| ||

A blockchain – originally block chain – is a distributed database that maintains a continuously growing list of ordered records called blocks. Each block contains a timestamp and a link to a previous block. By design, blockchains are inherently resistant to modification of the data — once recorded, the data in a block cannot be altered retroactively. Blockchains are "an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. The ledger itself can also be programmed to trigger transactions automatically."

Contents

- Simple Blockchain Explaination

- History

- Description

- Decentralization

- Forks

- Soft forks

- Hard forks

- Openness

- Permissionless

- Permissioned

- Disadvantages

- Applications

- The Big Four

- Smart contracts

- Alternative blockchains

- Other uses

- Commercial offerings

- Journals

- Papers

- References

Simple Blockchain Explaination

Blockchains are secure by design and an example of a distributed computing system with high byzantine fault tolerance. Decentralised consensus can therefore be achieved with a blockchain. This makes blockchains suitable for the recording of events, medical records, and other records management activities, identity management, transaction processing, and proving data provenance. This offers the potential of mass disintermediation and vast repercussions for how global trade is conducted.

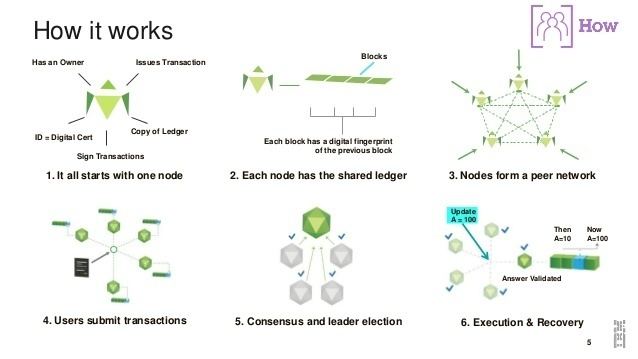

The first blockchain was conceptualised by Satoshi Nakamoto in 2008 and implemented the following year as a core component of the digital currency bitcoin, where it serves as the public ledger for all transactions. Through the use of a peer-to-peer network and a distributed timestamping server, a blockchain database is managed autonomously. The invention of the blockchain for bitcoin made it the first digital currency to solve the double spending problem, without the use of a trusted authority or central server. The bitcoin design has been the inspiration for other applications.

History

The first work on a cryptographically secured chain of blocks was described in 1991 by Stuart Haber and W. Scott Stornetta, followed by publications in 1996 by Ross J. Anderson and 1998 by Bruce Schneier and John Kelsey. In parallel, Nick Szabo was working in 1998 on a mechanism for a decentralized digital currency that he called bit gold. In 2000 Stefan Konst published a general theory for cryptographic secured chains and suggested a set of solutions for implementation.

The first blockchain was then conceptualised by Satoshi Nakamoto in 2008 and implemented the following year as a core component of the digital currency bitcoin, where it serves as the public ledger for all transactions. Through the use of a peer-to-peer network and a distributed timestamping server, a blockchain database is managed autonomously. The invention of the blockchain for bitcoin made it the first digital currency to solve the double spending problem. The bitcoin design has been the inspiration for other applications.

The blockchain format was first used for bitcoin, as a solution to the problem of making a database both secure and not requiring a trusted administrator. The words block and chain were used separately in Satoshi Nakamoto's original paper in October 2008, and when the term moved into wider use it was originally block chain, before becoming a single word, blockchain, by 2016. In August 2014, the bitcoin blockchain file size reached 20 gigabytes in size. In January 2015, the size had grown to almost 30 gigabytes, and from January 2016 to January 2017, the bitcoin blockchain grew from 50 gigabytes to 100 gigabytes in size [1].

By 2014, "Blockchain 2.0" was a term referring to new applications of the distributed blockchain database. The Economist described one implementation of this second-generation programmable blockchain as coming with "a programming language that allows users to write more sophisticated smart contracts, thus creating invoices that pay themselves when a shipment arrives or share certificates which automatically send their owners dividends if profits reach a certain level." Blockchain 2.0 technologies go beyond transactions and "exchange of value without powerful intermediaries acting as arbiters of money and information". They are expected to enable excluded people to enter the global economy, enable the protection of privacy and people to "monetize their own information", and provide the capability to ensure creators are compensated for their intellectual property. Second-generation blockchain technology makes it possible to store an individual's "persistent digital ID and persona" and are providing an avenue to help solve the problem of social inequality by "[potentially changing] the way wealth is distributed." As of 2016, Blockchain 2.0 implementations continue to require an off-chain oracle to access any "external data or events based on time or market conditions [that need] to interact with the blockchain."

