| ||

The 2008 housing and financial crashes caused the worst economic crisis since the Great Depression under George W. Bush's administration.

Contents

- Fiscal policy

- Tax cuts

- 2001 tax cut

- 2003 cuts and later

- Effect of policies on federal budget deficit and national debt

- Trade policy

- Efforts to reform Social Security

- Regulatory philosophy

- Fannie Mae and Freddie Mac

- Sarbanes Oxley Act

- Regulation of the financial sector

- Unemployment

- Income disparity

- Economic growth

- 2008 economic crisis and recession

- Income inequality

- References

During his first term (2001–2005), he sought and obtained Congressional approval for tax cuts: the Economic Growth and Tax Relief Reconciliation Act of 2001, the Job Creation and Worker Assistance Act of 2002 and the Jobs and Growth Tax Relief Reconciliation Act of 2003. These acts decreased all tax rates, reduced the capital gains tax, increased the child tax credit and eliminated the so-called "marriage penalty", and were set to expire in 2011.

The last two years of his presidency were characterized by the worsening subprime mortgage crisis, which resulted in government intervention to bail out damaged financial institutions and a weakening economy.

The U.S. national debt grew significantly from 2001 to 2009, both in dollar terms and relative to the size of the economy (GDP), due to a combination of tax cuts and wars in both Afghanistan and Iraq. Budgeted spending under President Bush averaged 19.9% of GDP, similar to his predecessor President Bill Clinton, although tax receipts were lower at 17.9% versus 19.1%.

Fiscal policy

During the George W. Bush administration, the federal government spending was increased from $1789 billion to $2983 billion (70%) but the revenues were only increased from $2025 billion to $2524 billion (25%). Individual income tax revenues were increased by 14%, corporate tax revenues by 50%, customs and duties by 40%. Discretionary defense spending was increased by 107%, discretionary domestic spending by 62%, Medicare spending by 131%, social security by 51%, and income security spending by 130%. Cyclically adjusted, revenues rose by 35% and spending by 65%.

Also proportionally Bush increased government spending more than any predecessor since Lyndon B. Johnson.

Tax cuts

Between 2001 and 2003, the Bush administration instituted a federal tax cut for all taxpayers. Among other changes, the lowest income tax rate was lowered from 15% to 10%, the 27% rate went to 25%, the 30% rate went to 28%, the 35% rate went to 33%, and the top marginal tax rate went from 39.6% to 35%. In addition, the child tax credit went from $500 to $1000, and the "marriage penalty" was reduced. Since the cuts were implemented as part of the annual congressional budget resolution, which protected the bill from filibusters, numerous amendments, and more than 20 hours of debate, it had to include a sunset clause. Unless congress passed legislation making the tax cuts permanent, they were to expire in 2010.

House Minority Leader Richard Gephardt said the middle class will not benefit enough from the tax cut and the wealthy will reap unfairly high benefits. Senate Majority Leader Tom Daschle argued that the tax cut is too large, too generous to the rich and too expensive.

Some policy analysts and non-profit groups such as Center on Budget and Policy Priorities, have attributed some of the rise in income inequality to the Bush Tax Cuts. Others, such as the Tax Policy Center attribute much of the rise to changes in technology, trade and immigration, and a decline in labor unions, among others. In February 2007, President Bush addressed this rise of inequality, saying "The fact is that income inequality is real -- it's been rising for more than 25 years. The reason is clear: We have an economy that increasingly rewards education and skills because of that education."

However, prominent social scientists, such as economist Paul Krugman and political scientist Larry Bartels, have pointed out that education fails to explain the rising gap between the top 1% and the bottom 99%, which has been the site of most increases in inequality. They point out that if education were to blame, a larger group would be pulling ahead of the rest of the population, and that wages of highly educated earners have fallen far behind those of the very rich. Furthermore, they point out that the U.S. is unique among developed countries in seeing such a sharp rise in inequality, while the composition of its economy and labor force is not - if education were to blame, one would expect the same trend across all post-industrial nations. Bartels has asserted that the skill base explanation is partially used as it is more "comforting" to blame impersonal forces, rather than policies.

The tax cuts had been largely opposed by American economists, including the Bush administration's own Economic Advisement Council. In 2003, 450 economists, including ten Nobel Prize laureate, signed the Economists' statement opposing the Bush tax cuts, sent to President Bush stating that "these tax cuts will worsen the long-term budget outlook... will reduce the capacity of the government to finance Social Security and Medicare benefits as well as investments in schools, health, infrastructure, and basic research... [and] generate further inequalities in after-tax income."

