| ||

The economic history of Argentina is one of the most studied, owing to the "Argentine paradox", its unique condition as a country that had achieved advanced development in the early 20th century but experienced a reversal, which inspired an enormous wealth of literature and diverse analysis on the causes of this decline.

Contents

- Colonial economy

- Post independence transition

- 18101829

- 18291870

- Export led boom

- 18701890

- Baring crisis to World War I

- 19141929

- Great Depression

- First Peronist period Nationalization

- Post Peron era and the 1960s

- Stagnation 1975 1990

- Free market reforms 1990 1995

- Economic crisis 1998 2002

- Return to growth 2003 2015

- Kirchner administration

- Fernandez administration

- Presidency of Mauricio Macri

- Causes of progressive decline

- References

Argentina possesses definite comparative advantages in agriculture, as the country is endowed with a vast amount of highly fertile land. Between 1860 and 1930, exploitation of the rich land of the pampas strongly pushed economic growth. During the first three decades of the 20th century, Argentina outgrew Canada and Australia in population, total income, and per capita income. By 1913, Argentina was the world's 10th wealthiest nation per capita.

Beginning in the 1930s, however, the Argentine economy deteriorated notably. The single most important factor in this decline has been political instability since 1930, when a military junta took power, ending seven decades of civilian constitutional government. In macroeconomic terms, Argentina was one of the most stable and conservative countries until the Great Depression, after which it turned into one of the most unstable. Successive governments from the 1930s to the 1970s pursued a strategy of import substitution to achieve industrial self-sufficiency, but the government's encouragement of industrial growth diverted investment from agricultural production, which fell dramatically.

The era of import substitution ended in 1976, but at the same time growing government spending, large wage increases and inefficient production created a chronic inflation that rose through the 1980s. The measures enacted during the last dictatorship also contributed to the huge foreign debt by the late 1980s, which became equivalent to three-fourths of the GNP.

In the early 1990s the government reined in inflation by making the peso equal in value to the U.S. dollar, and privatised numerous state-run companies, using part of the proceeds to reduce the national debt. However, a sustained recession at the turn of the 21st century culminated in a default, and the government again devalued the peso. By 2005 the economy had recovered, but a judicial ruling originating from the previous crisis led to a new default in 2014.

Colonial economy

During the colonial period, present-day Argentina offered fewer economic advantages compared to other parts of the Spanish Empire such as Mexico or Peru, which caused it to assume a peripheral position within the Spanish colonial economy. It lacked deposits of gold or other precious metals, nor did it have established native civilizations to subject to the encomienda. The sparsely population was accompanied by a difficult numeracy development in the 17th century. Nevertheless Argentina overtook Peru, which enjoyed an early rapid development in numeracy through the contact with Indios, in the middle of the 18th century. This numeracy development as a measure of early modern development demonstrates the rapid and remarkable development of Argentina in the period of colonial time.

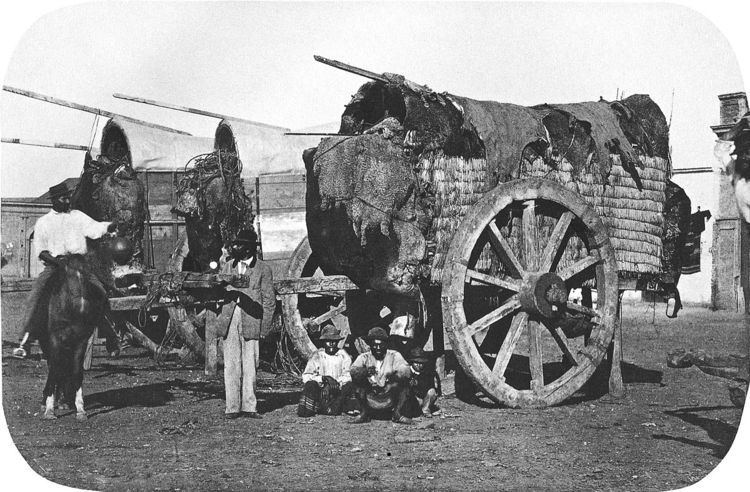

Only two-thirds of its present territory were occupied during the colonial period, as the remaining third consisted of the Patagonian Plateau, which remains sparsely populated to this day. The agricultural and livestock sector's output was principally consumed by the producers themselves and by the small local market, and only became associated with foreign trade towards the end of the 18th century. The period between the 16th and the end of the 18th century was characterized by the existence of self-sufficient regional economies separated by considerable distances, a lack of road, maritime or river communications, and the hazards and hardship of land transport. By the end of the 18th century, a significant national economy came into being, as Argentina developed a market in which reciprocal flows of capital, labour, and goods could take place on a significant scale between its different regions, which it had hitherto lacked.

Historians like Milcíades Peña consider this historical period of the Americas as pre-capitalist, as most production of the coastal cities was destined to overseas markets. Rodolfo Puiggrós consider it instead a feudalist society, based on work relations such as the encomienda or the slavery. Norberto Galasso and Enrique Rivera consider that it was neither capitalist nor feudalist, but an hybrid system result of the interaction of the Spanish civilization, on the transition from feudalism to capitalism, and the natives, still living in the prehistory.

The Argentine territories, held back by their closed economies, the lack of any activity closely linked to foreign trade, and the scant amounts of labour and capital they consequently received, fell far behind those of other areas of the colonial world that participated in foreign trade. Only activities associated with a dynamic exporting centre enjoyed some degree of prosperity, as occurred in Tucuman, where cloth was manufactured, and in Córdoba and the Litoral, where livestock was raised to supply the mines of Upper Peru.

This trade was legally limited to Spain: the Spanish Crown enforced a monopsony which limited supplies and enabled Spanish merchants to mark up prices and increase profits. British and Portuguese merchants broke this monopsony by resorting to contraband trade.

