| ||

The Greek government-debt crisis (also known as the Greek Depression) is the sovereign debt crisis faced by Greece in the aftermath of the financial crisis of 2007–08. The Greek crisis started in late 2009, triggered by the turmoil of the Great Recession, structural weaknesses in the Greek economy, and revelations that previous data on government debt levels and deficits had been undercounted by the Greek government.

Contents

- Overview

- Causes

- GDP growth

- Government deficit

- Government debt

- Budget compliance

- Data credibility

- Government spending

- Current account balance

- Tax evasion

- 2010 revelations and IMF bailout

- Fraudulent statistics

- 2011

- 2012

- 2014

- 2015

- 2017

- First Economic Adjustment Programme May 2010 June 2011

- Second Economic Adjustment Programme July 2011

- Bank recapitalization

- Creditors

- European banks

- European Investment Bank

- Greek public opinion

- Economic effects

- Taxation

- Social effects

- Other effects

- Grexit

- Digital currency cards

- Bailout

- European debt conference

- Germanys role in Greece

- Charges of hypocrisy

- Pursuit of national self interest

- References

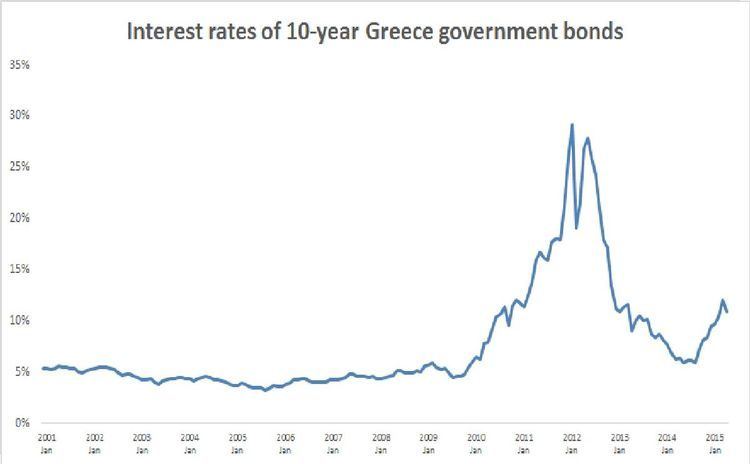

This led to a crisis of confidence, indicated by a widening of bond yield spreads and rising cost of risk insurance on credit default swaps compared to the other Eurozone countries, particularly Germany. The government enacted 12 rounds of tax increases, spending cuts, and reforms from 2010 to 2016, which at times triggered local riots and nationwide protests. Despite these efforts, the country required bailout loans in 2010, 2012, and 2015 from the International Monetary Fund, Eurogroup, and European Central Bank, and negotiated a 50% "haircut" on debt owed to private banks in 2011. After a popular referendum which rejected further austerity measures required for the third bailout, and after closure of banks across the country (which lasted for several weeks), on June 30, 2015, Greece became the first developed country to fail to make an IMF loan repayment. At that time, debt levels had reached €323bn or some €30,000 per capita.

Overview

The 2001 introduction of the euro reduced trade costs among Eurozone countries, increasing overall trade volume. Labour costs increased more (from a lower base) in peripheral countries such as Greece relative to core countries such as Germany, eroding Greece's competitive edge. As a result, Greece's current account (trade) deficit rose significantly.

A trade deficit means that a country is consuming more than it produces, which requires borrowing/direct investment from other countries. Both the Greek trade deficit and budget deficit rose from below 5% of GDP in 1999 to peak around 15% of GDP in the 2008–2009 periods. One driver of the investment inflow was Greece's membership in the EU and the Eurozone. Greece was perceived as a higher credit risk alone than it was as a member of the EU, which implied that investors felt the EU would bring discipline to its finances and support Greece in the event of problems.

As the Great Recession spread to Europe, the amount funds lent from the European core countries (e.g. Germany) to the peripheral countries such as Greece began to decline. Reports in 2009 of Greek fiscal mismanagement and deception increased borrowing costs; the combination meant Greece could no longer borrow to finance its trade and budget deficits at an affordable cost.

A country facing a “sudden stop” in private investment and a high (local currency) debt load typically allows its currency to depreciate to encourage investment and to pay back the debt in cheaper currency. This was not possible while Greece remained on the Euro. Instead, to become more competitive, Greek wages fell nearly 20% from mid-2010 to 2014, a form of deflation. This significantly reduced income and GDP, resulting in a severe recession, decline in tax receipts and a significant rise in the debt-to-GDP ratio. Unemployment reached nearly 25%, from below 10% in 2003. Significant government spending cuts helped the Greek government return to a primary budget surplus by 2014 (collecting more revenue than it paid out, excluding interest).

Causes

In January 2010, the Greek Ministry of Finance published Stability and Growth Program 2010. The report listed five main causes, poor GDP growth, government debt and deficits, budget compliance and data compatibility. Causes found by others included excess government spending, current account deficits and tax avoidance.

GDP growth

After 2008, GDP growth was lower than the Greek national statistical agency had anticipated. The Greek Ministry of Finance reported the need to improve competitiveness by reducing salaries and bureaucracy and to redirect governmental spending from non-growth sectors such as the military into growth-stimulating sectors.

The global financial crisis had a particularly large negative impact on GDP growth rates in Greece. Two of the country's largest earners, tourism and shipping were badly affected by the downturn, with revenues falling 15% in 2009.

Government deficit

Fiscal imbalances developed from 2004 to 2009: "output increased in nominal terms by 40%, while central government primary expenditures increased by 87% against an increase of only 31% in tax revenues." The Ministry intended to implement real expenditure cuts that would allow expenditures to grow 3.8% from 2009 to 2013, well below expected inflation at 6.9%. Overall revenues were expected to grow 31.5% from 2009 to 2013, secured by new, higher taxes and by a major reform of the ineffective tax collection system. The deficit needed to decline to a level compatible with a declining debt-to-GDP ratio.

Government debt

The debt increased in 2009 due to the higher than expected government deficit and higher debt-service costs. The Greek government assessed that structural economic reforms would be insufficient, as the debt would still increase to an unsustainable level before the positive results of reforms could be achieved. In addition to structural reforms, permanent and temporary austerity measures (with a size relative to GDP of 4.0% in 2010, 3.1% in 2011, 2.8% in 2012 and 0.8% in 2013) were needed. Reforms and austerity measures, in combination with an expected return of positive economic growth in 2011, would reduce the baseline deficit from €30.6 billion in 2009 to €5.7 billion in 2013, while the debt/GDP ratio would stabilize at 120% in 2010–2011 and decline in 2012 and 2013.