In 2016, the central securities depository of the Russian Federation (NSD) announced a pilot project based on the Nxt Blockchain 2.0 platform in order to explore the use of blockchain-based automated voting systems. Various regulatory bodies in the music industry have started testing models that use blockchain technology for royalty collection and management of copyrights around the world. IBM opened a blockchain innovation research centre in Singapore in July 2016. A working group for the World Economic Forum met in November 2016 to discuss the development of governance models related to blockchain. According to Accenture, an application of the diffusion of innovations theory suggests that in 2016 blockchains attained a 13.5% adoption rate within financial services, therefore reaching the early adopters phase. In 2016, industry trade groups joined to create the Global Blockchain Forum, an initiative of the Chamber of Digital Commerce.

Description

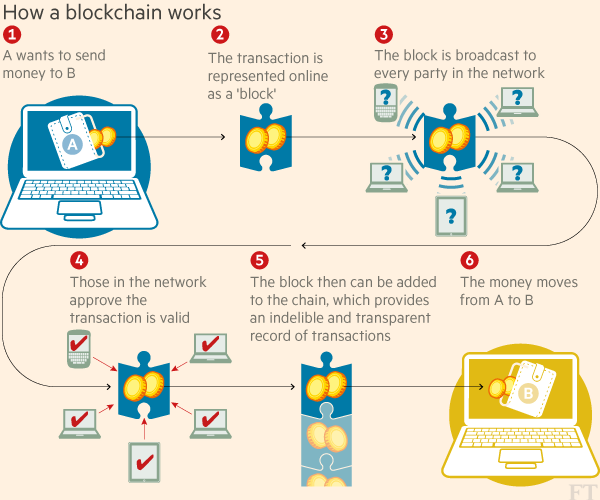

A blockchain facilitates secure online transactions. A blockchain is a decentralized digital ledger that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively. This allows the participants to verify and audit transactions in an inexpensive manner. They are authenticated by mass collaboration powered by collective self-interests. The result is a robust workflow where participants' uncertainty regarding data security is marginal. The use of a blockchain removes the characteristic of infinite reproducibility from a digital asset. It confirms that each unit of value was transferred only once, solving the long-standing problem of double spending. Blockchains have been described as a value-exchange protocol. This blockchain-based exchange of value can be completed more quickly, more safely and more cheaply than with traditional systems. A blockchain can assign title rights because it provides a record that compels offer and acceptance. From the technical point of view a blockchain is a hashchain inside another hashchain.