The Bush administration had claimed, based on the concept of the Laffer Curve, that the tax cuts actually paid for the themselves by generating enough extra revenue from additional economic growth to offset the lower taxation rates. However, income tax revenues in dollar terms did not regain their FY 2000 peak until 2006. Through the end of 2008, total federal tax revenues relative to GDP had yet to regain their 2000 peak.

When asked whether the Bush tax cuts had generated more revenue, Laffer stated that he did not know. However, he did say that the tax cuts were "what was right," because after the September 11 attacks and threats of recession, Bush "needed to stimulate the economy and spend for defense."

In terms of increasing inequality, the effect of Bush's tax cuts on the upper, middle and lower class is contentious. Some economists argue that the cuts have benefited the nation's richest households at the expense of the middle and lower class, while libertarians and conservatives have claimed that tax cuts have benefitted all taxpayers. Economists Peter Orszag and William Gale described the Bush tax cuts as reverse government redistribution of wealth, "[shifting] the burden of taxation away from upper-income, capital-owning households and toward the wage-earning households of the lower and middle classes."

This would suggest that the Bush tax cut policy was highly regressive, but some writers, notably at the Koch-funded Tax Foundation, argue that the concept of a progressive tax should be detached from its traditional association with income redistribution, noting that since the share of income of the most wealthy rose so much during the period, their share of the total tax burden went up even as their tax rates went down. Between 2003 and 2004, following the 2003 tax cuts, the share of after-tax income going to the top 1% rose from 12.2% in 2003 to 14.0% in 2004. (This followed the period from 2000 to 2002, where after-tax incomes declined the most for the top 1%.) At the same time, the share of overall tax liabilities of the top 1% increased from 22.9% to 25.3%,. In this way, they claim, the tax system actually became more progressive between 2000 and 2004.

2001 tax cut

Facing opposition in Congress for an initially proposed $1.6 trillion tax cut (over ten years), Bush held town hall-style public meetings across the nation in 2001 to increase public support for it. Bush and some of his economic advisers argued that unspent government funds should be returned to taxpayers. With reports of the threat of recession, Federal Reserve Chairman Alan Greenspan said tax cuts could work but must be offset with spending cuts.

Bush argued that such a tax cut would stimulate the economy and create jobs. In the end, five Senate Democrats crossed party lines to join Republicans in approving a $1.35 trillion tax cut program — one of the largest in U.S. history.

2003 cuts and later

Economists, including the Treasury Secretary at the time Paul O'Neill and 450 economists, including ten Nobel prize laureates, who contacted Bush in 2003, opposed the 2003 tax cuts on the grounds that they would fail as a growth stimulus, increase inequality and worsen the budget outlook considerably (see Economists' statement opposing the Bush tax cuts). Some argued the effects of the tax cuts have been as promised as revenues actually increased, the recession of 2000 ended, and the economy flourished.

Critics indicate that the tax revenues would have been considerably higher if the tax cuts had not been made. Income tax revenues in dollar terms did not regain their FY 2000 peak until 2006. The Congressional Budget Office (CBO) has estimated that extending the 2001 and 2003 tax cuts (which were scheduled to expire in 2010) would cost the U.S. Treasury nearly $1.8 trillion in the following decade, dramatically increasing federal deficits.

The Tax Policy Center reported that the various tax cuts under the Bush administration were "extraordinarily expensive" to the Treasury:

The congressional Joint Committee on Taxation calculated a score, or revenue change, for each of the seven major tax cut bills passed during the Bush administration: their combined cost sums to over $2.0 trillion from 2001 to 2017. Extending these tax cuts into the future would carry a similar cost: the Congressional Budget Office (CBO) recently estimated the cost of extending them through 2017 at $1.9 trillion, not counting the costs of debt service, and not counting the cost of indexing the alternative minimum tax (AMT) to inflation to prevent it from undoing much of the cuts...if one takes into account the direct effects of the tax cuts, extra interest payments, and the extra "interaction" cost of reforming the AMT while extending the Bush tax cuts, the combined cost of extending the tax cuts through 2017 adds up to $2.8 trillion.

