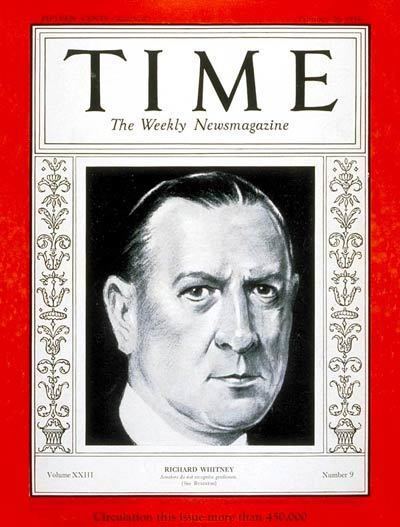

Name Richard Whitney | Role Financier | |

| ||

Education Born August 1, 1888 (age 86) Boston, Massachusetts | ||

Richard Whitney (August 1, 1888 – December 5, 1974) was an American financier, president of the New York Stock Exchange from 1930 to 1935. He was later convicted of embezzlement and imprisoned.

Contents

Richard whitney regulation will destroy capitalism

Biography

Richard Whitney was born on August 1, 1888 in Boston, Massachusetts to George Whitney, Sr. He was a descendant of John Whitney (1589/92 - 1673), an English immigrant who arrived in America in 1635 and who settled in Watertown, Massachusetts. This prominent branch of the Whitney family of New York descends from Boston. Richard Whitney's father, George Whitney, Sr., of Boston, Massachusetts, was president of North National Union Bank, and educated Richard and his older brother George Whitney, Jr., at Groton School and Harvard University.

In 1910 he followed his brother, George Whitney, Jr. to New York City where he established his own bond brokerage firm Richard Whitney & Co. Two years later, using money borrowed from his family, Richard Whitney & Co. purchased a seat on the New York Stock Exchange. His uncle had been a partner in J.P. Morgan & Co., and brother George proved invaluable because of his position at the Morgan Bank which allowed him to direct substantial business to Richard's brokerage.

Richard Whitney married the widow Gertrude Sheldon Sands in 1916. She was from Brooklyn, New York, and her first husband Samuel Steven Sands III was the step-son of William Kissam Vanderbilt (1849-1920). She had three children with Whitney. His father-in-law had served as president of the powerful Union League Club and Whitney became a member of a number of the city's elite social clubs and was appointed treasurer of the New York Yacht Club. In 1919, he was elected to the Board of Governors of the New York Stock Exchange and not long thereafter was named its vice-president.

On October 24, 1929, Black Thursday, he attempted to avert the Wall Street Crash of 1929. Alarmed by rapidly falling stock prices, several leading Wall Street bankers met to find a solution to the panic and chaos on the trading floor of the New York Stock Exchange. The meeting included Thomas W. Lamont, acting head of Morgan Bank; Albert Wiggin, head of the Chase National Bank; and Charles E. Mitchell, president of the National City Bank of New York. They chose Whitney, then vice president of the Exchange, to act on their behalf.

With the bankers' financial resources behind him, Whitney went onto the floor of the Exchange and ostentatiously placed a bid to purchase a large block of shares in U.S. Steel at a price well above the current market. As traders watched, Whitney then placed similar bids on other "blue chip" stocks. This tactic was similar to a tactic that had ended the Panic of 1907, and succeeded in halting the slide that day. The Dow Jones Industrial Average recovered with a slight increase, closing with it down only 6.38 points for that day. In this case, however, the respite was only temporary; stocks subsequently collapsed catastrophically on Black Tuesday, October 29. Whitney's actions gained him the sobriquet, "White Knight of Wall Street."

Downfall

At the same time that Richard Whitney was achieving great success, his brother George had also prospered at Morgan bank and by 1930 had been anointed as the likely successor to bank president, Thomas W. Lamont. While Richard Whitney was assumed to be a brilliant financier, he in fact had personally been involved with speculative investments in a variety of businesses and had sustained considerable losses. To stay afloat, he began borrowing heavily from his brother George as well as other wealthy friends, and after obtaining loans from as many people as he could, turned to embezzlement to cover his mounting business losses and maintain his extravagant lifestyle. He stole funds from the New York Stock Exchange Gratuity Fund, the New York Yacht Club (where he served as the Treasurer), and $800,000 worth of bonds from his father-in-law's estate.

Having retired as president of the NYSE in 1935, Whitney remained on the board of governors, but in early March 1938, his past began to catch up with him when the comptroller for the NYSE reported to his superiors that he had established absolute proof that Richard Whitney was an embezzler and that his company was insolvent. Within days, events snowballed, and Whitney and his company would both declare bankruptcy. An astonished public learned of his misdeeds on March 10 when he was officially charged with embezzlement by New York County District Attorney Thomas E. Dewey. Following his indictment by a grand jury, Richard Whitney was arrested and eventually pleaded guilty. He was sentenced to a term of five to ten years in Sing Sing prison. On April 12, 1938, six thousand people turned up at Grand Central Terminal to watch as a scion of the Wall Street Establishment was escorted in handcuffs by armed guards onto a train that delivered him to prison.

Despite everything, Richard Whitney's wife and family stood by him and friend May Kinnicutt and her husband, G. Hermann Kinnicutt, a partner in a stockbrokerage firm, provided Mrs. Whitney with a farmhouse to live in at Far Hills, New Jersey. George Whitney eventually made restitution for all the money his brother owed.

A model prisoner, Richard Whitney was released on parole in August 1941 after serving three years and four months in Sing Sing. He became the manager of a dairy farm, supervising three farmhands and twenty-five cows. In 1946, he went back into business when he became president of a textile company that made yarns from the ramie plant, which grew in Florida. Banned from dealing in securities for life, he was living a quiet life in Far Hills, New Jersey, at the time of his death on December 5, 1974.

Legacy

The story of Richard Whitney on Wall Street was recounted in detail in a film by German director August Everding in 1966, and by John Brooks as part of his 1969 book Once in Golconda : A True Drama of Wall Street 1920-1938 (ISBN 0-471-35753-7). Louis Auchincloss wrote a novel based on his life entitled The Embezzler. He is mentioned, not by name, in John O'Hara's short story "Graven Image." See also cite by Malcolm MacKay in his book Impeccable Connections: The Rise and Fall of Richard Whitney."