| ||

The economic impact of illegal immigrants in the United States is challenging to measure and politically contentious.

Contents

- Illegal Immigrant population

- Distribution of illegal immigrants by state

- Illegal immigrant income distribution

- Geographic origins of illegal immigrants

- Factors affecting population of illegal immigrants

- Economic effects An overview

- CBO study

- Heritage Foundation Study

- Institute on Taxation and Economic Policy Study

- Consumer demand

- Economic growth

- Social Security subsidization

- Price levels

- Economic costs of illegal immigrants

- Impact on wages for native low skilled workers

- Costs of education

- Costs of detainment

- Health care

- Effect on per capita wealth due to contribution to population growth

- Effect on income inequality

- Potential economic impact of amnesty

- Cost benefit analysis

- Relative contribution by income tax bracket

- Theoretical frameworks

- References

Illegal Immigrant population

There were 11.1 million unauthorized immigrants living in the United States as of March 2011, unchanged from the previous two years and a continuation of the sharp decline from its peak of 12 million in 2008. This decline has been the first significant decrease following two decades of growth up to 2007.

The reduction has been driven mainly by a decrease in the number of new immigrants from Mexico, the single largest source. Net immigration from Mexico to the U.S. has stopped and possibly reversed since 2010. At its peak in 2000, about 770,000 immigrants arrived annually from Mexico; the majority arrived illegally. By 2010, the inflow had dropped to about 140,000—a majority of whom arrived as legal immigrants.

One immigration research group reported that the number of illegal immigrants in the U.S. was 12.5 million in August 2007 at its peak. This decreased by 1.3 million to 11.2 million by July 2008 (11%) due to either increased law enforcement or fewer job opportunities. Based on the Department of Homeland Security estimates in 2009, unauthorized immigrant population living in the United States decreased to 10.8 million in January 2009 from 11.6 million in January 2008. Between 2000 and 2009, the unauthorized population grew by 27 percent.

A number of illegal immigrants have children once they are in the US, making their children US citizens and therefore not counted in the number of illegal children in the US.

The number of illegal immigrants in the U.S. labor force ranged from 8.1 million to 8.3 million between 2007 and 2012, approximately 5% of the U.S. labor force.

Distribution of illegal immigrants by state

Between 2000 and 2007, the fastest rate of growth of the illegal immigrant population was in Georgia, where it grew by 15.2%. In California, the state receiving the greatest number of new illegal immigrants, the number grew by 10.2%, in Florida by 16.7%, and in Texas by 32.7%. Arizona has the highest number of illegal immigrants of any US state. Their share of the workforce there is about 12%. According to a 2010 report by the Georgia Fruit and Vegetable Growers Association, Georgia farmers suffered because of a state regulation requiring illegal immigrants to be reported and not hired. Georgia farmers lost more than 50% of labor and crops because of the limited labor force.

Illegal immigrant income distribution

Immigrants to the U.S. are concentrated at both the high- and low-income ends of the U.S. labor market, determined largely by their educational attainment. In 2004, at the low end, half of workers age 25 and older who lacked a diploma were from Mexico and Central America. These workers were employed in jobs that required little formal education, such as construction labor and dishwashing, and on average they earned much less than did the average native worker.

Geographic origins of illegal immigrants

Illegal immigrants are all foreign-born non-citizens who are not legal residents. Most of them either entered the United States without inspection or were admitted temporarily and stayed past the date they were required to leave. It is very hard to study the illegal population, but estimates indicate that about one-third of the foreign-born population now living in the US is illegal. The Center for Immigration Studies reported in 2012 that about 50% of 12 million illegal immigrants in the United States arrived legally with temporary, non-immigrant visas and then overstay per David Seminara, CIS. Of all unauthorized immigrants living in the United States in 2009, 63 percent entered before 2000, and 62 percent were from Mexico.

About three-quarters (75%) of the nation's unauthorized immigrants are Latino. The majority of illegal immigrants (59%) are from Mexico. Significant regional sources of unauthorized immigrants include Asia (11%), Central America (11%), South America (7%), the Caribbean (4%) and the Middle East (less than 2%). Illegal immigrants constitute 4% of the nation's population. Approximately two-thirds have been in the U.S. for 10 years or fewer.