See Income inequality: Tax cuts

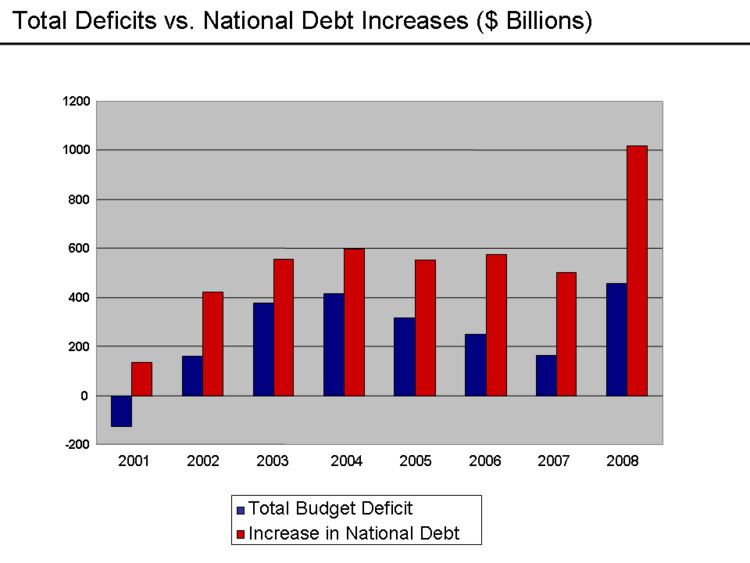

Effect of policies on federal budget deficit and national debt

The cumulative debt of the United States in the fiscal years 2001-2007 was approximately $4.08 trillion, or about 40.8% of the total national debt at the time of that completion of approximately $10.0 trillion.

The total surplus in FY 2001 was $128 billion. A combination of tax cuts and spending initiatives has added almost $1.7 trillion—through budget deficits—to the national debt since then (October 1, 2001 through September 30, 2007). It should be noted that yearly debt accumulation often exceeds the yearly budget deficit, because, for example, paying the interest on the debt is not planned in the budget to be paid off or because Social Security receipts run a surplus (see Fiscal policy of the United States). The total budget deficit for FY 2007 was $162 billion.

From the end of Fiscal Year 2001 (ending Oct. 1, 2001) to the fourth quarter of 2007, the economy has produced $6.5 trillion (in constant 2000 dollars) over and above third quarter 2001 GDP levels of $9.87 trillion per year. In the same period the federal government accumulated $3.0 trillion in gross debt (in constant 2000 dollars) or a debt load of 46.5¢ per dollar of the increased production (for comparison purposes in expressing the size of the debt; that is, new debt didn't exceed new production, but growing economies of growing populations are dependent for their vitality to certain consumption levels, so the increased production isn't necessarily immediately usable in its entirety to pay for the debt).

Most debt was accumulated as a result of tax cuts and increased national security spending. According to Richard Kogan and Matt Fiedler, "the largest costs — $1.2 trillion over six years — resulted from the tax cuts enacted since the start of 2001. Increased spending for defense, international affairs, and homeland security – primarily for prosecuting the wars in Iraq and Afghanistan – also was quite costly, amounting to almost $800 billion to date. Together, tax cuts and the spending increases for these security programs account for 84 percent of the increases in debt racked up by Congress and the President over this period." Lawrence Kudlow, however, noted "The U.S. has spent roughly $750 billion for the five-year war. Sure, that’s a lot of money. But the total cost works out to 1 percent of the $63 trillion GDP over that time period. It's miniscule [sic]." He also reported that "during the five years of the Iraq war,. . .household net worth has increased by $20 trillion." Nobel laureate Joseph Stiglitz has estimated the total cost of the Iraq War at closer to $3 trillion.

Interest on the debt (including both public and intragovernmental amounts) increased from $322 billion to $454 billion annually. The share of public debt owned by foreigners increased significantly from 31% in June 2001 to 50% in June 2008, with the dollar balance owed to foreigners increasing from $1.0 trillion to $2.6 trillion. This also significantly increased the interest payments sent overseas, from approximately $50 billion in 2001 to $121 billion during 2008.

President Bush also signed into law Medicare Part D, which provides additional prescription drug benefits to seniors. The program was not funded by any changes to the tax code. According to the GAO, this program alone created $8.4 trillion in unfunded obligations in present value terms, a larger fiscal challenge than Social Security.

Trade policy

The Bush administration generally pursued free trade policies. Bush used the authority he gained from the Trade Act of 2002 to push through bilateral trade agreements with several countries. Bush also sought to expand multilateral trade agreements through the World Trade Organization, but negotiations were stalled in the Doha Development Round for most of Bush's presidency.

