| ||

General insurance or non-life insurance policies, including automobile and homeowners policies, provide payments depending on the loss from a particular financial event. General insurance is typically defined as any insurance that is not determined to be life insurance. It is called property and casualty insurance in the U.S. and Canada and non-life insurance in Continental Europe.

Contents

In the UK, insurance is broadly divided into three areas: personal lines, commercial lines and London market.

The London market insures large commercial risks such as supermarkets, football players and other very specific risks. It consists of a number of insurers, reinsurers, P&I Clubs, brokers and other companies that are typically physically located in the City of London. The Lloyd's of London is a big participant in this market.[1] The London Market also participates in personal lines and commercial lines, domestic and foreign, through reinsurance.

Commercial lines products are usually designed for relatively small legal entities. These would include workers' compensation (employers liability), public liability, product liability, commercial fleet and other general insurance products sold in a relatively standard fashion to many organisations. There are many companies that supply comprehensive commercial insurance packages for a wide range of different industries, including shops, restaurants and hotels.

Personal lines products are designed to be sold in large quantities. This would include autos (private car), homeowners (household), pet insurance, creditor insurance and others.

ACORD [2] which is the insurance industry global standards organisation. ACORD has standards for personal and commercial lines and has been working with the Australian General Insurers to develop those XML standards, standard applications for insurance, and certificates of currency.

Types of General Insurance

General insurance can be categorised in to following [3]:

Market trends

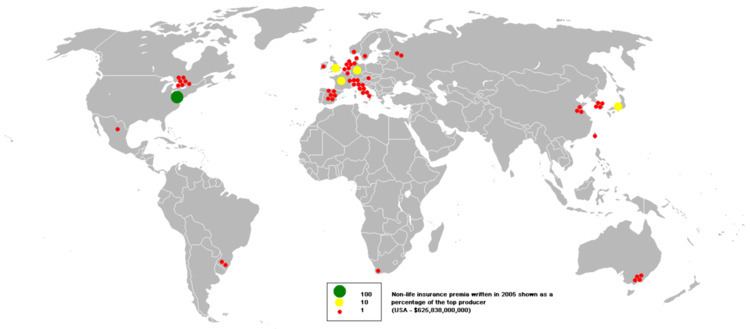

The U.S. was the largest market for non-life insurance premiums written in 2005 followed by the EU and Japan. Zimbabwean insurance industry is recovering following dollarization in 2009. It is one of the better performing sectors of the economy.