The British desire to trade with South America grew during the Industrial Revolution and the loss of their 13 colonies in North America during the American Revolution. To achieve their economic objectives, Britain initially launched the British invasions of the Río de la Plata to conquer key cities in Spanish America. When they allied to Spain during the Napoleonic Wars, they requested the Spanish authorities to open commerce to Britain in return.

The first Argentine historians, such as Bartolomé Mitre, attributed the free trade to the The Representation of the Hacendados economic report by Mariano Moreno, but is currently considered the result of a general negotiation between Britain and Spain, as reflected in the Apodaca-Canning treaty of 1809. The actions of Baltasar Hidalgo de Cisneros in Buenos Aires reflected similar outcomes emanating from the other Spanish cities of South America.

Compared to other parts of Latin America, slavery played a much lesser role in the development of the Argentine economy, mostly because of the absence of gold mines and sugar plantations, which would have demanded huge numbers of slave workers. Colonial Brazil, for example, imported as many as 2.5 million Africans in the 18th century. By contrast, an estimated 100,000 African slaves arrived at the port of Buenos Aires in the 17th and 18th centuries, and many were destined for Paraguay, Chile and Bolivia.

The colonial livestock ranches were established toward the middle of the 18th century. The pace of growth in the region increased dramatically with the establishment in 1776 of the new Viceroyalty of Rio de la Plata with Buenos Aires as its capital, and increased legal trading allowed by the Free Trade Act of 1778, which allowed for "free and protected" trade between Spain and its colonies. This trade system disintegrated during the Napoleonic era, and contraband became common again.

Post-independence transition

During the early post-independence period, an important share of Argentina's exports came from cattle and sheep production. The livestock-raising economy was based upon the abundance of fertile land in the littoral provinces. Cropping apparently lacked comparative advantage compared to livestock grazing.

Exports rose 4% to 5% annually from 1810 to 1850 and 7% to 8% from 1850 to 1870. This growth was achieved through the extension of the frontier and greater efficiency in livestock production.

As a result of the diversification in markets and products, Argentina managed to escape the trap of a single-staple economy and sustained its economic growth over six decades. The combined effect of declining prices of textiles and rising prices of livestock products produced dramatic improvements in the terms of trade, which rose 377% between 1810 and 1825 in local prices. Several governors waged campaigns against the natives to increase the available lands, from Juan Manuel de Rosas to Julio Argentino Roca.

Most poor gauchos joined forces with the most powerful caudillos in the vicinity. As the Federal party, they opposed the policies implemented by Buenos Aires, and waged the Argentine Civil Wars.

1810–1829

After Argentina became independent in 1810, an era in which commerce was controlled by a small group of peninsular merchants came to an end. The Primera Junta, the first government established after the 1810 May Revolution, undertook a protectionist policy until their fall from government.

The First Triumvirate (1811–1812), influenced by Bernardino Rivadavia and Manuel García, instead promoted unrestricted trade with Britain. The Second Triumvirate (1812–1814) and José Gervasio Artigas (who controlled the Liga Federal during the 1815–1820 period) sought to restore the initial protectionist policy, but the Supreme Director restored free trade once more. Thus, the economy of the Río de la Plata became one of the most open economies in the world.

Between 1812 and 1816 divisions developed between an Unitarist faction centred on Buenos Aires and a Federalist faction in the provinces, which eventually led to a series of civil wars that ended with the conquest of Buenos Aires by Federalist caudillos at the Battle of Cepeda in 1820.

Each province had its own money, and the same money had a different value from one province and another, and even among cities in the same province.

The government of Martín Rodríguez (1820–1824) and his minister Bernardino Rivadavia, then Las Heras and finally Rivadavia himself as the first president of Argentina from 1826 to 1827, developed an economic plan deemed as "The happy experience". This plan increased the British influence in the national politics. It was based on five main pillars: complete free trade and no protectionist policies against British imports, finance with a central bank managed by British investors, absolute control of the port of Buenos Aires as the sole source of income from national customs, British exploitation of the national natural resources, and an Unitarist national organization centred in Buenos Aires. After Rivadavia resigned in 1827, ending the "happy experience", the federalist Manuel Dorrego assumed power as governor of Buenos Aires, but was soon executed by the unitarian Juan Lavalle during a military coup.

The exports of gold, allowed by the free trade policies, soon depleted the national reserves. This posed a great problem, as gold was the medium of exchange of the local economy. Rivadavia sought to fix it by establishing the "Discount Bank", a central bank for printing fiat money. Like a number of other central banks worldwide (eg., The Bank of England, and the US Federal Reserve), this bank was not owned by the state, but by private investors, British in this case.

The report of the American John Murray Forbes to John Quincy Adams, sixth President of the United States, in 1824 mentioned that Britain had a huge influence in the economic power of the country.

He mentioned that the government in Buenos Aires was so eager to be on good terms with Britain and gain recognition of the declaration of independence that most official institutions (as the Bank) were under British control, and that Britain had similar control over the Argentine economy to that metropole of a colony, without the financial, civil or military costs. Even the lack of an Argentine merchant fleet allowed Britain to manage the maritime trade. Forbes's testimony should be appraised in perspective of the contemporary Anglo-American commercial rivalry, In light of the partial nature of the account and of his "jealousy, even antipathy" towards the English in Rio de la Plata.

In the mid-1820s, when Manuel José García was Minister of Finance, the government borrowed heavily to finance new projects and to pay off war debts. These loans were tendered at usurious rates: in one notorious loan, the government received credit for £570,000 from the Baring Brothers in exchange for a debt of £1,000,000. In the 1820s, the peso papel began to lose value rapidly with respect to the peso fuerte, which was linked to the price of gold. In 1827 the peso papel was devalued by 33%, and was devalued again by 68% in 1829.

1829–1870

Juan Manuel de Rosas forced Lavalle to leave the province, and the federals ruled Buenos Aires until 1852. Rosas modified a number of policies of the Rivadavian period but maintained others: he set a customs law with protectionist policies, but kept the port under the exclusive control of Buenos Aires and refused to call a constituent assembly.