Developing countries blamed the US and the EU for stagnated negotiations since both maintain protectionist policies in agriculture. While generally favoring free trade, Bush has also occasionally supported protectionist measures, notably the 2002 United States steel tariff early in his term. Bush also implemented a 300% tax on Roquefort cheese from France in retaliation for a European Union ban on hormone-treated beef common in the American beef industry.

George W. Bush successfully gained ratification of the Dominican Republic–Central America Free Trade Agreement (DR-CAFTA). Supporters of DR-CAFTA claim it has been a success, but detractors still oppose the agreement for a variety of reasons including its impact on the environment.

In 2005, Ben Bernanke addressed the implications of the USA's high and rising current account (trade) deficit, resulting from USA imports exceeding its exports. Between 1996 and 2004, the USA current account deficit increased by $650 billion, from 1.5% to 5.8% of GDP. Financing these deficits required the USA to borrow large sums from abroad, much of it from countries running trade surpluses, mainly the emerging economies in Asia and oil-exporting nations.

Efforts to reform Social Security

President Bush advocated the partial privatization of Social Security in 2005-2006, but was unsuccessful in achieving any reforms to the program against strong congressional resistance. His proposal would have diverted some of the payroll tax revenues that fund the program into private accounts. Critics argued that privatizing Social Security does nothing to address the long-term funding challenge facing the program. Diverting funds to private accounts would reduce available funds to pay current retirees, requiring significant borrowing. An analysis by the Center on Budget and Policy Priorities estimates that President Bush's 2005 privatization proposal would have added $1 trillion in new federal debt in its first decade of implementation and $3.5 trillion in the decade thereafter.

According to the Social Security Administration, payments will be cut by 22% under current law around 2041, if no reforms are made to the program.

Regulatory philosophy

The number of economic regulation governmental workers was increased by 91,196, whereas Bill Clinton had cut down the number by 969.

President Bush advocated the Ownership society, premised on the concepts of individual accountability, smaller government, and the owning of property. Critics have argued this contributed to the subprime mortgage crisis, by encouraging home ownership for those unable to afford them and insufficient regulation of financial institutions.

Fannie Mae and Freddie Mac

In 2003, the Bush Administration attempted to create an agency to oversee Fannie Mae and Freddie Mac. The bill never made progress in Congress, facing sharp opposition by Democrats. In 2005, the Republican controlled House of Representatives passed a GSE reform bill (Federal Housing Finance Reform Act) which "would have created a stronger regulator with new powers to increase capital at Fannie and Freddie, to limit their portfolios and to deal with the possibility of receivership". However, the Bush administration opposed the bill and it died in the Senate. Of the bill and its reception by the Bush White House, Ohio Republican Mike Oxley (the bill's author) said: "The critics have forgotten that the House passed a GSE reform bill in 2005 that could well have prevented the current crisis. All the handwringing and bedwetting is going on without remembering how the House stepped up on this. What did we get from the White House? We got a one-finger salute." The Bush economic policy regarding Fannie Mae and Freddie Mac changed during the economic downturn of 2008, culminating in the federal takeover of the two largest lenders in the mortgage market. Further economic challenges have resulted in the Bush administration attempting an economic intervention, through a requested $700 billion bailout package for Wall Street investment houses.

Sarbanes-Oxley Act

President Bush signed the Sarbanes-Oxley Act into law during July 2002, which he called "the most far-reaching reforms of American business practices since the time of Franklin Delano Roosevelt." The law was passed in the wake of several corporate scandals and widespread stock market losses. The law addressed conflicts of interest between accounting firms and the corporations they audit and required executives to certify the accuracy of the corporation's financial statements. The law has been controversial, with some advocating its positive effect on investor confidence and detractors citing its significant cost.

Regulation of the financial sector

President Bush stated in September 2008: "Once this crisis is resolved, there will be time to update our financial regulatory structures. Our 21st century global economy remains regulated largely by outdated 20th century laws." The Securities and Exchange Commission (SEC) and Alan Greenspan conceded failure in allowing the self-regulation of investment banks, which proceeded to take on increasingly risky bets and leverage after a key 2004 decision.

Nobel laureate Paul Krugman described the run on the shadow banking system as the "core of what happened" to cause the crisis. "As the shadow banking system expanded to rival or even surpass conventional banking in importance, politicians and government officials should have realized that they were re-creating the kind of financial vulnerability that made the Great Depression possible—and they should have responded by extending regulations and the financial safety net to cover these new institutions. Influential figures should have proclaimed a simple rule: anything that does what a bank does, anything that has to be rescued in crises the way banks are, should be regulated like a bank." He referred to this lack of controls as "malign neglect."