Factors affecting population of illegal immigrants

Ernesto Zedillo, former President of Mexico and current Director of the Yale Center for the Study of Globalization, argues that the US economy has a crucial need for migrant workers, and that the current debate must acknowledge this rather than just focus on enforcement. Peter Andreas, Professor of Political Science and International Studies at Brown University, asserts that illegal immigration is spurred on by periods of high demand for labor.

According to analyses by Zedillo and Andreas, greater demand for low-wage labor leads to higher illegal immigration. The numbers seem to support this analysis. Standard & Poor's estimated in April 2006 that, at that time, the U.S. was home to 11 million illegal immigrants. The Pew Hispanic Center estimated that the population of illegal immigrants grew from 1990 to a high of 11.9 million in 2006 plus another 1.1 million persons who are believed to be undercounted in the published estimates, and then dropped during the following recession. The change was noticeable by 2008, and was sharply down by 2010. In 2007, a decade-long trend reversed and the overall number of illegal immigrants fell below the number of legal permanent resident immigrants.

If considering the 2007 data for immigrant migration by the United States rate, the highest numbers of immigrants entered between 2000 and 2007 during a high demand for construction labor with real estate market growth. Then due to the economic slow down in late 2007, the number of illegal immigrants decreased. From the data of the Current Population Survey (CPS), which is collected monthly by the Census Bureau follows that there is a clear evidence that the illegal population has declined significantly between 2008- 2011. The evidence indicates that since hitting a peak in the summer of 2007 the illegal population may have declined by almost 14 percent. A decline in the illegal population is caused by two factors like US economy and US enforcement. The decline is caused by fewer immigrants coming and more returning home.

The Department of Homeland Security (DHS) estimated that between January 2000 and January 2007 the illegal alien population grew 3.3 million. But the newest DHS estimates show that between January 1, 2007, and January 1, 2008, the illegal alien population declined 180,000. Future enforcement efforts as well as the state of the economy will likely determine if the current trend continues. There is evidence that the illegal population rose in the summer of 2007, while Congress was considering legalizing illegal immigrants. When that legislation failed to pass, the illegal population quickly began a dramatic fall. After that legislation failed many employers were audited by local enforcement agencies and their illegal employees were forced to depart. Consequently, employers because of fear of huge fines reduced job availability for illegal immigrants and this caused a significant rise in their unemployment rate. This was a second factor to influence a reduction in illegal immigrants’ population in US. The relative importance of increased enforcement versus the economy is difficult to determine. What is clear is that a very long-standing migration pattern has reversed. But once the economy recovers and if enforcement is reduced, which seems likely, the illegal population will almost certainly resume its growth.

Economic effects: An overview

As consumers, illegal immigrants buy goods and services, which stimulates economic growth, while paying taxes and receiving minimal benefits. Studies indicate they are discriminated against and work with unfair wages and harsh conditions, particularly in certain states.

CBO study

During 2007, the nonpartisan Congressional Budget Office reviewed 29 reports published over 15 years on the impact of unauthorized immigrants on the budgets of state and local governments. While cautioning that the reports are not a suitable basis for developing an aggregate national effect across all states, they concluded that:

Heritage Foundation Study

In 2013, think tank The Heritage Foundation released a study concluding that as of 2010, the average unlawful immigrant household has a net deficit (benefits received minus taxes paid) of $14,387 per household. Many legislators, researchers and policy professionals from both sides of the immigration debate challenged the methodology of the 2013 Heritage Foundation study and its conclusions, indicating that the Heritage Foundation's estimated deficit figure is grossly inflated and such a deficit may not even exist.

Institute on Taxation and Economic Policy Study

The Institute on Taxation and Economic Policy released a report in February 2016, stating that 11 million illegal immigrants in the United States are paying annually an estimated amount of $11.64 billion in state and local taxes, "on average an estimated 8 percent of their incomes."