The customs law set trade barriers to products produced in the country, and imposed high import tariffs on luxury goods, together with export quotas and tariffs on gold and silver. However, the law was not completely effective because of the control of the port, which did not allow the provinces a steady financial income. The exclusive control of the port was long resisted by federals from other provinces, and led to the conflict of Rosas and Justo José de Urquiza at the battle of Caseros. Despite the financial obstacles, the economy of Entre Ríos has grew to a size near that of Buenos Aires, with the decline of saladeros and the growth of wool production.

In 1838 there was a new currency crisis, and the peso papel was devalued by 34%, and in 1839 when the peso papel lost 66% of its value. It was again devalued by 95% in 1845, and by 40% in 1851. The Alsina years, which coincided with the secession of Buenos Aires, saw an extremely poor economic performance. Efforts to fund extraordinary expenditure on the conflict between Buenos Aires and the other provinces of the Confederation caused the fiscal deficit to skyrocket. Similarly, the Confederation faced harsh economic conditions. Urquiza, president of the Confederation, issued the 'law of differential rights', benefiting the ships trading with the ports of the Confederation and but not with Buenos Aires.

The end of the civil wars provided the political and legal stability necessary to assert property rights and cut transaction costs, contributing to the huge inflows of capital and labour resources that built modern Argentina. In 1866 an attempt was made to stabilize the currency, by introducing a system of convertibility, which restricted the monetary authorities to issue paper currency only if it was fully backed by gold or convertible foreign currency. The decades of the 1860s and 1880s experienced the most favourable performance of the economy overall, setting the stage for the so-called Golden Age of Argentine history. - Nevertheless the first years of independence included a difficult economic development. In spite of the new freedom caused by the inauguration of the republic, the country was not economically united: expansion in some parts and decline in other parts. Indeed, people experienced different levels of income and welfare. Therefore it is unclear if this period of time (1820 – 1870) brought an income or welfare improvement.

In the 60 years after the founding of the farming colony at Esperanza in 1856, the base of Argentine agriculture gradually shifted from livestock to crops.

Export-led boom

Argentina, which had been insignificant during the first half of the 19th century, showed growth from the 1860s up until 1930 that was so impressive that it was expected to eventually become the United States of South America. This impressive and sustained economic performance was driven by the export of agricultural goods.

During the second half of the 19th century, there was an intense process of colonization of the territory in the form of latifundia. Until 1875 wheat was imported as it was not grown in sufficient quantities to supply local demand; by 1903 the country supplied all its own needs and exported 75,270,503 imperial bushels (2,737,491.8 m3) of wheat, enough to sustain 16,000,000 people.

In the 1870s real wages in Argentina were around 76% relative to Britain, rising to 96% in the first decade of the 20th century. GDP per capita rose from 35% of the United States average in 1880 to about 80% in 1905, similar to that of France, Germany and Canada.

1870–1890

In 1870, during Sarmiento's presidency, total debt amounted to 48 million gold pesos. A year later, it had almost doubled. Avellaneda became president after winning the 1874 presidential election. The coalition that supported his candidature became the Partido Autonomista Nacional, Argentina's first national party; all the presidents until 1916 would come from this party. Avellaneda undertook the tough actions needed to get the debt under control. In 1876 convertibility was suspended. The inflation rate rose to almost 20% in the following year, but the ratio of debt to GDP plummeted. Avellaneda's administration was the first to deliver a balance in the fiscal accounts since the mid-1850s. Avellaneda passed on to his successor, Julio Argentino Roca, a much more manageable economic environment.

In 1881, a currency reform introduced a bimetallic standard, which went into effect in July 1883. Unlike many precious metal standards the system was very decentralized: no national monetary authority existed and all control over convertibility rested with the five banks of issue. The period of convertibility lasted only 17 months: from December 1884 the banks of issue refused to exchange gold at par for notes. The suspension of convertibility was soon accommodated by the government, since, having no institutional power over the monetary system, there was little they could do to prevent it.

The profitability of the agricultural sector attracted foreign capital for railways and industries. British capital investments went from just over £20 million in 1880 to £157 million in 1890. During the 1880s, investment began to show some diversification as capital began to flow from other countries such as France, Germany and Belgium, though British investment still accounted for two thirds of total foreign capital. In 1890 Argentina was the destination of choice for British investment in Latin America, a position it held until World War I. By then, Argentina had absorbed between 40% and 50% of all British investment outside the United Kingdom. Despite its dependence on the British market, Argentina managed a 6.7% annual rate of growth of exports between 1870 and 1890 as a result of successful geographic and commodity diversification.

The first Argentine railway, a ten-kilometre road, had been built in 1854. By 1885, a total of 2,700 miles (4,300 km) of railways were open for traffic. The new railways brought livestock to Buenos Aires from the vast pampas, for slaughter and processing in the (mainly English) meat-packing plants, and then for shipment around the world. Some contemporary analysts lamented the export bias of the network configuration, while opposing the "monopoly" of private British companies on nationalist grounds. Others have since argued that the initial layout of the system was mostly shaped by domestic interests, and that it was not, in fact, strictly focused on the port of Buenos Aires.

The scarcity of labour and abundance of land induced a high marginal product of labour. European immigrants (chiefly Italians, Spaniards, French and Germans), tempted by the high wages, arrived in droves. The government subsidized European immigration for a short time in the late 1880s, but immigrants arrived in massive numbers even with no subsidy.

Baring crisis to World War I

Juárez Celman's administration saw a substantial increase in the ratio of debt to GDP toward the end of his tenure and an increasing weakness in the fiscal situation. The Baring Brothers merchant bank had developed a close and profitable association with Argentina, and when Celman's government was unable to meet its payments to the House of Baring, a financial crisis ensued. Argentina defaulted and suffered bank runs as the Baring Brothers faced failure. The crisis was caused by the lack of co-ordination between monetary policy and fiscal policy, which ultimately led to the collapse of the banking system. The financial crisis of 1890 left the government with no funds for its immigration subsidies programme, and it was abolished in 1891. Loans to Argentina were severely curtailed, and imports had to be cut sharply. Exports were less affected, but the value of Argentine exports did not surpass the 1889 peak until 1898.

