| ||

Foolish four best moments

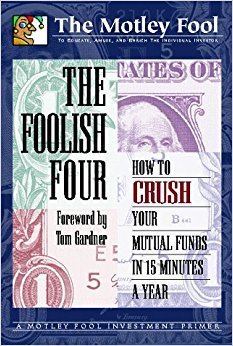

The "Foolish Four" is a now-discredited mechanical investing technique that was promoted by the Motley Fool finance group in the 1990s. Like the Dogs of the Dow, the Foolish Four attempts to select the member stocks of the Dow Jones Industrial Average that will outperform the average in the near future. The Foolish Four method was strongly promoted by the Motley Fool leadership until late 2000, when analysis showed the technique was ineffective.

Contents

- Foolish four best moments

- Hanging out with austin mahone and the foolish four besties bromance edition teen vogue

- Overview

- Criticism

- References

Hanging out with austin mahone and the foolish four besties bromance edition teen vogue

Overview

To identify the "Foolish Four," an investor determines the current dividend yield and current price for each of the 30 stocks comprising the Dow Jones Industrial Average. Then, the yield for each stock is divided by the square root of the stock's price. The stocks are ranked from highest to lowest using the number resulting from the division. The stocks ranking the second highest, third highest, fourth highest, and fifth highest in equal dollar amounts are bought. The highest ranking stock is not bought.

Criticism

The main people responsible for initially discrediting the Foolish Four were two contributors to discussion boards at Fool.com, who used the screen names "Datasnooper" and "Qwerty_RP4". They showed that there was no statistical validity to the stocks picked by the Foolish Four. There was no statistical difference between stocks picked by the formula on any day other than January 1 during the period of backtesting. There was no statistical difference between stocks picked on January 1 after the method was published. The entire outperformance was due to curve fitting of backtested data.

This stock-picking technique was referred to as "investment hogwash in its purest form" by Money magazine writer Jason Zweig in an August 1999 article titled "False Profits." There was no remotely plausible reason why the square root of a stock's price should have any bearing on the analysis of stocks, he wrote. Furthermore, Zweig wrote that he found an equally effective investment strategy would have been to select company stock based on such arbitrary factors as whether or not they had repeating letters in their names (e.g., Texaco vs. Exxon).

Subsequent review of this technique by Motley Fool employees suggested that it was unlikely to outperform a simple indexing strategy. After an extended period of resistance during which Motley Fool leadership claimed the technique was still effective if not spectacularly so, the Motley Fool discontinued its promotion in December 2000.