| ||

This article describes the use, market penetration and market share of new car sales of electric cars by country. It also provides historical background, fleet size, existing government incentives, and deployment details by country. The article encompasses both low-speed neighborhood electric vehicle (NEVs) and highway-capable all-electric cars (BEVs). Several countries publish their statistics and have purchase incentives schemes in place for the more general category of plug-in electric cars (PEVs), which includes also plug-in hybrids (PHEVs). Hybrid electric vehicles (HEVs) are not included because they can not be plugged and recharged from an off-vehicle electric energy source.

Contents

- Global outlook

- Australia

- Belgium

- Brazil

- Canada

- China

- Chile

- Colombia

- Costa Rica

- Croatia

- Denmark

- Estonia

- Finland

- France

- Germany

- Hong Kong

- Hungary

- Iceland

- India

- Israel

- Ireland

- Italy

- Japan

- Mexico

- Netherlands

- New Zealand

- Norway

- Philippines

- Poland

- Portugal

- Russia

- Singapore

- South Africa

- South Korea

- Spain

- Sri Lanka

- Sweden

- Switzerland

- Ukraine

- United Kingdom

- United States

- References

Cumulative global sales of highway legal plug-in electric passenger cars and light utility vehicles achieved the 2 million unit milestone in December 2016, of which, 38% were sold in 2016. Global sales of the light-duty plug-in vehicle segment achieved a 0.86% market share of total new car sales in 2016, up from 0.62% in 2015 and 0.38% in 2014. The global ratio between all-electric cars (BEVs) and plug-in hybrids (PHEVs) was 61:39 at the end of 2016, up from 59:41 at the end of 2015. Global sales of highway-capable pure electric cars passenger cars and utility vans reached the one million milestone in September 2016. Cumulative sales of plug-in hybrids totaled almost 800,000 units as of December 2016. Despite their rapid growth, plug-in electric cars represented 0.15% of the 1.4 billion motor vehicles on the world's roads by the end of 2016, up from 0.1% in 2015.

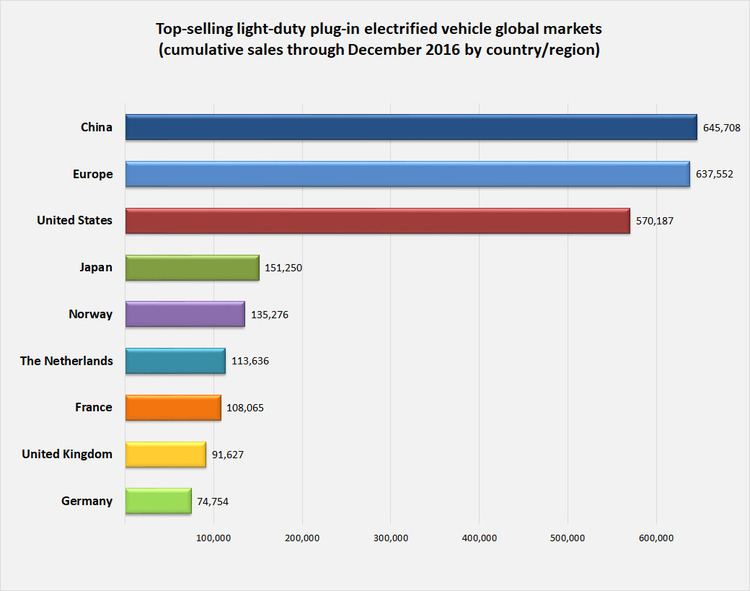

As of December 2016, China has the world's largest stock of highway legal light-duty plug-in electric vehicles with cumulative sales of more than 645,000 plug-in electric passenger cars. Among country markets, the United States ranks second with more than 570,000 plug-in electric cars sold through December 2016. Japan is the world's third largest plug-in car country market with about 147,500 plug-ins sold through December 2016. More than 637,000 light-duty plug-in electric passenger cars have been registered in Europe up until December 2016, representing 31.4% of global sales. As of December 2016, sales in the European light-duty plug-in electric segment are led by Norway with over 135,000 units registered, followed by the Netherlands with more than 113,000 units registered at the end of December 2016, and France with over 108,000 units. China is the world's leader in the plug-in heavy-duty segment, including all-electric buses, and plug-in commercial and sanitation trucks. The stock of new energy vehicles sold in China totaled more than 951,000 units through December 2016. As of December 2015, China was the world's largest plug-in electric bus market with a stock of almost 173,000 vehicles.

Norway is the country with the highest market penetration per capita in the world, also the country with the largest plug-in electric segment market share of new car sales (29.1% in 2016), and in March 2014 Norway became the first country where over 1 in every 100 passenger cars on the roads is a plug-in electric vehicle. The segment's market penetration climbed to 3% in December 2015, and achieved 5% at the end of 2016. Estonia, which has the second largest EV market penetration per capita after Norway, is the first country that completed the deployment of an EV charging network with nationwide coverage, with fast chargers available along highways at a minimum distance between 40 to 60 km (25 to 37 mi).

Global outlook

Cumulative global sales of highway legal plug-in electric passenger cars and light utility vehicles reached the one million unit milestone in September 2015, and achieved two million in December 2016. Sales of plug-in electric vehicles achieved the one million milestone almost twice as fast as hybrid electric vehicles (HEV). While it took four years and 10 months for the PEV segment to reach one-million sales, it took more than around nine years and a few months for HEVs to reach its first million sales. The stock of light-duty plug-in electric vehicles represented 0.15% of the 1.4 billion motor vehicles on the world's roads by the end of 2016, up from 0.1% in 2015. When sales are broken down by type of powertrain, all-electric cars have oversold plug-in hybrids, with pure electrics capturing about 61% of the global stock of over 2 million plug-ins on the world's roads by the end of 2016, up from 58.9% at the end of 2015. The global ratio between all-electrics (BEVs) and plug-in hybrids (PHEVs) has consistently been 60:40 between 2014 and the first half of 2016, mainly due to the large all-electric market in China. In the U.S. and Europe, the ratio is approaching a 50:50 split. Cumulative global sales of highway-capable light-duty pure electric vehicles since 2010 achieved the one million unit milestone in September 2016. Cumulative sales of plug-in hybrid cars totaled almost 800,000 units as of December 2016.

The global stock of plug-in electric vehicles between 2005 and 2009 consisted exclusively of all-electric cars, totaling about 1,700 units in 2005, and almost 6,000 in 2009. The plug-in stock rose to about 12,500 units in 2010, of which, only 350 vehicles were plug-in hybrids. By comparison, during the Golden Age of the electric car at the beginning of the 20th century, the EV stock peaked at approximately 30,000 vehicles. After the introduction of the Nissan Leaf and the Chevrolet Volt in late December 2010, the first mass-production plug-in cars by major carmakers, plug-in car sales grew to about 50,000 units in 2011, jumped to 125,000 in 2012, and rose to almost 213,000 plug-in electric cars and utility vans in 2013. Sales totaled over 315,000 units in 2014, up 48% from 2013.

In five years, global sales of highway legal light-duty plug-in electric vehicles have increased more than ten-fold, totaling more than 565,00 units in 2015. Plug-in sales in 2015 increased about 80% from 2014, driven mainly by China and Europe. Both markets passed in 2015 the U.S. as the largest plug-in electric car markets in terms of total annual sales, with China ranking as the world's best-selling plug-in electric passenger car country market in 2015. About 775,000 plug-in cars and vans were sold in 2016, representing 38% of cumulative global sales at the end of 2016. The global market share of the light-duty plug-in vehicle segment represented 0.86% of new car sales in 2016, up from 0.62% in 2015 and 0.38% in 2014.

As of December 2016, with cumulative sales of more than 645,000 plug-in electric passenger cars, China has the world's largest fleet of light-duty plug-in electric vehicles, after having overtook during 2016 both the U.S. and Europe in terms of cumulative sales. This figure accounts for both, domestically produced new energy passenger cars and imports. The fleet of Chinese plug-in cars represents 43.0% of the global stock of light-duty plug-in vehicles. Among country markets, the U.S. ranks second, with over 570,000 plug-in passenger cars sold through December 2016, representing 28.1% of the global stock of plug-ins. Japan has the world's third largest plug-in stock, with about 147,500 highway legal plug-in electric vehicles sold in the country between July 2009 and December 2016. Total Japanese sales of light-duty plug-in vehicles represent 7.3% of the global stock of plug-ins as of December 2016. In 2014 Japan had second largest plug-in stock with about 108,000 units.