Celman's successor, Carlos Pellegrini, laid the foundations for a return to stability and growth after the restoration of convertibility in 1899. He also reformed the banking sector in ways that were to restore stability in the medium term. Rapid growth rates soon returned: in the period 1903–1913, GDP increased at an annual rate of 7.7%, and industry grew even faster, jumping by 9.6%. By 1906, Argentina had cleared the last remnants of the 1890 default and a year later the country re-entered the international bond markets.

All the same, between 1853 and the 1930s, fiscal instability was a transitory phenomenon. The depressions of 1873–77 and 1890–91 played a crucial role in fostering the rise of industry: timidly in the 1870s and more decisively in the 1890s, industry grew with each crisis in response to the need of a damaged economy to improve its trade balance through import-substitution. By 1914, about 15% the Argentine labour force was involved in manufacturing, compared to 20% involved in commercial activities. In 1913, the country's income per head was on a par with that of France and Germany, and far ahead of Italy's or Spain's. At the end of 1913, Argentina had a gold stock of £59 million, or 3.7% of the world's monetary gold, while representing 1.2% of the world's economic output.

1914–1929

Argentina, like many other countries, entered into a recession following the beginning of World War I as international flows of goods, capital and labour declined. Foreign investment in Argentina came to a complete standstill from which it never fully recovered: Great Britain had become heavily indebted to the United States during the war and would never again export capital at a comparable scale. And after the opening of the Panama canal in 1914, Argentina and the other Southern cone economies declined, as investors turned their attention to Asia and the Caribbean. The United States, which came out of the war a political and financial superpower, especially perceived Argentina (and to a lesser extent Brazil) as a potential rival on world markets. Neither the Buenos Aires Stock Exchange nor the private domestic banks developed rapidly enough to fully replace British capital.

As a consequence, investable funds became increasingly concentrated in a single institution, the Banco de la Nacion Argentina (BNA), creating a financial system vulnerable to rent-seeking. Rediscounting and non-performing loans grew steadily at the BNA after 1914, polluting its balance sheet. This corrosion of balance sheets was a result of crony loans to the other banks and the private sector. In its rediscounting actions the BNA was not engaged in pure lender of last resort actions, following Bagehot's principle of lending freely at a penalty rate. Instead, the state bank allowed the private banks to shed their risks, with bad paper used as security, and lent them cash at 4.5%, below the rate the BNA offered its customers on time deposits.

However, unlike its neighbors, Argentina became capable of still having relatively healthy growth rates during the 1920s, not being as affected by the worldwide collapse on commodity prices such as Brazil and Chile. Similarly, the gold standard was still in place at a time almost all European countries had abandoned it. Automobile ownership in the country in 1929 was the highest in the Southern hemisphere.

For all its success, by the 1920s Argentina was not an industrialized country by the standards of Britain, Germany or the United States. A major hindrance to full industrialisation was the lack of energy sources such as coal or hydropower. Experiments with oil, discovered in 1907, had poor results. Yacimientos Petrolíferos Fiscales, the first state-owned oil company in Latin America, was founded in 1922 as a public company responsible for 51% of the oil production; the remaining 49% was in private hands.

Exports of frozen beef, especially to Great Britain, proved highly profitable after the invention of refrigerated ships in the 1870s. However Britain imposed new restrictions on meat imports in the late 1920s, which sharply reduced beef imports from Argentina. Ranchers responded by switching from pastoral to arable production, but there was lasting damage to the Argentine economy.

Great Depression

The Great Depression had a comparatively mild effect on Argentina, the unemployment rate never went above 10%, and the country largely recovered by 1935. However, the Depression permanently halted its economic expansion. Actually, much like other developing countries, the economy was already in a downturn beginning in 1927, a result of declining prices.

Argentina abandoned the gold standard in December 1929, earlier than most countries. For much of the previous period, the country had operated a currency board, in which a body known as the caja de conversión was charged with maintaining the peso's value in gold. The devaluation of the peso increased the competitiveness of its exports and protected domestic production. Argentina saw the value of its exports drop from $1,537 million in 1929 to $561 million in 1932, but this was by no means the most severe downturn in the region.

In response to the Great Depression, successive governments pursued a strategy designed to transform Argentina into a country self-sufficient in industry as well as agriculture. The strategy of growth was based on import substitution in which tariffs and quotas for final goods were raised. The import-substitution process had progressively been adopted since the late 19th century, but the Great Depression intensified it. The government's encouragement of industrial growth diverted investment from agriculture, and agricultural production fell dramatically.

In 1930, the armed forces forced the Radicals from power and improved economic conditions, but political turbulence intensified. In 1932, Argentina required immigrants to have a labour contract prior to arrival, or proof of financial means of support. The Roca-Runciman Treaty of 1933 gave Argentina a quota of the British market for exports of its primary products, but the discriminatory British imperial tariffs and the effects of deflation in Britain actually led to a small decline of Argentine exports to Great Britain.

Unemployment resulting from the Great Depression caused unrest. The industrial growth spurt of the 1930s gradually slowed. The economic conditions of the 1930s contributed to the process of internal migration from the countryside and smaller towns to the cities, especially Buenos Aires, where there were greater opportunities for employment. The urban working classes led several unsuccessful uprisings prior to the 1937 presidential elections. Traditional export agriculture stagnated at the outbreak of World War II and remained sluggish.