Unemployment

The seasonally adjusted unemployment rate rose from 4.3% in January 2001, peaking at 6.3% in June 2003 and reaching a trough of 4.4% in March 2007. After an economic slowdown, the rate rose again to 6.1% in August 2008 and up to 7.2% in December 2008. From December 2007 when the recession started to December 2008, an additional 3.6 million people became unemployed.

Income disparity

During President Bush's terms, income disparity grew. Median household income has more than kept up with inflation since Bush took control of fiscal policy during the 2001 near-recession, growing 1.6% higher in constant 2007 dollars to $50,233 in 2007 from $49,454 in 2001, while poverty rate increased from 11.25% in 2000 to 12.3% in 2006 after peaking at 12.7% in 2004; in 2008 increased to 13.2%.

Under 18 years poverty rate increased from 16.2% in 2000 to 18% in 2007; in 2008 rose to 19%. From 2000 to 2005, only 4% of workers, typically highly educated professionals, had real income increases.

Economic growth

At the time Bush took office the economy had grown at a 1.1% annualized rate over the previous three quarters to March 31 of the first year of Bush presidency (see Early 2000s recession). Bush had his tax cut plan approved by Congress in June.

Overall real GDP from January 2001 through December 2008 grew at an average annual rate of 2.125%. From 2001 through 2004, GDP growth was clocked at 2.35%. The number of jobs created grew by 6.5% on average. The growth in average salaries was 1.2%. Growth in consumer spending was 72% faster than growth in income. Investment in residential real-estate soared, growing 26% faster than average.

A March 2006 report by the United States Congress Joint Economic Committee showed that the U.S. economy outperformed its peer group of large developed economies from 2001 to 2005. (The other economies are Canada, the European Union, and Japan.) The U.S. led in real GDP growth, investment, industrial production, employment, labor productivity, and price stability.

A significant driver of economic growth during the Bush administration was home equity extraction, in essence borrowing against the value of the home to finance personal consumption. Free cash used by consumers from equity extraction doubled from $627 billion in 2001 to $1,428 billion in 2005 as the housing bubble built, a total of nearly $5 trillion dollars over the period. Using the home as a source of funds also reduced the net savings rate significantly. By comparison, GDP grew by approximately $2.3 trillion during the same 2001-2005 period in current dollars, from $10.1 to $12.4 trillion.

President Bush tried to calm turmoil in financial markets on March 17, 2008, by saying that his administration is "on top of the situation" in dealing with the slumping Economy of the United States. Bush and Congress had responded to signs of a slowing economy with the Economic Stimulus Act of 2008 on February 13.

2008 economic crisis and recession

The last year of Bush's second term was dominated by an economic recession. The National Bureau of Economic Research (NBER) marked December 2007, the month with the highest payroll employment numbers, as the high point of American economic production with output declining from then on to the present. GDP declined by an annualized -0.5% in the third quarter and -3.8% in the fourth quarter of 2008. The two consecutive quarters of negative economic growth met the "rule of thumb" definition of a recession, confirming the NBER's declaration of a recession.

Bush responded to the early signs of economic problems with lump-sum tax rebates and other stimulative measures in the Economic Stimulus Act of 2008. In March 2008, Bear Stearns, a major US investment bank heavily invested in subprime mortgage derivatives, began to go under. Rumors of low cash reserves dragged Bear's stock price down while lenders to Bear began to withdraw their cash. The Federal Reserve funneled an emergency loan to Bear through JP Morgan Chase. (As an investment bank, Bear could not borrow from the Fed but JP Morgan Chase, a commercial bank, could).

The Fed ended up brokering an agreement for the sale of Bear to JP Morgan Chase that took place at the end of March. In July, IndyMac went under and had to be placed in conservatorship. In the middle of the summer it seemed like recession might be avoided even though high gas prices threatened consumers and credit problems threatened investment markets, but the economy entered crisis in the fall. Fannie Mae and Freddie Mac were also put under conservatorship in early September.

A few days later, Lehman Brothers began to falter. Treasury Secretary Hank Paulson, who in July had publicly expressed concern that continuous bailouts would lead to moral hazard, decided to let Lehman fail. The fallout from Lehman's failure snowballed into market-wide panic. AIG, an insurance company, had sold credit default swaps insuring against Lehman's failure under the assumption that such a failure was extremely unlikely.