As of December 2016, about 637,500 plug-in electric passenger cars and vans have been registered in Europe, representing 31.4% of the global stock, the second largest after China. Of these, more than 212,000 light-duty vehicles were registered in Europe in 2016. As of December 2016, European sales of plug-in cars and vans are led by Norway with over 135,000 units registered, followed by the Netherlands with more than 113,000 units, and France with over 108,000. Norway was the top selling plug-in country market in Europe in 2016 with 45,492 plug-in cars and vans registered, surpassing the Netherlands, Europe’s top market in 2015. By the end of 2015, almost 25% of the European plug-in stock was registered in the Nordic countries, with over 100,000 registered plug-in electric cars. As of December 2016, ranking next is the UK with about 91,000 units, followed by Germany with almost 75,000, and Sweden with over 30,500. The other top selling country market is Canada with more than 27,000 new plug-in cars sold since 2011.

As of December 2015, France ranked as the largest European market for light-duty electric commercial vehicles or utility vans, accounting for nearly half of all vans sold in the European Union. The French market share of all-electric utility vans reached a market share of 1.22% of new vans registered in 2014, and 1.30% in 2015. Denmark is the second largest European market, with over 2,600 plug-in electric vans sold in 2015, with an 8.5% market share of all vans sold in the country. Most of the van sold in the Danish market are plug-in hybrids, accounting for almost all of the plug-in hybrid van sales across the EU.

New energy vehicle sales in China totaled more than 733,000 units units sold between January 2011 and September 2016. These figures include heavy-duty commercial vehicles such buses and sanitation trucks, and only include vehicles manufactured in the country as imports are not subject to government subsidies. The country achieved record sales of more than 200,000 new energy passenger cars in 2015, allowing China to rank as the world's top selling plug-in passenger car country market in 2015, ahead of the United States, the leading market in 2014. As of December 2015, China is also the world's leader in the plug-in heavy-duty segment, including electric buses, plug-in trucks, particularly sanitation/garbage trucks. As of December 2015, the global stock of plug-in electric buses was estimated to be about 173,000 units, almost entirely deployed in China, the world's largest electric bus market. Of these, almost 150,000 were all-electric buses. The Chinese electric bus stock grew nearly sixfold between 2014 and 2015. The production of all-electric buses in China totaled 115,664 units in 2016, up 31% from 88,248 units produced in 2015. In a few other countries, there are electric bus fleets, deployed in a few major cities mainly as pilots and demonstration projects. As of December 2015, there are 100 electric buses in India, 94 in the Netherlands, 30 in Sweden, and 21 in Japan.

The following table presents plug-in electric vehicle stock and PEV market share of new car sales between 2013 and 2015 for the ten countries with the largest plug-in electric-drive stock as of December 2015.

California is the largest U.S. car market, and accounts for approximately 48% of cumulative plug-in sales in the American market from 2011 to June 2016. The other nine states that follow California's Zero Emission Vehicle (ZEV) regulations have accounted for another 10% of cumulative plug-in car sales in the U.S. during the same period. California's plug-in stock totaled about 270,000 units at the end of 2016. Until December 2014 California had more plug-in electric vehicles than any other country, and in 2015 only two countries, Norway (22.4%) and the Netherlands (9.7%), achieved a higher plug-in market share than California. As of December 2016, China is the only country market that exceeds California in terms of cumulative plug-in electric car sales. Plug-in electric cars represented about 0.5% of the passenger fleet on the Californian roads by September 2015. Among U.S. states, California has the highest concentration of registered plug-in cars per 1,000 people, 4.68, as of December 2015. Only Norway has a higher concentration of plug-ins per capita.

Norway, with a population of about 5.2 million, is the country with the highest plug-in electric car ownership per capita in the world, with a market concentration of 21.5 registered plug-in cars per 1,000 people, 3.6 times higher than California's, the leading American market, and exceeding the U.S. average concentration by 14.2 times. In March 2014, Norway became the first country where over 1 in every 100 passenger cars on the roads is a plug-in electric. The segment's market penetration reached 2% in March 2015, passed 3% in December 2015, and achieved 5% at the end of 2016. Norway also has the world's largest plug-in electric segment market share of total new car sales, growing from 5.6% in 2013, to 13.8% in 2014, 22.4% in 2015, and reaching 29.1% in 2016. Ranking next is the Netherlands, with a market share of 3.9% in 2014, and 9.7% in 2015. In 2015 nine countries achieved plug-in electric car sales with a market share equal or higher than 1% of total new car sales, up from six in 2014. The nine countries are Norway (22.39%), the Netherlands (9.74%), Hong Kong (4.84%), Iceland (2.93%), Sweden (2.49%), Denmark (2.29%), Switzerland (1.98%), France (1.2%), and the UK (1.1%). In 2015 the European plug-in passenger car market share passed the one percent mark (1.41%) for the first time. The highest-ever monthly market share for plug-in electric segment was achieved in March 2016 in Norway, with one in three new passenger cars registered being a plug-in electric car (33.5%).

The following table presents the top 10 countries according to their PEV market share of total new car sales between 2016 and 2013.

Australia

In 2008 Australia started producing its first commercial all-electric vehicle. Originally called the Blade Runner, its name was changed to Electron, and is already being exported to New Zealand with one purchased by the Environment Minister Dr. Nick Smith. The Electron is based on the Hyundai Getz chassis and has proven popular with government car pools.

In October 2008, Better Place announced plans to deploy charging network to power electric cars in Melbourne, Sydney and Brisbane in partnership with Australian power company AGL and finance group Macquarie Capital. The initial network deployment was planned to take place in Canberra in late 2011. As of December 2011, 12 public charge spots (power outlets, not battery swap stations) had been installed in Australia. The roll out of the Australian network was initially planned to begin 6 months to a year after the roll out of the network in Denmark. In December 2012, Renault announced that the launch of the Renault Fluence Z.E. was postponed indefinitely following delays with the roll out of Australia's electric vehicle infrastructure. The electric car was scheduled to go on sale to the public from a number of dealers across the country in the fourth quarter of 2012. Better Place explained that delays in the deployments in Israel and Denmark are reflecting in the Australian roll out, which would take place between 12 and 18 months behind the other markets. Better place have since gone bust with the only sign they ever existed being a few lone silver posts standing in (mostly university) car parks. Chargepoint is now the only major operator of a charging network still based and active in Australia.

Beginning in mid-2009, twelve-month field trial was conducted with the Mitsubishi i-MiEV with potential electric vehicle customers, such as local, state and federal government bodies, and major fleet operators. Leasing for fleet customers began in Australia in August 2010. As of May 2011, a total of 110 i-MiEVs had been leased to government and corporate fleets, while retail sales to the public began in August 2011. As of September 2013, the Australian government does not offer any form of incentive or rebate scheme for the purchase of fuel-efficient vehicles by its citizens. As of December 2012, 125 i-MiEVs had been sold in the country, 30 of which were sold by December 2011.

A two-year fleet trial of 10 converted Ford Focus Electric cars, that also included 14 i-MiEVs and 3 Toyota Prius PHEVs, commenced in Western Australia in 2010. Each converted car was equipped with a 23 kWh battery pack, a 27 kW DC motor and a 1000A motor controller. These cars were then used in the study as regular fleet vehicles to find their usability for everyday driving. In July 2011, Nissan Australia provided 16 Nissan Leaf vehicles, to be used by both personal and commercial users, for an electric vehicle trial in Victoria. A total of 19 Leafs were registered in 2011, while sales of the Nissan Leaf in Australia began in June 2012—77 units were sold during 2012. The Holden Volt, a plug-in hybrid model, was released onto the Australian market by late 2012 and a total of 80 units were delivered during that year.

A total of 258 plug-in electric cars were sold during 2012, with the i-MiEV as the top selling model, with 95 units sold. Sales during 2013 totaled 304 units, up 20% from 2012. The Nissan Leaf was the top selling plug-in car with 188 units followed by the Holden Volt with 101 units. The EV market share in 2013 was 0.036% of total new car sales in the country. As of September 2013, the largest public charging networks exist in the capital cities of Perth and Melbourne, with around 30 stations (7 kW AC) established in both cities—smaller networks exist in other capital cities. An Australian standard for charging connectors does not exist as of September 2013.

Since 2014 Mitsubishi is no longer importing the i-MiEV after slow sales due to the high price and due to competition from the more successful Outlander PHEV for battery components. Sales during the first quarter of 2014 totaled 42 units, representing a 0.015% market share of new car sales, and during the first half of 2014 sales reached 114 units. Deliveries of the Tesla Model S in Australia began in late 2014. Deliveries of the BMW i3 also commenced at the end of 2014. Sales during 2014 totaled 1,228 units, up 288% from 2013. The plug-in electric segment reached a 0.11% market share of total new car sales in the country, up threefold from 0.036% in 2013. The surge in sales was due to the introduction of the Mitsubishi Outlander P-HEV, which sold 895 units during 2014, and became Australia's top selling plug-in electric vehicle. Cumulative sales in the Australian market since 2010 reached over 1,950 units by the end of December 2014, up from 304 units in 2013.