Consumer demand

Economic activity produced by illegal immigrant spending employs about 5% of the total US workforce. Illegal immigrants occupy over 3 million dwellings, or just under 4% of the total number of homes in the US. UCLA research indicates immigrants produce $150 billion of economic activity equivalent to spending stimulus every year. The advantages of illegal migration tend mostly to be on the side of the employer. An employer will benefit from the illegal status of a migrant who is desperate for work and therefore prepared to accept poor pay, usually below local norms. Hiring an illegal worker also brings the employer the advantage of paying less in the way of welfare contributions and other non-wage costs.

Nearly every dollar earned by illegal immigrants is spent immediately, and the average wage for US citizens is $10.25/hour with an average of 34 hours per week. This means that approximately 8 million US jobs are dependent upon economic activity produced by illegal immigrant activities within the US.

Economic growth

Most arguments against illegal immigration begin with the premise that undocumented workers don't pay income taxes, and that they therefore take more in services than they contribute. However, IRS estimates that about 6 million unauthorized immigrants file individual income tax returns each year. Research reviewed by the nonpartisan Congressional Budget Office indicates that between 50 percent and 75 percent of unauthorized immigrants pay federal, state, and local taxes. Illegal immigrants are estimated to pay in about $7 billion per year into Social Security. In addition, they spend millions of dollars per year, which supports the US economy and helps to create new jobs. The Texas State Comptroller reported in 2006 that the 1.4 million illegal immigrants in Texas alone added almost $18 billion to the state's budget, and paid $1.2 billion in state services they used.

The Social Security and Medicare contributions of illegal immigrants directly support older Americans, as illegal immigrants are not eligible to receive these services. The Internal Revenue Service issues an Individual Taxpayer Identification Number (ITIN) regardless of immigration status because both resident and nonresident aliens may have Federal tax return and payment responsibilities under the Internal Revenue Code. Federal tax law prohibits the IRS from sharing data with other government agencies including the INS. In 2006 1.4 million people used ITIN when filing taxes, of which more than half were illegal immigrants.

Social Security subsidization

Illegal immigrants pay social security payroll taxes but are not eligible for benefits. During 2006, Standard & Poor's analysts wrote: "Each year, for example, the U.S. Social Security Administration maintains roughly $6 billion to $7 billion of Social Security contributions in an "earnings suspense file"—an account for W-2 tax forms that cannot be matched to the correct Social Security number. The vast majority of these numbers are attributable to illegal workers who will never claim their benefits. For 2010, the Social Security Administration estimated that illegal immigrants and their employers paid $13 billion in social security (OASDI) payroll taxes.

The Social Security Administration has stated that it believes unauthorized work by non-citizens is a major cause of wage items being posted as erroneous wage reports instead of on an individual's earnings record. When Social Security numbers are already in use; names do not match the numbers or the numbers are fake, or the person of record is too old, young, dead etc., the earnings reported to the Social Security Agency are put in an Earnings Suspense file [ESF]. The Social Security spends about $100 million a year and corrects all but about 2% of these. From tax years 1937 through 2003 the ESF had accumulated about 255 million mismatched wage reports, representing $520 billion in wages and about $75 billion in employment taxes paid into the over $1.5 trillion in the Social Security Trust funds. As of October 2005, approximately 8.8 million wage reports, representing $57.8 billion in wages remained unresolved in the suspense file for tax year 2003.

Price levels

NPR reported in March 2006 that when the wages of lower-skilled workers go down, the rest of America benefits by paying lower prices for things like restaurant meals, agricultural produce and construction. The economic impact of illegal immigration is far smaller than other trends in the economy, such as the increasing use of automation in manufacturing or the growth in global trade. Those two factors have a much bigger impact on wages, prices and the health of the U.S. economy. But economists generally believe that when averaged over the whole economy, the effect is a small net positive. Harvard's George Borjas says the average American's wealth is increased by less than 1 percent because of illegal immigration.