After 1993, the debt-to-GDP ratio remained above 94%. The crisis caused the debt level to exceed the maximum sustainable level (defined by IMF economists to be 120%). According to "The Economic Adjustment Programme for Greece" published by the EU Commission in October 2011, the debt level was expected to reach 198% in 2012, if the proposed debt restructure agreement was not implemented.

Budget compliance

Budget compliance was acknowledged to need improvement. For 2009 it was found to be "a lot worse than normal, due to economic control being more lax in a year with political elections". The government wanted to strengthen the monitoring system in 2010, making it possible to track revenues and expenses, at both national and local levels.

Data credibility

Problems with unreliable data had existed since Greece applied for Euro membership in 1999. In the five years from 2005 to 2009, Eurostat each year noted reservations about Greek fiscal data. Previously reported figures were consistently revised down. The flawed data made it impossible to predict GDP growth, deficit and debt. By the end of each year, all were below estimates. Data problems were evident in several other countries, but in the case of Greece, the magnitude of the 2009 revisions increased suspicion about data quality.

In May 2010, the Greek government deficit was again revised and estimated to be 13.6%, the second highest in the world relative to GDP behind Iceland at 15.7% and Great Britain third at 12.6%. The government forecast public debt to hit 120% of GDP during 2010. The actual ratio was closer to 150%.

The revised statistics revealed that Greece from 2000 to 2010 had exceeded the Eurozone stability criteria, with yearly deficits exceeding the recommended maximum limit at 3.0% of GDP, and with the debt level significantly above the limit of 60% of GDP.

Government spending

The Greek economy was one of the Eurozone's fastest growing from 2000 to 2007, averaging 4.2% annually, as foreign capital flooded in. This capital inflow coincided with a higher budget deficit.

Greece had budget surpluses from 1960–73, but thereafter it had budget deficits. From 1974–80 the government had budget deficits below 3% of GDP, while 1981–2013 deficits were above 3%.

An editorial published by Kathimerini claimed that after the removal of the right-wing military junta in 1974, Greek governments wanted to bring left-leaning Greeks into the economic mainstream and so ran large deficits to finance military expenditures, public sector jobs, pensions and other social benefits.

As a percentage of GDP, Greece had the second-biggest defense spending in NATO, after the US.

Pre-Euro, currency devaluation helped to finance Greek government borrowing. Thereafter the tool disappeared. Greece was able to continue borrowing because of the lower interest rates for Euro bonds, in combination with strong GDP growth.

Current account balance

Economist Paul Krugman wrote, "What we’re basically looking at...is a balance of payments problem, in which capital flooded south after the creation of the euro, leading to overvaluation in southern Europe" and "In truth, this has never been a fiscal crisis at its root; it has always been a balance of payments crisis that manifests itself in part in budget problems, which have then been pushed onto the center of the stage by ideology."

The translation of trade deficits to budget deficits works through sectoral balances. Greece ran current account (trade) deficits averaging 9.1% GDP from 2000–2011. By definition, a trade deficit requires capital inflow (mainly borrowing) to fund; this is referred to as a capital surplus or foreign financial surplus. This can drive higher levels of government budget deficits, if the private sector maintains relatively even amounts of savings and investment, as the three financial sectors (foreign, government, and private) by definition must balance to zero.

Greece's large budget deficit was funded by running a large foreign financial surplus. As the inflow of money stopped during the crisis, reducing the foreign financial surplus, Greece was forced to reduce its budget deficit substantially. Countries facing such a sudden reversal in capital flows typically devalue their currencies to resume the inflow of capital; however, Greece was unable to do this, and so has instead suffered significant income (GDP) reduction, another form of devaluation.

Tax evasion

Tax receipts consistently were below the expected level. In 2010, estimated tax evasion losses for the Greek government amounted to over $20 billion. 2013 figures showed that the government collected less than half of the revenues due in 2012, with the remaining tax to be paid according to a delayed payment schedule.

Greece scored 36/100 according to Transparency International's Corruption Perception Index, ranking it as the most corrupt country in the EU. One bailout condition was to implement an anti-corruption strategy. The government's activities improved their score of 43/100 in 2014, still the lowest in the EU, but close to that of Italy, Bulgaria and Romania.

It is estimated that the amount of evaded taxes stored in Swiss banks is around 80 billion Euro. In 2015 a tax treaty to address this issue was under negotiation between the Greek and Swiss government.

Data for 2012 places the Greek "black economy" at 24.3% of GDP, compared with 28.6% for Estonia, 26.5% for Latvia, 21.6% for Italy, 17.1% for Belgium and 13.5% for Germany (which partly correlates with the high percentage of Greeks who are self-employed vs. 15% EU average, – several studies have shown a clear correlation between tax evasion and self-employment).

2010 revelations and IMF bailout

Despite the crisis, the Greek government's bond auction in January 2010 of €8 bn 5-year bonds was 4x over-subscribed. The next auction (March) sold €5bn in 10-year bonds reached 3x. However, yields increased, which worsened the deficit. In April 2010, it was estimated that up to 70% of Greek government bonds were held by foreign investors, primarily banks.

In April, after publication of GDP data which showed an intermittent period of recession starting in 2007, credit rating agencies then downgraded Greek bonds to junk status in late April 2010. This froze private capital markets, and put Greece in danger of sovereign default without a bailout.

On 2 May, the European Commission, European Central Bank (ECB) and International Monetary Fund (IMF) (the Troika) launched a €110 billion bailout loan to rescue Greece from sovereign default and cover its financial needs through June 2013, conditional on implementation of austerity measures, structural reforms and privatization of government assets. The bailout loans were mainly used to pay for the maturing bonds, but also to finance the continued yearly budget deficits.

Fraudulent statistics

To keep within the monetary union guidelines, the government of Greece for many years simply misreported economic statistics. At the beginning of 2010, it was discovered Goldman Sachs and other banks helped the Greek government to hide its debts. Christoforos Sardelis, former head of Greece’s Public Debt Management Agency, said that the country did not understand what it was buying. He also said he learned that "other EU countries such as Italy" had made similar deals.

Most notable was a cross currency swap, where billions worth of Greek debts and loans were converted into yen and dollars at a fictitious exchange rate, thus hiding the true extent of Greek loans. Swaps were not registered as debt because Eurostat statistics did not include financial derivatives. A German derivatives dealer commented, "The Maastricht rules can be circumvented quite legally through swaps," and "In previous years, Italy used a similar trick to mask its true debt with the help of a different US bank." These conditions enabled Greece and other governments to spend beyond their means, while ostensibly meeting EU deficit targets.

