| ||

Customs declaration is a form that is required by most nations - countries when a citizen or a visitor or goods are entering that nation's borders, called import. The purpose of the form document is to declare what goods are been brought in to the nation, as some may have limits or customs excise tax or are banned from entry. The form is also used to calculate tariffs or duty, if any.

Contents

- United States

- Canada

- European Union

- United Kingdom

- Australia

- New Zealand

- India

- China

- Russia

- South Korea

- Hong Kong

- Singapore

- Philippines

- Pakistan

- Sri Lanka

- Poland

- Sweden

- References

Type of forms:

When traveling with your goods, some nations require a customs declaration form from each person, for other nations there is one form per family arriving together. A family is usually defined as family members residing in the same household, that are related by marriage, adoption, blood, or domestic relationship. International flights travelers are often required to complete the form cards and present the custom form with their passports at immigration checkpoints.

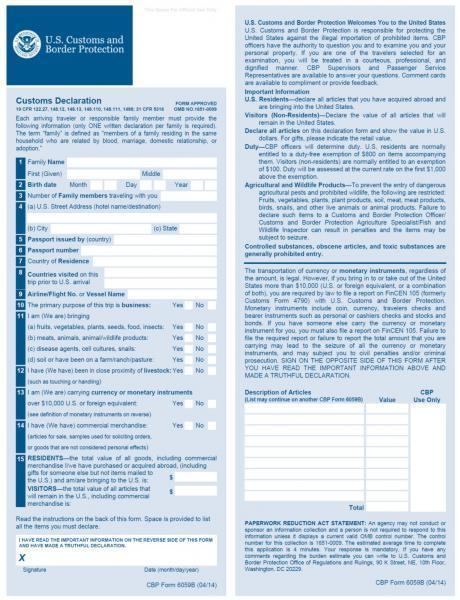

United States

Canada

Customs declaration managed by the Canada Border Services Agency:

European Union

The European Union has an European Commission for Taxation and Customs Union. European Union Customs Union sets trade in the EU. European Customs Information Portal is an importing and exporting service provided by the EU. Some territories within the EU do not participate in the customs union, usually as a result of their geographic circumstances. Through agreements, the EU is in customs unions with Andorra, San Marino, and Turkey respectively, with the exceptions of certain goods.

United Kingdom

UK Border Agency handles customs in the United Kingdom. UK Border Agency works with HM Revenue and Customs.

Australia

Australian Customs Service handles the customs imports and exports of Australia.

New Zealand

New Zealand Customs Service handles the customs imports and exports of New Zealand.

India

Central Board of Excise and Customs handles the customs imports and exports of India.

China

General Administration of Customs handles the customs imports and exports for the Government of China.

Russia

Federal Customs Service of Russia handles the customs imports and exports for the Russia. Russian Customs Tariff cover the Federal Customs Service of Russia

South Korea

Korea Customs Service handles the customs imports and exports for South Korea.

Hong Kong

Customs and Excise Department handles the customs imports and exports for Hong Kong.

Singapore

Singapore Customs handles the customs imports and exports for Singapore.

Philippines

Bureau of Customs handles the customs imports and exports for Philippines.

Pakistan

Pakistan Customs handles the customs imports and exports for Pakistan and control of the list of tariffs in Pakistan.

Sri Lanka

Sri Lanka Customs handles the customs imports and exports for Sri Lanka

Poland

Customs Service of Poland handles the customs imports and exports for Poland

Sweden

Swedish Customs Service handles the customs imports and exports for Sweden.