Dr. David Jaeger from Center for American Progress estimated that if all illegal workers were removed from the workforce, a number of industries would face substantial shortages of workers, and Americans would have to be induced into the labor pool or provided incentives to take jobs far below their current education and skill levels. For this phenomenon to occur to a meaningful extent, substantial wage escalation would likely be necessary, thus eroding competitiveness in global markets. Dependence on foreign low skilled and low income labor will increase because the education level of US population has increased. If in 1960, about 50% of American men were employed by the low-skilled labor force without completing high school; the number is now less than 10%.

Economic costs of illegal immigrants

Ernesto Zedillo, former President of Mexico and current Director of the Yale Center for the Study of Globalization, asserts that illegal immigrants are only a drain on government services when they are incapable of paying taxes; and that this incapacity is the result of restrictive federal policies that require proof of citizenship.

Impact on wages for native low skilled workers

National Public Radio (NPR) reported in March 2006 that: "...overall, illegal immigrants don't have a big impact on U.S. wage rates. The most respected recent studies show that most Americans would notice little difference in their paychecks if illegal immigrants suddenly disappeared from the United States. That's because most Americans don't directly compete with illegal immigrants for jobs. There is one group of Americans that would benefit from a dramatic cut in illegal immigration: high-school dropouts. Most economists agree that the wages of low-skill high-school dropouts are suppressed by somewhere between 3 percent and 8 percent because of competition from immigrants, both legal and illegal. Economists speculate that for the average high-school dropout, that would mean about a $25 a week raise if there were no job competition from immigrants. Illegal immigrants seem to have very little impact on unemployment rates. Illegal workers certainly do take jobs that would otherwise go to legal workers, but illegal workers also create demand that leads to new jobs. They buy food and cars and cell phones, they get haircuts and go to restaurants. On average, there is close to no net impact on the unemployment rate."

Research by George Borjas found that the influx of immigrants (both legal and illegal) from Mexico and Central America from 1980 to 2000 accounted for a 3.7% wage loss for American workers (4.5% for black Americans and 5% for Hispanic Americans). Borjas found that wage depression was greatest for workers without a high school diploma (a 7.4% reduction) because these workers face the most direct competition with immigrants, legal and illegal. A study by Economist Giovanni Peri concluded that between 1990 and 2004, immigrant workers raised the wages of native born workers in general by 4%, while more recent immigrants suppressed wages of other immigrants.

In 2008 Gordon H. Hanson at University of California-San Diego and National Bureau of Economic Research performed study on US economy and illegal immigration trend. From the study was concluded that unauthorized immigrants provide a ready source of manpower in agriculture, construction, food processing, building cleaning and maintenance, and other low-end jobs. The study was performed to see if illegal immigration affects the native workers employment. Cities with high percentage of illegal immigration were used in this study and data showed that illegal immigrants overall impact on the US economy is small. On the other hand, US employers gain from lower labor costs and the ability to use their land, capital, and technology more productively. Even if this study didn’t show huge impact on US employment by illegal immigrants, other studies show that illegal immigrant cause increase unemployment for US high school drop-offs. In February 2008, for instance, the national unemployment rate was 4.8 percent, but the unemployment rate for adults (over 25 years old) without a high school diploma was 7.3 percent. In addition the unemployment rate for youth 16–19 years old was 16.8 percent and for young adults 20– 24 years old was 8.9 percent in February, 2008. These three main groups are the employees of low paid and low skilled jobs that are usually taken by illegal immigrants. Since Alabama's new immigration law was signed into law on June 9, 2011, Alabama's unemployment rate fell 1.2 percentage points in three months - September through November. At the same time neighboring state had the same trend. Tennessee and Florida had rate dropped 0.6 percent, Georgia’s unemployment declined 0.4 percent, and in Mississippi unemployment dropped a mere tenth of a percent.

Costs of education

Estimates indicate that about 4% of the school-age population is made up of children who are illegal immigrants. Many require remedial assistance in language skills, which increases costs to the public schools. During April 2006, Standard & Poor's analysts wrote: "Local school districts are estimated to educate 1.8 million illegal children. At an average annual cost of $7,500 (averages vary by jurisdiction) per student, the cost of providing education to these children is about $11.2 billion." Other estimates of the costs to educate illegal children and US-born children of illegal immigrants reached $30 billion in 2009.