The European statistics agency, Eurostat, had at regular intervals from 2004-2010, sent 10 delegations to Athens with a view to improving the reliability of Greek statistical figures. In January it issued a report that contained accusations of falsified data and political interference. The Finance Ministry accepted the need to restore trust among investors and correct methodological flaws, "by making the National Statistics Service an independent legal entity and phasing in, during the first quarter of 2010, all the necessary checks and balances".

The new government of George Papandreou revised the 2009 deficit from a previously estimated 6%–8% to 15.7% of GDP, using Eurostat's standardized method. The figure for Greek government debt at the end of 2009 increased from its first November estimate at €269.3 billion (113% of GDP) to a revised €299.7 billion (130% of GDP). This was the highest for any EU country. After an in-depth Financial Audit of the fiscal years 2006–09. Eurostat announced in November 2010 that the revised figures for 2006–2009 finally were considered to be reliable.

2011

A year later, a worsened recession along with poor implementation by the Greek government of the agreed bailout conditions forced a second bailout worth €130 billion. This included a bank recapitalization package worth €48bn. Private bondholders were required to accept extended maturities, lower interest rates and a 53.5% reduction in the bonds' face value.

On 17 October 2011, Minister of Finance Evangelos Venizelos announced that the government would establish a new fund, aimed at helping those who were hit the hardest from the government's austerity measures. The money for this agency would come from a crackdown on tax evasion. The government agreed to creditor proposals that Greece raise up to €50 billion through the sale or development of state-owned assets, but receipts were much lower than expected, while the policy was strongly opposed by Syriza. In 2014, only €530m was raised. Some key assets were sold to insiders.

2012

The second bailout programme was ratified in February 2012. A total of €240 billion was to be transferred in regular tranches through December 2014. The recession worsened and the government continued to dither over bailout program implementation. In December 2012 the Troika provided Greece with more debt relief, while the IMF extended an extra €8.2bn of loans to be transferred from January 2015 to March 2016.

2014

The fourth review of the bailout programme revealed unexpected financing gaps. In 2014 the outlook for the Greek economy improved. The government predicted a structural surplus in 2014, opening access to the private lending market to the extent that its entire financing gap for 2014 was covered via private bond sales.

Instead a fourth recession started in Q4-2014. The parliament called snap parliamentary elections in December, leading to a Syriza-led government that rejected the existing bailout terms. The Troika suspended all scheduled remaining aid to Greece, until the Greek government retreated or convinced the Troika to accept a revised programme. This rift caused a liquidity crisis (both for the Greek government and Greek financial system), plummeting stock prices at the Athens Stock Exchange and a renewed loss of access to private financing.

2015

After Greece's January snap election, the Troika granted a further four-month technical extension of its bailout programme; expecting that the payment terms would be renegotiated before the end of April, allowing the review and last financial transfer could be completed before the end of June.

Facing sovereign default, the government made new proposals in the first and second half of June. Both were rejected, raising the prospect of recessionary capital controls to avoid a collapse of the banking sector – and exit from the Eurozone.

The government unilaterally broke off negotiations on 26 June. Tsipras announced that a referendum would be held on 5 July to approve or reject the Troika's 25 June proposal. The Greek stock market closed on 27 June.

The government campaigned for rejection of the proposal, while four opposition parties (PASOK, To Potami, KIDISO and New Democracy) objected that the proposed referendum was unconstitutional. They petitioned for the parliament or president to reject the referendum proposal. Meanwhile, the Eurogroup announced that the existing second bailout agreement would technically expire on 30 June, 5 days before the referendum.

The Eurogroup clarified on 27 June that only if an agreement was reached prior to 30 June could the bailout be extended until the referendum on 5 July. The Eurogroup wanted the government to take some responsibility for the subsequent program, presuming that the referendum resulted in approval. The Eurogroup had signaled willingness to uphold their "November 2012 debt relief promise", presuming a final agreement. This promise was that if Greece completed the program, but its debt-to-GDP ratio subsequently was forecast to be over 124% in 2020 or 110% in 2022 for any reason, then the Eurozone would provide debt-relief sufficient to ensure that these two targets would still be met.

On 28 June the referendum was approved by the Greek parliament with no interim bailout agreement. The ECB decided to maintain its Emergency Liquidity Assistance to Greek banks. Many Greeks continued to withdraw cash from their accounts fearing that capital controls would soon be invoked.

On 5 July a large majority voted to reject the bailout terms (a 61% to 39% decision with 62.5% voter turnout). This caused stock indexes worldwide to tumble, fearing Greece's potential exit from the Eurozone ("Grexit"). Following the vote, Greece's finance minister Yanis Varoufakis stepped down on 6 July and was replaced by Euclid Tsakalotos.

On 13 July, after 17 hours of negotiations, Eurozone leaders reached a provisional agreement on a third bailout programme, substantially the same as their June proposal. Many financial analysts, including the largest private holder of Greek debt, private equity firm manager, Paul Kazarian, found issue with its findings, citing it as a distortion of net debt position.

2017

On February 20, 2017, the Greek finance ministry reported that the government’s debt load is now €226.36 billion after increasing by €2.65 billion in the previous quarter.

First Economic Adjustment Programme (May 2010 – June 2011)

On 1 May 2010, the Greek government announced a series of austerity measures The next day the Eurozone countries and the IMF agreed to a three-year €110 billion loan, paying 5.5% interest, conditional on the implementation of austerity measures. Credit rating agencies immediately downgraded Greek governmental bonds to an even lower junk status.

The programme was met with anger by the Greek public, leading to protests, riots and social unrest. On 5 May 2010, a national strike was held in opposition. Nevertheless, the austerity package was approved on 29 June 2011, with 155 out of 300 members of parliament voting in favour.

Second Economic Adjustment Programme (July 2011 – )

At a 21 July 2011 summit in Brussels, Euro area leaders agreed to extend Greek (as well as Irish and Portuguese) loan repayment periods from 7 years to a minimum of 15 years and to cut interest rates to 3.5%. They also approved an additional €109 billion support package, with exact content to be finalized at a later summit. On 27 October 2011, Eurozone leaders and the IMF settled an agreement with banks whereby they accepted a 50% write-off of (part of) Greek debt.

Greece brought down its primary deficit from €25bn (11% of GDP) in 2009 to €5bn (2.4% of GDP) in 2011. However, the Greek recession worsened. Overall 2011 Greek GDP experienced a 7.1% decline. The unemployment rate grew from 7.5% in September 2008 to an unprecedented 19.9% in November 2011.