A total of 246 Holden Volts had been sold in the country by mid April 2015, with the stock of the first generation almost empty. General Motors announced that it will not build the second generation Volt in right-hand-drive configuration, so the Holden Volt will be discontinued in the country when the remaining stock is sold out. As of April 2015, the following models are available in the Australian market: Nissan Leaf, Tesla Model S, both variants of the BMW i3 (REx and all-electric), BMW i8, Mitsubishi Outlander P-HEV, and Porsche plug-in hybrids, 918 Spyder, Panamera and Cayenne. Other models scheduled to be launched in the country include the Audi A3 e-tron and the Audi Q7 e-tron.

As of December 2014, a total of 65 Model S cars were registered in New South Wales and only four in Victoria. At the end of March 2015, registrations totaled 119 in New South Wales and 54 in Victoria. Although there were no sales figures reported for Tesla in other states, the combined sales of these two states alone were enough for the Model S to rank as the top selling all-electric car in the country for the first quarter of 2015, ahead of the BMW i3 (46) and the Nissan Leaf (31). Australia's top selling plug-in electric vehicle for the first quarter of 2015 was the Outlander P-HEV, with 198 units sold, again in the first quarter of 2016 ranked as the top selling plug-in with 195 units, and continued as the country's all-time best selling plug-in with 2,015 units sold through March 2016 since its introduction in 2013. As of December 2016, about 1,000 Nissan Leafs have been sold since its introduction in the country in 2012.

The following table presents registrations of highway-capable plug-in electric cars by year between 2010 and March 2016:

Belgium

Sales of electric cars in the country rose from 97 units in 2009, to 116 in 2010, 425 in 2011, to 1,038 electric-drive vehicles by early October 2012. Of the latter, only 350 units were sold to individual customers. The three top selling plug-electric cars sold in 2012 through September 2012 are the Opel Ampera with 155 units, the Peugeot iOn with 95, and the Renault Fluence Z.E. with 86 units. The Nissan Leaf sold 57 units during the first half of 2012, and the Chevrolet Volt 24 units during the same period. A total of 900 electric cars were sold in 2012.

The Belgian government established a personal income tax deduction of 30% of the purchase price including VAT of a new electric vehicle, up to €9,510. Plug-in hybrids are not eligible. This tax incentive will end on December 31, 2012. There is also available a tax deduction up to 40% for investments in external recharging stations publicly accessible, to a maximum of €250. The Wallonia regional government has an additional €4,500 eco-bonus for cars registered before December 31, 2011.

Brazil

A total of 117 electric drive vehicles were registered in Brazil in 2012, and 383 during the first ten months of 2013. These figures include both conventional hybrid electric vehicles and plug-in electric cars. Registrations during 2013 represent a 0.01% market share of new cars sales in the country through October 2013. As of February 2013, there were only 70 electric cars registered in the country, of which, 68 are corporate cars, including 9 Nissan Leafs that are being demonstrated as taxis in São Paulo.

As of September 2015, there were 2,214 hybrid and electric vehicles registered in the state of São Paulo, including passenger cars (723), buses, motorcycles and mopeds. Of these, 1,274 electric-drive vehicles are registered in São Paulo city, of which, 387 are passenger cars.

In May 2010 the government put on hold a new policy to promote the introduction of electric cars, and a decision is still pending. Instead, plug-in electric cars and hybrid electric vehicles are subject to high taxes. As of February 2013 these included a 35% import tax, plus a 55% tax on industrialized products (IPI) imported outside Mercosur and Mexico, 13% contribution to social security (PIS/COFINS), and between 12 and 18% tax on transit of goods and services (ICMS), depending on the state, adding up to more than 120%. The tax burden results in an average final price of R$200,000 (US$100,000) for an electric car, and up to R$120,000 (US$60,000) for a regular hybrid. As of March 2014, the IPI for imported hybrid and electric vehicles varies between 13% to 25%, but the government is considering to exempt electric cars from IPI and reduce the tax to hybrids to 2%, the same levy paid by small cars manufactured in Brazil.

In March 2013, the first two Leafs out of a fleet of 15, were deployed in Rio de Janeiro to operate as taxis. This program is a partnership between the government of Rio de Janeiro City, Nissan do Brasil (NBA) and Petrobras Distribuidora. The first two electric taxis are available at the Santos Dumont airport stand, and charging is provided in two Petrobras service stations at the Lagoa Rodrigo de Freitas and in the Barra da Tijuca neighborhood. The program is part of the city's goal to reduce the emission of greenhouse gases by 16% by 2016 compared to emission levels of 2005.

In June 2013, Nissan and the government of the State of Rio de Janeiro signed a memorandum of understanding to study the possibility of manufacturing the Nissan Leaf in the state, and the entire infrastructure necessary for running electric cars. The state government would provide fiscal incentives during the investment phase, and the electric car will be exempted from import taxes.

In May 2014 São Paulo city passed a municipal law to exempt plug-in electric, hybrids and fuel cell vehicles from the city's driving restriction scheme (Portuguese: rodízio veicular). Also owners of electric drive cars with a purchase price up to R$150,000 (~ US$65,200) are entitled to a 50% reimbursement of the annual car ownership tax (IPVA) for five years up to a total of R$10,000 (~ US$4,300). The benefits went into effect in September 2015.

In September 2014 the BMW i3 became the first plug-in electric car available in the country for retail customers. Due to the high import taxes, the i3 pricing starts at R$225,900 (US$98,500) for the all-electric model and at R$235,950 (US$102,600) for the model with the range-extender. The i3 is available only in eight cities: São Paulo, Rio de Janeiro, Curitiba, Brasilia, Belo Horizonte, Salvador, Recife, and Joinville. As of June 2016, other plug-ins available for retail sales are the BMW i8 plug-in hybrid, starting at R$799,950 (US$235,280), and the Mitsubishi Outlander P-HEV, starting at R$204,990 (US$60,290).

According to Research and Markets, electric vehicles sales in the country are expected to reach 80,000 units annually in 2020. The research firm forecasts that the Brazilian electric vehicle market will likely be dominated by scooter and motorcycles.

Canada

Cumulative sales of plug-in electric cars in Canada passed the 20,000 unit mark in May 2016. The Chevrolet Volt, released in 2011, is the all-time top selling plug-in electric vehicle in the country, with cumulative sales of 6,387 units through May 2015, representing over 30% of all plug-in cars sold in the country. Ranking second is the Tesla Model S with 4,160 units sold through April 2016, followed by the Nissan Leaf with 3,692 units delivered as of May 2016. The Model S was the top selling plug-in electric car in Canada in 2015 with 2,010 units sold.

Quebec is the regional market leader in Canada, with about 11,000 plug-in electric cars registered as of September 2016, of which, 55% are plug-in hybrids. Registrations in the province totaled 3,100 units in 2015, representing a market share of 0.7% of new car sales, and 45% of total Canadian plug-in electric car sales that year.

A total of 1,969 plug-in cars were sold in 2012, up from 521 in 2011. Sales climbed 57.7% in 2013 to 3,106 units, and in 2014 were up 63.0% from 2013 to 5,062 units, reaching cumulative sales of 10,658 plug-in cars through December 2014. The market share of the plug-in electric car segment grew from 0.03% in 2011, to 0.12% in 2012, and reached 0.27% of new car sales in the country in 2014.

British Columbia is the only place in the country where it is legal to drive a low-speed vehicle (LSV) electric car on public roads, although it also requires low speed warning marking and flashing lights. Quebec is allowing LSVs in a three-year pilot project. These cars will not be allowed on the highway, but will be allowed on city streets.

In January 2009, Hydro-Québec and Mitsubishi signed an agreement to test 50 i-MiEV, at the time, the largest pilot test of electric cars in Canada ever. The test's goal was to allow a better understanding of winter usage of the technology. BC-Hydro and Mitsubishi had previously tested a three-vehicle fleet in British Columbia. In October 2010, Transport Canada and Mitsubishi Motor Sales of Canada announced a partnership to test the Mitsubishi i-MiEV. Transport Canada's ecoTECHNOLOGY for Vehicles (eTV) Program tested two i-MiEVs in government facilities and in a variety of real-world conditions. This program aim was to evaluate the i-MiEV road performance and range. Retail sales of the i-MiEV began in December 2011,

The Nissan Leaf roll-out in Canada began with fleet customers on July 29, 2011, and deliveries to individuals began in late September 2011. As of December 2011, the Leaf was sold only through 27 Leaf-certified dealers for the entire country, and sales are limited to customers who live within a 65 km (40 mi) radius of one of those dealers. Cumulative sales through December 2014 reached 1,965 units, and, as of December 2014, the Leaf ranked as the top selling all-electric car in the country.