Spending for public education of illegal immigrant children in K-12 public education in Minnesota for 2003-2004 was a total of $78.76 million to $118.14 million.

For the same time period, total spending in New Mexico at the state and local levels for illegal immigrant schoolchildren was about $67 million.

Illegal immigrants who have attended school in California for three years are eligible for reduced in-state tuition for public colleges.

Costs of detainment

Jessica M. Vaughan, Director of Policy Studies at Center for Immigration Studies reported in March 2012 that the Obama administration is trying to move away from using detention centers that are currently housing thousands of illegal immigrants each day. These facilities are very costly. The 608-bed Karnes facility cost the private operator, GEO Group, $32 million to build. This works out to $52,632 per bed. U.S. Immigration and Customs Enforcement (ICE) is expected to pay GEO Group about $15 million a year to run the center. Some apprehended near the border especially native Mexicans, stay less than one day in detention while are under quick processing for departure. Their stay in detention is about 12 hours. ICE detention centers in the southwest border areas handle groups of 100 of these illegal entrants twice a day. These quick turn-backs numbered about 75,000 last year, or nearly 20 percent of ICE's total reported removals. Some of these who had to stay more than 12 hours are released under bonds until their court hearing because of lack of space in detention centers. As of 2010 715,000 of these failed to appear for their hearings in court or who have ignored orders to depart. The US spending on enforcement activities is already very high. Center of Immigration Studies reported that in 2007-2008 enforcement resources like spending on border and interior enforcement cost far more than the tax savings they generated from reduced illegal presence in the United States.

Health care

Reuters reported that illegal immigrants, as well as legal immigrants in the country less than five years, generally are not eligible for Medicaid. However, they can get Medicaid coverage for health emergencies if they are in a category of people otherwise eligible, such as children, pregnant women, families with dependent children, elderly or disabled individuals, and meet other requirements. The cost of this emergency care was less than 1% of Medicaid costs in North Carolina from 2001–2004 and the majority was for childbirth and related complications. USA Today reported that "Illegal immigrants can get emergency care through Medicaid, the federal-state program for the poor and people with disabilities. But they can't get non-emergency care unless they pay. They are ineligible for most other public benefits." In 2006, the Oklahoma Health Care Authority estimated that it would spend about $9.7 million on emergency Medicaid services for unauthorized immigrants and that 80 percent of those costs would be for services associated with childbirth.

Because of the U.S. Emergency Medical Treatment and Active Labor Act of 1986 (42 U.S.C. § 1395dd), most hospitals may not refuse anyone treatment for an emergency medical condition because of citizenship, legal status, or ability to pay. An example of the cost conflict between federal government, state and local government, and private institutions, the Immigration and Naturalization Service (INS) brings injured and ill illegal immigrants to hospital emergency rooms but does not pay for their medical care. Almost $190 million, or about 25 percent, of the uncompensated costs Southwest border county hospitals incurred resulted from emergency medical treatment provided to illegal immigrants.

At least two research studies have been done which attempt to discover the cost of health care for illegal immigrants by asking the illegal themselves.

Moreover, studies have also shown that not providing illegal immigrants with a decent healthcare might actually cost the country in the long-run rather than save expenses. In 2000, researchers compared the perinatal outcomes and costs of illegal women with and without prenatal care and inferred the impact of denial of prenatal benefits to illegal immigrants in California. Nearly 10% of illegal women had no prenatal care. These women were nearly 4 times as likely to be delivered of low birth weight infants and more than 7 times as likely to be delivered of premature infants as were illegal women who had prenatal care. For every dollar cut from prenatal care, an increase of $3.33 in the cost of postnatal care and $4.63 in incremental long-term cost were expected. Elimination of publicly funded prenatal care for illegal women could save the state $58 million in direct prenatal care costs but could cost taxpayers as much as $194 million more in postnatal care, resulting in a net cost of $136 million initially and $211 million in long-term costs. Although their parents are illegal immigrants, these children are actually U.S citizens.

