Udeshi, Co-founder;Praveen Ghanta, Co-founder Profiles | ||

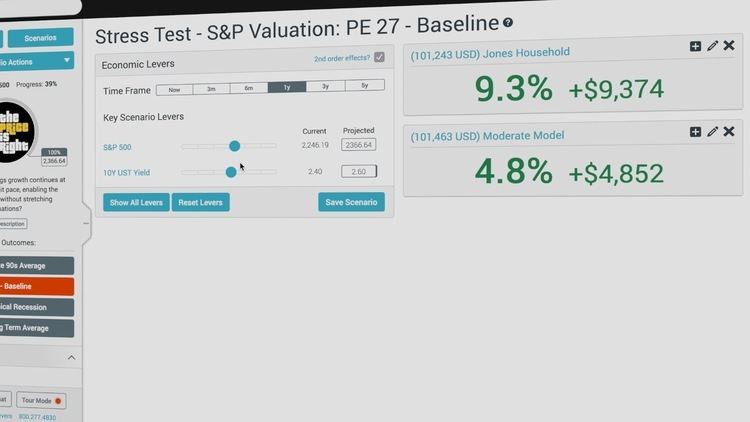

HiddenLevers is a financial technology company located in New York City. It provides financial advisors and professional traders with Web-based tools to assess macro risks and stress test portfolios.

Contents

History

HiddenLevers is a self-funded startup company founded by Praveen Ghanta and Raj Udeshi. Founded in October 2009, the company aims to provide macro research and risk management tools that take advantage of econometric data. In early 2010, HiddenLevers moved its operations to the Varick Street Incubator run by the New York City Economic Development Corporation and NYU-Poly. The company debuted the tool at FinovateFall 2010, and since then, HiddenLevers has been featured in several financial industry trade publications. In 2010 HiddenLevers also began writing economic commentary for SeekingAlpha, Business Insider, and MorningStar.

As of June 2011, HiddenLevers had over 100 financial professionals involved in a paid beta test program and a full scale launch by the end of 2011.

Products and Services

HiddenLevers's services focus on two key areas: research and risk management.

In addition to these core services, HiddenLevers offers access to aggregated economic data, embeddable charts, and advisor webinars.

How it Works

HiddenLevers's model consists of two levels: "a regression model that calculates relationships between every economic lever and every asset, and an intelligent filtering process that separates correlation from causation."

HiddenLever's regression model runs the stock's percentage return against the S&P 500's return and an economic indicator's return. The basic form of the equation looks like:

All statistically significant results from the regression analysis are used to drive the investment-lever relationships throughout HiddenLevers.

The intelligent filtering process takes place in four steps. First, HiddenLevers creates a detailed proprietary industry list. Then, stocks are mapped to relevant industries. Afterwards, causal relationships are determined between economic levers and industries and the levers are mapped to relevant industries. Finally, the mappings are used to filter regression data.