Retail sales of the Tesla Model S began in 2012, with 95 cars delivered that year. A total of 638 units were sold in 2013, and cumulative sales reached 1,580 units through December 2014, allowing the Model S to rank as the second best selling all-electric car in the country. During 2014 the BMW i3, Kia Soul EV, BMW i8 and Porsche 918 Spyder were introduced in the Canadian market. The top selling models in 2015 were the Tesla Model S with 2,010 units, followed by the Chevrolet Volt with 1,463, the Nissan Leaf with 1,233, the BMW i3 with 367, and the Kia Soul EV with 318. In 2015, the Model S passed the Nissan Leaf as the all-time best selling all-electric car in Canada.

The all-electric Renault Twizy 40 low-speed quadricycle was certified by Transport Canada in March 2016, and is scheduled to be released on the Canadian market by mid-2016.

There were 18,451 highway legal plug-in electric cars registered in Canada as of December 2015, of which, 10,034 (54%) are all-electric cars and 8,417 (46%) are plug-in hybrids. These figures include some used imports from the U.S. Until 2014 Canadian sales were evenly split between all-electric cars (50.8)% and plug-in hybrids (49.2%). The following table presents new car sales by year of all the highway-capable plug-in electric cars available in Canada between 2011 and December 2015.

Canada's National Advanced Transportation Center, an electric vehicle advocacy group, will attempt in April 2014 to break the Guinness World Record for the largest electric-vehicle parade.

Purchase incentives for new plug-in electric vehicles (PEVs) were established in Ontario consisting of a rebate between CA$5,000 (4 kWh battery) to CA$8,500 (17 kWh or more) (~US$5,050 to US$8,650), depending on battery size, for purchasing or leasing a new PEV after July 1, 2010. The rebates will be available to the first 10,000 applicants who qualify. The province also introduced green-coloured licence plates for exclusive use of plug-in hybrids and battery electric vehicles. These unique green vehicle plates allow PEV owners to travel in the province's carpool lanes until 2015 regardless of the number of passengers in the vehicle. Also, owners are eligible to use recharging stations at GO Transit and other provincially owned parking lots.

Quebec began offering rebates of up to CA$8,000 (~ US$8,358) beginning on January 1, 2012, for the purchase of new plug-in electric vehicles equipped with a minimum of 4 kWh battery, and new hybrid electric vehicles are eligible for a CA$1,000 rebate. All-electric vehicles with high-capacity battery packs were eligible for the full CA$8,000 rebate, and incentives were reduced for low-range electric cars and plug-in hybrids. Quebec's government earmarked CA$50 million(US$52.3 million) for the program, and the maximum rebate amount was set to be slowly reduced every year until a maximum of CA$3,000 in 2015, but the rebates would continue until the fund runs out. There was also a ceiling for the maximum number of eligible vehicles: 10,000 for all-electric vehicles and plug-in hybrids, and 5,000 for conventional hybrids.

In November 2013, the provincial government announced its decision to earmark in 2014 an additional CA$65 million (~ US$45.5 million) to fund a three-year extension to the electric-vehicle rebate program. The maximum rebate was kept at CA$8,000, but a graded scale was introduced in order to spread the incentive over 10,000 or more vehicles. Quebec's government also set the goal to deploy 12,500 more electric vehicles in the province by 2017, consisting of 10,200 consumer cars, 325 taxis, and 2,000 government-fleet vehicles. Also, incentives were issued for "greening" 525 taxis, aimed to introduce 325 plug-in vehicles (275 plug-in hybrids and 50 all-electrics) and 200 conventional hybrids. The purchase incentives start at CA$20,000 for battery-electric taxis, CA$12,000 for plug-in hybrids, and CA$3,000 for conventional hybrids, with the rebate declining over time. The province planned to also subsidize the deployment of charging stations for taxis.

In October 2016, the National Assembly of Quebec passed a new zero emission vehicle legislation that obliges any carmaker who sells in the Canadian province more than 4,500 new vehicles per year over a three-year average, to offer their customers a minimum number of plug-in hybrid and all-electric models. Under the new law, 3.5% of the total number of autos sold by carmakers in Quebec have to be zero emissions vehicles (ZEV) starting in 2018, rising to 15.5% in 2020. A tradable credit system was created for those carmakers not fulfilling their quotas to avoid financial penalties. The quotas will be determined by Quebec's Ministry of Sustainable Development. Quebec became the first Canadian province to pass such legislation, joining ten U.S. states, including California, that have similar ZEV laws. Quebec aims to have 100,000 zero emission vehicles on the road by 2020. Initially, the provincial government set the goal in 2011 to have 300,000 plug-in vehicles on the roads by 2020.

The Government of British Columbia announced the LiveSmart BC program which will start offering rebates of up to CA$5,000 per eligible clean energy vehicle commencing on December 1, 2011. The incentives will be available until March 31, 2013 or until available funding is depleted, whichever comes first. Available funds are enough to provide incentives for approximately 1,370 vehicles. Battery electric vehicles, fuel cell vehicles and plug-in hybrids with battery capacity of 15.0 kWh and above are eligible for a CA$5,000 incentive. Also effective December 1, 2011, rebates of up to CA$500 per qualifying electric vehicle charging equipment will be available to B.C. residents who have purchased a clean energy vehicle.

China

The stock of new energy vehicles sold in China since 2011 passed the 500,000 unit milestone in March 2016, making the country the largest plug-in market in the world when all automotive segments are considered. Sales of domestically produced plug-in passenger cars achieved the 500,000 unit milestone in September 2016. Domestically produced cars account for 96% of new energy car sales in China. As of November 2016, China also has the world's largest fleet of light-duty plug-in electric vehicles, with about 600,000 plug-in cars. China overtook the U.S. and Europe in terms of annual sales of light-duty plug-in electric vehicles, both in calendar years 2015 and current-year-to-date through November.

The Chinese government adopted in 2009 a plan to leapfrog current automotive technology, and seize the growing new energy vehicle (NEV) market to become of the world leaders in manufacturing of all-electric and hybrid vehicles. The government's political support for the adoption of electric vehicles has four goals, to create a world-leading industry that would produce jobs and exports; energy security to reduce its oil dependence which comes from the Middle East; to reduce urban air pollution; and to reduce its carbon emissions. In June 2012 the State Council of the People's Republic of China published a plan to develop the domestic energy-saving and new energy vehicle industry. The plan set a sales target of 500,000 new energy vehicles by 2015 and 5 million by 2020. As sales were much lower than initially expected, and most of the deployed NEV stock has been purchased by the government for public fleets, new monetary incentives were issued in 2014, and the national government set a sales target of 160,000 units for 2014. Although the goal was not achieved, new energy vehicles sales in 2014 totaled 74,763 units, up 324% from 2013. The surge in demand continued in 2015, with a total of 331,092 NEVs sold in 2015, rising 343% year-on-year.

As of September 2016, cumulative sales of domestically produced highway legal new energy passenger cars totaled 521,649 units since 2005, excluding imports, representing 29.2% of the global light-duty plug-in stock. By the end of September 2016, China's stock of plug-in passenger cars reached the level of the American stock, and by November 2016, China’s cumulative total plug-in passenger vehicles sales had surpassed those of Europe, allowing China to become the market with the world's largest stock of light-duty plug-in vehicles. As of December 2016, sales of new energy passenger cars since 2010 totaled 632,371 units.

The Chinese government uses the term new energy vehicles (NEVs) to designate plug-in electric vehicles, and only pure electric vehicles and plug-in hybrid electric vehicles are subject to purchase incentives. Initially, conventional hybrids were also included. On June 1, 2010, the Chinese government announced a trial program to provide incentives for new energy vehicles of up to 60,000 yuan (~US$9,281 in June 2011) for private purchase of new battery electric vehicles and 50,000 yuan (~US$7,634 in June 2011) for plug-in hybrids in five cities. The government set the goal to raise the country's annual production capacity to 500,000 plug-in hybrid or all-electric cars and buses by the end of 2011, up from 2,100 in 2008. A mid-September 2013 joint announcement by the National Development and Reform Commission and finance, science, and industry ministries confirmed that the central government will provide a maximum of US$9,800 toward the purchase of an all-electric passenger vehicle and up to US$81,600 for an electric bus. The subsidies are part of the government's efforts to address China's problematic air pollution.

In April 2016 the Traffic Management Bureau under the Ministry of Public Security announced the introduction of new green license plates to identify new energy vehicles, as opposed to the country's standard blue plates. The objective of the special plates is to facilite police enforcement of the preferential policies that some local authorities apply to cleaner cars to help cut emissions and ease traffic. For example, central Beijing has in place a road space rationing scheme, a driving restriction regulation that bans conventional vehicles from entering the city for one day a week, but new energy vehicles are exempted from the restriction.