Bank recapitalization

The Hellenic Financial Stability Fund (HFSF) completed a €48.2bn bank recapitalization in June 2013, of which the first €24.4bn were injected into the four biggest Greek banks. Initially, this recapitalization was accounted for as a debt increase that elevated the debt-to-GDP ratio by 24.8 points by the end of 2012. In return for this, the government received shares in those banks, which it could later sell (per March 2012 was expected to generate €16bn of extra "privatization income" for the Greek government, to be realized during 2013–2020).ecb

HFSF offered three out of the four big Greek banks (NBG, Alpha and Piraeus) warrants to buy back all HFSF bank shares in semi-annual exercise periods up to December 2017, at some predefined strike prices., These banks acquired additional private investor capital contribution at minimum 10% of the conducted recapitalization. Eurobank, failed to attract private investor participation and thus became almost entirely financed/owned by HFSF. During the first warrant period, the shareholders in Alpha bank bought back the first 2.4% of HFSF shares. Shareholders in Piraeus Bank bought back the first 0.07% of HFSF shares. National Bank (NBG) shareholders bought back the first 0.01% of the HFSF shares, because the market share price was cheaper than the strike price. Shares not sold by the end of December 2017 may be sold to alternative investors.

In May 2014, a second round of bank recapitalization worth €8.3bn was concluded, financed by private investors. All six commercial banks (Alpha, Eurobank, NBG, Piraeus, Attica and Panellinia) participated. HFSF did not tap into their current €11.5bn reserve capital fund. Eurobank in the second round was bale to attract private investors. This required HFSF to dilute their ownership from 95.2% to 34.7%.

According to HFSF's third quarter 2014 financial report, the fund expected to recover €27.3bn out of the initial €48.2bn. This amount included "A €0.6bn positive cash balance stemming from its previous selling of warrants (selling of recapitalization shares) and liquidation of assets, €2.8bn estimated to be recovered from liquidation of assets held by its 'bad asset bank', €10.9bn of EFSF bonds still held as capital reserve, and €13bn from its future sale of recapitalization shares in the four systemic banks." The last figure is affected by the highest amount of uncertainty, as it directly reflects the current market price of the remaining shares held in the four systemic banks (66.4% in Alpha, 35.4% in Eurobank, 57.2% in NBG, 66.9% in Piraeus), which for HFSF had a combined market value of €22.6bn by the end of 2013 – declining to €13bn on 10 December 2014.

Once HFSF liquidates its assets, the total amount of recovered capital will be returned to the Greek government to help to reduce its debt. In early December 2014, the Bank of Greece allowed HFSF to repay the first €9.3bn out of its €11.3bn reserve to the Greek government. A few months later, the remaining HFSF reserves were likewise approved for repayment to ECB, resulting in redeeming €11.4bn in notes during the first quarter of 2015.

Creditors

Initially, European banks had the largest holdings of Greek debt. However, this shifted as the "troika" (ECB, IMF and a European government-sponsored fund) purchased Greek bonds. As of early 2015, the largest individual contributors to the fund were Germany, France and Italy with roughly €130bn total of the €323bn debt. The IMF was owed €32bn and the ECB €20bn. Foreign banks had little Greek debt.

European banks

Excluding Greek banks, European banks had €45.8bn exposure to Greece in June 2011. However, by early 2015 their holdings had declined to roughly €2.4bn.

European Investment Bank

In November 2015, the European Investment Bank (EIB) lent Greece about 285 million euros. This extended the 2014 deal that EIB would lend 670 million euros. It was thought that the Greek government would invest the money on Greece's energy industries so as to ensure energy security and manage environmentally friendly projects. Werner Hoyer, the president of EIB, expected the investment to boost employment and have a positive impact on Greece's economy and environment.

Greek public opinion

According to a poll in February 2012 by Public Issue and SKAI Channel, PASOK—which won the national elections of 2009 with 43.92% of the vote—had seen its approval rating decline to 8%, placing it fifth after centre-right New Democracy (31%), left-wing Democratic Left (18%), far-left Communist Party of Greece (KKE) (12.5%) and radical left Syriza (12%). The same poll suggested that Papandreou was the least popular political leader with a 9% approval rating, while 71% of Greeks did not trust him.

In a May 2011 poll, 62% of respondents felt that the IMF memorandum that Greece signed in 2010 was a bad decision that hurt the country, while 80% had no faith in the Minister of Finance, Giorgos Papakonstantinou, to handle the crisis. (Venizelos replaced Papakonstantinou on 17 June). 75% of those polled had a negative image of the IMF, while 65% felt it was hurting Greece's economy. 64% felt that sovereign default was likely. When asked about their fears for the near future, Greeks highlighted unemployment (97%), poverty (93%) and the closure of businesses (92%).

Polls showed that the vast majority of Greeks are not in favour of leaving the Eurozone. Roger Bootle, independent British economist and consultant, wrote, "there has been so much propaganda over the years about the merits of the euro and the perils of being outside it that both expert and popular opinion can barely see straight. It is true that default and a euro exit could endanger Greece's continued membership of the EU. More importantly, though, there is a strong element of national pride. For Greece to leave the euro would seem like a national humiliation. Mind you, quite how agreeing to decades of misery under German subjugation allows Greeks to hold their heads high defeats me." Nonetheless, other 2012 polls showed that almost half (48%) of Greeks were in favour of default, in contrast with a minority (38%) who are not.

Economic effects

Greek GDP's worst decline, −6.9%, came in 2011, a year in which seasonally adjusted industrial output ended 28.4% lower than in 2005. During that year, 111,000 Greek companies went bankrupt (27% higher than in 2010). As a result, the seasonally adjusted unemployment rate grew from 7.5% in September 2008 to a then record high of 23.1% in May 2012, while the youth unemployment rate time rose from 22.0% to 54.9%.

Key statistics are summarized below, with a detailed table at the bottom of the article. According to the CIA World Factbook and Eurostat:

Greece defaulted on a $1.7 billion IMF payment on June 29, 2015. The government had requested a two-year bailout from lenders for roughly $30 billion, its third in six years, but did not receive it.

The IMF reported on 2 July 2015 that the "debt dynamics" of Greece were "unsustainable" due to its already high debt level and "...significant changes in policies since [2014]—not least, lower primary surpluses and a weak reform effort that will weigh on growth and privatization—[which] are leading to substantial new financing needs." The report stated that debt reduction (haircuts, in which creditors sustain losses through debt principal reduction) would be required if the package of reforms under consideration were weakened further.