First Peronist period: Nationalization

After the 1943 Argentine coup d'état, Juan Perón, a member of the United Officers Group that engineered the plot, became Minister of Labor. Campaigning among workers with promises of land, higher wages, and social security, he won a decisive victory in the 1946 presidential elections. Under Perón, the number of unionized workers expanded as he helped to establish the powerful General Confederation of Labor. Perón turned Argentina into a corporatist country in which powerful organized interest groups negotiated for positions and resources. During these years, Argentina developed the largest middle class on the South American continent.

Early Peronism was a period of macroeconomic shocks during which a strategy of import substitution industrialization was put into practice. Bilateral trade, exchange control and multiple exchange rates were its most important characteristics. Beginning in 1947, Perón took a leftward shift after breaking up with the "Catholic nationalism" movement, which led to gradual state control of the economy, reflected in the increase in state-owned property, interventionism (including control of rents and prices) and higher levels of public inversion, mainly financed by the inflationary tax. The expansive macroeconomic policy, which aimed at the redistribution of wealth and the increase of spending to finance populist policies, led to inflation.

Wartime reserves enabled the Peronist government to fully pay off the external debt in 1952; by the end of the year, Argentina became creditor of US$5.000.000.000. Between 1946 and 1948, the French and British-owned railways were nationalized, and the existing networks were expanded, reaching 120 000 kilometers of rails by 1954. The government also established the IAPI to control the foreign trade in export commodities. Perón erected a system of almost complete protection against imports, largely cutting off Argentina from the international market. In 1947, he announced his first Five-Year Plan based on growth of nationalized industries. Protectionism also created a domestically oriented industry with high production costs, incapable of competing in international markets. At the same time, output of beef and grain, the country's main export goods, stagnated. The IAPI began shortchanging growers and, when world grain prices dropped in the late 1940s, it stifled agricultural production, exports and business sentiment, in general. Despite these shortcomings, protectionism and government credits did allow an exponential growth of the internal market: radio sales increased 600% and fridge sales grew 218%, among others.

During the first Five-Year Plan, various public works and programs were executed, with the aim to modernize the country's infrastructure. For example, a total of 22 hydroelectrical power plants were erected, increasing electrical output from 45 000 kVA in 1943, to 350 000 kVA in 1952. Between 1947 and 1949, a network of gas pipelines, which linked Comodoro Rivadavia with Buenos Aires, was built. The gas distribution reached 15 million m³, reducing costs by a third.

During this period Argentina's economy continued to grow, on average, but more slowly than the world as a whole or than its neighbours, Brazil and Chile. A suggested cause is that a multitude of frequently changed regulations, at times extended to ridiculous specifics (such as a 1947 decree setting prices and menus for restaurants), choked economic activity. The long-term effect was to create pervasive disregard for the law, which Argentines came to view as a hindrance to earning a living rather than an aid to enforcing legitimate property rights. The combination of industrial protectionism, redistribution of income from the agrarian to the industrial sector, and growing state intervention in the economy sparked an inflationary process. By 1950, Argentina's GDP per capita accounted just nearly half of the United States.

Perón's second Five-Year Plan in 1952 favoured increased agricultural output over industrialization, but industrial growth and high wages in previous years had expanded the domestic demand for agrarian goods. During the 1950s, output of beef and grain fell, and the economy suffered. The policy shift toward agricultural production created a gap in income distribution, as the majority of those who worked in agriculture laboured on tiny plots, while the majority of the land was in large estates. Argentina signed trade agreements with Britain, the Soviet Union and Chile, slightly opening the market to international trade as Perón's second economic plan sought to capitalize on the country's comparative advantage in agriculture.

Post-Peron era and the 1960s

In the 1950s and part of the 1960s, the country had a slow rate of growth in line with most Latin American countries, while most of the rest of the world enjoyed a golden era. Stagnation prevailed during this period, and the economy often found itself contracting, mostly the result of union strife.

Wage growth beginning in 1950 pushed prices up. The inflation rate increased faster, and soon real wages fell. High inflation prompted a stabilization plan that included tighter monetary policy, a cut in public expenditures, and increases in taxes and utility prices. Increasing economic wariness as the 1950s progressed became one of the leading causes for Perón's downfall in the Revolución Libertadora of 1955, as the working classes saw their quality of life diminished, thus stripping Perón from a large part of his popular support.

Arturo Frondizi won the 1958 presidential election in a landslide. In the same year he announced the beginning of the "oil battle": a new attempt at import substitution which aimed to achieve self-sufficiency in oil production by signing several contract with foreign companies for the mining and exploitation of oil. In 1960, Argentina joined the Latin American Free Trade Association.

Another coup in June 1966, the so-called Argentine Revolution, brought Juan Carlos Onganía to power. Ongania appointed Adalbert Krieger Vasena to head the Economy Ministry. His strategy implied a very active role for the public sector in guiding the process of economic growth, calling for state control over the money supply, wages and prices, and bank credit to the private sector.

Krieger's tenure witnessed increased concentration and centralization of capital, coupled with privatisation of many important sectors of the economy. The international financial community offered strong support for this program, and economic growth continued. GDP expanded at an average annual rate of 5.2% between 1966 and 1970, compared to 3.2% during the 1950s.

After 1966, in a radical departure from past policies, the Ministry of Economy announced a programme to reduce rising inflation while promoting competition, efficiency, and foreign investment. The anti-inflation programme focussed on controlling nominal wages and salaries. Inflation decreased sharply, decreasing from an annual rate of about 30% in 1965–67 to 7.6% in 1969. Unemployment remained low, but real wages fell.

A gradual reversal in trade policy culminated in the military announcing import substitution as a failed experiment, lifting protectionist barriers and opening the economy to the world market. This new policy boosted some exports, but an overvalued currency meant certain imports were so cheap that local industry declined, and many exports were priced out of the market. The Ministry of Economy put an end to the exchange rate policy of previous governments. The currency underwent a 30% devaluation. In 1970, the "peso moneda nacional" (one of the longest-lived currencies in the region) was replaced by the "peso ley" (100 to 1).