New energy vehicle sales in China totaled 951,447 units between January 2011 and December 2016. These figures include heavy-duty commercial vehicles such buses and sanitation trucks, and only accounts for vehicles manufactured in the country because imports are not subject to government subsidies. As of September 2016, the Chinese stock of plug-in electric vehicles consisted of about 540,000 all-electric vehicles (73.7%) and almost 193,000 plug-in hybrids (26.3%) sold since 2011. The country achieved record sales of 207,380 new energy passenger cars in 2015, allowing China to rank as the world's top selling plug-in passenger car country market in 2015, ahead of the United States, the leading market in 2014. A particular feature of the Chinese passenger plug-in market is the dominance of small entry level vehicles. In 2015, all-electric car sales in the mini and small segments (A-segment) represented 87% of total pure electric car sales, while 96% of total plug-in hybrid car sales were in the compact segment (C-segment). Sales of plug-in passenger cars achieved the 500,000 unit milestone in September 2016. Imported plug-in cars, such as Tesla Model S or BMW i3s are not included.

Over 160,000 heavy-duty new energy vehicles were sold between 2011 and 2015, of which, 123,710 (77.2%) were sold in 2015. Sales of commercial new energy vehicles in 2015 consisted of 100,763 all-electric vehicles (81.5%) and 22,947 plug-in hybrid vehicles (18.5%). The share of all-electric bus sales in the Chinese bus market climbed from 2% in 2010 to 9.9% in 2012, and was expected to be closed to 20% for 2013. As of December 2014, China had about 36,500 all-electric buses. The global stock of plug-in electric buses was estimated to be about 173,000 units as of December 2015, almost entirely deployed in China, the world's largest electric bus market. Of these, almost 150,000 were all-electric buses. The Chinese electric bus stock grew nearly sixfold between 2014 and 2015.

A total of 8,159 new energy vehicles were sold in China during 2011, including passenger cars (61%) and buses (28%). Of these, 5,579 units were all-electric vehicles and 2,580 plug-in hybrids. Electric vehicle sales represented 0.04% of total new car sales in 2011. Sales of new energy vehicles in 2012 reached 12,791 units, which includes 11,375 all-electric vehicles and 1,416 plug-in hybrids. New energy vehicle sales in 2012 represented 0.07% of the country's total new car sales. During 2013 new energy vehicle sales totaled 17,642 units, up 37.9% from 2012 and representing 0.08% of the nearly 22 million new car sold in the country in 2013. Deliveries included 14,604 pure electric vehicles and 3,038 plug-in hybrids. The top selling new energy car in China between 2011 and 2013 was the Chery QQ3 EV city car, with 2,167 units sold in 2011, 3,129 in 2012, and 5,727 in 2013.

New energy vehicle sales in China during 2014 totaled 74,763 units, consisting of 45,048 all-electric vehicles, and 29,715 plug-in hybrids. Of these, 71% were passenger cars, 27% buses, and 1% trucks. Pure electric vehicle sales increased 210% from 2013 while plug-in hybrid sales grew 880% from the previous year. The plug-in electric segment market share reached 0.32% of the 23.5 million new car sales sold in 2014. The BYD Qin ranked as the top selling plug-in electric car in China in 2014, with 14,747 units sold during the year, and became the country's top selling plug-in passenger car ever. The Qin was followed by the all-electrics Kandi EV with 14,398, Zotye Zhidou E20, with 7,341 units, and BAIC E150 EV with 5,234.

Domestically produced new energy vehicle sales in 2015 totaled a record 331,092 units, consisting of 247,482 all-electric vehicles and 83,610 plug-in hybrid vehicles, up 449% and 191% from 2014, respectively. Sales of plug-in passenger cars, excluding imports, totaled 176,627 units in 2015, allowing China to rank as the world's best-selling plug-in electric car country market in 2015. The plug-in electric passenger car segment market share rose to 0.84% in 2015, up from 0.25% in 2014. The top selling passenger models in 2015 were the BYD Qin plug-in hybrid with 31,898 units sold, followed by the BYD Tang (18,375), and the all-electrics Kandi EV (16,736), BAIC E150/160/200 EV (16,488), and the Zotye Z100 EV (15,467).

As of December 2015, with 31,898 units sold in 2015, the BYD Qin continued to rank as the all-time top selling plug-in passenger car in the country, with cumulative sales of 46,787 units since its introduction. The BYD Qin was the world's second best selling plug-in hybrid car in 2015 after the Mitsubishi Outlander P-HEV, and also ranked fifth among the world's top selling plug-in electric cars in 2015. BYD Auto ended 2015 as the world's best selling manufacturer of highway legal light-duty plug-in electric vehicles, with around 60,000 units sold, followed by Tesla Motors, with 50,580 units sold in 2015.

A total of about 289,000 new energy vehicles were sold during the first nine months of 2016, up 100.6% year-on-year, consisting of 216,000 pure electric vehicles, up 128.4% year-on-year, and 73,000 plug-in hybrid vehicles, up 47.2% from the same period the previous year. A total of 209,359 new energy passenger cars were sold in the first three quarters of 2016, up 122% year-on-year, consisting of about 145,000 all-electric cars, up 170% year-on-year, and about 65,000 plug-in hybrids, up 60% year-on-year. The plug-in segment market share totaled 1.08% of new car sales during the period.

Three BYD Auto models topped the Chinese ranking of best-selling new energy passenger cars in 2016. The BYD Tang plug-in hybrid SUV was the top selling plug-in car with 31,405 units delivered, followed by the BYD Qin (21,868) and the BYD e6 (20,605). As of December 2016, the BYD Qin, with 68,655 units sold since its inception, remains the all-time top selling plug-in electric car in the country. For a second year running BYD Auto was the world's top selling plug-in car manufacturer in 2016 with over 100,000 units delivered in China, ahead of Tesla Motors by about 30,000 units. The following table presents annual sales of the top selling new energy passenger cars by model with cumulative sales of about or over 3,000 units between 2011 and December 2015.

Chile

The Mitsubishi i-MiEV was launched in May 2011 at a price of CLP28,9 million (US$60,000). Initial availability was limited to 25 units. The first public quick charging station in the country was opened in April 2011 in preparation for the arrival of the first i-MiEV electric cars. As of August 2012, only 10 units have been sold.

In August 2014 Mitsubishi withdrew the i-Miev from the market due to its low sales volume and introduced the Outlander PHEV at a lower price of US$54,000. Later that year BMW introduced their "i" range with the i3 (US$55,000) and i8 (US$225,000) plug-in cars; while Renault launched their whole Zero Emission (Z.E.) lineup, including the Fluence Z.E. sedan, the Kangoo utility van and Zoe city car. The French brand sold 22 electric vehicles in their first month in the Chilean market.

Colombia

In 2013 the government established incentives to promote the adoption of plug-in electric vehicles. These include the exemption from the driving restriction scheme (Spanish: Pico y placa) in place in several Colombian cities such as Bogotá and Medellín. Also the government exempted all-electric and plug-in hybrid cars from import duties for three years, but limited to an annual quota of 750 plug-in cars of each type. All-electric vehicles are exempted 100% if the vehicle's "Free On Board" (FOB) value is less than US$52,000, while plug-ins with an internal combustion engine of less than 3 liters, the import duty was reduced to 5%.

The first South American all-electric taxi fleet made up of BYD e6 was launched at the beginning of 2013 in Bogotá, the capital city of Colombia after receiving operation approval by the Colombia Ministry of Transportation. These taxis are exempted from the driving restriction scheme. The program is an effort to improve the local air quality and set an example to other cities in the country. In September 2013 a total of 45 e6 taxis of this pilot program were delivered. The e6 fleet are part of Colombia's "BIOTAXIS Project." Another three BYD e6s were sent to Colceincias, Bogota's Tech, Science and Innovation Administration.

The BMW i3 was introduced in Colombia in late 2014 with pricing starting at COP$154.9 million (~US$49,000). As of June 2015, i3 sales totaled 25 units. The all-electric Renault Twizy quadracycle was introduced in the Colombian market in June 2015, at a price starting at COP$40 million (~US$12,650). Sales of the Mitsubishi Outlander P-HEV were scheduled to begin in September 2015.

Retail sales during 2014 totaled 52 pure electric cars and four plug-in hybrids. Lower sales than expected are the result of lack of charging infrastructure and the relatively high price of plug-in vehicles despite the reduced import duties. In addition to the charging stations used for the electric taxi fleet, there is only one public charging point in Bogotá. As of June 2015, a totalof 126 plug-in electric vehicles have been sold in the country, mostly to corporate customers, and consisting of 43 BYD e6s (taxis), 35 Mitsubishi i-MiEVs, 25 BMW i3s, 19 Renault Twizys, and four Nissan Leafs. A total of 203 Twizys had been sold as of October 2015, of which, 114 were sold in October, capturing a 0.1% market share of new car sales, and placing Colombia at the forefront of electric vehicle market in Latin America, along with Costa Rica.