Taxation

As of 2016, five indirect taxes had been added to goods and services. At 23%, the value added tax is one of the Eurozone's highest, exceeding other EU countries on small and medium-sized enterprises. One researcher found that the poorest households faced tax increases of 337%.

The ensuing tax policies are accused for having the opposite effects than intended, namely reducing instead of increasing the revenues, as high taxation discourages transactions and encourages tax evasion, thus perpetuating the depression. Some firms relocated abroad to avoid the country's higher tax rates.

The fear of higher taxes increasing tax evasion seems to ring true. Greece not only has some of the highest taxes in Europe, it also has major problems in terms of tax collection. The VAT deficit due to tax evasion is estimated at 34%. Tax debts in Greece are now equal to 90% of annual tax revenue, which is the worst number in all industrialized nations. Much of this is due to the fact that Greece has a vast underground economy, which was estimated to be about the size of a quarter of the country’s GDP before the crisis. The International Monetary Fund therefore argued that Greece’s debt crisis could be almost completely resolved if the country’s government found a way to solve the tax evasion problem.

Social effects

The social effects of the austerity measures on the Greek population were severe.

In February 2012, it was reported that 20,000 Greeks had been made homeless during the preceding year, and that 20 per cent of shops in the historic city centre of Athens were empty.

By 2015, the Organisation for Economic Co-operation and Development (OECD) reported that nearly twenty percent of Greeks lacked funds to meet daily food expenses. As the economy contracted and the welfare state declined, traditionally strong Greek families came under increasing strain, attempting to cope with increasing unemployment and homeless relatives. Many unemployed Greeks cycled between friends and family members until they ran out of options and ended up in homeless shelters. These homeless had extensive work histories and were largely free of mental health and substance abuse concerns.

The Greek government was unable to commit the necessary resources to homelessness, due in part to austerity measures. A program was launched to provide a stipend to assist homeless to return to their homes, but many enrollees never received grants. Various attempts were made by local governments and non-governmental agencies to alleviate the problem. The non-profit street newspaper Shedia (Greek: Σχεδία), Raft is sold by street vendors in Athens attracted many homeless to sell the paper. Athens opened its own shelters, the first of which was called the Hotel Ionis. In 2015, the Venetis bakery chain in Athens gave away ten thousand loaves of bread a day, one-third of its production. In some of the poorest neighborhoods, according to the chain's general manager, “In the third round of austerity measures, which is beginning now, it is certain that in Greece there will be no consumers — there will be only beggars."

Other effects

Horse racing has ceased operation due conducting organization being liquidated.

Paid soccer players will receive their salary with new tax rates.

Grexit

Krugman suggested that the Greek economy could recover from the recession by exiting the Eurozone ("Grexit") and returning to its national currency, the drachma. That would restore Greece's control over its monetary policy, allowing it to navigate the trade-offs between inflation and growth on a national basis, rather than the entire Eurozone. Iceland made a dramatic recovery after it filed for bankruptcy in 2008, in part by devaluing the krona (ISK). In 2013, it enjoyed an economic growth rate of some 3.3 percent. Canada was able to improve its budget position in the 1990s by devaluing its currency.

However, the consequences of "Grexit" could be global and severe, including:

Digital currency cards

Greece and other states practice fraction-reserve banking in which the amount of bank deposits far exceeds the amount of currency in circulation. Digital currency cards provide a way to make payments without the need to print/circulate more currency.

Bailout

Greece could accept additional bailout funds and debt relief (i.e., bondholder haircuts or principal reductions) in exchange for greater austerity. However, austerity has damaged the economy, deflating wages, destroying jobs and reducing tax receipts, thus making it even harder to pay its debts. If further austerity were accompanied by enough reduction in the debt balance owed, the cost might be justifiable.

European debt conference

Economist Thomas Piketty said in July 2015: "We need a conference on all of Europe’s debts, just like after World War II. A restructuring of all debt, not just in Greece but in several European countries, is inevitable." This reflected the difficulties that Spain, Portugal, Italy and Ireland had faced (along with Greece) before ECB-head Mario Draghi signaled a pivot to looser monetary policy. Piketty noted that Germany received significant debt relief after World War II. He warned that: "If we start kicking states out, then....Financial markets will immediately turn on the next country."

Germany's role in Greece

Germany has played a major role in discussion concerning Greece's debt crisis, though that is hardly surprising given that it was German banks who held the largest amount of Hellenic debt. Critics have accused the German government of hypocrisy; of pursuing its own national interests via an unwillingness to adjust fiscal policy in a way that would help resolve the eurozone crisis (and citing benefits it enjoyed through the crisis including falling borrowing rates, investment influx, and exports boost thanks to Euro’s depreciation); of using the ECB to serve their country's national interests; and have criticised the nature of the austerity and debt-relief programme Greece has followed as part of the conditions attached to its bailouts.

Charges of hypocrisy

Hypocrisy has been alleged on multiple bases. "Germany is coming across like a know-it-all in the debate over aid for Greece", commented Der Spiegel, while its own government did not achieve a budget surplus during the era of 1970 to 2011, although a budget surplus indeed was achieved by Germany in all three subsequent years (2012–2014) – with a spokesman for the governing CDU party commenting that "Germany is leading by example in the eurozone – only spending money in its coffers". A Bloomberg editorial, which also concluded that "Europe's taxpayers have provided as much financial support to Germany as they have to Greece", described the German role and posture in the Greek crisis thus:

In the millions of words written about Europe's debt crisis, Germany is typically cast as the responsible adult and Greece as the profligate child. Prudent Germany, the narrative goes, is loath to bail out freeloading Greece, which borrowed more than it could afford and now must suffer the consequences. [...] By December 2009, according to the Bank for International Settlements, German banks had amassed claims of $704 billion on Greece, Ireland, Italy, Portugal and Spain, much more than the German banks' aggregate capital. In other words, they lent more than they could afford. [… I]rresponsible borrowers can't exist without irresponsible lenders. Germany's banks were Greece's enablers.

German economic historian Albrecht Ritschl describes his country as "king when it comes to debt. Calculated based on the amount of losses compared to economic performance, Germany was the biggest debt transgressor of the 20th century." Despite calling for the Greeks to adhere to fiscal responsibility, and although Germany's tax revenues are at a record high, with the interest it has to pay on new debt at close to zero, Germany still missed its own cost-cutting targets in 2011 and is also falling behind on its goals for 2012.