Effect on per-capita wealth due to contribution to population growth

As recognized in a World Bank report, population growth has a deteriorating effect on per-capita wealth. Quantitatively, it introduces "a Malthusian term" in calculations of changes in per-capita wealth with time. Wealth includes public as well as private wealth. A water reservoir, or a highway for automobiles, for example, has a per-capita value that diminishes as the number of people using it increases, unless the reservoir or highway is enlarged (which has costs, including environmental ones that may be hard to measure). As of 2012, net immigration, including both legal and illegal immigration, constitutes more than 25 percent of US population growth.

Effect on income inequality

Economist David Card wrote in 2009 that immigration (legal and illegal) has a minor impact on income inequality and wages: "Together these results imply that the impacts of recent immigrant inflows on the relative wages of U.S. natives are small. The effects on overall wage inequality (including natives and immigrants) are larger, reflecting the concentration of immigrants in the tails of the skill distribution and higher residual inequality among immigrants than natives. Even so, immigration accounts for a small share (5%) of the increase in U.S. wage inequality between 1980 and 2000."

Potential economic impact of amnesty

Amnesty refers to granting illegal immigrants additional rights, which grants access to more government services while requiring higher taxes. The Heritage Foundation reported in 2013: "If enacted, amnesty would be implemented in phases. During the first or interim phase (which is likely to last 13 years), unlawful immigrants would be given lawful status but would be denied access to means-tested welfare and Obamacare. Most analysts assume that roughly half of unlawful immigrants work “off the books” and therefore do not pay income or FICA taxes. During the interim phase, these “off the books” workers would have a strong incentive to move to “on the books” employment. In addition, their wages would likely go up as they sought jobs in a more open environment. As a result, during the interim period, tax payments would rise and the average fiscal deficit among former unlawful immigrant households would fall." During the interim phase immediately after amnesty plans then under discussion, tax payments would increase more than government benefits, and the average fiscal deficit for former unlawful immigrant households would fall moderately to $11,455. At the end of the interim period, unlawful immigrants would become eligible for means-tested welfare and medical subsidies under Obamacare. Average benefits would rise to $43,900 per household; tax payments would remain around $16,000; the average fiscal deficit (benefits minus taxes) would be about $28,000 per household. Amnesty would also raise retirement costs by making unlawful immigrants eligible for Social Security and Medicare, resulting in a net fiscal deficit of around $22,700 per retired amnesty recipient per year.

Cost-benefit analysis

The Feb 2011 report "The Fiscal Burden of Illegal Immigration on US Taxpayers" from the Federation for American Immigration Reform, a non-profit group that advocates limiting both legal and illegal immigration, "estimates the annual costs of illegal immigration at the federal, state and local level to be about $113 billion; nearly $29 billion at the federal level and $84 billion at the state and local level. The study also estimates tax collections from illegal alien workers, both those in the above-ground economy and those in the underground economy. Those receipts [apx $13 billion] do not come close to the level of expenditures..."

Editorialist Robert Samuelson points out that poor immigrants strain public services such as local schools and health care. He points out that "from 2000 to 2006, 41 percent of the increase in people without health insurance occurred among Hispanics", although he makes clear that these facts are true of legal as well as illegal immigrants.

According to a 1998 article in The National Academies Press, "many [previous studies] represented not science but advocacy from both sides of the immigration debate...often offered an incomplete accounting of either the full list of taxpayer costs and benefits by ignoring some programs and taxes while including others," and that "the conceptual foundation of this research was rarely explicitly stated, offering opportunities to tilt the research toward the desired result." One survey conducted in the 1980s found that 76 percent of economists felt recent illegal immigration had a positive effect on the economy.

Aviva Chomsky, a professor at Salem State College, states that "Early studies in California and in the Southwest and in the Southeast...have come to the same conclusions. Immigrants, legal and illegal, are more likely to pay taxes than they are to use public services. Illegal immigrants are not eligible for most public services and live in fear of revealing themselves to government authorities. Households headed by illegal immigrants use less than half the amount of federal services that households headed by documented immigrants or citizens make use of."