Costa Rica

As of January 2015, the Costa Rican stock of electric drive vehicles consisted of 477 hybrid electric vehicles and 2,229 plug-in electric vehicles, including passenger cars, buses, motorcycles, quadricycles and electric bicycles. With a registered fleet of 1,399,082 units at the end of 2014, electric vehicles represent a 0.16% share of the Costa Rican stock of motor vehicles. Costa Rica is considered the leading country in electric vehicle adoption in Latin America.

The first electric car to go on sale in the country was the REVAi, introduced in March 2009. The REVAi, powered by lead–acid batteries, sold 10 units during its first month in the market, 5 by corporate clients and 5 by individual customers. The Mitsubishi i MiEV was launched in February 2011, with initial availability limited to 25 to 50 units. According to Mitsubishi, Costa Rica was selected at the first market launch in the Americas due to its environmental record, despite the lack of government incentives for purchasing electric cars.

As of February 2012, only a total of 61 all-electric cars had been registered in the country, with 31 purchased by individual customers, and 30 sold to embassies, universities, and corporate clients. Lack of charging infrastructure, there are no public charging stations in the country, and the need to introduce government incentives to reduce purchase taxes, were cited as the main causes for the low volume sales. Nissan signed an agreement with the Costa Rican government in February 2012 to implement a pilot program as part of the introduction of the Nissan Leaf in the country. A task force was created through the agreement to assess the infrastructure requirements for the deployment of electric cars and the definition necessary government incentives for consumers to purchase electric cars. Nissan planned to start Leaf sales by late 2013.

In January 2013 BYD Auto signed an agreement with the Costa Rican Ministry of Environment and Energy to deploy 200 BYD e6 electric cars for use as "green taxis." The electric cars will be exempt from import duties and the government has agreed to deploy charging stations in strategic locations in the city of San José. Retail sales of the BYD Qin plug-in hybrid began in Costa Rica in November. Retail sales of the Mitsubishi Outlander P-HEV began in March 2015. The BMW i3 was released in the Costa Rican market in September 2016. Pricing of the i3 94 A·h starts at US$67,500, since the bill to eliminate import duties and other taxes is still pending approval in Congress.

Plug-in car sales totaled 108 units in 2016, representing a market share of 0.2%, the highest among Latin American countries. The top selling models were The Mitsubishi Outlander P-HEV with 60 units, the BMW i3 with 22, and the BMW X5 eDrive with 15.

Initially, the only existing fiscal incentive for the purchase of electric vehicles was the exemption from the consumption tax implemented in 2006, while conventional vehicles pay a 30% rate. A bill introduced in 2010 to reduce purchase and import duty taxes did not move forward in the Legislative Assembly. Since October 2012, electric cars are exempted from the driving restriction implemented by plate number to restrict access to downtown San José, the country's capital.

In October 2015 a new bill was introduced into the Legislative Assembly, called, "Incentives and Promotion of the Electric Transport", which would eliminate all taxation on all-electric and plug-in hybrid vehicles including import duties, consumption tax, and sales tax, which would result in a 44% reduction of the current retail price. The bill also proposes free parking at parking meters for electric vehicles, free designated parking at private and public facilities, and a five-year exemption from the annual road tax. The bill set a cap of 100,000 units to benefit from the law and the benefits would be in place for five-years, whichever comes first. Vehicles eligible for the tax exemptions includes passenger cars, passenger vans, motorcycles, buses and trains.

The bill also promotes the development of charging infrastructure with goal to provide charging points every 80 km (50 mi) on national highways and every 120 km (75 mi) on the municipal road network. The proposed law also mandates all government agencies to replace 10% of their auto fleets with plug-in electric vehicles; and public transportation and taxi services are mandated to slowly replace their fleets with electric vehicles, with a minimum of 10% of plug-in electric cars for new taxi cab medallions ("ecotaxis"). In addition, the law would provide income tax incentives for corporations that replace with plug-ins at least 10% of their fleets, with a minimum of three company cars.

Croatia

As of November 2015, there were 440 electric cars registered in Croatia. There are 82 charging stations available in 32 cities and towns as of February 2016. In 2014, the Croatian government subsidized the purchase of electric cars with HRK 70,000 (c. €9300) for a fully electric vehicle, HRK 50,000 (c. €6600) for a plug-in hybrid, and HRK 30,000 (c. €4000) for other hybrid vehicles.

A small city car called XD assembled by Croatian company DOK-ING. The name XD comes from oddly shaped rear lights ("X" shaped) and "D" beginning letter of the company's name. The XD can travel over 250 km on a single charge with Lithium-ion batteries. Car's base-cost will be only €10,000. Serial production is predicted to start mid-2012.

Denmark

As of December 2015, there were around 4,000 electric cars in Denmark. Denmark is the second largest European market for light-duty plug-in electric commercial vehicles or utility vans, with over 2,600 plug-in electric vans sold in 2015, representing an 8.5% market share of all vans sold in the country. Most of the van sold in the Danish market are plug-in hybrids, accounting for almost all of the plug-in hybrid van sales across the European Union. As of 2014, the country generated about a third of its electric power from wind energy, but some of it is exported to hydropower storage in Norway and elsewhere because there is currently no way for utilities to store the excess power inside Denmark.

Better Place partnered with Denmark's leading energy company, Dong Energy, in a €103 million (770 million Danish Kroner) investment to introduce electric cars and infrastructure to Denmark. With the Better Place model, Dong hoped to leverage the existing electric grid and electric vehicle batteries to harness and store the abundance of wind-generated power and distribute appropriately for transportation consumption. The network commercial launch was scheduled for late 2011.

The first battery switch station in Denmark, out of 20 planned to be deployed across the country until March 2012 as part of the network of charging infrastructure, was unveiled in June 2011 at Gladsaxe, near Copenhagen. Sales of the Renault Fluence Z.E., the electric car selected for the network, began in late 2011, and 234 units were sold in Denmark between 2012 and April 2013. As of December 2012 there were 17 battery swapping stations fully operational in the country enabling Danish customers to drive anywhere across the country in an electric car. On 26 May 2013, and following the decision of the Board of Directors of Better Place's global company, Better Place Danmark A/S decided to begin bankruptcy proceedings. Some of these stations were converted to hydrogen-producing fuel stations for hydrogen cars such as the Toyota Mirai.

A taxi demonstration project in Copenhagen, including three Fluences and a Nissan Leaf, began in May 2013 scheduled to run through the second quarter of 2015. The demonstration was supported with a 12.5 million kroner government grant.

Estonia

As of February 2015, a total of 1,188 plug-in electric vehicles were registered in Estonia. As of December 2013, there were 757 all-electric cars registered in Estonia, up from 619 pure electric cars registered through 2012. With a total of 506 pure electric cars during 2012, Estonia ranked second after Norway in terms of EV penetration of the total auto fleet, with 1 electric car for every 1,000 registered cars. However, the market share of the all-electric car segment dropped from 2.39% in 2012 to 0.69% in 2013, as registrations decreased to 138 units in 2013. The top selling electric car in 2013 was the Nissan Leaf with 95 units sold. In the year 2015, the number of electric cars sold in Estonia was 34. The figure is low compared to other advanced economies in the EU, and low sales are atrributed to lack of government subsidies after the carbon credit scheme was depleted.

Estonia is the first country that completed the deployment of an EV charging network with nationwide coverage, with fast chargers available along highways at a minimum distance between 40 to 60 km (25 to 37 mi). As of December 2012, the nationwide network consisted of 165 fast chargers fully financed by the Estonian government, with a separation on highways of no more than 60 km (37 mi) with a higher density on urban areas. These public fast chargers are dual units, with a 50 kW CHAdeMO port and a 22 kW AC plug.

On March 3, 2011, the government of Estonia confirmed the sale to Mitsubishi Corporation of 10 million carbon dioxide credits in exchange for 507 i-MiEV electric cars. The deal also included funding to build 250 fast charging stations in larger towns and main highways by 2013, and subsidies for the first 500 private buyers of any electric car approved by the European Union. The first 50 i-MiEVs were delivered in October 2011 and this official fleet was assigned for use by municipal social workers. During the first round of allocations of the electric cars, municipalities requested only 336 of the 507 i-MiEVs available. Several local authorities stated concerns about the electric car performance during harsh winter conditions, maintenance costs and the i-MiEV' reliability on difficult countryside roads.

Finland

As of October 2016, there were about 2,250 plug-in electric cars on Finish roads. Registrations in 2015 totaled 658 plug-in cars, up from 445 in 2014. During the first three quarters of 2016 plug-in electric car registrations totaled 1,017 units, consisting of 163 pure electric cars and 854 plug-in hybrids. Plug-in electric car sales have been slow primarily due to the limited range of pure electric cars and the high purchase prices of plug-in models in general.

