| ||

As defined by the U.S. Supreme Court, a bucket shop is "[a]n establishment, nominally for the transaction of a stock exchange business, or business of similar character, but really for the registration of bets, or wagers, usually for small amounts, on the rise or fall of the prices of stocks, grain, oil, etc., there being no transfer or delivery of the stock or commodities nominally dealt in."

Contents

People often mistakenly interchange the words bucket shop and boiler room, but there is actually a significant difference. A boiler room has been defined as a place where high-pressure salespeople use banks of telephones to call lists of potential investors (known as "sucker lists") in order to peddle speculative, even fraudulent, securities. However, with a bucket shop, it could be better thought of as a place where people go to make "side bets" – similar to a bookie.

"Bucket shop" is a defined term under the criminal law of many states in the United States that make it a crime to operate a bucket shop. Typically the criminal law definition refers to an operation in which the customer is sold what is supposed to be a derivative interest in a security or commodity future, but there is no transaction made on any exchange. The transaction goes "in the bucket" and is never executed. Because no trading of actual securities occurs, the customer is essentially betting against the bucket shop operator in a game based on abstract security prices. While trading in a legitimate exchange also provides a similar game or wagering aspect, the one distinctive characteristic of a bucket shop is the mimicry of trading securities when no actual securities are traded. The bucket shop's exchange is a fiction, which the parties agree to imagine as following the events occurring in a real exchange. Alternatively, the bucket shop operator "literally 'plays the bank,' as in a gambling house, against the customer." Operating a bucket shop in the United States would also likely involve violations of several provisions of federal securities or commodity futures laws.

A person who engages in the practice is referred to as a bucketeer and the practice is sometimes referred to as bucketeering.

History in the United States (ca. 1870--1920)

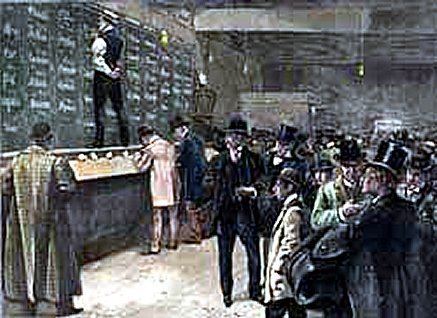

Bucket shops specializing in stocks and commodity futures appeared in the United States in the 1870s, corresponding to the innovation of stock tickers upon which they depended. In 1889, the New York Stock Exchange addressed the "ticker trouble" (bucket shops operating on intraday stock price movements), and attempted to suppress bucket shops by disconnecting telegraphic stock tickers. This embargo instead proved a severe hindrance to the Exchange's wealthy local clients, as well as the Exchange's brokers in other cities across the country. It also had the surprising effect of favoring competing exchanges, and was abandoned within days.

Edwin Lefèvre, who is believed to have been writing on behalf of Jesse Lauriston Livermore, describes the operations of bucket shops in the 1890s in detail.

In the United States, the traditional pseudo-brokerage bucket shops came under increasing legal assault in the early 1900s, and were effectively eliminated before the 1920s. However, the term came to apply to other types of scams, some of which are still practiced. They were typically small store front operations that catered to the small investor, where speculators could bet on price fluctuations during market hours. However, no actual shares were bought or sold: all trading was between the bucket shop and its clients. The bucket shop made its profit from commissions, and also profited when share prices went against the client.

The terms of trade were different for each bucket shop, but bucket shops typically catered to customers who traded on thin margins, even as low as 1%. Most bucket shops refused to make margin calls, so that if the stock price fell even momentarily to the limit of the client's margin, the client would lose his entire investment.

The highly leveraged use of margins theoretically gave the speculators equally large upside potential. However, if a bucket shop held a large position on a stock, it might sell the stock on the real stock exchange, causing the price on the ticker tape to momentarily move down enough to wipe out its client's margins, and the bucket shop could take 100% of their investments.

They were made illegal after they were cited as a major contributor to the two stock market crashes in the early 1900s. The activity flourished until outlawed in the 1920s.

Origin of the term

The origin of the term bucket shop has nothing to do with financial markets, as the term originated from England in the 1820s. During the 1820s, street urchins drained beer kegs which were discarded from public houses. The street urchins would take the dregs to an abandoned shop and drink them. This practice became known as bucketing, and the location at which they drained the kegs became known as a bucket shop. The idea was transferred to illegal brokers because they too sought to profit from sources too small or too unreliable for legitimate brokers to handle.

The term bucket shop came to apply to low-class pseudo stock brokerages that did not execute trades.