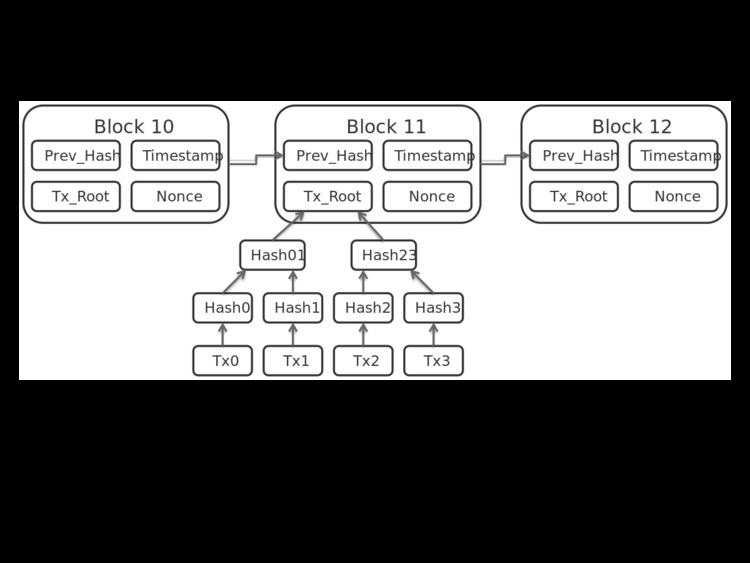

A blockchain database consists of two kinds of records: transactions and blocks. Blocks hold batches of valid transactions that are hashed and encoded into a Merkle tree. Each block includes the hash of the prior block in the blockchain, linking the two. Variants of this format were used previously, for example in Git, and it is not by itself sufficient to qualify as a blockchain. The linked blocks form a chain. This iterative process confirms the integrity of the previous block, all the way back to the original genesis block. Some blockchains create a new block as frequently as every five seconds. As blockchains age they are said to grow in height. Blocks are structured by division into layers.

Sometimes separate blocks can be validated concurrently, creating a temporary fork. In addition to a secure hash based history, any blockchain has a specified algorithm for scoring different versions of the history so that one with a higher value can be selected over others. Blocks which are not selected for inclusion in the chain are called orphan blocks. Peers supporting the database don't have exactly the same version of the history at all times, rather they keep the highest scoring version of the database that they currently know of. Whenever a peer receives a higher scoring version (usually the old version with a single new block added) they extend or overwrite their own database and retransmit the improvement to their peers. There is never an absolute guarantee that any particular entry will remain in the best version of the history forever, but because blockchains are typically built to add the score of new blocks onto old blocks and there are incentives to only work on extending with new blocks rather than overwriting old blocks, the probability of an entry becoming superseded goes down exponentially as more blocks are built on top of it, eventually becoming very low.:ch. 08 For example, in a blockchain using the proof-of-work system, the chain with the most cumulative proof-of-work is always considered the valid one by the network. In practice there are a number of methods that can demonstrate a sufficient level of computation. Within a blockchain the computation is carried out redundantly rather than in the traditional segregated and parallel manner.

The blockchain is parsed by software to extract relevant information.

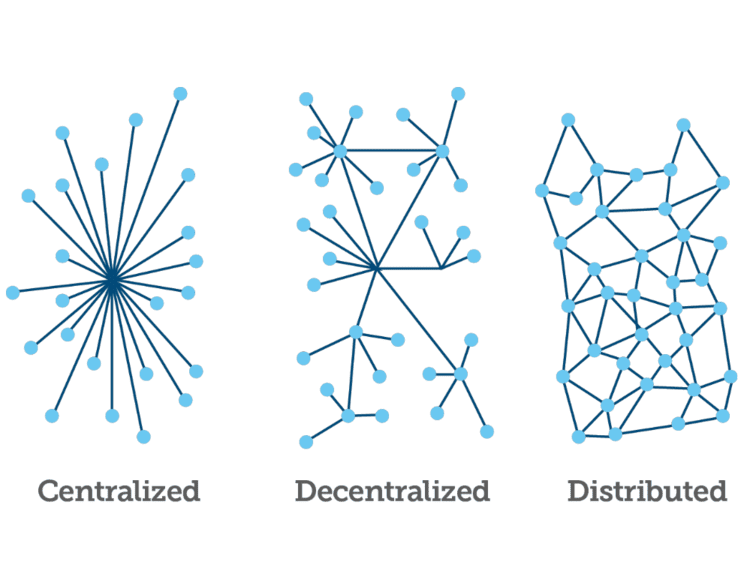

Decentralization

By storing data across its network, the blockchain eliminates the risks that come with data being held centrally. Decentralised blockchains may use ad-hoc message passing and distributed networking. Its network lacks centralized points of vulnerability that computer hackers can exploit or any central point of failure. Blockchain security methods include the use of public-key cryptography.:5 A public key (a long, random-looking string of numbers) is an address on the blockchain. Bitcoins sent across the network are recorded as belonging to that address. A private key is like a password that gives its owner access to their digital assets or otherwise interact with the various capabilities that blockchains now support. Data stored on the blockchain is generally considered incorruptible.