In November 2016, the government set the goal to have 250,000 plug-in electric cars and 50,000 biogas cars on the road by 2030. To achieve this goal the government is considering to earmark €100 million in subsidies for electric and biogas cars between 2017 and 2020. The transport ministry is considering two options, a €4,000 purchase subsidy available for the first 25,000 emissions-free cars sold, or to overhaul automotive taxes to encourage people to buy clean cars. These goals are part of the Finnish government efforts to meet Finland's climate commitments under the 2015 Paris Agreement.

Electric cars are also present in Finland, with companies such as Valmet Automotive (Fisker Karma and Garia A/S electric golf cart production) and also agreement of Think City car production, Fortum (concept cars and infrastructure), Kabus (hybrid buses; part of Koiviston Auto Oy), BRP Finland (part of Bombardier Recreational Products), Lynx (snowmobile), Patria (military vehicles), European Batteries (Li-ion battery plant in Varkaus), Finnish Electric Vehicles (battery control systems), ABB, Efore, Vacon (electric motor technology production), Ensto (production of charging units), Elcat (electric vehicle production since the 1980s), production of electric car accessories, Suomen Sähköauto Oy (produces small electric cars), Oy AMC Motors Ltd. (produces and designs small electric cars), Raceabout (specialist electric sport car with very few sales), Gemoto skooters from Cabotec, Resonate's Gemini and Janus Scooters, Moto Bella Oy, Axcomotors, Randax, Visedo.

Research related to electric cars is in progress at the VTT Technical Research Centre of Finland and Tekes.

Sharing knowledge is also in progress: in Helsinki the Electric Motor Show was held from 10 to 12 September 2010. The show will feature only cars, motorcycles, scooters, mopeds and microcars and components for them. Year 2010 is second year for Helsinki Electric motor show. The plan is to hold the show annually.

Basic charging infrastructure is already available all over Finland, used for engine pre-warming in the cold winters. Because of its climate – cold winters and warm summers – Finland is considered a convenient "test laboratory" for electric cars and many companies have made field tests in Finland. It has been said in Autobild 08/09 magazine that Fortum is developing the high-speed charging system. With a new kind of three-phase charging method electric cars can be charged in four minutes. A commercial product should be ready by 2011.

There are also mines and metal refineries for lithium alloy in Finland. At the moment there are several mining projects under way such as the Keliber project.

There are several electric car organisations in Finland, such as the Electric Vehicle Association of Finland and Electric Vehicles Finland.

There is also a non-commercial electric car conversion organisation called Electric Cars - Now! that converts standard Toyota Corollas into Li-ion battery-powered electric cars. As of August 2009, more than 1,700 pre-orders for conversion Toyotas have been placed. The speciality in the Electric Cars - Now! project is that it is an open source project: anyone can start similar production anywhere they want, the benefits for the customer being open-source spare part coding and so on. The ideas and design are freely available from the Electric Cars - Now! organisation.

France

As of December 2016, a total of 108,065 light-duty plug-in electric vehicles have been registered in France, making the country the third largest European plug-in country market and the sixth largest in the world. As of September 2016, and accounting for registrations since 2010, the plug-in electric stock consisted of 61,686 all-electric passenger cars, 24,696 all-electric utility vans, and 12,857 plug-in hybrids. As of December 2015, France ranked as the country with the world's largest market for light-duty electric commercial vehicles or utility vans. Nearly half of the vans sold in the European Union are sold in the country as a result of a national purchase incentive scheme, which French companies have embraced. The market share of all-electric utility vans reached a market share of 1.22% of new vans registered in 2014, and 1.30% in 2015.

All-electric car registrations increased from 184 units in 2010 to 2,630 in 2011. Sales in 2012 increased 115% from 2011 to 5,663 electric cars, making France the world's fourth largest all-electric country market in 2012. Registrations reached 8,779 electric cars in 2013, up 55.0% from 2012, and the all-electric market share of total new car sales went up to 0.49% from 0.3% in 2012. In addition, 5,175 electric utility vans were registered in 2013, up 42% from 2012, representing a market share of 1.4% of all new light commercial vehicles sold in 2013. Sales of all-electric passenger cars and utility vans totaled 13,954 units in 2013, France was the leading European light-duty all-electric market in 2012 and 2013.

All-electric car sales in the French market for 2011 were led by the Citroën C-Zero with 645 units followed by the Peugeot iOns with 639 vehicles. During 2012, all-electric car registrations in France were led by the Bolloré Bluecar with 1,543 units. The Renault Kangoo Z.E. was the top selling utility electric vehicle with 2,869 units registered in 2012, capturing 82% of the segment sales. Registrations of pure electric cars in 2013 were led by the Renault Zoe with 5,511 units representing 62.8% of total pure electric car sales. Registrations of all-electric light utility vehicles were led by the Renault Kangoo Z.E. with 4,174 units, representing 80.7% of the segment sales. Registrations of plug-in hybrids in 2012 were led by the Toyota Prius PHV with 413 units. During 2013 the Prius PHEV continuing as the plug-in hybrid segment leader with 393 units registered. When plug-in hybrids sales in 2013 are accounted for, a total of 14,762 plug-in electric vehicles were registered in France in 2013, making the country the second largest plug-in market in Europe after the Netherlands.

A total of 15,045 all-electric cars and vans were registered in 2014, up 7.8% from 2013. Registrations of all-electric cars in 2014 passed the 10,000 unit mark for the first time (10,560). This figure does not include BMW i3 with range extender. All-electric utility vans continued to be a significant share of the all-electric segment, with 4,485 units registered in 2014. All-electric cars captured a 0.59% market share, while light-duty electric vehicles reached a 1.22% market share of their segment. The slow down in sales during the first half of 2014, allowed Norway to end 2014 as the top selling European market in the all-electric segment, with France ranking second. The Zoe continued leading plug-in electric vehicle registrations in 2014, with 5,970 units registered, followed by the Kangoo Z.E. van with 2,657 registrations.

Plug-in hybrid car registrations totaled 1,527 units in 2014, almost doubling registrations from a year earlier. Plug-in hybrid sales were driven by the Mitsubishi Outlander P-HEV, with 820 units registered in 2014, representing 54% of the segment registrations in 2014. Between 2012 and 2014, cumulative plug-in hybrid registrations reached 2,985 units, rising cumulative French registrations of plug-in electric vehicles since 2005 to 46,590 units, just ahead of the Netherlands (45,020), and making France the European country where there were more plug-in electric vehicles on the road as of December 2014.

A total of 27,701 light-duty electric vehicles were registered in France in 2015, consisting of 17,779 all-electric cars, 4,916 electric vans, and 5,006 plug-in hybrid cars. All-electric cars captured a 0.9% market share of new passenger car registrations in 2015, and the entire plug-in passenger car market achieved a market share of 1.17%. All-electric car registrations in 2015 continued to be led by the Renault Zoe (10,406), the electric utility van segment was led by the Kangoo Z.E. (2,836), and the plug-in hybrid segment was led by the Volkswagen Golf GTE (1,687). A total of 33,774 light-duty electric vehicles were registered in France in 2016, making the country the third largest in Europe in 2016 after Norway and the UK. France was the top selling European market in the light-duty all-electric segment with 27,307 units registered, up 23% from 2015. During the first three quarters of 2016, registrations consisted of 16,091 all-electric cars, 3,991 electric vans, and 4,858 plug-in hybrid cars. The Renault Zoe continued as the top selling plug-in electric car with 8,163 units during this period. The plug-in passenger car market achieved a market share of 1.57% of new car sales during the first nine months of 2016. As of September 2016, the Renault Zoe is the all-time best-selling plug-in electric vehicle in the French market with 30,098 units registered since 2012. Ranking second is the Kangoo Z.E. utility van with 15,032 units registered since 2010. As of September 2016, the all-time top selling plug-in hybrid is the Volkswagen Golf GTE with about 2,500 units, followed by the Mitsubishi Outlander PHEV with almost 2,000 registered. The stock of light-duty plug-in electric vehicles registered in France passed the 100,000 unit milestone in October 2016.

The following table presents registrations of the top selling light-duty highway-capable electric vehicles by type (all electric cars and vans, and plug-in hybrids) with detailed all-electric car registrations by model between 2010 and December 2015.

Since 2008 France has a bonus-malus system offering a financial incentive, or bonus, for the purchase of cars with low carbon emissions, and a penalty fee, or malus, for the purchase of high-emission vehicles. The fee schedule is updated each year. From April 1, 2015, the French government introduced a super-bonus, increasing the financial incentive to a cumulative total of €10,000, consisting of the regular bonus of €6,300 for purchasing a pure electric car, plus up to €3,700 for customers scrapping a diesel-powered car in circulation before 1 January 2001. In the case of plug-in hybrids with CO2 emission levels between 21 and 60 g/km, the purchase bonus was €4,000 plus the scrapping premium of €3,700.

