Nationality United States Influenced Robert J. Shiller | Role Economist Name George Akerlof Children Robert Akerlof | |

| ||

Full Name George Arthur Akerlof Institution Georgetown UniversityUniversity of California, Berkeley Alma mater Lawrenceville SchoolYale University (B.A.)MIT (Ph.D.) Contributions Information asymmetryEfficiency wages Influenced by Robert Solow, John Maynard Keynes Books Animal Spirits: How Hum, Phishing for Phools: The Econ, Explorations in Pragmati, An economic theorist's, Identity Economics: How Our I Similar People | ||

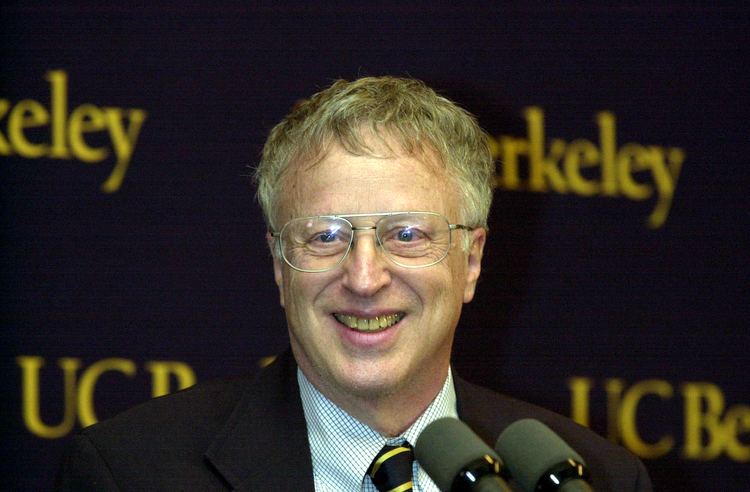

Discussing identity economics with nobelist george akerlof

George Arthur Akerlof (born June 17, 1940) is an American economist who is a University Professor at the McCourt School of Public Policy at Georgetown University and Koshland Professor of Economics Emeritus at the University of California, Berkeley. He won the 2001 Nobel Memorial Prize in Economic Sciences (shared with Michael Spence and Joseph E. Stiglitz).

Contents

- Discussing identity economics with nobelist george akerlof

- George akerlof phd phishing for phools lecture at duke university

- Early life and education

- The Market for Lemons and asymmetric information

- Identity economics

- Reproductive technology shock

- Looting

- Norms and macroeconomics

- Personal life

- References

George akerlof phd phishing for phools lecture at duke university

Early life and education

Akerlof was born in New Haven, Connecticut, United States, the son of Rosalie Grubber (née Hirschfelder) and Gösta Åkerlöf, who was a chemist and inventor. His mother was Jewish, from a family that had emigrated from Germany. His father was a Swedish immigrant. Akerlof graduated from the Lawrenceville School in 1958 and received the Aldo Leopold Award in 2002. In 1962 he received his BA degree from Yale University, in 1966 his PhD degree from MIT, and taught at the London School of Economics 1978–80.

"The Market for Lemons" and asymmetric information

Akerlof is perhaps best known for his article, "The Market for Lemons: Quality Uncertainty and the Market Mechanism", published in Quarterly Journal of Economics in 1970, in which he identified certain severe problems that afflict markets characterized by asymmetric information, the paper for which he was awarded the Nobel Memorial Prize. In Efficiency Wage Models of the Labor Market, Akerlof and coauthor Janet Yellen (his wife) propose rationales for the efficiency wage hypothesis in which employers pay above the market-clearing wage, in contradiction to the conclusions of neoclassical economics.

Identity economics

In his latest work, Akerlof and collaborator Rachel Kranton of Duke University introduce social identity into formal economic analysis, creating the field of identity economics. Drawing on social psychology and many fields outside of economics, Akerlof and Kranton argue that individuals do not have preferences only over different goods and services. They also adhere to social norms for how different people should behave. The norms are linked to a person's social identities. These ideas first appeared in their article "Economics and Identity", published in Quarterly Journal of Economics in 2000.

Reproductive technology shock

In the late 1990s Akerlof's ideas attracted the attention of some on both sides of the debate over legal abortion. In articles appearing in The Quarterly Journal of Economics, The Economic Journal, and other forums Akerlof described a phenomenon that he labeled "reproductive technology shock." He contended that the new technologies that had helped to spawn the late twentieth century sexual revolution, modern contraceptives and legal abortion, had not only failed to suppress the incidence of out-of-wedlock childbearing but also had actually worked to increase it. According to Akerlof, for women who did not use them, these technologies had largely transformed the old paradigm of socio-sexual assumptions, expectations, and behaviors in ways that were especially disadvantageous. For example, the availability of legal abortion now allowed men to view their offspring as the deliberate product of female choice rather than as the joint product of sexual intercourse. Thus, it encouraged biological fathers to reject not only the notion of an obligation to marry the mother but also the idea of a paternal obligation.

While Akerlof did not recommend legal restrictions on either abortion or the availability of contraceptives his analysis seemed to lend support to those who did. Thus, a scholar strongly associated with liberal and Democratic-leaning policy positions has been approvingly cited by conservative and Republican-leaning analysts and commentators.

Looting

In 1993 Akerlof and Paul Romer brought forth Looting: The Economic Underworld of Bankruptcy for Profit, describing how under certain conditions, owners of corporations will decide it is more profitable for them personally to 'loot' the company and 'extract value' from it instead of trying to make it grow and prosper. For example:

Bankruptcy for profit will occur if poor accounting, lax regulation, or low penalties for abuse give owners an incentive to pay themselves more than their firms are worth and then default on their debt obligations. Bankruptcy for profit occurs most commonly when a government guarantees a firm's debt obligations.

Norms and macroeconomics

In his 2007 presidential address to the American Economic Association, Akerlof proposed natural norms that decision makers have for how they should behave, and showed how such norms can explain discrepancies between theory and observed facts about the macroeconomy. Akerlof proposed a new agenda for macroeconomics, using social norms to explain macroeconomic behavior. He is considered together with Gary Becker as one of the founders of social economics.

He is a trustee of the Economists for Peace and Security and co-director of the Social Interactions, Identity and Well-Being program at the Canadian Institute for Advanced Research (CIFAR). He is on the advisory board of the Institute for New Economic Thinking. He was elected a fellow of the American Academy of Arts and Sciences in 1985.

Personal life

His wife, Janet Yellen, is the Chair of the Board of Governors of the Federal Reserve System and professor emeritus at UC Berkeley's Haas School of Business, and was the former President and CEO of the Federal Reserve Bank of San Francisco and former Chair of President Bill Clinton's Council of Economic Advisors. His son Robert Akerlof has a PhD in economics from Harvard University and teaches at the University of Warwick.

Akerlof spoke at the Warwick Economics Summit in February 2012 with a talk entitled "Phishing for Phools".