In May 1969, discontent with Krieger's economic policies led to riots in the cities of Corrientes, Rosario and Córdoba. Krieger was removed, but the Onganía administration was unable to agree on an alternative economic policy. By 1970, the authorities were no longer capable of maintaining wage restraints, leading to a wage-price spiral. As the economy started to languish and import substitution industrialization ran out of steam, urban migration slowed. Per capita income fell, and with it the standard of living. Perón’s third term of office was characterized by an expansive monetary policy, which resulted in an uncontrolled rise in the level of inflation.

Stagnation (1975 - 1990)

Between 1975 and 1990, real per capita income fell by more than 20%, wiping out almost three decades of economic development. The manufacturing industry, which had experienced a period of uninterrupted growth until the mid-1970s, began a process of continuous decline. The extreme dependence on state support of the many protected industries exacerbated the sharp fall of the industrial output. The degree of industrialization at the start of the 1990s was similar to its level in the 1940s.

In the early 1970s, per capita income in Argentina was twice as high as in Mexico and more than three times as high as in Chile and Brazil. By 1990, the difference in income between Argentina and the other Latin American countries was much smaller.

Starting with the Rodrigazo in 1975, inflation accelerated sharply, reaching an average of more than 300% per year from 1975 to 1991, increasing prices 20 billion times.

When the military dictatorship finance minister Martinez de Hoz assumed power, inflation was equivalent to an annual rate of 5000%, and output had declined sharply. In 1976, the era of import substitution was ended, and the government lowered import barriers, liberalized restrictions on foreign borrowing, and supported the peso against foreign currencies.

That exposed the fact that domestic firms could not compete with foreign imports because of the overvalued currency and long-term structural problems. A financial reform was implemented that aimed both to liberalize capital markets and to link Argentina more effectively with the world capital market.

After the relatively stable years of 1976 to 1978, fiscal deficits started to climb again, and the external debt tripled in three years. The increased debt burden interrupted industrial development and upward social mobility. From 1978, the rate of exchange depreciation was fixed with a tablita, an active crawling peg that was based on a timetable to announce a gradually-declining rate of depreciation. The announcements were repeated on a rolling basis to create an environment in which economic agents could discern a government commitment to deflation. Inflation gradually fell throughout 1980 to below 100%.

However, in 1978 and 1979, the real exchange rate appreciated because inflation consistently outpaced the rate of depreciation. The overvaluation ultimately led to capital flight and a financial collapse.

Growing government spending, large wage raises, and inefficient production created a chronic inflation that rose through the 1980s, when it briefly exceeded an annual rate of 1000%. Successive regimes tried to control inflation by wage and price controls, cuts in public spending, and restriction of the money supply. Efforts to stem the problems came to naught when in 1982 Argentina came into conflict with the United Kingdom over the Falkland Islands.

In August 1982, after Mexico had announced its inability to service its debt, Argentina approached the International Monetary Fund (IMF) for financial assistance, as it too was in serious difficulties. While developments looked positive for a while, an IMF staff team visiting Buenos Aires in August 1983 discovered a variety of problems, particularly a loss of control over wages affecting both the budget and external competitiveness, and the program failed. With the peso quickly losing value to inflation, the new Argentine peso argentino was introduced in 1983, with 10,000 old pesos exchanged for each new peso.

In December 1983, Raúl Alfonsin was elected President of Argentina, bringing to an end to the military dictatorship. Under Alfonsin, negotiations started on a new programme with the IMF, but they led to nothing. In March 1984, Brazil, Colombia, Mexico and Venezuela lent Argentina $300 million for three months, followed by a similar amount by the United State. That provided some breathing space as it was not before late September 1984 that an agreement was reached between the IMF and Argentina.

In 1985, the Argentine austral replaced the discredited peso. In 1986, Argentina failed to pay the debt for several months, and the debt was renegotiated with the creditor banks. In 1986 and 1987, the Austral Plan faded away, as fiscal policy was undermined by large off-budget spending and a loose monetary policy, again falling out of compliance with an IMF programme. A new IMF arrangement was reached in July 1987, only to collapse in March 1988.

The next move by the authorities was to launch the Primavera Plan in August 1988, a package of economically heterodox measures that foresaw little fiscal adjustment. The IMF refused to resume lending to Argentina. Six months after its introduction, the plan collapsed, leading to hyperinflation and riots.

Free-market reforms (1990 - 1995)

The Peronist Carlos Menem was elected president in May 1989. He immediately announced a new shock programme, this time with more fiscal adjustment in view of a government deficit of 16% of GDP. In November 1989 agreement was reached on yet another standby with the IMF, but again the arrangement was ended prematurely, followed by another bout of hyper-inflation, which reached 12,000% per year.

After the collapse of public enterprises during the late 1980s, privatisation became strongly popular. Menem privatised almost everything the state owned, except for a couple of banks. In terms of service there were indisputable improvements. For example, before the telephone privatisation, to get a new line it was not unusual to wait more than ten years, and apartments with telephone lines carried a big premium in the market. After privatisation the wait was reduced to less than a week. Productivity increased as investment modernised farms, factories and ports. However, in all cases, there were large outlays of employees. In addition, the process of privatisation was suspected of corruption in many cases. Ultimately, the privatised enterprises became private (rather than public) monopolies. Their tariffs on long-term contracts were raised in line with American inflation, even though prices in Argentina were falling.

In 1991, economy minister Domingo Cavallo set out to reverse Argentina's decline through free-market reforms such as open trade. On 1 January 1992, a monetary reform replaced the austral with the peso at a rate of 10,000 australs for 1 peso. The cornerstone of the reform process was a currency board, under which the peso was fixed by law at par to the dollar, and the money supply restricted to the level of hard-currency reserves. A risky policy which meant at a later stage argentina could not devalue. After a lag, inflation was tamed. With risk of devaluation apparently removed, capital poured in from abroad. GDP growth increased significantly and total employment rose steadily until mid-1993. During the second half of 1994, the economy slowed down and unemployment increased from 10% to 12.2%.