Effective January 4, 2016, the €6,300 purchase bonus, limited to 27% of the purchase price, for vehicles emitting up to 20 g/km was maintained. This bonus corresponds to pure electric vehicles and those equipped with a range extender. Vehicles emitting between 21 and 60 g/km are entitled to a €1,000 bonus. This bonus corresponds to the majority of plug-in hybrids. The €10,000 super-bonus for the purchase or lease of a new all-electric car was maintained. The scrappage bonus for the purchase of pure electric cars was maintained at €3,700, while the bonus for plug-in hybrid car emitting between 21 and 60 g/km was set at €2,500. As of September 2016, the scrappage bonus of €3,700 for trading in old diesel-powered cars has been granted to more than 10,000 purchase transactions.

Germany

As of September 2016, a total of 66,674 plug-in electric cars have been registered in Germany since 2010. The country is the largest passenger car market in Europe, however ranks as the fifth largest plug-in market in Europe as of September 2016. About 80% of the plug-in cars registered in the country through September 2016 were registered since January 2014. The official German definition of electric vehicles changed at the beginning of 2013, before that, official statistics only registered all-electric vehicles because plug-in hybrids were accounted together with conventional hybrids. As a result, the registrations figures for 2012 and older do not account for total new plug-in electric car registrations. As of November 2014, the country had 4,800 public charging stations.

The fleet of electric car registered in the country increased from 1,558 units in 2009 to 2,307 in 2010. The electric car stock in 2011 increased 96.8% from 2010 to 4,541 units registered, and up 56.7% from 2011 to 7,114 units in 2012, reaching 12,156 registered cars on 1 January 2014. At the beginning of 2014 registrations of plug-in electric vehicles represented a 0.028% market share of all passenger vehicles registered in Germany. The plug-in hybrid segment in the German market in 2014 experienced an explosive growth of 226.9% year-over-year, and the overall plug-in segment increased 75.5% from a year earlier. The surge in sales continued in 2015, the plug-in hybrid segment grew 125.1% year-over-year, while the all-electric segment climbed 91.2% from the previous year.

During 2011, a total of 2,154 pure electric cars were registered in the country, up from 541 units in 2010. All-electric car sales for 2011 were led by the Mitsubishi i-MiEV family representing 50.6% of all electric car registrations in 2011. Plug-in hybrid registrations totaled 266 units in 2011, led by the Opel Ampera (241), for a total of 2,420 plug-in electric vehicles registered in 2011. A total of 2,956 all-electric vehicles were registered in Germany during 2012, a 37.2% increase over 2011. When 901 registered plug-in hybrids are accounted for, 2012 registrations climb to 3,857 units, and sales of plug-in electric car represented a 0.12% market share of new passenger vehicles sold in the country in 2012. Registrations of plug-in electric vehicles were led by the Opel Ampera extended-range electric car with 828 units, followed by the Smart electric drive with 734 units. In addition, a total of 2,413 Renault Twizys were sold during 2012, making Germany the top selling European market for the electric quadricycle.

A total of 7,436 new plug-in electric cars were registered in Germany in 2013, consisting of 6,051 all-electric cars and 1,385 plug-in hybrids. Total registrations at the end of 2013 reached 12,156 units. The Smart electric drive led new plug-in car registrations in 2013 with 2,146 units, followed by Renault Zoe with 1,019. Registrations of plug-in electric cars totaled 13,049 units in 2014, consisting of 8,522 all-electric cars and 4,527 plug-in hybrids. The plug-in segment achieved a market share of 0.4% of new car sales that year. The BMW i3 ended 2014 as the top selling plug-in electric car with 2,233 units registered.

Plug-in hybrid registrations totaled 11,101 units in 2015, up 145% from 2014, and all-electric cars totaled 12,363 units registered, up 45% from 2014. Combined sales of the two segments totaled 23,464 units. The plug-in segment achieved a market share of 0.7% of new car sales that year, up from 0.4% in 2014. The German monthly plug-in market share passed the 1% mark for the first time ever in December 2015, with an all-time record market share of 1.28% of new car registrations that month. Also, with 3,176 plug-in cars registered in December 2015, the German market achieved the highest monthly sales volume ever. The top selling models in 2015 were the Kia Soul EV (3,839), followed by the BMW i3 (2,271), and the Mitsubishi Outlander P-HEV (2,128).

During the first three quarters of 2016, sales of plug-in hybrids surpassed sales of all-electric cars for the first time in the country. A total of 17,074 units were registered, consisting of 7,678 all-electric cars and 9,396 plug-in hybrids. The plug-in segment achieved a market share of 0.7% of new car sales. The top selling models during the first eight months of 2016 were the Renault Zoe (1,836), BMW i3 (1,237), Tesla Model S (978), Audi A3 e-tron (908), and Volkswagen Golf GTE (852). The introduction of the purchase bonus did not produce immediate effect on plug-in car sales until September 2016, when registrations peaked to 3,061 units, consisting of 1,641 all-electric cars, up 76.6% year-on-year, and 1,420 plug-in hybrids, up 36.8% year-on-year. Combined registrations of both type of plug-in accounted for 1.1% of new car registrations, allowing the German plug-in market share to pass the 1% mark for the first time during 2016.

The following table presents registrations of the top selling highway-capable plug-in electric cars available for retail customers by year between 2010 and June 2014.

Under its National Plattform for Electric Mobility, Chancellor Angela Merkel set in 2010 the goal to bring one million electric vehicles on German roads by 2020. Initially, the government also announced that it would not provide subsidies to the sales of plug-in electric cars but instead it would only fund research in the area of electric mobility. The Bundestag passed the Electric Mobility Act in March 2015 authorizing local government to grant non-monetary incentives, which are not mandatory. The benefits include measures to privilege battery-powered cars, fuel cell vehicles and some plug-in hybrids, just like Norway does, by granting local governments the authority to allow these vehicles into bus lanes, and to offer free parking and reserved parking spaces in locations with charging points. The law also provides issuing special license plates for electric vehicles to allow proper identification to avoid abuses of these privileges.

According to the fourth progress report of the German National Platform for Electric Mobility, only about 24,000 plug-in electric cars are on German roads by the end of November 2014, well behind the target of 100,000 unit goal set for 2014. As a result, Chancellor Angela Merkel recognized in December 2014 that the government has to provide more incentives to meet the goal of having one million electric cars on the country's roads by 2020. At the beginning of 2016, German politicians from the three parties in Mrs. Merkel's ruling coalition and auto executives began talks to introduce a subsidy for green car buyersto boost sales of electric and plug-in hybrid cars.

An incentive scheme to promote plug-in electric vehicle adoption was approved in April 2016 with a budget of €1 billion (US$1.13 billion). A total of €600 million (US$678 million) is reserved for the purchase subsidies, which are expected to run until all the money is disbursed, estimated to last until 2019 at the latest. Another €300 million (US$339 million) are budgeted to finance the deployment of charging stations in cities and on autobahn highway stops. And another €100 million (US$113 million) would go toward purchasing electric cars for federal government fleets. The program is aimed to promote the sale of 400,000 electric vehicles. The cost of the purchase incentive is shared equally between the government and automakers. Electric car buyers get a €4,000 (US$4,520) discount while buyers of plug-in hybrid vehicles get a discount of €3,000 (US$3,390). Premium cars, such as the Tesla Model S and BMW i8, are not eligible to the incentive because there is a cap of €60,000 (US$67,800) for the purchase price. Only electric vehicles purchased after 18 May 2016 are eligible for the bonus and the owner must keep the new electric car at least nine months. The same rule applies for leasing.

As of September 2016, BMW, Citroën, Daimler, Ford, Hyundai, Kia, Mitsubishi, Nissan, Peugeot, Renault, Toyota, Volkswagen, and Volvo had signed up to participate in the scheme. The online application system to claim the bonus went into effect on 2 July 2016. As of September 2016, a total of 26 plug-in electric cars and vans are eligible for the purchase bonus. According to the Federal Office of Economics and Export Control (BAFA), a total of 4,451 applications have been made for the government subsidy for the purchase of a plug-in electric model as of 30 September 2016, consisting of 2,650 all-electrics and 1,801 plug-in hybrids.

Hong Kong

As of September 2016, there were 6,298 plug-in electric vehicles on the roads in Hong Kong, up from 3,253 in October 2015, and from less than 100 units in 2010. As of September 2016, plug-in cars represented 1.1% of Hong Kong's total car registered stock of 579,104 units. The plug-in segment market share achieved 4.8% of new car sales in Hong Kong in 2015.