Every node or miner in a decentralized system has a copy of the blockchain. Data quality is maintained by massive database replication and computational trust. No centralized "official" copy exists and no user is "trusted" more than any other. Transactions are broadcast to the network using software. Messages are delivered on a best effort basis. Mining nodes validate transactions, add them to the block they’re creating, and then broadcast the completed block to other nodes.:ch. 08 Blockchains use various time-stamping schemes, such as proof-of-work to serialize changes. Alternate consensus methods include proof-of-stake and proof-of-burn. Growth of a decentralized blockchain is accompanied by the risk of node centralization because computer resources required to operate bigger data become more expensive.

Forks

If two groups of users disagree about a proposed change to a public (permissionless) blockchain protocol or algorithms, the two groups are free to each run their own versions of the blockchain software, which creates two descendant blockchains with their own separate histories from that point forward.

There are two types of forks: Soft forks and hard forks.

Soft forks

Soft forks are forward-compatible, meaning that nodes running software which only enforces the old consensus rules consider blocks mined by miners using the new consensus rules as valid, whereas nodes enforcing the new consensus rules don't (necessarily) consider blocks mined by miners who only enforce the older consensus rules valid. This comes to be as is such a case, the consensus rules are expanded and the set of blocks considered valid by nodes enforcing the newer consensus rules therefore is a real subset of the set of blocks considered valid by the nodes only enforcing the older consensus rules.

Hard forks

Hard forks are not forward-compatible, meaning that nodes running software which enforces the old consensus rules don't (necessarily) consider the blocks mined by miners using the new consensus rules valid and vice versa. This causes a "permanent divergence in the block chain".

For example, Ethereum has hard-forked multiple times. One of the first Ethereum hard forks was an ad-hoc fork to "make whole" the investors in The DAO, which had been hacked by exploiting a vulnerability in its code.

In 2014 the Nxt community was asked to consider a hard fork that would have led to a rollback of the blockchain records, in order to mitigate the effects of a theft of 50 million NXT from a major cryptocurrency exchange. The hard fork proposal was rejected, and the majority of the funds were recovered after negotiations.

Openness

Open blockchains are more user friendly than some traditional ownership records, which, while open to the public, still require physical access to view. Because all early blockchains were permissionless, controversy has arisen over the blockchain definition. An issue in this ongoing debate is whether a private system with verifiers tasked and authorized (permissioned) by a central authority should be considered a blockchain. Proponents of permissioned or private chains argue that the term "blockchain" may be applied to any data structure that batches data into time-stamped blocks. These blockchains serve as a distributed version of multiversion concurrency control (MVCC) in databases. Just as MVCC prevents two transactions from concurrently modifying a single object in a database, blockchains prevent two transactions from spending the same single output in a blockchain. Opponents say that permissioned systems resemble traditional corporate databases, not supporting decentralized data verification, and that such systems are not hardened against operator tampering and revision. The Harvard Business Review defines blockchain as a distributed ledger or database open to anyone, and Computerworld claims that "much of [permissioned blockchain hype] is nothing more than snake oil and spin".

Permissionless

The great advantage to an open, permissionless network is that guarding against bad actors is not required and no access control is needed. This means that applications can be added to the edge of the network without the approval or trust of others, using the blockchain as a transport layer. This openness allows researchers to examine real-time transaction data in a closed economic system.

Bitcoin and Ethereum currently secure their blockchain by requiring new entries including a proof of work. To prolong the blockchain, bitcoin uses Hashcash puzzles developed by Adam Back in the 1990s. Ethereum plans to switch to a proof-of-stake system in the future.

Financial companies have not prioritised decentralized blockchains. In 2016, venture capital investment for blockchain related projects was weakening in the USA but increasing in China. Bitcoin and Ethereum use open (public) blockchains. As of September 2016, bitcoin has the highest market capitalization while Ethereum is second.

Permissioned

Permissioned blockchains are emerging as open source protocols where openness and collaboration are encouraged. These will always have the ability to restrict who can participate in the consensus processes as well as who can transact. These private blockchains lack transparency. They do not rely on anonymous miners to validate transactions nor do they benefit from the network effect. Miners are vetted. The New York Times notes that many corporations are using blockchain networks "with private blockchains, independent of the public system."