Allegations of hypocrisy could be made towards both sides: Germany complains of Greek corruption, yet the arms sales meant that the trade with Greece became synonymous with high-level bribery and corruption; former defence minister Akis Tsochadzopoulos was jailed in April 2012 ahead of his trial on charges of accepting an €8m bribe from Germany company Ferrostaal.

Pursuit of national self-interest

Since the euro came into circulation in 2002—a time when the country was suffering slow growth and high unemployment—Germany's export performance, coupled with sustained pressure for moderate wage increases (German wages increased more slowly than those of any other eurozone nation) and rapidly rising wage increases elsewhere, provided its exporters with a competitive advantage that resulted in German domination of trade and capital flows within the currency bloc. As noted by Paul De Grauwe in his leading text on monetary union, however, one must "hav[e] homogenous preferences about inflation in order to have a smoothly functioning monetary union." Thus, as the Levy Economics Institute put it, in jettisoning a common inflation rate, Germany "broke the golden rule of a monetary union". The violation of this golden rule led to dire imbalances within the eurozone, though they suited Germany well: the country's total export trade value nearly tripled between 2000 and 2007, and though a significant proportion of this is accounted for by trade with China, Germany's trade surplus with the rest of the EU grew from €46.4 bn to €126.5 bn during those seven years. Germany's bilateral trade surpluses with the peripheral countries are especially revealing: between 2000 and 2007, Greece's annual trade deficit with Germany nearly doubled, from €3 bn to €5.5 bn; Italy's more than doubled, from €9.6 bn to €19.6 bn; Spain's well over doubled, from €11 bn to €27.2 bn; and Portugal's more than quadrupled, from €1 bn to €4.2 bn. German banks played an important role in supplying the credit that drove wage increases in peripheral eurozone countries like Greece, which in turn produced this divergence in competitiveness and trade surpluses between Germany and these same eurozone members:

There is ample evidence that, in the last ten years, the largest wage increases took place in countries like Spain or Greece that experienced the strongest domestic demand growth. Thus demand drives wages and not the other way round, since the PIGS suffered from the bulk of the loss of competitiveness after unemployment in these countries had fallen sharply. The statistical loss of competitiveness of the PIGS thus should not be traced back to inadequate reforms or aggressive trade unions, but instead to booms in domestic demand. The latter has been driven above all by cheap credit for consumption purposes in the case of Greece and for construction work in the cases of Spain and Ireland. This, in turn, translated into higher labor demand and, as a consequence, also to higher wages

Economist Paul Krugman remarked:

Listen to many European leaders—especially, but by no means only, the Germans—and you'd think that their continent's troubles are a simple morality tale of debt and punishment: Governments borrowed too much, now they're paying the price, and fiscal austerity is the only answer.

Germans see their government finances and trade competitiveness as an example to be followed by Greece, Portugal and other troubled countries in Europe, but the problem is more than simply a question of southern European countries emulating Germany. Dealing with debt via domestic austerity and a move toward trade surpluses is very difficult without the option of devaluing your currency, and Greece cannot devalue because it is chained to the euro. Roberto Perotti of Bocconi University has also shown that on the rare occasions when austerity and expansion coincide, the coincidence is almost always attributable to rising exports associated with currency depreciation. As can be seen from the case of China and the US, however, where China has had the yuan pegged to the dollar, it is possible to have an effective devaluation in situations where formal devaluation cannot occur, and that is by having the inflation rates of two countries diverge. If German inflation rises faster than that of Greece and other strugglers, then the real effective exchange rate will move in the strugglers' favour despite the shared currency. Trade between the two can then rebalance, aiding recovery, as Greece's products become cheaper. Dean Baker therefore argued that the problem is Germany continuing to shut off just such an adjustment mechanism, meaning

[its] position on the heavily indebted southern countries is absurd. It wants to maintain its huge trade surplus with these countries, while still insisting that they make good on their debts. This is like a store owner insisting that his customers keep buying more from him, while still paying off their debts.

"The counterpart to Germany living within its means is that others are living beyond their means", agreed Philip Whyte, senior research fellow at the Centre for European Reform. "So if Germany is worried about the fact that other countries are sinking further into debt, it should be worried about the size of its trade surpluses, but it isn't." Germany, though not the worst offender, has even been ringing up arms sales to Greece in the order of tens of millions of euros, and has "recruited thousands of the Continent's best and brightest […] a migration of highly qualified young job-seekers that could set back Europe's stragglers even more, while giving Germany a further leg up", the latter fact openly acknowledged by the new German foreign minister, Frank-Walter Steinmeier.

OECD projections of relative export prices—a measure of competitiveness—showed Germany beating all euro zone members except for crisis-hit Spain and Ireland for 2012, with the lead only widening in subsequent years. A study by the Carnegie Endowment for International Peace in 2010 noted that "Germany, now poised to derive the greatest gains from the euro's crisis-triggered decline, should boost its domestic demand" to help the periphery recover. In March 2012, Bernhard Speyer of Deutsche Bank reiterated: "If the eurozone is to adjust, southern countries must be able to run trade surpluses, and that means somebody else must run deficits. One way to do that is to allow higher inflation in Germany but I don't see any willingness in the German government to tolerate that, or to accept a current account deficit." (A year later, Germany continued to reject pleas for it to run deficits). A research paper by Credit Suisse concurred: "Solving the periphery economic imbalances does not only rest on the periphery countries' shoulders even if these countries have been asked to bear most of the burden. Part of the effort to re-balance Europe also has to been borne by Germany via its current account." At the end of May 2012, the European Commission warned that an "orderly unwinding of intra-euro area macroeconomic imbalances is crucial for sustainable growth and stability in the euro area," and prodded Germany to "contribute to rebalancing by removing unnecessary regulatory and other constraints on domestic demand". In July 2012, the IMF added its call for higher wages and prices in Germany, and for reform of parts of the country's economy to encourage more spending by its consumers (which would help generate demand that would soak up exports from other countries), saying such adjustments were "pivotal" to rebalancing the eurozone and global economy. In October 2012, even Christine Lagarde called for Greece to at least be given more time to meet bailout targets, though this was immediately rejected by Germany's finance minister. As if to emphasise the root problem, when downgrading France and other eurozone countries in January 2012, S&P gave one of its reasons as "divergences in competitiveness between the eurozone's core and the so-called 'periphery'". The Germans "wear their anti-inflation obsession as a badge of honour", but "price stability for Germany [… means] catastrophe for the euro." Paul Krugman estimates that Spain and other peripherals need to reduce their price levels relative to Germany by around 20 percent to become competitive again:

If Germany had 4 percent inflation, they could do that over 5 years with stable prices in the periphery—which would imply an overall eurozone inflation rate of something like 3 percent. But if Germany is going to have only 1 percent inflation, we're talking about massive deflation in the periphery, which is both hard (probably impossible) as a macroeconomic proposition, and would greatly magnify the debt burden. This is a recipe for failure, and collapse.