Although the economy was already in a mild recession at this point, conditions worsened substantially after the devaluation of the Mexican peso during December 1994. The economy shrank by 4%, and a dozen banks collapsed. With the labour force continuing to expand and employment falling sharply along with aggregate demand, unemployment rose by over 6% in 6 months. But the government responded effectively: it tightened bank regulation and capital requirements, and encouraged foreign banks to take over weaker local ones. The economy soon recovered and, between 1996 and 1998, both output and employment grew rapidly and unemployment declined substantially. However, at the beginning of 1999, the Brazilian currency underwent a strong depreciation. The Argentine economy contracted 4% in 1999, and unemployment increased again.

Exports grew from $12 billion in 1991 to $27 billion in 2001, but many industries could not compete abroad, especially after Brazil's devaluation. The strong, fixed exchange rate turned the trade balance to a cumulative US$22 billion in deficits between 1992 and 1999. Unable to devalue, Argentina could only become more competitive if prices fell. Deflation came from recession, falling wages and rising unemployment. Interest rates remained high, with banks lending dollars at 25%.

The share of public spending in GDP increased from 27% in 1995 to 30% in 2000. Some poorer provinces had depended on state enterprises or on inefficient industries, such as sugar, which could not compete when trade was opened. To quell social unrest, provincial governors padded their payrolls. The government had embarked on a pension reform with costs reaching 3% of GDP in 2000, as it still had to pay pensioners but no longer received contributions.

Economic crisis (1998 - 2002)

Argentina fell into a deep recession in the second half of 1998, triggered and then compounded by a series of adverse external shocks, which included low prices for agricultural commodities, the appreciation of the US dollar, to which the peso was pegged at par, the 1998 Russian financial crisis, the LTCM crisis and the devaluation of the Brazilian real in January 1999. Argentina did not enjoy a rapid recovery, and the sluggishness of GDP growth fuelled concerns about the sustainability of public debt.

In December 1999, President Fernando de la Rúa took office, seeking assistance from the IMF shortly thereafter. In March 2000, the IMF agreed to a three-year $7.2 billion stand-by arrangement with Argentina, conditioned on a strict fiscal adjustment and the assumption of 3.5% GDP growth in 2000 (actual growth was 0.5%). In late 2000, Argentina began to experience severely diminished access to capital markets, as reflected in a sharp and sustained rise in spreads on Argentine bonds over U.S. Treasuries. In December, The de la Rua government announced a $40 billion multilateral assistance package organized by IMF. The uneven implementation of fiscal adjustments and reforms, a worsening global macroeconomic environment, and political instability led to the complete loss of market access and intensified capital flight by the second quarter of 2001. Argentine debt, held mostly in bonds, was massively sold short and the government found itself unable to borrow or meet debt payments.

In December 2001, a series of deposit runs began to have a severe impact on the health of the banking system, leading the Argentine authorities to impose a partial deposit freeze. With Argentina no longer in compliance with the conditions of the expanded IMF-supported program, the IMF decided to suspend disbursements. At the end of December, in a climate of severe political and social unrest, the country partially defaulted on its international obligations; in January 2002, it formally abandoned the convertibility regime.

The ensuing economic and political crisis was arguably the worst since the country's independence. By the end of 2002, the economy had contracted by 20% since 1998. Over the course of two years, output fell by more than 15%, the Argentine peso lost three-quarters of its value, and registered unemployment exceeded 25%. Income poverty in Argentina grew from an already high 35.4% in October 2001 to a peak of 54.3% in October 2002.

Critics of the policy of economic liberalization pursued during the Menem Presidency argued that Argentina's economic woes were caused by neoliberalism, which had been actively promoted by the U.S. government and the IMF under the Washington Consensus. Others have stressed that the main shortcoming of economic policy-making during the 1990s was that economic reform was not pursued with enough determination. A 2004 report by the IMF's Independent Evaluation Office criticised the IMF's conduct prior to Argentina's economic collapse of 2001, saying the IMF had supported the country's fixed exchange rate for too long, and was too lenient towards fiscal deficits.

Return to growth (2003 - 2015)

In January 2002 Eduardo Duhalde was appointed president, becoming Argentina's fifth president in two weeks. Roberto Lavagna, who became Minister of the Economy in April 2002, was credited for the ensuing recovery of the economy, having stabilised prices and the exchange rate in a moment when Argentina was at risk of hyperinflation. Since the default in 2001, growth has resumed, with the Argentine economy growing by over 6% a year for seven of the eight years to 2011. This was achieved in part because of a commodity price boom, and also because the government managed to keep the value of the currency low, boosting industrial exports.

Kirchner administration

Néstor Kirchner became president in May 2003. In the mid-2000s, export of unprocessed soybeans and of soybean oil and meal generated more than 20% of Argentina's export revenue, triple the joint share of the traditional exports, beef and wheat. Export taxes comprised 8% to 11% of the Kirchner government's total tax receipts, around two-thirds of which came from soy exports. Taxes on imports and exports increased government spending from 14% to 25% of GDP. However, the import and export taxes have discouraged foreign investment, while high spending has pushed inflation over 20%.

An attempt by the Kirchner administration to impose price controls in 2005 failed as the items most in demand went out of stock and the mandatory prices were in most cases not observed. Various sectors of the economy were re-nationalised, including the national postal service (2003), the San Martín Railway line (2004), the water utility serving the Province of Buenos Aires (2006) and Aerolíneas Argentinas (2009).

In December 2005, Kirchner decided to liquidate the Argentine debt to the IMF in a single payment, without refinancing, for a total of $9.8 billion. The payment was partly financed by Venezuela, who bought Argentine bonds for US$1.6 billion. As of mid-2008 Venezuela hold an estimated US$6 billion in Argentine debt. In 2006, Argentina re-entered international debt markets selling US$500 million of its Bonar V five-year dollar denominated bonds, with a yield of 8.36%, mostly to foreign banks and Moody's boosted Argentina's debt rating to B from B-.