Disadvantages

Nikolai Hampton pointed out in Computerworld that "There is also no need for a ‘51 percent’ attack on a private blockchain, as the private blockchain (most likely) already controls 100 percent of all block creation resources. If you could attack or damage the blockchain creation tools on a private corporate server, you could effectively control 100 percent of their network and alter transactions however you wished." This has a set of particularly profound adverse implications during a financial crisis or debt crisis like the financial crisis of 2007–08, where politically powerful actors may make decisions that favor some groups at the expense of others. and "the bitcoin blockchain is protected by the massive group mining effort. It's unlikely that any private blockchain will try to protect records using gigawatts of computing power — it's time consuming and expensive." He also said, "Within a private blockchain there is also no ‘race’; there's no incentive to use more power or discover blocks faster than competitors. This means that many in-house blockchain solutions will be nothing more than cumbersome databases."

Applications

Blockchain technology has a large potential to transform business operating models in the long term. Blockchain distributed ledger technology is more a foundational technology—with the potential to create new foundations for global economic and social systems—than a disruptive technology, which typically "attack a traditional business model with a lower-cost solution and overtake incumbent firms quickly." Even so, there are a few operational products maturing from proof of concept by late 2016. The use of blockchains promises to be able to bring significant efficiencies to global supply chains, financial transactions, asset ledgers and decentralized social networking.

As of 2016, some observers remain skeptical. Steve Wilson, of Constellation Research, believes the technology has been hyped with unrealistic claims. In order to mitigate risk businesses are reluctant to place blockchain at the core of the business structure.

Blockchains are a technology that may be integrated into multiple areas. Specific applications built on blockchains may therefore be a disruptive innovation, because they enable substantially lower-cost solutions to be instantiated which can often disrupt existing business models. Blockchain protocols facilitate businesses to use new methods of processing digital transactions. Examples include a payment system and digital currency, facilitating crowdsales, or implementing prediction markets and generic governance tools. Blockchains are expected to disrupt the cloud computing industry although practical technical issues remain as obstacles.

Blockchains can be thought of as an automatically notarised ledger. They alleviate the need for a trust service provider and are predicted to result in less capital being tied up in disputes. Blockchains have the potential to reduce systemic risk and financial fraud. They automate processes which were previously time-consuming and done manually such as the incorporation of businesses. In theory, it would be possible to collect taxes, conduct conveyancing and provide risk management with blockchains.

Major applications of blockchain include cryptocurrencies—including bitcoin, BlackCoin, Dash, and Nxt—and blockchain platforms—Factom as a distributed registry, Gems for decentralized messaging, MaidSafe for decentralized applications, Storj for a distributed cloud, and Tezos for decentralized voting. Each cryptocurrency has its own features and particularities. Frameworks and trials such as the one at the Sweden Land Registry aim to demonstrate the effectiveness of the blockchain at speeding land sale deals. The Republic of Georgia is piloting a blockchain-based property registry. The Ethical and Fair Creators Association uses blockchain to help startups protect their authentic ideas.

New distribution methods are available for the insurance industry such as peer-to-peer insurance, parametric insurance and microinsurance following the adoption of blockchain. Banks are interested in this technology because it has potential to speed up back office settlement systems. The sharing economy and IoT are also set to benefit from blockchains because they involve many collaborating peers. Online voting is another application of the blockchain. Blockchains are being used to develop information systems for medical records which increases interoperability. In theory, legacy disparate systems can be completely replaced by blockchains. Blockchains are being developed for data storage, publishing texts and identifying the origin of digital art.

The Big Four

Each of the Big Four accounting firms are testing blockchain technologies in various formats. Ernst and Young has provided digital wallets to all employees, has installed a bitcoin ATM in their office in Switzerland, and accepts bitcoin as payment for all its consulting services. Marcel Stalder, CEO of Ernst and Young Switzerland stated "We don’t only want to talk about digitalization, but also actively drive this process together with our employees and our clients. It is important to us that everybody gets on board and prepares themselves for the revolution set to take place in the business world through blockchains, [to] smart contracts and digital currencies." PWC, Deloitte, and KPMG have taken a different path from Ernst & Young and are all testing private blockchains.