National Public Radio (NPR) wrote in 2006: "Supporters of a crackdown argue that the U.S. economy would benefit if illegal immigrants were to leave, because U.S. employers would be forced to raise wages to attract American workers. Critics of this approach say the loss of illegal immigrants would stall the U.S. economy, saying illegal workers do many jobs few native-born Americans will do."

Professor of Law Francine Lipman writes that the belief that illegal migrants are exploiting the US economy and that they cost more in services than they contribute to the economy is "undeniably false". Lipman asserts that "illegal immigrants actually contribute more to public coffers in taxes than they cost in social services" and "contribute to the U.S. economy through their investments and consumption of goods and services; filling of millions of essential worker positions resulting in subsidiary job creation, increased productivity and lower costs of goods and services; and unrequited contributions to Social Security, Medicare and unemployment insurance programs."

Relative contribution by income tax bracket

PEW studies on unauthorized immigrants estimates that the average household of 3.1 persons earns about $36,000 per year. This average wage is consistent with about the PEW estimate of 49% of illegal immigrants not having graduated from any kind of high school.

The Congressional Budget office (CBO) estimates that people in this salary bracket (the second quintile) pay about 6.8% of their income in Federal taxes.

The Heritage Foundation estimates that the average household in the bottom quintile received $29,015 in benefits and paid $4,251 in Federal, state and local taxes. In the second quintile the average household received $24,709 in benefits and paid $9,524 in Federal, state and local taxes. In the top quintile, the average household received $21,515 in benefits and services and paid $69,704 in Federal, state and local taxes. However, it is unclear how much benefit the average unauthorized immigrant household is eligible for.

Theoretical frameworks

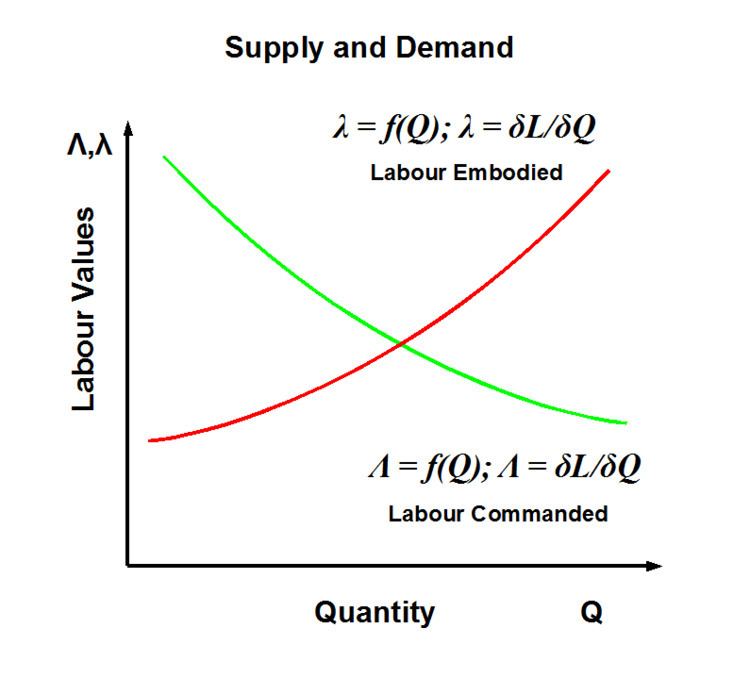

Labor is a key economic factor of production. There are many lenses through which one can view the mobility of factors of production, such as labor, across borders as part of international trade. These models are not very useful for examining illegal immigration because they tend to either disallow international labor mobility or assume perfect labor mobility, when neither is true in reality.

The minimum wage in the U.S. also plays a role from a theoretical perspective, with people arguing on both sides that the minimum wage is linked to immigration. This effect is generally explained in terms of reduced labor market experience, lower job-related skills, or just outright employer discrimination. Some argue that were the minimum wage higher, more U.S. natives would be willing to take the riskier jobs that are held by many immigrants. Others believe that because the U.S. has a minimum wage an illegal market for jobs is created for work that pays below the minimum wage, which fuels migration to the U.S.