| ||

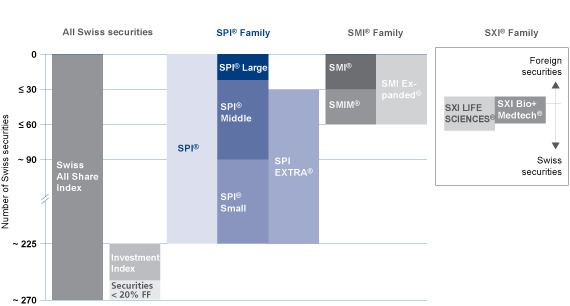

The Swiss Performance Index SPI is Switzerland's most closely followed performance index. It is a dividend-corrected index that includes all SWX Swiss Exchange-traded equity securities of companies domiciled in Switzerland or the Principality of Liechtenstein.

The underlying share universe includes approximately 230 equity issues. For a company's shares to be included, the company must be domiciled in Switzerland and the shares must have a free float equal to or greater than 20%. In 1998, all investment companies were taken out of the SPI Family and put into the specially designed Investment Index.

The SPI is divided into sectors on the basis of economic activity. This classification is based on the International Classification Benchmark ICB from Dow Jones and FTSE, which simplifies international performance comparisons significantly. Two other classification systems are used as well: classification based on market capitalisation (small, middle, large) and security category (registered shares, bearer share, participation certificates).

Paid prices are taken into account in calculating the SPI as a whole. If no paid prices are available, the index is calculated on the basis of bid prices. The index is recalculated and published every three minutes. On 1 June 1987, the SPI was standardised at 1000 points.