Smart contracts

Blockchain-based smart contracts are contracts that can be partially or fully executed or enforced without human interaction. One of the main objectives of a smart contract is automated escrow. The IMF believes blockchains could reduce moral hazards and optimize the use of contracts in general. Due to the lack of widespread use their legal status is unclear.

Some blockchain implementations could enable the coding of contracts that will execute when specified conditions are met. A blockchain smart contract would be enabled by extensible programming instructions which both define and execute an agreement. For example, Ethereum is an open source blockchain project that was built specifically to realize this possibility by implementing a Turing-complete programming language capability to implement such contracts.

Applications

As a distributed ledger, blockchain reduces the costs involved in verifying transactions, and by removing the need for trusted "third-parties" such as banks to complete transactions, the technology also lowers the cost of networking, therefore allowing several applications. The primary use of blockchains today is for the creation of cryptocurrencies, such as bitcoin. While a few central banks, in countries such as China, United States, Sweden, Singapore, South Africa, & England are studying issuance of a Central Bank Issued Cryptocurrency (CICC), none have done so thus far.

In October 2014, the MIT Bitcoin Club, with funding from MIT alumni, provided undergraduate students at the Massachusetts Institute of Technology access to $100 of bitcoin. The adoption rates, as studied by Catalini and Tucker (2016), revealed that when people who typically adopt technologies early are given delayed access, they tend to reject the technology.

The Harvard Business Review conducted a two-year research project exploring how blockchain technology can securely move and store host "money, titles, deeds, music, art, scientific discoveries, intellectual property, and even votes". Furthermore, major portions of the financial industry are implementing distributed ledgers for use in banking, and according to a September 2016 IBM study, this is occurring faster than expected. The credit and debits payments company MasterCard has added three blockchain-based APIs for programmers to use in developing both P2P and B2B payment systems.

CLS Group is using blockchain technology to expand the number of currency trade deals it can settle.

A January 2017 World Economic Forum report predicted that by 2025 ten percent of global GDP will be stored on blockchains or blockchain-related technology.

Alternative blockchains

Alternative blockchains, also known as altchains, are based on bitcoin technology in concept and/or code. The term encompasses all blockchains but bitcoin's main chain. Compared to bitcoin, these designs generally add functionality to the blockchain design. Altchains can provide solutions including other digital currencies, although tokens used in these designs are not always considered to be such. Altchains target performance, anonymity, storage and applications such as smart contracts. Starting with a strong focus on financial applications, blockchain technology is extending to activities including decentralized applications and collaborative organizations that eliminate a middleman.

Notable non-cryptocurrency designs include:

For a list of cryptocurrencies, see List of cryptocurrencies.

Other uses

Blockchain technology can be used to create a permanent, public, transparent ledger system for compiling data on sales, storing rights data by authenticating copyright registration, and tracking digital use and payments to content creators, such as musicians. Imogen Heap's Mycelia service, which allows managers to use a blockchain for tracking high-value parts moving through a supply chain, was launched as a concept in July 2016. Everledger, "building systems to record the movement of diamonds from mines to jewelry stores", is one of the inaugural clients of IBM's blockchain-based tracking service.

Commercial offerings

Distributed ledgers and other blockchain-inspired software are being developed by commercial organizations for various applications:

In August 2016 a research team at the Technical University of Munich published a research document about how blockchains may disrupt industries. They analyzed the venture funding that went into blockchain ventures. Their research shows that $1.55 billion went into startups with an industry focus on finance and insurance, information and communication, and professional services. High startup density was found in the USA, UK and Canada.

ABN Amro announced a project in real estate to facilitate the sharing and recording of real estate transactions, and a second project in partnership with the Port of Rotterdam to develop logistics tools.

Journals

In September 2015, the first peer-reviewed academic journal dedicated to cryptocurrency and blockchain technology research, Ledger, was announced. The inaugural issue was published in December 2016. The journal covers aspects of mathematics, computer science, engineering, law, economics and philosophy that relates to cryptocurrencies such as bitcoin.

The journal encourages authors to digitally sign a file hash of submitted papers, which will then be timestamped into the bitcoin blockchain. Authors are also asked to include a personal bitcoin address in the first page of their papers.