Without enough cash to pay out its Lehman-related debts, AIG went under and was nationalized. Credit markets locked up and catastrophe seemed all too likely. Paulson proposed providing liquidity to financial markets by having the government buy up debt related to bad mortgages with a Troubled Asset Relief Program. Congressional Democrats advocated an alternative policy of investing in financial companies directly. Congress passed the Emergency Economic Stabilization Act of 2008, which authorized both policies.

Throughout the crisis, Bush seemed to defer to Paulson and Federal Reserve Chairman Ben Bernanke. He kept a low public profile on the issue with his most significant role being a public television address where he announced that a bailout was necessary otherwise the United States "could experience a long and painful recession."

Income inequality

Many economists are critical of the Bush administration's policies and argue that the economy is only benefiting the wealthy, increasing inequality between the top 1% and the rest of society. Economists Aviva Aron-Dine and Richard Sherman point to recent data from the Congressional Budget Office (CBO), showing that "the average after-tax income of the richest one percent of households rose from $722,000 in 2003 to $868,000 in 2004, after adjusting for inflation, a one-year increase of nearly $146,000, or 20 percent. This increase was the largest increase in 15 years, measured both in percentage terms and in real dollars."

At the same time, the share of overall tax liabilities of the top 1% increased from 22.9% to 25.3% , as the result of a tax system which became more progressive since 2000. According to economists Emmanuel Saez and Thomas Piketty, who reviewed income tax returns for all income groups since 1917, found that in 2005, the top 1% received its largest share of gross income since 1928.

Economist John Weeks asserts that increased income inequality in the U.S., one of only four high-income OECD countries to experience a significant increase in inequality, is largely the result of a less progressive taxation structure, the weakening strength of labor unions, which has resulted in "a growing imbalance in the economic and political power of capital and labor." However, claims of a "less progressive taxation structure" are refuted by the fact that "high-income households pay a modestly larger share of total federal income taxes," which is the generally accepted measure of progressivity.

In actuality though, the existence of a progressive federal personal income tax, does not refute the claims of an overall regressive tax system. First consider that the prior statement ignores federal payroll and excise/customs taxes, which as suggested by the fact that these taxes are disproportionately carried by the middle and lower classes, are widely considered regressive type taxes.

Moreover, as a percentage of total federal taxes, these regressive type taxes have seen an increase in recent years. To display this, consider that in 2000, 60.8% of the federal taxes collected came from personal and corporate income taxes (i.e. two progressive taxes) whereas only 38.9% came from payroll and excise/customs taxes (i.e. two regressive taxes). This is a ratio of 60.8 to 38.9, with the remaining 0.4% coming from taxes collected from the rest of the world. By 2005, this ratio had changed to 56.4 to 43.1, thus indicating a trend towards a less progressive federal tax system.

Lastly, by taking local and state taxes into consideration, it can be fully seen how claims about the strong progressiveness of the American tax system are misguided as local/state tax systems are very regressive. Consider that in the year 2000, 30.1% of all state and local taxes were from progressive type taxes (see above for examples)whereas 64.4% came from regressive type taxes. By 2005, this trend had become exacerbated as only 28.8% now came from progressive type taxes, and 65.0% came from regressive type taxes.

One could say that this has no bearing as state and local taxes make up a smaller portion of overall revenue as a share of GDP.<who?> However, examine that in 2005 federal, local and state revenue as a share of GDP was 26.9% and that of this number, 9.3% came from state and local taxes, whereas 17.6% came from federal taxes. This is the closest these two numbers have been since 1959 and further shows the increasing reliance upon state and local tax revenue which have been suggested to come from regressive sources.

Economist Stephen Rose asserts that Piketty and Saez use an older method to adjusting for inflation, exclude government transfers, and they do not address demographic changes. Rose concludes that while inequality did increase, the increase has been exaggerated.

Libertarian economist Alan Reynolds, senior fellow at the Cato Institute, makes similar assertions as Rose Gary Burtless, senior fellow at the centrist Brookings Institution, however, stated that Reynolds did not provide sufficient evidence to dismiss the findings of Saez, which are further supported by the CBO. According to him, "many of [Reynold's] criticisms are misguided or unfair given the goals of the Pikkety-Saez project... The CBO handles almost all the problems Reynolds mentions, and its calculations show a sizeable rise in both pre-tax and after-tax inequality since the late 1980s."