The US has also repeatedly, and heatedly, asked Germany to loosen fiscal policy at G7 meetings, but the Germans have repeatedly refused. The US Treasury Department's semi-annual currency report for October 2013 observed that:

Within the euro area, countries with large and persistent surpluses need to take action to boost domestic demand growth and shrink their surpluses. Germany has maintained a large current account surplus throughout the euro area financial crisis, and in 2012, Germany's nominal current account surplus was larger than that of China. Germany's anemic pace of domestic demand growth and dependence on exports have hampered rebalancing at a time when many other euro-area countries have been under severe pressure to curb demand and compress imports in order to promote adjustment. The net result has been a deflationary bias for the euro area, as well as for the world economy. […] Stronger domestic demand growth in surplus European economies, particularly in Germany, would help to facilitate a durable rebalancing of imbalances in the euro area.

These October 2013 Treasury Department observations would germinate in the very poorest of soil, however, because the year before, in October 2012, Germany had chosen to legally cement its dismissal of these repeated pleas by legislating against the very possibility of stimulus spending, "by passing a balanced budget law that requires the government to run near-zero structural deficits indefinitely." November 2013 saw the European Commission open an in-depth inquiry into German's surplus.

Even with such policies, Greece and other countries would face years of hard times, but at least there would be some hope of recovery. By May 2012, there were signs that the status quo, and "it's tough to overstate just how fantastic the status quo has been for Germany", was beginning to change as even France began to challenge German policy, and in April 2013, a week after even Manuel Barroso had warned that austerity had "reached its limits", EU employment chief Laszlo Andor called for a radical change in EU crisis strategy—"If there is no growth, I don't see how countries can cut their debt levels"—and criticised what he described as the German practice of "wage dumping" within the eurozone to gain larger export surpluses. "The euro has allowed Germany to 'beggar its neighbours', while also providing the mechanisms and the ideology for imposing austerity on the continent", announced Heiner Flassbeck (a former German vice finance minister) and economist Costas Lapavitsas in 2013, not long after a leaked version of a text from French president Francois Hollande's Socialist Party openly attacked "German austerity" and the "egoistic intransigence of Mrs Merkel". 2012 saw the German trade surplus rise to second highest level since 1950, but 2013 saw continuing signs that the crisis was gradually taking its toll.

Battered by criticism, the European Commission finally decided that "something more" was needed in addition to austerity policies for peripheral countries like Greece. "Something more" was announced to be structural reforms—things like making it easier for companies to sack workers—but such reforms have been there from the very beginning, leading Dani Rodrik to dismiss the EC's idea as "merely old wine in a new bottle." Indeed, Rodrik noted that with demand gutted by austerity, all structural reforms have achieved, and would continue to achieve, is pumping up unemployment (further reducing demand), since fired workers are not going to be re-employed elsewhere. Rodrik suggested the ECB might like to try out a higher inflation target, and that Germany might like to allow increased demand, higher inflation, and to accept its banks taking losses on their reckless lending to Greece. That, however, "assumes that Germans can embrace a different narrative about the nature of the crisis. And that means that German leaders must portray the crisis not as a morality play pitting lazy, profligate southerners against hard-working, frugal northerners, but as a crisis of interdependence in an economic (and nascent political) union. Germans must play as big a role in resolving the crisis as they did in instigating it." Paul Krugman described talk of structural reform as "an excuse for not facing up to the reality of macroeconomic disaster, and a way to avoid discussing the responsibility of Germany and the ECB, in particular, to help end this disaster." Furthermore, Financial Times analyst Wolfgang Munchau observed that

Austerity and reform are the opposite of each other. If you are serious about structural reform, it will cost you upfront money. [… A]usterity […] weaken[s] the economy's capacity in the short run, and possibly also in the long run. If you have youth unemployment of more than 50 per cent for a sustained period, as is now the case in Greece, […] many of those people will never find good jobs in their lives.

Though Germany claims its public finances are "the envy of the world", the country is merely continuing what has been called its "free-riding" of the euro crisis, which "consists in using the euro as a mechanism for maintaining a weak exchange rate while shifting the costs of doing so to its neighbors." The weakness of the euro, caused by the economy misery of peripheral countries, has been providing Germany with a large and artificial export advantage to the extent that, if Germany left the euro, the concomitant surge in the value of the reintroduced Deutsche Mark, which would produce "disastrous" effects on German exports as they suddenly became dramatically more expensive, would play the lead role in imposing a cost on Germany of perhaps 20–25% GDP during the first year alone after its euro exit. Claims that Germany had, by mid-2012, given Greece the equivalent of 29 times the aid given to West Germany under the Marshall Plan after World War II completely ignores the fact that aid was just a small part of Marshall Plan assistance to Germany, with another crucial part of the assistance being the writing off of a majority of Germany's debt.

Germany insists that it is ready to do "everything" to guarantee the eurozone. "Yet, for all the rhetoric, little has changed. The austerity strategy imposed by Berlin on Europe's 'Arc of Depression'—against the better judgement of the European Commission, the OECD, International Monetary Fund, and informed economic opinion across the globe—has not been modified in the slightest even though economic contraction has proved deeper than expected in every single victim country." The version of adjustment offered by Germany and its allies is that austerity will lead to an internal devaluation, i.e. deflation, which would enable Greece gradually to regain competitiveness. "Yet this proposed solution is a complete non-starter", in the opinion of one UK economist. "If austerity succeeds in delivering deflation, then the growth of nominal GDP will be depressed; most likely it will turn negative. In that case, the burden of debt will increase." A February 2013 research note by the Economics Research team at Goldman Sachs again noted that the years of recession being endured by Greece "exacerbate the fiscal difficulties as the denominator of the debt-to-GDP ratio diminishes", i.e. reducing the debt burden by imposing austerity is, aside from anything else, utterly futile. "Higher growth has always been the best way out the debt (absolute and relative) burden. However, growth prospects for the near and medium-term future are quite weak. During the Great Depression, Heinrich Brüning, the German Chancellor (1930–32), thought that a strong currency and a balanced budget were the ways out of crisis. Cruel austerity measures such as cuts in wages, pensions and social benefits followed. Over the years crises deepened". The austerity program applied to Greece has been "self-defeating", with the country's debt now expected to balloon to 192% of GDP by 2014. After years of the situation being pointed out, in June 2013, with the Greek debt burden galloping towards the "staggering" heights previously predicted by anyone who knew what they were talking about, and with her own organization admitting its program for Greece had failed seriously on multiple primary objectives and that it had bent its rules when "rescuing" Greece; and having claimed in the past that Greece's debt was sustainable—Christine Lagarde felt able to admit publicly that perhaps Greece just might, after all, need to have its debt written off in a meaningful way. In its Global Economic Outlook and Strategy of September 2013, Citi pointed out that Greece "lack[s] the ability to stabilise […] debt/GDP ratios in coming years by fiscal policy alone", and that "large debt relief" is probably "the only viable option" if Greek fiscal sustainability is to re-materialise; predicted no return to growth until 2016; and predicted that the debt burden would soar to over 200% of GDP by 2015 and carry on rising through at least 2017. Unfortunately, German Chancellor Merkel and Foreign Minister Guido Westerwelle had just a few months prior already spoken out again against any debt relief for Greece, claiming that "structural reforms" (i.e. "old wine in a new bottle", see Rodrik et al. above) were the way to go and—astonishingly—that "debt sustainability will continue to be assured".