In early 2007 the administration began interfering with inflation estimates.

Fernandez administration

In December 2007 Fernández de Kirchner became president. In 2008 the rural sector mobilized against a resolution that would have increased the export tax rate on soybean exports from 35% to 44.1%. Ultimately, the new taxation regime was abandoned. Official Argentine statistics are believed to have significantly underreported inflation since 2007, and independent economists publishing their own estimates of Argentine inflation have been threatened with fines and prosecution.

In October 2008 President Fernández de Kirchner nationalised private pension funds for almost $30 billion, ostensibly to protect the pensions from falling stock prices around the world, although critics said the government simply wanted to add the money to its budget. Private pension funds, which were first licensed in 1994, suffered large losses during the 1998–2002 crisis and by 2008, the state subsidized 77% of the funds' beneficiaries.

The late-2000s recession hit the country in 2009 with GDP growth slowing to 0.8%. High GDP growth resumed in 2010, and the economy expanded by 8.5%. In April 2010, Economy Minister Amado Boudou prepared a debt swap package for the holders of over US$18 billion in bonds who did not participate in the 2005 Argentine debt restructuring. In late 2010, the largest new natural gas deposits in 35 years were discovered in Neuquén Province. The unemployment rate in the third quarter of 2011 was 7.3%.

In November 2011, the government laid a plan to cut utilities subsidies to higher income households. By mid-2011, credit was outpacing GDP by a wide margin, raising concerns that the economy was overheating. Argentina began a period of fiscal austerity in 2012. In April 2012, the government announced plans to expropriate YPF, despite the opposition of some energy experts, claiming that YPF's Spanish partner and major holder, Repsol, had not done his duty as to provide the financial support for research and land exploitation, as well as being a bad administrator concerned only in sending profits to Spain and forsaking YPF's economic growth.

Rising inflation and capital flight caused a rapid depletion of the country's dollar reserves, prompting the government to severely curtail access to dollars in June 2012. The imposition of capital controls, in turn, led to the emergence of a black market for dollars, known as the "dólar blue", at higher rates than the official exchange rate.

By May 2014, private forecasts estimated annual inflation at 39.9%, one of the highest rates in the world. In July 2014, a ruling from a New York court ordered the country to pay the remaining holders of the bonds defaulted in 2001, which by then were mostly American Vulture funds, before it paid any of its exchange bondholders. The Argentine government refused, causing the country to default on its debt again.

Presidency of Mauricio Macri

On December 17, 2015 Macri released the exchange restrictions, which meant, according to the opinion of some, that the peso undergoes a devaluation near 40%, It would be the largest recorded since 2002, when convertibility ended. In January 2016 it devaluated again strongly, climbing to 44 Cents Also, the measure of some products for a contraction of consumption. To top it off, unemployment will reach double digits as a result of current economic measures and the multiplication of layoffs in the public and private sector. Layoffs in the private sector have increased five-fold.

In April 2016, monthly inflation in the country rose to 6.7%, the highest since 2002, according to the indicator disseminated by Congress based on reports from economic consultants for the suspension of INDEC indices, decreed in December In interannual terms, inflation reached 41.7%, one of the highest in the world. By 2016, it is estimated that inflation reached 37.4%, the fiscal deficit 4.8% and GDP will fall by 1.9%. In December 2015, in fiscal year 2015, it announced the elimination of export retentions for wheat, maize and meat, while reducing withholding taxes on soybean to 30%, with a fiscal cost of 23,604 million pesos. This led to strong increases in staple products, including oil which increased by 51%, flour 110%, chicken 90%, and noodles 78% among others, and a 50% increase in the price of meat in two weeks. Because of the new prices of cereals, which increased by about 150%, many producing pigs are in crisis. The removal of the retentions has caused the cost of corn to increase by 150% and soybean by 180%. It is estimated that in the province of Buenos Aires alone 40 thousand pork producers would be in crisis.

Causes of progressive decline

The unique condition of Argentina, as a country which had achieved advanced development in the early 20th century but experienced a reversal, has inspired a wealth of literature and analyses on the causes of this progressive decline. The Nobel prize-winning economist Simon Kuznets is said to have remarked that there were four types of countries: the developed, the underdeveloped, Japan and Argentina.

According to Di Tella and Zymelman (1967), the main difference between Argentina and other settler societies such as Australia and Canada was its failure to seek adequate alternatives to compensate for the end of geographical expansion with the definitive closing of the frontier. Solberg (1985) noted the differences between the land distribution in Canada, which led to a rising number of small farmers, and the small number of landowners each with large areas of land in Argentina.

Duncan and Fogarty (1984) argued that the key difference lies in the contrast between the stable, flexible government of Australia and the poor governance of Argentina. According to Platt and Di Tella (1985) the political tradition and immigration from different regions were the key factors, while Díaz Alejandro (1985) suggested that a restrictive immigration policy, similar to Australia’s, would have increased productivity encouraged by the relative scarcity of labour.

More recently, Taylor (1992) pointed that the relatively high dependency ratio and the slow demographic transition in Argentina led to a reliance on foreign capital to offset the resulting low savings rate. From the 1930s onwards, the accumulation of capital was hampered by the relatively high prices of (mostly imported) capital goods, which was caused by the industrial policy of import substitution, in contrast with the export-led growth favoured by Canada. Other distorting factors behind the high relative prices of capital goods include the multiple exchange rates, the black market for foreign currencies, the depreciation of the national currency and high customs tariffs. This resulted in a lower capital intensity, which led to lower rates of labour productivity.

The ultimate cause of Argentina’s historical backwardness appears to be its institutional framework. In macroeconomic terms, Argentina was one of the most stable and conservative countries until the Great Depression, after which it turned into one of the most unstable.