Strictly in terms of reducing wages relative to Germany, Greece had been making 'progress': private-sector wages fell 5.4% in the third quarter of 2011 from a year earlier and 12% since their peak in the first quarter of 2010. The second economic adjustment programme for Greece called for a further labour cost reduction in the private sector of 15% during 2012–2014.

The question then is whether Germany would accept the price of inflation for the benefit of keeping the eurozone together. On the upside, inflation, at least to start with, would make Germans happy as their wages rose in keeping with inflation. Regardless of these positives, as soon as the monetary policy of the ECB—which has been catering to German desires for low inflation so doggedly that Martin Wolf describes it as "a reincarnated Bundesbank"—began to look like it might stoke inflation in Germany, Merkel moved to counteract, cementing the impossibility of a recovery for struggling countries. With eurozone adjustment locked out by Germany, economic hardship elsewhere in the currency block actually suited its export-oriented economy for an extended period, because it caused the euro to depreciate, making German exports cheaper and so more competitive. By July 2012, however, the European crisis was beginning to take its toll. Germany's unemployment continued its downward trend to record lows in March 2012, and yields on its government bonds fell to repeat record lows in the first half of 2012 (though real interest rates are actually negative).

German and other financial institutions have scooped a huge chunk of the rescue package: "more than 80 percent of the rescue package is going to creditors—that is to say, to banks outside of Greece and to the ECB. The billions of taxpayer euros are not saving Greece. They're saving the banks." The shift in liabilities from European banks to European taxpayers has been staggering: one study found that the public debt of Greece to foreign governments, including debt to the EU/IMF loan facility and debt through the eurosystem, increased by €130 bn, from €47.8 bn to €180.5 billion, between January 2010 and September 2011. The combined exposure of foreign banks to Greek entities—public and private—was around 80bn euros by mid-February 2012. In 2009 they were in for well over 200bn. The Economist noted that, during 2012 alone, "private-sector bondholders reduced their nominal claims by more than 50%. But the deal did not include the hefty holdings of Greek bonds at the European Central Bank (ECB), and it was sweetened with funds borrowed from official rescuers. For two years those rescuers had pretended Greece was solvent, and provided official loans to pay off bondholders in full. So more than 70% of the debts are now owed to 'official' creditors", i.e. European taxpayers and the IMF. With regard to Germany in particular, a Bloomberg editorial noted that, before its banks reduced its exposure to Greece, "they stood to lose a ton of money if Greece left the euro. Now any losses will be shared with the taxpayers of the entire euro area." Similarly in Spain:

German lenders will be among the biggest beneficiaries of a Spanish bank bailout, with rescue funds helping to ensure they get paid back in full for poor lending decisions made in the run-up to the financial crisis, and helping politicians in Berlin avoid a politically sensitive bank bailout of their own. German lenders were among Europe's most profligate before 2008, channelling the country's savings to the European periphery in search of higher profits. […] German banks were facing deep losses linked to potential Spanish bank failures. However, a bailout of Spanish banks—backed initially by Spanish taxpayers and potentially later by the European Stability Mechanism—will ensure creditors won't take losses, making the bailout effectively a back-door bailout of reckless German lending. […] Jens Sondergaard, senior European economist at Nomura, said: "The Spanish bailout in effect is a bailout of German banks. If lenders in Spain were allowed to default, the consequences for the German banking system would be very serious."

The director of LSE's Hellenic Observatory mused: "Who is rescued by the bailouts of the European debt crisis? The question won't go away. […] The Greek banks—vital to the provision of new investment in an economy facing a sixth year of continuous recession—have certainly not been 'rescued' [… and] face large-scale nationalisation. […] Athenians might well turn the aphorism around and warn their partners in Lisbon: 'Beware of Europeans bearing gifts.'"

All of this has resulted in increased anti-German sentiment within peripheral countries like Greece and Spain. German historian Arnulf Baring, who opposed the euro, wrote in his 1997 book Scheitert Deutschland? (Does Germany fail?): "They (populistic media and politicians) will say that we finance lazy slackers, sitting in coffee shops on southern beaches", and "[t]he fiscal union will end in a giant blackmail manoeuvre […] When we Germans will demand fiscal discipline, other countries will blame this fiscal discipline and therefore us for their financial difficulties. Besides, although they initially agreed on the terms, they will consider us as some kind of economic police. Consequently, we risk again becoming the most hated people in Europe." Anti-German animus is perhaps inflamed by the fact that, as one German historian noted, "during much of the 20th century, the situation was radically different: after the first world war and again after the second world war, Germany was the world's largest debtor, and in both cases owed its economic recovery to large-scale debt relief." When Horst Reichenbach arrived in Athens towards the end of 2011 to head a new European Union task force, the Greek media instantly dubbed him "Third Reichenbach"; in Spain in May 2012, businessmen made unflattering comparisons with Berlin's domination of Europe in WWII, and top officials "mutter about how today's European Union consists of a 'German Union plus the rest'". Almost four million German tourists—more than any other EU country—visit Greece annually, but they comprised most of the 50,000 cancelled bookings in the ten days after the 6 May 2012 Greek elections, a figure The Observer called "extraordinary". The Association of Greek Tourism Enterprises estimates that German visits for 2012 will decrease by about 25%. Such is the ill-feeling, historic claims on Germany from WWII have been reopened, including "a huge, never-repaid loan the nation was forced to make under Nazi occupation from 1941 to 1945."